-

×

Focus on Authenticity - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $

Focus on Authenticity - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $ -

×

A Maze of Problems! - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $

A Maze of Problems! - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $ -

×

Dream With the Soul of the World By Robert Moss - The Shift Network

1 × 46,00 $

Dream With the Soul of the World By Robert Moss - The Shift Network

1 × 46,00 $ -

×

Financial Calm - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $

Financial Calm - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $ -

×

Are You Emotionally Smart - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $

Are You Emotionally Smart - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $ -

×

Finding Balance - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $

Finding Balance - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $ -

×

Genius Within - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $

Genius Within - Teleseminar & Self-Study Online Course By Ready2Go Marketing Solutions

1 × 31,00 $ -

×

Genius Within - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $

Genius Within - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $ -

×

Destination: A New You! - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $

Destination: A New You! - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $ -

×

Courage, Risks and Rewards - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $

Courage, Risks and Rewards - Teleseminar By Ready2Go Marketing Solutions

1 × 23,00 $ -

×

Adventures for Healing in the Dreamtime By Robert Moss - The Shift Network

1 × 69,00 $

Adventures for Healing in the Dreamtime By Robert Moss - The Shift Network

1 × 69,00 $

9 Steps to Financial Freedom: Wisdom, Strategies and Tactics for Abundant Wealth (Audiobook) with John Demartini

6,00 $

SKU: KEB. 6053579bNzB

Category: Finance

Tags: 9 Steps to Financial Freedom, John Demartini, Strategies, Tactics for Abundant Wealth (Audiobook), Wisdom

Download 9 Steps to Financial Freedom: Wisdom, Strategies and Tactics for Abundant Wealth (Audiobook) with John Demartini, check content proof here:

9 Steps to Financial Freedom: Wisdom, Strategies, and Tactics for Abundant Wealth

In “9 Steps to Financial Freedom: Wisdom, Strategies, and Tactics for Abundant Wealth,” Dr. John Demartini delineates a multifaceted framework for creating and sustaining wealth. This audiobook is not just a guide; it serves as a holistic approach to financial literacy and empowerment, encouraging listeners to engage with their finances actively and purposefully. The central tenet of Demartini’s teachings is that the journey to financial freedom is not solely about accumulating wealth it is an introspective process that encompasses understanding one’s values, reshaping one’s mindset, and applying strategic methodologies for lasting monetary success.

The concept of financial freedom stretches beyond the conventional definition of wealth. It embodies emotional resilience, the cultivation of positive beliefs surrounding money, and practical strategies that transcend mere survival in the financial realm. The ideas put forth by Demartini compel individuals to explore their relationship with money, consider the potential of investing wisely, and appreciate the significance of continuous learning. This framework acts as a compass that guides individuals toward achieving financial mastery, ensuring they not only reach their monetary goals but also experience personal growth along the journey. Through detailed analysis and practical tactics, Demartini elaborates on how to navigate common pitfalls and decipher the unique steps necessary to attain abundant wealth.

Understanding Wealth Building

Wealth building is akin to tending to a garden. It requires careful planning, nurturing, and patience to see the fruits of your labor flourish. Understanding wealth building can be broken down into three fundamental components: knowledge, mindset, and action. Knowledge refers to the information and strategies one gathers to make informed financial decisions. A robust understanding of principles such as the power of compound interest, investment trajectories, and market dynamics is essential. Mindset, however, serves as the soil in which this knowledge is cultivated. If the soil is rich with positivity and growth-focused beliefs, the seeds of knowledge have a far better chance of taking root and thriving.

On the other hand, action forms the branches and leaves of a well-structured financial strategy. Without it, knowledge remains dormant, and mindset remains unutilized. For true wealth building, one must actively engage in practices that create tangible financial growth, such as budgeting, saving, and investing. Several key elements underscore the wealth-building process:

- Knowledge Acquisition: Reading books, attending seminars, or listening to audiobooks like Demartini’s can deepen your understanding of wealth-building strategies.

- Self-Assessment: Evaluating personal beliefs about money can reveal subconscious barriers that hinder financial growth. Questions like “What does wealth mean to me?” or “How do I view debt?” can unveil critical insights.

- Practical Implementation: Establish goals and actionable steps to adhere to. This may consist of setting a strict savings goal, creating a diversified investment portfolio, or pursuing multiple revenue streams.

Understanding the nuances of wealth building empowers individuals to tailor their financial journeys based on their unique aspirations and circumstances. Just as a gardener must understand their environment, aspiring wealth builders must acknowledge their unique starting points and work deliberately toward their financial objectives.

Key Questions for Commitment to Wealth

Central to Dr. Demartini’s framework are the pivotal questions that signal one’s commitment to financial growth. These questions serve not only as introspective tools, but they also probe deeply into personal aspirations and motivations. By addressing these inquiries, individuals can enhance their commitment to wealth-building strategies, allowing for a more focused and tailored approach to achieving financial autonomy.

- What are my wealth-building goals? This question sets the foundation, prompting a clear articulation of what financial success looks like for the individual. It encourages detailed planning, alongside desires for financial independence, security, or philanthropy.

- How do I perceive money? This question digs into emotional beliefs surrounding money and wealth. Identifying whether you view money as a tool for empowerment or a source of stress can radically shift how you manage finances.

- Am I willing to educate myself regarding financial systems? Commitment is also reflected in one’s willingness to engage with various wealth-building techniques and invest time in gaining knowledge about different avenues available.

- What sacrifices am I prepared to make for my financial goals? Understanding the truth that wealth building often necessitates short-term sacrifices can help align focus and dedication. Whether it’s cutting unnecessary expenses or investing in education this self-reflection is crucial.

- How am I tracking my progress? Establishing a regular check-in creates accountability and allows one to adapt strategies based on financial performance or changes in goals over time.

By thoroughly exploring these questions, individuals can foster a profound commitment to their financial journey. The insights gained will serve as a guiding star, illuminating the pathway toward abundant wealth through actionable steps.

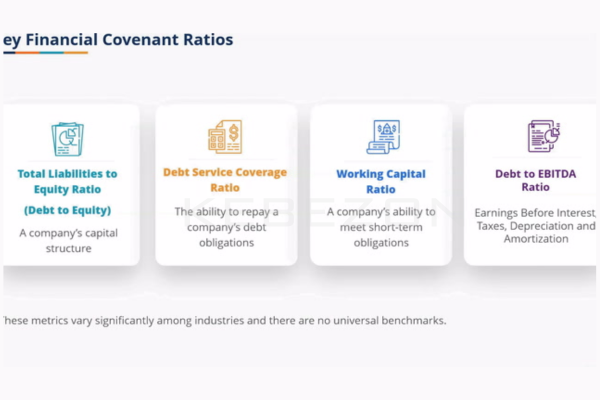

Distinctions Between Saving, Investing, and Speculating

To lay a sturdy foundation for wealth building, it is crucial to understand the distinctions between saving, investing, and speculating three seemingly similar yet fundamentally different financial activities. Each has its own objectives, risks, and implications in the wealth-creation process.

- Saving:

- Purpose: Saving involves setting aside money gradually for future use, generally for emergencies or short-term goals.

- Low Risk: Savings accounts yield minimal returns but carry low risk, making them ideal for maintaining liquidity.

- Time Frame: Short-term focus, typically spanning months to a few years for specific endeavors like vacations, home repairs, etc.

- Investing:

- Purpose: Investing aims to allocate funds into various assets such as stocks, bonds, or real estate to generate higher returns over time.

- Higher Risk with Potential for Returns: While investments may entail risks due to market fluctuations, they usually yield greater returns than savings.

- Long-Term Focus: Investors often seek to hold assets for extended periods (five years or more) to achieve substantial appreciation.

- Speculating:

- Purpose: Speculation aims for short-term gains through risky assets or market movements, often aligned with trends or whims.

- High Volatility: With the potential for significant profit comes the possibility of severe losses, making speculation akin to ********.

- Short Time Horizon: Speculators expect fluctuations to create opportunities, requiring quick decision-making and extensive market knowledge.

Understanding these distinctions helps individuals strategically allocate their funds based on specific financial goals and timelines, ultimately cultivating a balanced approach towards wealth accumulation.

The Role of Mindset in Wealth Creation

Dr. Demartini posits that mindset is foundational in shaping one’s financial future. The wealth-building mindset is an amalgamation of beliefs, values, and attitudes that influence financial decision-making. Here are key aspects about how mindset plays a significant role in wealth creation:

- Awareness and Education: Individuals must cultivate a strong understanding of financial principles, investment strategies, and the importance of both saving and investing. A wealth-oriented mindset emphasizes the importance of continuous learning and adaptation, empowering individuals to make informed decisions.

- Long-Term Perspective: Maintaining a long-range viewpoint is essential for thriving in the financial landscape. Wealth building often requires tenacity through market fluctuations, projecting confidence that diligent strategies will yield results over time.

- Embracing Growth Opportunities: A growth-oriented mindset is crucial for harnessing opportunities that arise in turbulent markets. Wealth builders are often individuals seeking knowledge and growth through experiences rather than shying away from risks.

- Financial Discipline: Cultivating a disciplined approach to managing finances is indispensable. By treating finances like a business, individuals can create structured budgets, monitor expenses meticulously, and adhere to investment plans consistently.

In “9 Steps to Financial Freedom,” Demartini underscores the significance of refining one’s mindset and aligning it with wealth-creation principles. A positive mindset not only transforms financial thinking but fosters a sense of control over financial futures, thereby facilitating sustainable wealth.

Proven Strategies for Wealth Building

Proven strategies for wealth building serve as crucial pathways toward achieving financial independence. These tactics encompass both foundational principles and innovative approaches to enhancing your financial portfolio. Introducing actionable strategies informed by solid financial education can significantly influence your wealth trajectory.

- Create a Comprehensive Financial Plan: Establishing a strategic financial plan allows for tailored guidance regarding income, expenses, and investment goals. Regularly reviewing and adapting the plan is essential as circumstances evolve.

- Invest Early and Consistently: The age-old adage, “the earlier, the better,” holds tremendous truth in wealth building due to the phenomenon of compound interest. Start small, but invest consistently in stocks, mutual funds, or bonds, ideally sheltering money in retirement accounts for tax benefits.

- Minimize Debt: Leverage effective debt management strategies, such as the snowball or avalanche method, to pay down high-interest loans that can impede financial progress. Increasing credit scores can also open doors to better borrowing rates.

- Maximize Retirement Contributions: Prioritize contributions to retirement accounts such as 401(k)s and IRAs, particularly those with employer-matching benefits. Managing to contribute the maximum can have exponential long-term benefits.

- Diversify Income Streams: Adopting multiple income avenues through side businesses, real estate investments, or freelancing can bolster cash flow and reduce exclusive reliance on a single income source.

- Continuous Financial Education: Engage with various resources: books, podcasts, or courses can enrich your understanding of personal finances and investment opportunities.

These strategies serve as powerful catalysts for building wealth and progressing towards financial independence, reinforcing commitment and diligence while navigating financial challenges.

Six Essential Steps to Achieve Financial Independence

Achieving financial independence is a journey that requires a structured, deliberate approach. Here are six essential steps that align with Dr. Demartini’s teachings, providing a roadmap toward financial freedom:

- Set Clear, Defined Goals: Establish specific, measurable financial goals that reflect your aspirations. Whether it’s saving for a home, building an investment portfolio, or planning for retirement, having clarity around your objectives is crucial.

- Create and Stick to a Budget: A well-structured budget is vital for monitoring income and expenses. Analyze your spending habits and adjust as necessary to ensure that you consistently allocate a portion of your income to savings and investments.

- Establish an Emergency Fund: Aim to save at least three to six months’ worth of living expenses. Having an emergency fund provides peace of mind and financial stability, alleviating stress during unforeseen circumstances.

- Prioritize Savings and Investments: Allocate a segment of your income each month to savings and investments. Automated transactions into retirement or investment accounts can simplify the process and reduce the temptation to spend.

- Review and Revise Regularly: Consistently monitor your financial progress and review your goals and strategies. Regular check-ins allow for course correction and reinforce your commitment to your financial future.

- Cultivate a Wealth-Building Mindset: Focus on developing attitudes and beliefs that promote positive financial behaviors. Surround yourself with like-minded individuals who inspire you to achieve greater financial success.

By following these structured steps, individuals can create a solid foundation for financial success and independence, actively engaging in the wealth-building journey while adhering to a disciplined approach.

Forced Accelerated Savings Techniques

Dr. John Demartini underscores the critical role of disciplined savings techniques in achieving financial freedom. Forced Accelerated Savings Techniques focus on capitalizing on personal discipline and automatic processes that drive wealth accumulation with minimal friction. Here are several effective techniques to consider:

- Automated Savings Transfers: Set up automatic transfers from your checking account to savings or investment accounts. By directing funds automatically, you prioritize saving before engaging in discretionary spending.

- Pay Yourself First: Adopt the philosophy of treating savings as a recurring expense. After receiving your income, immediately allocate a portion for savings before addressing other financial commitments.

- Utilize High-Interest Savings Accounts: While conventional savings accounts might yield low returns, high-interest accounts or certificates of deposit (CDs) allow your savings to grow more rapidly.

- Implement a Savings Challenge: Engage in a savings challenge to motivate yourself to save more. For example, start saving a specific amount and increase it incrementally each week or month a game-like approach can foster engagement.

- Reinforce Habitual Saving: By setting a consistent schedule for savings contributions, you can form healthy financial habits. Consider setting reminders or establishing monthly rituals to engage consistently with your savings goals.

Ingle a benefactor of these techniques, individuals can instill discipline into their financial practices while enhancing their overall financial health, forming a robust foundation for wealth accumulation.

Maximizing Profit Margins

Maximizing profit margins can significantly amplify wealth accumulation efforts. Dr. Demartini emphasizes that businesses not only need to focus on revenue generation but also actively enhance profit margins to facilitate long-term growth and investment opportunities. Here are several strategies to consider:

- Assess Operational Efficiencies: Regularly evaluate business operations for optimal efficiency. Identify areas where processes can be streamlined or costs reduced without compromising quality.

- Dynamic Pricing Strategies: Implement pricing strategies that adapt to market demand while maximizing revenue. Offering tiered pricing, seasonal discounts, or bundled services can enhance customer value perception.

- Negotiate Supplier Contracts: Build strong relationships with suppliers and negotiate favorable terms to reduce costs. Establishing trust can lead to better pricing structures over time, improving profit margins.

- Outsource Wisely: Consider outsourcing non-core functions that may be more cost-effective for third-party providers. Redirecting resources towards core competencies fosters enhanced productivity and profitability.

- Monitor Key Performance Indicators (KPIs): Track financial metrics to gauge performance against set goals. KPIs can reveal trends and opportunities for increasing efficiencies.

- Invest in Technology: Leverage technology to automate processes and improve overall productivity. Utilizing financial and operational software can streamline cumbersome tasks, freeing resources for strategic investment.

By adopting these proven techniques to maximize profit margins, individuals and businesses can cultivate healthier financial ecosystems and leverage those profits toward future growth opportunities.

Leveraging Financial Tools

Leveraging financial tools effectively forms a cornerstone of successful wealth-building strategies. Financial tools can be likened to navigational aids, guiding individuals through the complexities of personal finance and investment landscapes. Here’s how they can be effectively utilized:

- Budgeting Software: Employ budgeting apps such as YNAB (You Need A Budget) or Mint to track spending, savings, and investment goals. These tools provide a clear visual representation of finances, enabling better decision-making.

- Investment Platforms: Platforms like Robinhood or E*TRADE simplify the investment process, allowing users to access market insights while making informed choices that align with personal goals.

- Retirement Calculators: Utilize various online tools and calculations to assess retirement savings requirements based on lifestyle expectations. These calculators can illuminate your journey toward a secure retirement.

- Financial Analytics Tools: Make use of tools integrating financial analytics for sophisticated investment tracking. Software options can help manage risk and provide data-driven insights to refine investment strategies.

- Passive Income Monitoring Systems: Leverage technology to track passive income sources like dividends or rental properties, streamlining the collection and reinvestment process.

By effectively incorporating and utilizing these financial tools, individuals can enhance their decision-making capabilities, amplify wealth-building efforts, and maintain focused trajectories toward financial freedom.

The Impact of Compound Interest

Understanding the impact of compound interest is vital for anyone embarking on the journey of wealth building. Compound interest serves as one of the most potent forces in finance, magnifying the growth of investments over time. Here’s a closer look at its significance:

- Exponential Growth: Compound interest allows your money to earn interest not only on the principal but also on accumulated interest. This compounding effect can significantly increase total investment returns, especially when investments are held for extended periods.

- Time is Your Ally: The sooner one starts investing and taking advantage of compound interest, the more opportunity there is for exponential growth. Time is a crucial element that cannot be understated in the context of wealth accumulation.

- Illustrative Example: For instance, investing 10 million VND at an annual interest rate of 10% compounded annually results in 25 million VND after 10 years. Conversely, if one waits 10 years to start the same investment, it accumulates only 10 million VND after the same duration, highlighting the significance of early investment.

- Regular Contributions Propagation: Adding consistent amounts to your investment can further enhance the compounding effect, underlining the adage “money makes money.” Having a habit of reinvesting earnings will accelerate the compounding effect, thus amplifying wealth creation.

- Long-Term Strategy: Compound interest encourages long-term strategic thinking in investment decisions. An investor’s patience and commitment to a well-thought-out investment plan can yield extraordinary results over time.

As noted in “9 Steps to Financial Freedom,” understanding the nuances of compound interest can transform one’s financial approach from short-sightedness to strategic wealth accumulation, fostering a mindset geared towards the long term.

Entrepreneurial Mindset and Value Hierarchy

The entrepreneurial mindset reflects the attitudes and values conducive to both business success and personal financial growth. This mindset fosters innovation, resilience, and a proactive approach, which are paramount for mastering wealth. Included in this framework is understanding the value hierarchy, which prioritizes actions based on their potential to generate success.

- Opportunity Recognition: Individuals possessing an entrepreneurial mindset tend to view challenges as opportunities rather than impediments. They often seek innovative solutions for complex problems, thereby enhancing wealth creation possibilities.

- Risk Management: Entrepreneurs display a unique proficiency in assessing and managing risk, taking calculated chances that others may avoid. This ability to embrace uncertainty opens doors for higher returns and innovations.

- Growth Mindset: Cultivating a desire for continual learning helps entrepreneurs stay informed about market trends, investment opportunities, and strategies, allowing them to adapt swiftly to changes.

- Value Hierarchy: Entrepreneurs prioritize their values, aligning actions with long-term financial objectives. Wealth-oriented behaviors, such as reinvesting profits and seeking out value-adding partnerships, become critical in this hierarchy.

- Leveraging Resources: Entrepreneurs adeptly utilize resources including people, technology, and financial tools to create efficiencies and optimize growth potential. This reflects a dynamic understanding of how to maximize both financial and human capital.

By embracing an entrepreneurial mindset and establishing a well-defined value hierarchy, individuals can create a robust framework for navigating financial landscapes, unlocking pathways towards prosperity and financial independence.

Troubleshooting Financial Limitations

Troubleshooting financial limitations is an essential component of achieving financial independence. Recognizing barriers, such as limiting beliefs, poor financial habits, or lack of education, is the first step in addressing underlying issues. Consider the following strategies:

- Identifying Limiting Beliefs: Much of one’s relationship with money is founded on ingrained beliefs. Identifying destructive convictions, such as “I will never be wealthy,” empowers individuals to reframe their financial mindset.

- Develop a Comprehensive Financial Literacy Program: Commit to personal finance education through books, courses, and workshops. Knowledge directly counteracts ignorance and opens doors to informed decision-making.

- Set Realistic Goals: Establishing achievable financial targets promotes a sense of accomplishment, reinforcing positive behavior and commitment toward future opportunities.

- Embrace Accountability Measures: Consider working with a financial advisor or finding an accountability partner. Engaging with professionals grants access to tailored advice, ensuring that actions align with set goals.

- Continuous Reflection: Regularly reflect on your financial progress by evaluating spending habits, investment performance, and alignment with overarching financial objectives. Monitoring and adaptability are key in refining strategies.

Addressing financial limitations provides clarity, converting obstacles into stepping stones on the path toward financial freedom. By proactively confronting these challenges through education, reflection, and targeted action, individuals can create environments conducive to sustainable wealth creation.

Addressing Misleading Beliefs

Addressing misleading beliefs about money is vital for personal financial growth. Many societal notions and familial narratives shape perspectives on wealth, often leading to self-imposed limitations. To overcome these, it is imperative to initiate a process of cognitive restructuring:

- Identify Misconceptions: Recognize any damaging beliefs regarding wealth, such as “money is the root of all evil” or “wealth is only for the lucky.” By shining a light on these perspectives, individuals can take steps to counteract them.

- Reframe Your Mindset: Instead of viewing wealth creation as something burdensome, categorize it as an empowering opportunity for personal growth, community impact, and the ability to provide for oneself and others.

- Affirm Positive Financial Beliefs: Create empowering financial affirmations that can serve as daily reminders. Statements like “I am worthy of financial success” can cultivate a positive mindset over time.

- Surround Yourself with Positivity: Engage with individuals who embody the wealth mindset, whether through networking events or mentorship. The influence of positive, financially literate peers can support behavioral change.

- Focus on Values: Align financial decisions with personal values, ensuring that wealth-building activities reflect one’s beliefs and motivations, contributing to a sense of purpose.

By implementing these strategies, individuals can effectively address misleading beliefs that hinder financial progress and cultivate a mindset conducive to wealth accumulation and financial independence.

The Subordination Effect on Financial Growth

The subordination effect refers to psychological tendencies that place individuals in subordinate positions relative to others, often resulting in feelings of inadequacy. This perception can greatly impede financial growth. Recognizing and combating the subordination effect is essential for achieving financial independence.

- Recognizing Personal Value: Individuals must acknowledge and value their financial capabilities and contributions. Creating a personal value statement helps individuals articulate their worth, reinforcing self-belief.

- Transform Comparison into Inspiration: Shift the focus from comparing oneself to successful individuals to drawing inspiration from their journeys. Analyze the habits and practices that propelled their success, applying what resonates in your own financial strategy.

- Seek Supportive Networks: Engage with mentors and communities that foster inclusivity and support. Surrounding oneself with positive influences can help mitigate feelings of subordination and build a more empowered mindset.

- Adopt a Growth-Minded Perspective: Cultivate an attitude that embraces learning and development. Viewing obstacles as growth opportunities fosters resilience and reduces feelings of inferiority.

- Challenge Fear of Failure: Reframe setbacks as learning experiences rather than failures. Understanding that no financial journey is without ups and downs allows for a more constructive and optimistic outlook.

Addressing the subordination effect enhances self-confidence and empowers individuals to pursue financial growth, leveraging their unique strengths and capabilities toward achieving abundant wealth.

Practical Applications

Practical applications of wealth-building strategies play a significant role in financial mastery. Effective implementation of strategies allows individuals not only to conceptualize wealth-building principles but also to translate them into actionable steps. Here are several practical applications derived from Dr. Demartini’s teachings:

- Establish a Routine for Financial Check-Ins: Set regular intervals (monthly, quarterly) to review your financial status, reassess goals, and fine-tune budgetary practices to maintain financial awareness.

- Engage in Peer Learning: Form study groups with friends or colleagues focused on financial literacy. This collaborative approach promotes accountability and knowledge sharing.

- Gradually Increase Savings Contributions: As your financial situation improves, increase your savings and investment contributions to further bolster net worth and wealth-building potential.

- Take Advantage of Educational Resources: Actively seek out resources such as workshops, webinars, or podcasts that focus on investing principles, personal finance, and wealth building.

- Experiment with New Investment Avenues: Be willing to explore different asset classes or investment opportunities. Trying out peer-to-peer lending, real estate crowdfunding, or micro-investing can diversify your portfolio.

Incorporating these practical applications into one’s financial routine promotes an active and engaged wealth-building approach while simultaneously fostering habits conducive to financial independence.

Creating Passive Income Streams

Creating passive income streams is a critical element of financial freedom. Passive income refers to earnings derived from investments or business ventures that do not require active involvement on a regular basis. The following strategies highlight effective ways to establish passive income streams:

- Real Estate Investing: Purchasing rental properties can provide consistent cash flow through rent payments while also benefitting from property appreciation. Alternatively, consider investing in Real Estate Investment Trusts (REITs) that offer dividend income without direct property management.

- Dividend Stocks: Invest in stocks that pay dividends, offering regular income distribution while also allowing for capital appreciation. Compounding returns can significantly increase wealth over time.

- Create Digital Products: Leverage your expertise or creativity by developing online courses, e-books, or design assets. These products can generate revenue with minimal ongoing effort once established.

- Blogging or Vlogging: Start a blog or YouTube channel centered around a niche you are passionate about. Monetize through affiliate marketing, sponsored content, and advertising, earning income while focusing on topics you love.

- Peer-to-Peer Lending: Platforms like LendingClub allow you to lend money to individuals or businesses while earning interest on your investments. Carefully assess credit risks to optimize returns.

By implementing these strategies, individuals can build passive income streams that bolster financial growth, allowing for greater financial independence while reducing dependence on traditional employment sources.

Effective Investment Opportunities

Identifying effective investment opportunities is crucial for wealth-building success. Dr. John Demartini emphasizes various avenues that individuals can explore to grow their wealth strategically. Understanding different investment types can help tailor portfolios to personal preferences, risk tolerances, and future aspirations.

- Stock Market Investments: Investing in stocks provides opportunities for capital appreciation and dividends. Research companies, evaluate market trends, and consider exchange-traded funds (ETFs) for broader market exposure.

- Real Estate Investments: Whether through direct rentals, commercial properties, or REITs, real estate offers stability and potential for appreciation, making it an attractive investment avenue.

- Savings Bonds and CDs: Lower-risk options such as savings bonds and certificates of deposit (CDs) provide modest returns while safeguarding principal, ideal for conservative investors.

- Mutual Funds and Index Funds: These pooled investments allow individuals to diversify holdings across stocks and bonds, spreading risk and increasing potential for returns over time.

- Startups and Small Businesses: Investing in startups can yield significant returns but carries higher risks. Consider angel investing or participating in crowdfunding platforms for innovative ventures.

By thoroughly considering these investment options, investors can create diverse portfolios that align with their values, risk tolerances, and long-term goals, fostering pathways toward abundant wealth and financial freedom.

Conclusion on Financial Mastery Techniques

In summation, Dr. John Demartini’s “9 Steps to Financial Freedom” provides a comprehensive and insightful guide toward mastering personal finance and wealth-building principles. By emphasizing practical strategies, a positive mindset, and the importance of continuous learning, individuals can cultivate a disciplined approach to achieving financial independence.

Key techniques outlined throughout the audiobook include establishing clear financial goals, practicing effective savings methods, and leveraging investment opportunities to foster wealth accumulation. The articulation of distinctions between saving, investing, and speculating serves to enhance understanding and guide financial decisions, while the emphasis on addressing limiting beliefs reinforces the psychological aspects critical to financial growth.

Ultimately, individuals committed to integrating these principles can pave the way for sustainable financial success. By maintaining focus, adaptability, and engagement with learning opportunities, one can transform their financial landscape and achieve the coveted state of financial freedom.

Evaluation of Wealth Building Effectiveness

Evaluating wealth-building effectiveness requires a comprehensive analysis of the strategies implemented and the outcomes achieved. Dr. Demartini’s nine steps emphasize that successful wealth building relies on a multifaceted approach encompassing commitment, strategy, and continual refinement.

- Measuring Financial Progress: By setting clear objectives and regularly assessing income, expenses, and investments, individuals can gauge progress toward wealth-building targets. Tracking performance against set goals provides insight into areas requiring adjustment or enhancement.

- Adjusting Strategies: Financial strategies must remain dynamic; what works at one stage may not be effective later. Regularly revisiting and potentially recalibrating your financial plan in response to changing circumstances can enhance effectiveness and relevance.

- Building Resilience Through Learning: Review successes and setbacks as learning opportunities, fortifying resilience and increasing your adaptability in navigating future challenges.

- Engagement with Financial Resources: Regularly consult financial literature, attend seminars, and participate in relevant professional networks to enhance your understanding and navigate the evolving landscape.

By implementing thorough evaluations of financial strategies and effectiveness, individuals create a strong foundation for sustained growth and improved financial lifestyles.

Recommendations for Further Learning

To cultivate a comprehensive understanding of wealth accumulation and financial independence, pursuing further education in personal finance is paramount. Here are several recommendations for expanding financial knowledge and skills based on Dr. Demartini’s teachings:

- Financial Literacy Resources: Explore books, articles, and podcasts focused on where to deepen knowledge regarding budgeting, investment strategies, and personal finance.

- Online Courses and Webinars: Participate in online financial courses or webinars that cover fundamental concepts, advanced investing techniques, or specific areas of interest.

- Networking Opportunities: Engage with financial groups or forums, both online and in-person, to exchange insights and analyze investment strategies with like-minded investors.

- Regular Review of Market Trends: Stay informed about economic changes and their impact on financial investments or strategies. This helps in making timely adjustments to maintain financial growth.

- Seek Professional Guidance: Consult with financial advisors who specialize in areas relevant to personal goals. Their expertise can empower individuals to implement tailored strategies effectively.

By incorporating these recommendations into a continuous learning journey, individuals can enhance their financial knowledge and boost their ability to make informed decisions, ultimately leading to greater wealth creation and financial independence.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “9 Steps to Financial Freedom: Wisdom, Strategies and Tactics for Abundant Wealth (Audiobook) with John Demartini” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.