Accounting for Financial Modeling with Gregory Ahuy & Bekzod Kasimov – Financial Model Online

75,00 $ Original price was: 75,00 $.15,00 $Current price is: 15,00 $.

Download Accounting for Financial Modeling with Gregory Ahuy & Bekzod Kasimov – Financial Model Online, check content proof here:

Accounting for financial modeling: A review of the course – Gregory Ahuy and Bekzod Kasimov

Understanding the intricacies of finance and accounting is like trying to decode a foreign language one that holds the secrets to business performance and sustainability. This is where the course “Accounting for Financial Modeling” by Gregory Ahuy and Bekzod Kasimov comes into play, offering an enlightening journey into the functional realms of financial statements and accounting principles.

Tailored for both novices and seasoned professionals, this course promises not just knowledge but practical skills that can transform theoretical concepts into actionable insights. By exploring foundational elements and advanced topics, the course provides learners with the necessary tools to construct and analyze financial models proficiently, crucial for careers in finance.

Course structure and content

Basics of Accounting

At the core of the course lies an exploration of the essential components of financial statements. Students embark on an enlightening voyage through the nature of revenue, expenses, taxes, and net income elements that together construct the very skeleton of an income statement. Imagine piecing together a puzzle where each component plays a vital role in revealing the entire picture of a company’s financial health.

The instruction adheres to U.S. GAAP standards, which serve as the backbone of accounting principles in the United States. The course excellently contrasts these principles with IFRS the International Financial Reporting Standards providing a holistic understanding of how accounting varies globally. Students gain insights not only into how to prepare these financial statements but also into the significance of adhering to these standards. This foundational knowledge is akin to learning the rules of a game before attempting to become a champion; it lays the groundwork for future success in the field.

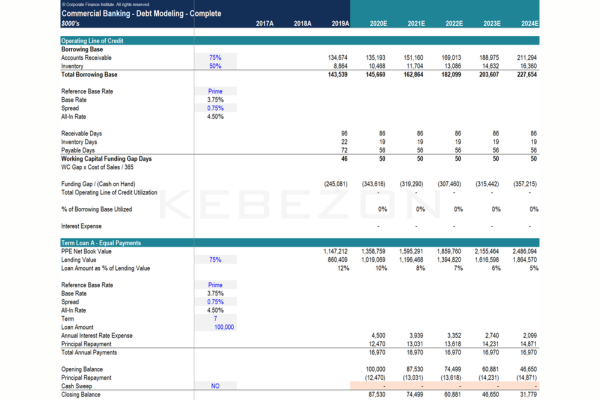

Advanced Topics

As participants progress, the course takes a sophisticated turn, delving into advanced accounting issues essential for investment analysis and financial modeling. Here, concepts such as stock-based compensation, deferred tax assets, and liabilities, as well as M&A accounting, are scrutinized. These topics are not merely academic; they are real-world issues that financial professionals constantly grapple with.

For example, understanding stock-based compensation is crucial for analyzing a company’s performance, as it affects both earnings and share dilution. This knowledge is particularly beneficial for financial analysts and managers individuals who must make informed decisions based on precise data interpretation. The emphasis on such advanced topics prepares students for the complexities of corporate finance, setting a solid groundwork for their future careers.

Real-World Applications

The beauty of the course lies in its commitment to transforming theoretical knowledge into practice. Through real-world exercises, students are tasked with constructing and analyzing income statements, balance sheets, and cash flow statements. It’s as though they are given the keys to unlock the vault of financial wisdom, where each exercise offers a valuable lesson.

Evaluation through quizzes and practical homework assignments reinforces learning, ensuring that concepts are not only understood but mastered. The iterative approach of applying knowledge enables participants to gain confidence and proficiency, akin to a musician practicing scales before performing a concerto. They become adept at navigating the complex landscape of financial statements, which is essential for any professional seeking to thrive in the competitive financial arena.

Target audience

Who Should Enroll?

“Accounting for Financial Modeling” is tailored for a diverse audience, spanning various levels of expertise in the field of finance. The course caters to those who aspire to deepen their understanding of financial modeling and analysis professionals such as:

- Financial analysts: Individuals tasked with evaluating investments and providing financial insights.

- Financial managers: Professionals responsible for the fiscal health of an organization, needing to comprehend advanced accounting principles.

- Investment advisors: Specialists who require a profound understanding of financial statements to guide their investment strategies.

- Students: Aspiring finance professionals looking to build a strong foundational knowledge in accounting principles.

This wide-ranging applicability makes the course not just an educational tool, but also a career catalyst. Participants are equipped with the skills to build, review, or analyze financial models, thus enhancing their marketability in an ever-evolving job market.

Conclusion

Overall, the course “Accounting for Financial Modeling” by Gregory Ahuy and Bekzod Kasimov stands out as an exceptional learning opportunity in the landscape of financial education. Through its structured approach, combining essential theory with practical applications, it empowers participants to navigate complex financial statements with confidence.

From the intricacies of basic accounting to the depths of advanced concepts, the curriculum prepares professionals for real-world challenges, particularly those in investment banking and financial services. By fostering a hands-on learning environment, this course emerges as a vital resource, one that can profoundly enhance financial modeling capabilities and pave the way for a successful career in finance.

Whether you are just starting your journey or looking to refine your existing skills, this course offers insights and knowledge that can form the cornerstone of your professional endeavors.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Accounting for Financial Modeling with Gregory Ahuy & Bekzod Kasimov – Financial Model Online” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.