Advanced Futures and Forwards with Paul North – CFI Education

15,00 $

Download Advanced Futures and Forwards with Paul North – CFI Education, check content proof here:

Paul North’s Advanced Futures & Forwards: A Review

It is imperative for both professionals and students to remain at the forefront of the constantly changing financial landscape. Paul North’s advanced futures and forwards course is expected to offer a thorough comprehension of futures and forwards markets, thereby providing participants with practical skills and critical insights. This course underscores the intricacies of financial derivatives, basis trading, and hedging strategies.

It provides a well-organized curriculum that accommodates a wide range of students by providing both theoretical knowledge and practical examples. This review will examine the course’s essential components, illustrating its value to individuals seeking to improve their understanding of this critical sector of financial services.

Key Aspects of the Course

Understanding Basis

At the core of many trading strategies lies the concept of basis, a pivotal factor that significantly influences hedging decisions. The course begins by painting a vivid picture of what basis is namely, the difference between the spot price of an asset and its futures price. Participants will learn about the various elements that affect basis, including supply and demand dynamics, storage costs, and market sentiment.

It’s akin to understanding the temperature before deciding to pack a winter coat; grasping the underlying factors of basis ensures that traders can make informed decisions when hedging against price fluctuations.

Moreover, the curriculum thoughtfully incorporates practical examples to solidify this understanding. By analyzing real market data, participants can visualize how basis impacts their hedging strategies. This experiential approach not only grounds the theoretical concepts but also ignites a passion for deeper analytical exploration. The emphasis on basis thus serves as a cornerstone for the entire course, preparing individuals for more advanced topics in futures and forwards trading.

Bond Futures

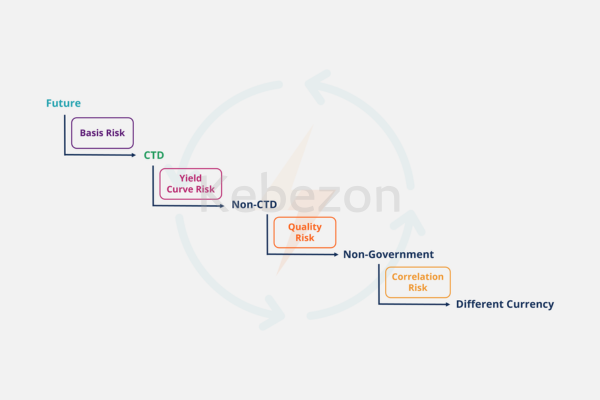

The course then transitions to another critical area, bond futures, where it delves thoroughly into the intricate details that are essential for successful trading. Participants acquire knowledge regarding the particulars of cheapest-to-deliver (CTD) bonds, a concept that is essential for determining the bond to deliver in order to execute a futures contract.

The beauty of this section is its pragmatic approach; students are not left to contemplate dull theories; rather, they are provided with actionable knowledge that can be immediately applied in the field. Additionally, the course underscores the importance of employing effective hedging strategies for bond futures. Participants are introduced to risk management strategies that are indispensable in the current volatile market through the examination of how to mitigate CTD bonds.

Learners can gain a deeper understanding of the practical implications of their studies through the use of case studies and insightful discussions. This segment is particularly enticing because it is not merely about the numbers on a screen; it is about comprehending the extensive implications of those numbers in the financial world.

Market Dynamics

Understanding the dynamics between futures and forward contracts is vital for any finance professional. The course distinguishes between these two types of derivatives, highlighting their respective advantages and disadvantages. A unique aspect of this comparison is the emphasis on central clearing in futures contracts, showcasing how it mitigates counterparty risk.

This is akin to comparing a bustling city with its organized public transportation system against a quiet town where the bus schedule is rather unpredictable the former offers more security and predictability.

Furthermore, the curriculum dives deeper into market operations, including liquidity considerations and price volatility. In doing so, it prepares participants to navigate the turbulent waters of financial markets confidently. With numerous strategies to leverage, learners emerge with a robust toolkit that can significantly enhance their career trajectories within financial services.

Learning Flexibility

The flexible, self-paced learning structure of the advanced futures & forwards course is one of its most notable features. This distinctive method enables participants to interact with the material irrespective of their current professional status or obligations. The course is designed to accommodate the requirements of both novices and experienced professionals, regardless of whether they are beginners seeking to understand the fundamentals or seasoned professionals seeking to enhance their skills.

This adaptability is comparable to possessing a wardrobe that seamlessly transitions from a day at the office to an evening out for busy professionals. By allowing you to personalize your learning experience, you can ensure that you are able to assimilate the material at your own tempo without feeling overwhelmed. The course’s considerate design fosters a more profound level of engagement, enabling participants to revisit intricate subjects until they are assured of their comprehension.

Reception and Effectiveness of the Course

Paul North’s advanced futures and forwards course has received an overwhelming amount of favorable feedback. Participants commend the practical relevance of the content and the lucidity of the instruction. Numerous students have expressed their gratitude for the curriculum’s ability to connect theoretical knowledge with practical applications, a characteristic that distinguishes this course from numerous others readily available.

Additionally, the improved career prospects that result from comprehending the concepts introduced in this course have been emphasized by industry professionals. Statistical analyses have demonstrated that participants in this course are more likely to secure promotions or transition to more lucrative positions within the financial services industry. This correlation emphasizes the course’s efficacy, as a comprehensive comprehension of futures and derivatives trading is becoming increasingly essential in the current competitive job market.

Skills Acquired

Upon completing this course, participants can expect to acquire a plethora of skills that can be directly applied to their work. Here’s a brief overview of some key skills:

- Advanced Hedging Techniques: Develop tailored hedging strategies to mitigate risk effectively.

- Pricing and Valuation: Gain insights into pricing methodologies for futures and forwards.

- Market Analysis: Enhance abilities to analyze market dynamics, including supply-demand fluctuations.

- Risk Management: Equip yourself with advanced risk management tactics that are essential in today’s financial landscape.

In conclusion,

Paul North’s advanced futures & forwards course is an indispensable educational endeavor for both novices and seasoned professionals in the finance industry. The course effectively equips participants with the knowledge and skills required for success in the derivatives markets through its comprehensive approach, which encompasses critical elements such as basis trading, bond futures, and market dynamics. Its appeal is further enhanced by its adaptable and accessible learning structure, which is suitable for a variety of career stages.

In the end, participating in this course is not merely an investment in education; it is an opportunity to develop a more profound comprehension of financial instruments that have the potential to influence one’s career path. Therefore, the knowledge acquired from this course is invaluable, regardless of whether you are seeking to enhance your current expertise or to pursue a new financial path. It is certain that remaining informed on such topics will enable you to remain competitive as the financial world continues to develop

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Advanced Futures and Forwards with Paul North – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.