Agriculture Lending Fundamentals with Gabriel Lip – CFI Education

15,00 $

Download Agriculture Lending Fundamentals with Gabriel Lip – CFI Education, check content proof here:

Review of Agriculture Lending Fundamentals – Gabriel Lip

The field of agriculture is as rich and diverse as the lands it springs from. Just as a farmer meticulously tends to their crops, understanding the unique aspects of agricultural lending can cultivate fruitful opportunities for financial professionals and agricultural operators alike. Offering a nuanced look into the financial requirements of the agricultural sector, the course “Agriculture Lending Fundamentals” led by Gabriel Lip through the Corporate Finance Institute is an essential resource. Designed thoughtfully for those aspiring to enter or deepen their expertise in agriculture lending, this course presents a unique blend of theoretical insights and practical applications.

This article delves into the constituents of this program, exploring its curriculum focus, structure, target audience, and the value it brings in navigating the intricate landscape of agricultural finance.

Course Overview

Unique Aspects of Agricultural Lending

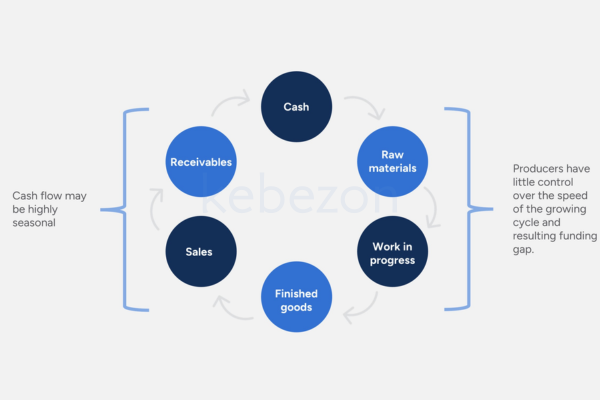

Lending in agriculture is distinct, infused with its own set of challenges and opportunities. Farmers and ranchers often face fluctuating market conditions that impact their cash flow, commodity prices, and overall financial health. As such, this course emphasizes the working capital cycle, the demand for capital expenditures, and various qualitative risk factors that can affect lending decisions. Understanding these elements is akin to knowing the seasonal patterns in farming absolutely essential for effective financial management.

Through this course, participants explore several critical areas including:

- The working capital cycle for agricultural enterprises, highlighting the seasonal nature of crops and livestock.

- Key capital expenditures necessary for farm operations, such as equipment purchases and infrastructure improvements.

- The identification and analysis of qualitative risk factors that impact agricultural lending, including climatic conditions, soil fertility, and regulatory issues.

Practical Skills Development

One of the most striking elements of this course is its focus on merging theory with real-world applications. Students are not just passively absorbing knowledge; they are actively engaging in scenarios that mirror real lending experiences. This hands-on approach enables participants to assess productive assets thoroughly and understand the collateral that is often required in agricultural lending.

For instance, learners gain practical insights into assessing the value of farmland, livestock, and machinery, building a skill set that is invaluable in making informed lending decisions. This practical framework underlines the importance of not just theoretical knowledge but also the ability to apply this knowledge in real-world contexts.

Target Audience

Who Can Benefit?

“Agriculture Lending Fundamentals” is not solely for seasoned finance professionals; it is structured to benefit a broad spectrum of participants. This includes aspiring agriculture lenders, bankers, credit analysts, and loan brokers, making it an inclusive resource for anyone interested in the agricultural finance sector.

The course’s online and self-paced nature makes it accessible, catering to individuals from various backgrounds, whether they possess previous experience in finance or are stepping onto new ground. This flexibility empowers learners to unlock their potential, building foundational knowledge that can significantly enhance their roles in agriculture lending.

Customization for Success

Identifying different target audiences helps tailor learning experiences to meet specific needs. For instance:

- Aspiring Agriculture Lenders: Build a solid foundation in agricultural financing principles.

- Bankers: Gain insights into the specific financial needs of agricultural clients.

- Credit Analysts: Learn to evaluate risk factors unique to agricultural investments.

- Loan Brokers: Understand the collateral requirements and lending processes associated with agricultural operations.

This customization fosters a deeper engagement with the material, allowing each learner to derive maximum value from their experience.

Curriculum Highlights

Key Topics Covered

The course covers essential topics that are vital for understanding the complexities of agricultural lending. Each segment of the curriculum is crafted to elevate the learner’s comprehension of agricultural finance fundamentals. The topics include, but are not limited to:

- Risk Assessment in Agriculture: Understanding the inherent risks in agricultural lending, from natural disasters to market volatility.

- Loan Structuring Techniques: Learning how to structure loans uniquely for agricultural clients, considering cash flow cycles and repayment strategies.

- Collaterals and Asset Evaluation: Focusing on how to evaluate agricultural assets effectively, such as land, livestock, and machinery.

Comparative Analysis

To provide a thorough understanding, the course utilizes comparative analysis methodologies, encouraging participants to differentiate agricultural lending from other commercial lending practices. A quick comparison can be drawn as follows:

| Aspect | Agricultural Lending | General Commercial Lending |

| Cash Flow Cycle | Seasonal fluctuations | More consistent income streams |

| Risk Factors | Weather, pests, market prices | Economic trends, consumer demand |

| Collateral Types | Farmland, equipment, livestock | Real estate, inventory, receivables |

| Loan Structure | Tailored to seasonal repayment | Standard repayment structures |

This comparative approach enhances the learners’ ability to think critically about lending practices, gearing them for success in varied financial contexts.

Conclusion

As we stand at the crossroads of finance and agriculture, the “Agriculture Lending Fundamentals” course by Gabriel Lip offers a fertile ground for individuals seeking to sow the seeds of knowledge in agricultural finance. The program’s blend of theoretical insights with practical skills sets it apart, illuminating the pathways to successful lending in a complex and often volatile market.

For anyone looking to cultivate their expertise in this vital sector, this course serves not only as a guideline but also as an inspirational toolkit allowing both budding and seasoned professionals to navigate the fields of agricultural finance with confidence. By understanding and applying what they learn, participants are empowered to support farmers and ranchers, ultimately fortifying the backbone of our food systems and rural economies. Whether you are harvesting knowledge for personal growth or professional advancement, “Agriculture Lending Fundamentals” promises to reap a bountiful reward.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Agriculture Lending Fundamentals with Gabriel Lip – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.