CANDLESTICKS APPLIED By Steve Nison & Syl Desaulniers – Candle Charts

299,00 $ Original price was: 299,00 $.15,00 $Current price is: 15,00 $.

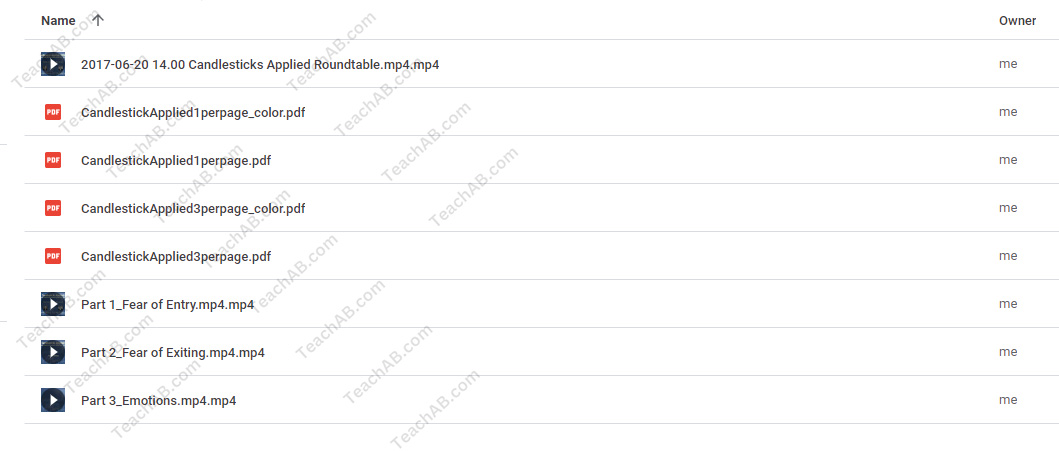

Download CANDLESTICKS APPLIED By Steve Nison & Syl Desaulniers – Candle Charts, check content proof here:

Steve Nison and Syl Desaulniers’ Influence on Candlestick Charting

Trading is like sailing an ocean; traders try to stay afloat while navigating through waves of market turbulence. The instruments of analysis that aid in interpreting the constantly fluctuating tides of pricing and trends are at the forefront of this quest. Candlestick charts are a very useful tool for studying the subtleties of market psychology. Steve Nison has been instrumental in bringing complex Japanese candlestick methods to a wider audience by pioneering this methodology in the West.

By providing traders with useful tactics and real-world applications, Nison and Syl Desaulniers have enhanced the field of technical analysis. This article delves into the contributions of these two eminent figures, examining their works and the principles they advocate in the realm of candlestick charting.

The Foundational Work of Steve Nison

Steve Nison’s journey in the realm of technical analysis can be traced back to his groundbreaking book, Japanese Candlestick Charting Techniques. This seminal work not only introduced traders to the beauty and complexity of candlestick patterns but also emphasized the psychology that underpins market movements.

Unveiling Candlestick Patterns

Candlestick patterns, with their intricate formations resembling different shapes and symbols, serve as a graphical representation of trading activity over a specific timeframe. Each candle reveals significant insights about price movement, including the open, close, high, and low prices. For instance:

| Pattern | Indication |

| Bullish Engulfing | Potential reversal to an uptrend |

| Bearish Engulfing | Potential reversal to a downtrend |

| Doji | Indecision in the market |

| Hammer | Reversal signal after a downtrend |

Nison painstakingly dissects these patterns in Japanese Candlestick Charting Techniques, giving them life via evocative explanations and useful applications. His focus on comprehending the importance of each formation in relation to market dynamics sets the standard for successful trading tactics.

Going Beyond the Fundamentals

Nison’s impact goes beyond just recognizing trends. Beyond Candlesticks, his follow-up book, examines other charting methods like as Renko and Kagi charts. This extension gives traders access to a wider range of analytical tools, enabling a more sophisticated interpretation of price movement. By acknowledging the shortcomings of conventional candlestick analysis and providing different viewpoints, Nison gives traders a variety of instruments to address market difficulties.

Syl Desaulniers: A Contemporary Perspective

The collaboration ***ween Steve Nison and Syl Desaulniers marks a significant enhancement in the use of candlesticks in trading. Desaulniers brings a contemporary lens to the application of these techniques, emphasizing real-world scenarios and practical strategies.

Practical Integration of Candlestick Patterns

Desaulniers’ contributions focus on integrating candlestick patterns with other technical analysis methods. This holistic approach can significantly improve decision-making processes for traders seeking to refine their strategies. By combining candlestick analysis with indicators like moving averages or RSI (Relative Strength Index), traders can bolster their confidence in forecasting market trends.

- Key Strategies:

- Confirming candlestick signals with additional indicators.

- Employing candlesticks in tandem with support and resistance levels.

- Using volume analysis to validate market movements.

The Mentality of Trading

Understanding the psychological factors influencing price changes is one of the most notable themes in both Nison’s and Desaulniers’ writings. Prices represent human emotions and actions and are more than just numbers on a chart. Trading professionals may more accurately predict possible reversals or continuations by understanding the psychology underlying market patterns.

This psychological understanding is especially important when market volatility is high. For example, traders frequently display excitement during a bullish surge, which might result in overbought circumstances. On the other hand, panic can lead to hurried sell-offs during bad markets. Traders can more skillfully negotiate the complexity of market psychology by recognizing these emotional cues.

Fundamental Principles for Candlestick Trading Success

Through their combined expertise, Nison and Desaulniers have outlined several critical principles that every trader should consider when utilizing candlesticks:

Embrace the Context

Understanding the context in which a candlestick formation appears is vital. Patterns can signify different things based on whether they emerge in an uptrend, downtrend, or sideways market. For example, a doji candle in a trending market might suggest exhaustion, while the same pattern in a ranging market could indicate indecision.

Knowledge of Trends

Avoiding trading against current market trends is a key guideline that Nison and Desaulniers have outlined. Successful traders use current trends to guide their judgments rather than swimming upstream. This idea is summed up in the proverb “The trend is your friend.”

Confirmation and Momentum

Understanding market momentum is essential when using candlestick signs. Before making a transaction, Nison and Desaulniers stress the significance of verifying signals. In order to successfully reduce risks, this may include examining other signs or pricing behavior.

In conclusion

Steve Nison and Syl Desaulnier’s contributions act as lighthouses in the wide and sometimes turbulent ocean of trading, pointing traders in the direction of knowledge and profitable investing. In addition to demystifying intricate market dynamics, their work on candlestick charting equips traders with the information they need to confidently navigate the markets. Understanding market psychology and skillfully combining candlestick patterns with more general technical analysis establish these approaches as essential components of the trading toolbox.

In the end, Nison and Desaulniers’ contribution to candlestick analysis goes beyond simple patterns and provides a framework for negotiating the complex web of financial markets. The fundamental and useful ideas that these pioneers gave are still invaluable as traders continue to study their lessons, shedding light on the way to successful trading tactics.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “CANDLESTICKS APPLIED By Steve Nison & Syl Desaulniers – Candle Charts” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.