Credit Administration and Documentation with Scott Powell – CFI Education

15,00 $

You may check content proof of “Credit Administration and Documentation with Scott Powell – CFI Education” below:

Review of Credit Administration and Documentation – Scott Powell

In the complex world of finance, understanding the nuances of credit administration is akin to navigating a labyrinth, where every twist and turn requires caution and clarity. Scott Powell’s course, “Credit Administration and Documentation,” serves as an illuminating guide through this intricate maze, shedding light on vital aspects of credit management that are essential for both seasoned professionals and those new to the field.

With an engaging focus on the framework of credit analysis and thorough documentation practices, the course equips participants with the knowledge and tools necessary to mitigate risks and make informed decisions. By embarking on this learning journey, students are not just absorbing information; they are being prepared to become astute guardians of financial ethics and responsibility.

Importance of Credit Administration

Understanding the Core Functions

Credit administration is not merely a background task but a core function within financial institutions that underpins their ability to assess and manage credit risks effectively. Just as a captain navigates a ship through turbulent waters, credit administrators guide their organizations through the unpredictable seas of borrower behavior and market fluctuations. This course offers a comprehensive understanding of why credit administration is crucial, emphasizing its role in maintaining compliance with regulatory frameworks an intricate web of laws, rules, and guidelines designed to ensure market stability.

Emphasizing a proactive approach, one of the key messages is that effective credit administration can prevent potential losses before they materialize. Through insights shared by Scott Powell, participants learn to dissect the critical elements of credit risk considerations. Recognizing warning signs, such as a sudden drop in a borrower’s credit score or unusual spending patterns, is akin to spotting dark clouds on the horizon before a storm. By honing this skill, credit analysts become vigilant sentinels, ready to act before disaster strikes.

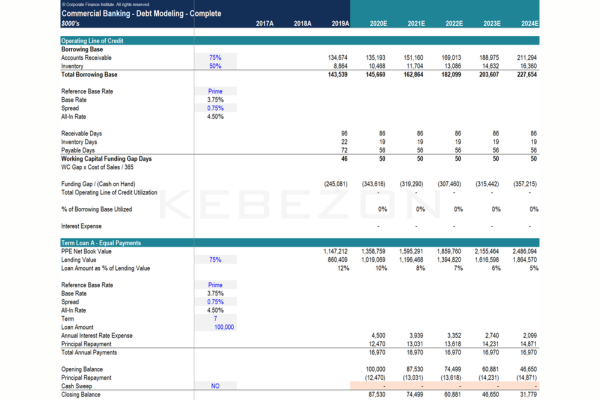

Comparative Analysis of Credit Risks

Participants are encouraged to engage in a comparative analysis that quantifies different types of credit risks, which can range from default risk to concentration risk. Below is a comparative summary of common credit risk types and their characteristics:

| Type of Credit Risk | Description | Impact on Portfolio |

| Default Risk | Risk of a borrower being unable to meet debt obligations | Can lead to significant losses |

| Concentration Risk | Risk from overexposure to a single borrower or sector | Reduces diversification, increasing vulnerability |

| Country Risk | Risk arising from adverse local economic factors | Affects international portfolios significantly |

| Liquidity Risk | Risk of being unable to sell an asset quickly at market value | Impacts cash flow and capital management |

By engaging with these various risk types, course participants can develop a multidimensional understanding of credit landscapes, which is foundational for risk mitigation and strategic decision-making.

Documentation Practices in Credit Administration

The Backbone of Decision Making

In the realm of credit administration, documentation serves as the backbone of informed decision-making. Scott Powell stresses the importance of meticulous documentation as a means for supporting lending decisions and ongoing servicing actions. A well-structured credit file is much like a well-organized library; each document placed with purpose enables quicker retrieval and informed choices when questions arise.

Proper documentation allows financial institutions to respond flexibly to changes in the borrower’s circumstances. From tax returns and financial statements to personal guarantees and collateral documentation, maintaining a thorough assortment of paperwork ensures that decisions are based on a complete and accurate representation of the borrower’s financial health. It’s akin to a doctor performing a thorough examination before diagnosing an illness; the quality of the diagnosis is dependent upon the quality of information collected.

Recommended Documentation Processes

To enhance the efficiency of documentation practices, the course outlines several recommended processes. Key processes include:

- Standardization: Developing templates for credit requests that ensure all necessary information is collected consistently.

- Periodical Reviews: Establishing a routine for updating and reviewing existing documentation to reflect borrowers’ current states.

- Digital Tools: Leveraging technology to organize, store, and retrieve documentation more effectively, thus enhancing accessibility for all stakeholders.

Implementing these practices ensures that documentation supports not just the current portfolios but also future lending strategies, thus producing long-term benefits for institutions.

Monitoring Credit Accounts

Steps in Effective Monitoring

Monitoring credit accounts is akin to nurturing a delicate plant; it requires regular attention to ensure growth and prevent decay. This is where Scott Powell’s expertise shines as he outlines the procedural steps involved in maintaining oversight over credit accounts.

The course highlights the importance of regularly analyzing account performance indicators, including payment history, credit utilization rates, and any shifts in the borrower’s financial landscape. Key steps include:

- Regular Evaluations: Conducting periodic assessments of borrower accounts to ensure compliance with loan agreements.

- Early Detection Systems: Implementing warning systems that can signal potential risks, such as late payments or declining credit scores.

- Communication Channels: Establishing solid communication lines with borrowers to understand their challenges and respond promptly.

By fostering a culture of diligence in monitoring, institutions can preemptively address issues before they escalate into significant credit problems.

Annual Reviews of Credit Accounts

Another critical aspect is conducting annual reviews of credit accounts, which serve as checkpoints to reassess borrowers’ ongoing eligibility and performance. Scott Powell emphasizes that these reviews are not merely bureaucratic exercises but vital practices that can transform the trajectory of lending relationships.

The process typically encompasses:

- Evaluating current financial health

- Revisiting original credit assessments

- Assessing industry trends and economic conditions

Such rigorous analysis maps out not only the health of the loan portfolio but also the lender-borrower relationship, fostering a sense of mutual accountability and trust an invaluable asset in the world of finance.

Conclusion

Scott Powell’s course on credit administration offers a profound exploration into the foundational structures of effective credit management, shedding light on the significance of diligent administration and detailed documentation. By interweaving theory with practical insights, the course empowers aspiring credit analysts to navigate the complex interplay of credit risks, documentation practices, and account monitoring with confidence. Just as a masterfully composed symphony needs each instrument to play its part harmoniously, effective credit administration relies on the collaboration of various components that together create a robust framework for financial stability.

As participants step away from the course, they carry with them not just knowledge, but the aptitude to become astute navigators in the ever-evolving financial landscape, safeguarding their institutions against the tides of economic uncertainty. If managed with diligence and precision, credit can usher in growth and opportunity rather than chaos and that is the promise of well-executed credit administration.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Credit Administration and Documentation with Scott Powell – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.