Crypto And The Blockchain with Chris Dixon & Changpeng “CZ” Zhao & Emilie Choi & Paul Krugman – MasterClass

6,00 $

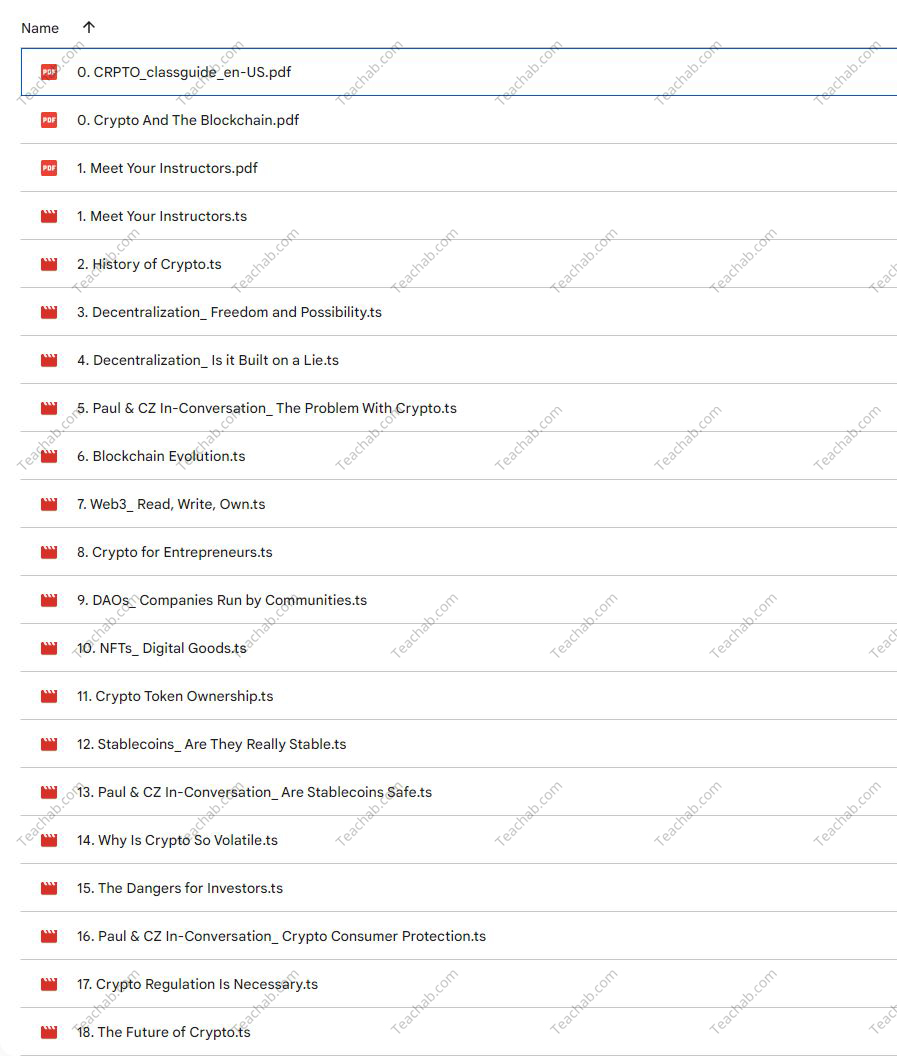

Download Crypto And The Blockchain with Chris Dixon & Changpeng “CZ” Zhao & Emilie Choi & Paul Krugman – MasterClass, check content proof here:

Blockchain and Crypto: Perspectives from Sector Experts

In addition to being a financial revolution, the world of cryptocurrencies and blockchain technology is a paradigm shift that has the potential to completely alter our understanding of value, trust, and ownership. With a plethora of information and expertise from industry experts including Paul Krugman, Emilie Choi, Changpeng “CZ” Zhao, and Chris Dixon, the masterclass “Crypto and the Blockchain” offers a deep dive into this innovative sector.

This course goes beyond fundamental ideas, exploring the subtleties and complexity of Web3, the development of cryptocurrency, and the wider societal ramifications. We shall discover the many facets of cryptocurrencies and their potential to transform financial institutions as we set out on our trip through the perspectives of these eminent academics.

Web3’s Transformative Potential

The Future Vision of Chris Dixon

Chris Dixon, a software entrepreneur renowned for his progressive outlook, highlights the significant transformations signaled by Web3. According to him, this version of the web represents a move away from centralized governance and toward decentralized networks, which allow people to have real ownership and become more economically independent. Web1, Web2, and the rising internet are the three stages of the internet that Dixon compares convincingly.

Web3.

- Web1: The static web where users primarily consumed information.

- Web2: The dynamic web characterized by user-generated content and the rise of companies like Google and Facebook, which centralized control and data.

- Web3: A vision where decentralized systems empower users, allowing them to reclaim their data and control.

Dixon argues that in this new digital landscape, users can interact without intermediaries, reclaiming the power that traditional financial institutions have long held. This shift not only democratizes access to resources but also encourages innovation by fostering an environment where new ideas can thrive independently.

As a vivid metaphor for this transition, Dixon likens the rise of Web3 to the transition from horses to automobiles. Just as the car revolutionized transportation, making it faster and more efficient, Web3 promises to enhance the way we interact with digital economies, paving the way for new business models and opportunities.

Essentials for Comprehending the Blockchain Environment

The significance of comprehending the blockchain, a cutting-edge technology that powers cryptocurrencies, is at the heart of Dixon’s lessons. He demonstrates blockchain’s function in maintaining openness and trust by drawing a comparison to a digital ledger or a public library, where all books (transactions) are permanent and accessible to everybody.

This environment may be further clarified by a list of fundamental ideas in the blockchain ecosystem:

- Decentralization: Removing centralized powers to lessen censorship and control.

- Transparency: Credibility is increased since every transaction is documented and verifiable.

- Smart contracts are self-executing agreements with preset parameters that encourage efficiency and automation.

These aspects of blockchain technology provide a strong argument for its adoption across a range of industries in a world where data privacy and ownership are becoming more and more important, which ultimately supports Dixon’s hopeful outlook for a decentralized future.

A Historical Context of Cryptocurrencies

Changpeng Zhao’s Journey Through Crypto

To better appreciate the landscape of cryptocurrencies, Changpeng Zhao, CEO of Binance, contextualizes its history. He narrates the inception of Bitcoin in the wake of the 2008 financial crisis, where the need for a secure alternative to traditional banking became paramount. This moment marked the birth of a revolutionary technology that would fundamentally alter how value is perceived and transferred globally.

Zhao outlines key milestones in the evolution of cryptocurrencies:

- Bitcoin’s Introduction (2008): The release of the white paper by the pseudonymous Satoshi Nakamoto.

- The Launch of Ethereum (2015): Introducing smart contracts and expanding the functionality of blockchain.

- The ICO Boom (2017): A surge in Initial Coin Offerings, making it easier for startups to raise funds through digital assets.

Zhao uses these turning points to show how cryptocurrencies have evolved from specialized inventions to widely used financial products. According to his perspective, blockchain technology is comparable to the early stages of the internet, a developing infrastructure that can support a wide range of value transfer applications and services.

Blockchain’s Infrastructure Implications

In a deep analogy, Zhao compares the function of blockchain in banking to that of the internet in information sharing, arguing that blockchain will transform value transfer in the same way that the internet revolutionized communication. It gets rid of the inefficiencies that come with traditional finance by allowing peer-to-peer transactions to happen directly without the need for middlemen.

Zhao also draws attention to the unrealized potential of decentralized finance (DeFi), which permits the existence of a range of financial services without the need for centralized authority. More financial inclusion is made possible by this, giving people and companies everywhere the chance to take part in the global economy.

The Case for Inclusivity in Cryptocurrency

Emilie Choi’s Focus on Decentralization

Emilie Choi, president of Coinbase, complements the historical narrative by stressing the inclusive nature of cryptocurrencies. She posits that decentralization serves as a catalyst for financial access, particularly for underserved populations historically excluded from traditional banking systems. Choi suggests that the very essence of cryptocurrencies is to provide opportunities for economic participation where barriers previously existed.

Through tangible examples, Choi illustrates how crypto technologies allow individuals in developing countries to access financial services, whether through mobile payments or obtaining microloans. For instance, in regions where banking infrastructure is lacking, blockchain technology enables the unbanked to engage in financial activities using simply a mobile device.

The Financial Inclusion Ripple Effect

It is possible to think of this inclusion as a domino effect that encourages entrepreneurship and innovation. These communities are enabled to expand their enterprises, make educational investments, and enhance their quality of life as they get access to financial instruments. The following is a list of possible advantages of crypto inclusivity:

- Crowdfunding and microloans: Giving money to new businesses that would struggle to get conventional loans.

- Savings Accounts: Giving consumers the ability to safely save funds in a virtual wallet.

- Peer-to-peer transactions: boosting trade without paying exorbitant costs.

Choi encapsulates what cryptocurrencies may do in this framework—a society in which all people have a voice at the financial table. This idea supports a fair and just economic environment and is consistent with the larger story of decentralized finance.

A Critical Lens on Cryptocurrency

Paul Krugman’s Skepticism and Economic Analysis

In sharp contrast, Paul Krugman assumes the role of a skeptical economist, providing a rigorous critique of the cryptocurrency market. His insights highlight concerns about the speculative nature of cryptocurrencies, arguing that inherent volatility poses significant risks to investors. This critical perspective is crucial for grounding the discussions within the masterclass, reminding participants of the importance of due diligence in an evolving financial landscape.

Krugman’s analysis emphasizes several key factors to consider:

- Speculation vs. Investment: Many participants engage with cryptocurrencies more as speculative assets rather than as long-term investments.

- Market Volatility: The abrupt price fluctuations often seen in the crypto market can lead to unsustainable bubbles.

- Regulatory Challenges: As governments seek to establish regulations, there exists uncertainty regarding the future of cryptocurrencies.

The Juggling Act of Risk and Opportunity

By understanding both the promise and the hazards associated with cryptocurrencies, Krugman’s appraisal promotes a balanced approach. He compares the market’s present situation to the gold rush, when the desire for rapid wealth causes many people to disregard basic economic fundamentals. Through this contrast, students are reminded of how crucial it is to approach this complicated terrain with an informed viewpoint.

As Krugman examines how cryptocurrency swings affect the typical investor, he invites readers to think about past examples that highlight the necessity of exercising caution when dealing with speculative markets. By encouraging thoughtful discussions and introspection on these issues, the masterclass recognizes the complexity of the bitcoin environment.

In conclusion,

A comprehensive introduction to this exciting topic, the “Crypto and Blockchain” masterclass with Chris Dixon, Changpeng Zhao, Emilie Choi, and Paul Krugman blends rigorous economic analysis with visionary optimism. While being mindful of the speculative nature and accompanying hazards, we are urged to embrace the possibilities for decentralization and financial inclusiveness as we traverse the complexity of cryptocurrencies.

The course fosters a thorough grasp of the academic and practical elements of cryptocurrencies and blockchain technology, making it an important resource for students. Participants are urged to reflect on their responsibilities in the changing landscape and engage with it carefully by utilizing the lecturers’ many areas of expertise. By doing this, we open the door for both individual development and a more innovative, free, and owned economy in the future.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Crypto And The Blockchain with Chris Dixon & Changpeng “CZ” Zhao & Emilie Choi & Paul Krugman – MasterClass” Cancel reply

You must be logged in to post a review.

Related products

Business

Reviews

There are no reviews yet.