Crypto Strategies From Swing Trading To Intraday – Alessio Rutigliano & Roman Bogomazov

199,00 $ Original price was: 199,00 $.17,00 $Current price is: 17,00 $.

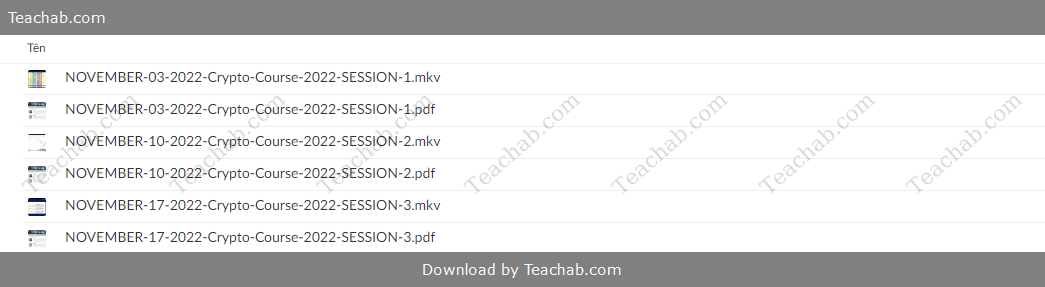

Download Crypto Strategies From Swing Trading To Intraday – Alessio Rutigliano & Roman Bogomazov, check content proof here:

Crypto techniques ranging from intraday to swing trading

Trading cryptocurrencies has developed into a complex field that blends aspects of technology, human psychology, and money. A thorough comprehension of different trading techniques becomes crucial as traders traverse this unstable terrain. “Crypto Strategies from Swing Trading to Intraday,” which is taught by seasoned professionals Alessio Rutigliano and Roman Bogomazov, is one of the best courses in this area. This course, which is designed for intermediate to expert traders, offers a thorough examination of the Wyckoff Method along with crucial frameworks and tools to assist traders in understanding and reacting to the rapidly shifting cryptocurrency market.

Over the course of multiple sessions, participants engage with intricate strategies that blend both swing trading and intraday techniques. The unique structure of the course not only focuses on theoretical concepts but also emphasizes practical applications, ensuring that learners walk away with actionable insights. With the cryptocurrency market often described as a wild frontier of investment, the knowledge shared in this course can serve as a compass, guiding traders through the stormy seas of price fluctuations, news cycles, and market sentiments.

Overview of the Course

Organization and Length

Three two-hour sessions make up the course, which has been carefully planned to offer a comprehensive examination of cryptocurrency trading tactics. With a heavy emphasis on applying taught ideas, this time frame enables a balance between education and involvement. An atmosphere where traders may exchange experiences and ideas is created by the dynamic structure, which promotes student involvement and teamwork.

- Session Breakdown:

- Session 1: Introduction to the Wyckoff Method and Swing Trading Strategies

- Session 2: Initial Coin Offerings (ICOs) and Market Heatmaps

- Session 3: Risk Management Techniques and Practical Applications

This structured yet flexible approach makes it easy for traders to grasp complex concepts systematically, ensuring a solid understanding of each topic before moving on to the next.

Key Topics Covered

The core topics addressed in the course are not only relevant but critical for navigating the unpredictable realms of cryptocurrency trading:

- Swing Trading Strategies:

- Techniques to capitalize on medium-term movements in the market, using tools familiar to experienced traders.

- Initial Coin Offering Patterns:

- Insights into assessing the potential of new cryptocurrencies before they enter the market.

- Market Heatmaps:

- Visual representations of market movements, aiding traders in quickly identifying opportunities and trends.

- Risk Management:

- Strategies to minimize exposure, specifically in a landscape characterized by high volatility and rapid price changes.

These subjects serve as foundational pillars, empowering traders to develop a robust trading strategy tailored to their individual risk tolerance and goals.

The Proficiency of Teachers

Roman Bogomazov and Alessio Rutigliano

Roman Bogomazov and Alessio Rutigliano contribute a plethora of expertise and experience to the training. Their proficiency with the Wyckoff Method enables them to reveal the underlying forces influencing price movement and offer insightful analysis of market structures. This approach, which is well-known for emphasizing how supply and demand interact, has endured and proven useful in a variety of financial sectors, including cryptocurrency.

- Highlighting the Instructors:

- Alessio Rutigliano: Known for his analytical prowess and practical teaching style, Alessio translates complex concepts into digestible lessons that resonate with traders at all levels.

- Roman Bogomazov: A master of market analysis, Roman employs detailed case studies to demonstrate the application of strategies, enabling participants to see theory come to life.

The combination of their backgrounds allows for an engaging learning experience, where strategic discussions are enriched by real-world examples and data analysis.

Teaching Methodology

The course adopts an interactive approach, ensuring that students are not passive recipients of information but active participants in their learning journey. This engagement facilitates a deeper understanding of the dynamics of the cryptocurrency market.

- Personal Feedback: Students receive tailored insights on their trading strategies, allowing for continuous improvement and adaptation.

- Real-World Scenarios: Through exercises based on historical data and trends, traders can practice their skills in a controlled environment, enhancing their readiness for actual market conditions.

Use of Strategies in Practice

Pay Attention to Real-World Difficulties

This course is designed to provide traders the skills they need to overcome the particular difficulties presented by the volatility of cryptocurrency markets. Participants may modify their tactics to suit any market circumstance by studying swing and intraday trading approaches.

Additionally, students may anticipate tackling real-world issues because of the emphasis on practical applications. Rutigliano and Bogomazov, for example, teach students how to read market structures, recognize leadership qualities, and analyze how news cycles affect market behavior.

- Case Studies: In-depth reviews of successful and unsuccessful trades provide valuable lessons that can inform future decisions.

- Market Analysis Tools: Traders learn to utilize various tools, from point and figure charting to price alerts, enhancing their situational awareness in fast-changing conditions.

Risk Management Techniques

One of the critical components of trading is risk management, and this course highlights methodologies specifically designed for high volatility environments. Traders are taught the importance of defining their risk tolerance and developing strategies that protect capital.

- Key Risk Management Strategies:

- Setting Stop-Loss Orders: Establishing predetermined exit points to safeguard against catastrophic losses.

- Diversification: Distributing investments across various assets to mitigate risks.

Long-term success in a market that is sometimes compared to a roller coaster depends on knowing how to maintain composure throughout tumultuous swings.

In conclusion

To sum up, “Crypto strategies from swing trading to intraday” provides traders wishing to improve their abilities in the cryptocurrency space with a thorough educational experience. With knowledgeable guidance, an emphasis on real-world applications, and an abundance of tactics based on the Wyckoff Method, this course gives students the skills they need to successfully negotiate the choppy waters of cryptocurrency trading.

The abilities gained from this course provide traders with a strong basis for taking advantage of new opportunities while successfully managing risk as the market continues to evolve. Students can graduate from Rutigliano and Bogomazov’s instruction more knowledgeable and self-assured, prepared to face the difficulties of the bitcoin market.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Crypto Strategies From Swing Trading To Intraday – Alessio Rutigliano & Roman Bogomazov” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.