Dan Dowd Trading

5,00 $

You may check content proof of “Dan Dowd Trading” below:

Dan Dowd Trading: An In-Depth Review

When discussing modern trading methodologies, Dan Dowd Trading stands out as a compelling blend of educational insights and practical application. At the heart of Dowd’s approach is a deep understanding of market dynamics that significantly diverges from traditional trading strategies. His emphasis on the Inner Circle Trader (ICT) framework introduces novices and seasoned traders alike to concepts such as liquidity, price action, and the behavior of institutional traders, often referred to as “smart money.” This review aims to peel back the layers of Dowd’s trading philosophy, dive into his educational offerings, and examine the effectiveness of his techniques through the lens of community feedback and performance metrics.

Whether you are a curious beginner or a professional searching for innovative strategies, Dan Dowd’s trading methodology provides an engaging mix of theory and practical steps. It recognizes that successful trading requires more than just understanding indicators; it requires an appreciation of market psychology, a systematic approach to trade execution, and a continuous learning mindset. This review hopes to guide aspiring traders through Dan Dowd’s principles, exploring both the nuances of his strategies and the broader trading community that supports them.

Understanding Dan Dowd’s Trading Philosophy

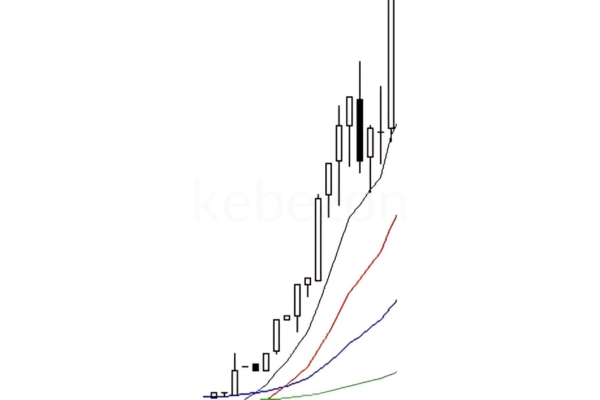

Dan Dowd’s trading philosophy encapsulates a profound understanding of market mechanics, particularly through the lens of the ICT methodologies. At its core, Dowd’s approach encourages traders to view the market not merely as a canvas of fluctuating prices but as a dynamic environment influenced by the actions of institutional investors. Often compared to sailing through unpredictable waters, Dowd suggests that recognizing market traps and diversions created by “smart money” is essential for navigating successfully.

To truly grasp this philosophy, one must focus on the key concepts that Dowd teaches: liquidity, fair value gaps, and optimal trade entry positions. By viewing liquidity as the lifeblood of market movement, traders can identify crucial zones where price reversals may occur. This concept serves as a guidepost for decision-making, akin to a lighthouse guiding ships through treacherous waters. By leveraging insights from smart money movements, traders can hope to align their strategies with the broader market direction, akin to riding the waves rather than fighting against them.

Moreover, Dowd emphasizes the importance of education in trading, underscoring that understanding the psychology behind price movements can set a trader apart from the crowd. By portraying trading as a skill set akin to art, he creatively inspires students to paint their own success stories on the wide canvas of the financial markets. Students are urged to embrace ongoing learning, as the only constant in trading is change, much like the ever-shifting tides of the ocean.

Key Concepts of ICT Trading

At the core of Dan Dowd’s philosophy is a series of interconnected concepts borrowed from the Inner Circle Trader (ICT) framework. These concepts do not just serve as abstract ideas; they form a tangible methodology that traders can apply directly in their daily practices. Below, we delve deeper into these key concepts that make up ICT trading:

- Liquidity: As highlighted earlier, liquidity is foundational in Dowd’s trading. It is the framework through which traders understand where significant trading orders are clustered in the market. Identifying liquidity pools helps predict where price is still poised to return, akin to finding hidden currents in a vast ocean.

- Fair Value Gaps (FVG): FVGs represent areas on a price chart where price has left behind an imbalance, suggesting potential reversal points. These gaps function as signspost markers in a trader’s journey, indicating where price may return to rebalance itself.

- Optimal Trade Entry (OTE): This concept targets specific retracement levels that maximize the likelihood of successful trades, aiming for entries typically between 61.8% and 78.6% of a price movement. This precision is akin to waiting for the perfect roller coaster drop timing is essential.

- Market Structure Shifts: Recognizing shifts in market structure is vital for identifying trend changes. These shifts serve as turning points in a trader’s expedition, similar to spotting when dark clouds signal a storm approaching.

- Displacement and Inducement: Dowd introduces these concepts to depict the market’s seemingly erratic behavior, showcasing how sudden movements can create misleading signals. Understanding these elements can prevent traders from falling into traps set by institutional players much like avoiding hidden reefs in turbulent waters.

Using these concepts harmoniously in one’s trading routine equips traders with the tools to interpret market behavior accurately and respond intelligently.

Summary of Key Concepts:

**Concept** **Description** **Liquidity** Identifying price levels with clustered stop orders for predictive trading. **Fair Value Gaps (FVG)** Recognizing price imbalances that suggest potential price reversals. **Optimal Trade Entry (OTE)** Executing trades at specific retracement levels for increased success probability. **Market Structure Shifts** Detecting significant shifts in market trends for accurate trade timing. **Displacement** Observing rapid price movements that signify shifts in market sentiment. **Inducement** Identifying manipulative movements that lure traders into positions against market direction.

Smart Money Insights in Trading

Understanding the behavior of smart money, or institutional investors, is at the heart of Dan Dowd’s trading insights. This paradigm shift from typical retail trading strategies to a focus on the institutions that shape market movement encapsulates the essence of the ICT methodology.

- Understanding Smart Money Mechanics: Institutional traders have the capital to execute significant trades that undoubtedly impact market movements. By analyzing these behaviors, Dowd teaches traders to align their strategies with smart money’s actions. It’s like playing chess, where understanding your opponent’s strategic moves opens a pathway for your own success.

- Market Manipulation Awareness: Recognizing how smart money creates market traps can save traders from falling prey to poorly timed decisions. Dowd emphasizes the need to be aware of zones where retail traders are likely placing stop-loss orders, ensuring traders can position themselves more effectively, avoiding detrimental entrapments.

- Analyzing Imbalances: One of the pivotal aspects of smart money trading is the recognition of imbalances between buyers and sellers. Dowd’s insights will empower students to focus on identifying these areas hotspots where price action may indicate a forthcoming change in direction.

- Leveraging Volume Analysis: Understanding volume as an amplifier of price movement allows traders to discern the strength of movements. By combining volume data with smart money insights, traders can form a clearer picture of upcoming price action.

Through these intelligently crafted insights, Dan Dowd successfully demystifies the often-overlooked dynamics involving institutional behaviors. His methods underscore how the subtle nuances of smart money trading can empower individual traders to make informed decisions and seize opportunities often missed by the average participant.

Reviews of Dan Dowd Trading Courses

The sentiment surrounding Dan Dowd’s courses is widely positive, with many participants voicing appreciation for his methodical approach to teaching complex trading concepts. In a world saturated with misleading information, Dowd’s clarity cuts through the noise, offering students a refreshing perspective on trading.

- Structured Educational Content: Users often highlight the organization and systematic progression of the course material, which builds upon fundamental concepts before advancing to more sophisticated strategies. The structure is likened to climbing a mountain each step taken ensures a safer and more rewarding climb to the summit.

- Accessible Learning Resources: The online nature of Dowd’s courses allows participants from various backgrounds to engage without significant barriers. With video tutorials, live discussions, and community support, learners can interact with material in a dynamic format suited to different learning styles.

- Positive Community Feedback: The supportive community aspect of Dowd’s training programs is often lauded. By fostering a collaborative environment on platforms like Discord, students can connect, share insights, and learn from one another akin to a well-led team navigating unknown territory together.

Summary of User Reviews:

- Structured and Clear: Traders appreciate the logical sequencing of concepts within the course, facilitating comprehension.

- Interactive Learning Environment: Engaging with fellow traders bolsters learning through shared knowledge and feedback.

- Comprehensive Support: Participants find value in continued mentorship and guidance, even after course completion.

Course Overviews and Highlights

Dan Dowd Trading offers a meticulously structured series of courses designed to accommodate various levels of traders, ensuring no one is left behind. Here’s a closer examination of the primary educational offerings:

- Beginner to Advanced ICT Course: This foundational course covers essential trading concepts and progresses to more complex strategies, ensuring a thorough understanding of market behavior.

- Time-Based Trade Model: Focusing on timing is pivotal in this course, where participants learn to incorporate time elements into decision-making, optimizing their chances for successful trades.

- Order Block Course: Diving into the intricacies of order blocks, this course equips students with the ability to identify pivotal price levels that indicate future price movements.

- Weekly Trading Reviews: Regular lessons and market analyses engage learners and provide real-time insights that refine their trading strategies.

- Discord Community Access: A lively community fosters continuous learning, allowing members to exchange insights and experiences an invaluable asset for any trader.

Course Highlights Table:

**Course** **Focus** **Beginner to Advanced ICT Course** Comprehensive understanding of strategies and concepts. **Time-Based Trade Model** Optimum trade timing discussions and applications. **Order Block Course** Detailed exploration of order blocks and future price predictions. **Weekly Reviews** Ongoing assessments and real-time interactions to hone techniques. **Discord Community** Collective engagement for peer learning and mentorship.

User Testimonials on Educational Value

User testimonials reflect the enriching experience many have encountered in Dan Dowd Trading’s educational offerings. The narrative woven through these reviews depicts a community of learners committed to enhancing their trading skills through shared knowledge.

- Finding Clarity in Complexity: Many users credit the structured courses for breaking down complex trading concepts into digestible formats. This transformative learning experience empowers individuals to overcome initial uncertainties.

- Supportive Learning Environment: Testimonials often highlight the benefits of engaging within a community of peers. The opportunity to ask questions, participate in discussions, and examine different trading perspectives fosters a nurturing environment for growth.

- Accelerated Learning Curves: Participants share stories of how Dowd’s courses helped them avoid common pitfalls associated with trading. By equipping students with effective strategies from the outset, many report experiencing accelerated growth in their trading journeys.

Summary of User Experiences:

- Clarity and Simplicity: Many students praise the clarity with which Dowd imparts trading concepts.

- Supportive Community: Engaging discussions enhance the experience, offering various insights.

- Avoiding Pitfalls: Insights gleaned from the courses help members sidestep common trading mistakes, fostering growth.

Analyzing Dan Dowd’s Trading Strategies

Dan Dowd’s trading strategies, rooted in the ICT framework, emphasize practical applications for real-world trading scenarios, heavily drawing on price action analysis and an acknowledgment of market dynamics.

- Focus on Price Action: Unlike many retail trading methodologies, Dowd’s approach relies on understanding the underlying reasons for price movements rather than overdependence on technical indicators. He encourages traders to listen to the market’s voice, which speaks through its price action, rather than following conventional narratives dictated by external indicators.

- Methods of Execution: Dowd emphasizes disciplined execution of strategies learned throughout his courses. This encouragement resonates with many traders seeking stability having a plan in place helps mitigate anxiety during turbulent market conditions.

- Community as a Learning Tool: The integrated community aspect enriches learning opportunities; sharing live trading experiences provides immediate feedback and a sense of accountability among peers, reinforcing commitment to their individual trading plans.

- Continuous Learning Emphasis: Dowd instills the value of lifelong learning, actively encouraging traders to refine their strategies and adapt to market shifts as they evolve.

Summary of Strategy Effectiveness:

- Price Action Focus: Prioritizing real-time market behavior over external indicators.

- Execution Discipline: Emphasizing the importance of sticking to planned strategies reduces impulsive decisions.

- Community Dynamics: Utilizing peer interactions enhances accountability and learning among traders.

Price Action Techniques in Practice

Dan Dowd’s trading strategies revolve around price action, enabling him to navigate the complexities of the market without the crutch of excessive technical indicators. Through practical applications, he fosters a robust understanding of market conditions.

- Analyzing Charts: Dowd encourages aspiring traders to interpret charts with a keen eye, recognizing unique price movements as signals of potential market shifts. His insight promotes the idea that price movements often narrate the story of market sentiment.

- Understanding Market Liquidity: By identifying liquidity zones, traders can better predict potential points of price reversals. Dowd’s practical teachings provide a roadmap for identifying these key areas rather than relying solely on automated signals.

- Creating Trade Setups: Dowd emphasizes the importance of crafting specific trade setups based on price action analysis. This attention to detail reflects his broader strategy of personalized trading, emphasizing that each trade should be based on well-researched contexts and market conditions.

- Real-Time Decision Making: The real-time application of these techniques implies that traders need to be alert and adaptable. Dowd encourages a mindset where traders assess market conditions continuously, sharpening their instincts to capitalize on precise moment-to-moment movements.

Practical Application Summary:

- Chart Analysis: Emphasis on interpreting signals from price movements.

- Liquidity Recognition: Identifying critical price levels to anticipate reversals.

- Tailored Trade Setups: Crafting personalized strategies rather than relying on generic strategies.

- Adaptability: Encouraging real-time assessments to respond to market changes.

Comparison with Traditional Trading Methods

While traditional trading often emphasizes standardized strategies and reliance on technical indicators, Dan Dowd’s methods adopt a more holistic approach to the trading landscape. Below are some key contrasts between his strategies and traditional trading methodologies.

- Understanding Market Manipulation: Traditional trading methodologies frequently overlook the influence of institutional investors. In contrast, Dowd emphasizes identifying the patterns of smart money, enabling individual traders to avoid traps set against retail traders.

- Community Learning vs. Individualism: Traditional trading often promotes solitary learning journeys, while Dowd’s community-centered approach fosters collaboration. Through shared experiences, traders can learn and grow collectively.

- Price Movement Interpretation: Traditional methods may rely on extensive usage of technical indicators for decision-making. Dowd’s approach emphasizes reading price action and understanding market dynamics providing a richer context for trading decisions.

- Risk Management: Dowd’s strategies are built around risk awareness, going beyond just the typical stop-loss approach found in traditional methods. His comprehensive risk management practices encourage participation at various market levels, ensuring they adapt to fluctuating market demands.

Comparison Summary Table:

**Feature** **Traditional Trading** **Dan Dowd Trading** **Focus** Standardized strategies Personalized strategies based on market analysis **Learning Approach** Often individualistic Community fostered learning with peer interactions **Market Interpretation** Heavy reliance on indicators Emphasis on price action and market dynamics **Risk Management** Basic stop-loss strategies Comprehensive risk management practices

Community Feedback on Dan Dowd Trading

Community engagement within Dan Dowd Trading reflects the positive atmosphere and collaborative spirit that enriches the learning experience. Participants actively share their journeys, insights, and successes, creating a vibrant ecosystem where traders can thrive.

- Mutual Support: The community fosters a supportive environment in which traders feel encouraged to share both their achievements and setbacks. This open dialogue cultivates growth among members, who learn from each other’s experiences.

- Diverse Perspectives: As members come from varying backgrounds some seasoned professionals and others just launching their trading journeys the sharing of different trading experiences broadens the knowledge base available to all participants.

- Accountability and Motivation: Through regular discussions and shared trading ideas, members hold each other accountable for adhering to their trading plans. This additional layer of motivation helps each trader stay focused on their individual goals.

Community Feedback Summary:

- Supportive Dynamics: Traders feel encouraged to share insights, creating a positive atmosphere for collective growth.

- Diverse Interactions: Members gain a variety of perspectives based on different trading experiences.

- Motivational Structures: Accountability mechanisms foster a disciplined approach among participants.

User Experiences in Discord Community

The Dan Dowd Trading Discord community serves as a vibrant hub of collaboration, learning, and sharing. Here, traders from various backgrounds converge to engage in meaningful discussions about market strategies and trading techniques.

- Real-time Interactions: The active Discord channels facilitate discussions about current market conditions, live trade setups, and immediate feedback on trading decisions. Members consider this real-time interaction invaluable to their trading development.

- Guided Learning: Dowd frequently engages with the community, offering insights and direct support to members looking to refine their trading strategies. This type of mentoring elevates the overall learning experience, as it connects educational content with practical application.

- Success Celebrations: This dynamic community also celebrates the success stories of its members, creating an uplifting atmosphere where achievements are recognized, encouraging others to persist in their trading journeys.

- Resource Sharing: Community members often share research, articles, and insights, broadening the wealth of information accessible to everyone. Such resource-sharing habits contribute significantly to individual members’ continued education.

User Experience Summary:

- Immediate Interactions: Real-time discussions enhance learning and responsiveness to market trends.

- Active Mentoring: Continuous engagement from Dowd provides personalized guidance.

- Celebration of Success: Recognizing individual success encourages communal motivation.

- Resource Exchange: Sharing of informative materials enriches knowledge and strategy application.

Success Stories from Participants

The narratives of success within Dan Dowd’s community reveal a tapestry of individual journeys shaped by growth, learning, and newfound trading confidence. Participants often share transformative experiences rooted in the principles taught in Dowd’s courses.

- Increased Trading Consistency: Many former students report achieving a newfound consistency in their trading results, attributing this improvement to the structured methodologies learned in Dowd’s courses. Success, in this context, is both about hitting profit targets and maintaining discipline across trades.

- Overcoming Challenges: Participants express how Dowd’s teachings have helped them surmount common trading pitfalls. By instilling a deeper understanding of market behavior, they’ve become more adept at managing their psychological responses during challenging trading situations.

- Community Engagement: Testimonials emphasize how ongoing participation in the community contributes significantly to individual success. The motivational support from peers not only reduces feelings of isolation but also fosters a sense of camaraderie traders feel they are working together towards similar goals.

Success Stories Summary:

- Consistency: Participants report achieving greater stability in their trading outcomes.

- Challenge Resolution: Insightful teachings equip participants to confront and overcome trading adversities.

- Community Impact: Engagement within the group contributes to heightened motivation and shared successes.

Evaluating the Effectiveness of Dan Dowd’s Approach

Dan Dowd’s approach to trading is crafted not just for immediate success but for fostering a long-term understanding of market dynamics that promote consistent profitability. Through a structured curriculum, Dowd shapes traders into more knowledgeable and confident participants in the financial arena.

- Curriculum Structure: The organized content structure ensures that concepts build upon each other, allowing traders to grasp complex ideas progressively. This thoughtful design enables students to layer their knowledge effectively.

- Psychological Resilience: Dowd emphasizes emotional control and discipline a vital component for achieving manageable success. Many traders share that the psychological skills learned are as critical as the technical knowledge gained through coursework.

- Real-world Application: By focusing on relevant scenarios and price action, Dowd prepares traders for live market conditions, allowing them to apply what they’ve learned in real-time rather than in hypothetical scenarios.

Effectiveness Evaluation Summary:

- Structured Learning: A well-organized curriculum supports progressive learning.

- Psychological Strengths: Emphasizing discipline fosters mental resilience in traders.

- Practical Applications: By focusing on real-world scenarios, traders are better prepared for live market conditions.

Performance Metrics from Course Participants

The data collected from course participants reflects the significant impact of Dan Dowd’s methods on trading performance. Evaluating these metrics offers insight into the effectiveness of the strategies taught.

- Success Rate Improvements: Participants frequently report significant increases in their trading success rates, with many claiming win rates upwards of 70% using the strategies they’ve learned.

- Profitability: Analyzing performance reports showcases that many traders have seen substantial profit margins after implementing Dowd’s insights. Regular backtesting further reinforces these claims, highlighting the profitability of tested strategies.

- Increased Confidence: The metrics show that as traders enhance their skills, their confidence levels also grow, enabling them to take on larger positions or more advanced strategies without the fear that previously hindered their trading decisions.

Performance Metrics Summary:

- Enhanced Win Rates: Many report win rates above 70% after implementing Dowd’s strategies.

- Profit Growth: Regular backtesting indicates significant profit potential from learned methods.

- Confidence Boost: Increased confidence levels lead to more decisive trading actions.

Long-Term Impact on Trading Success

Dan Dowd’s teaching methodologies exhibit impressive long-term implications for traders, extending beyond immediate successes into sustainable practices that promote future profitability.

- Lifelong Skills Development: The foundational skills and knowledge gained through the trading courses foster an environment for participants to continue developing their trading acumen throughout their careers. The investment in learning pays dividends over time.

- Community Network: The relationships built within the community can provide ongoing support and collaboration opportunities, ensuring that traders will always have a network to rely upon throughout their trading journeys.

- Adaptability to Market Changes: The emphasis on understanding market dynamics allows traders to adapt their methodologies in response to shifting conditions. This versatility is crucial for longevity in the volatile world of finance.

Long-Term Impact Summary:

- Sustainable Skill Growth: The courses lay a foundation for continuous learning and improvement.

- Networking Benefits: Strong community connections foster ongoing collaboration.

- Flexibility in Strategies: An understanding of market dynamics equips traders to adapt to future changes effectively.

Related Content on Trading Concepts

In addition to foundational trading skills, Dan Dowd’s teachings extend into wider concepts relevant to understanding and engaging with the markets. Broadening knowledge in these areas can significantly enhance a trader’s toolkit.

- Smart Money Concepts: Gaining insight into how institutional investors operate provides valuable context for market movements a key component of Dowd’s philosophy.

- Liquidity Understanding: As discussed throughout the review, comprehending liquidity plays a crucial role in predicting price movements, making it essential content for traders.

- Price Action Analysis: Mastering price patterns and trends strengthens a trader’s capabilities, allowing for more instinctive and informed decision-making.

Summary of Related Content:

- Smart Money Principles: Deepen understanding of institutional behaviors.

- Liquidity Knowledge: Essential for anticipating future price movements.

- Price Action Mastery: Builds skills needed for effective analysis and trading decisions.

Connections to Smart Money Trading Principles

Dan Dowd’s methodology is intrinsically linked to smart money trading principles, which emphasize understanding how institutional players influence market dynamics. Recognizing these connections is crucial for traders looking to enhance their effectiveness.

- Tracking Price Movements: Dowd’s focus on price action aligns closely with the principles that guide smart money understanding how institutions accumulate or distribute assets provides critical insights into predicting future price actions.

- Identifying Liquidity Pools: The understanding of liquidity areas prompts traders to examine where institutional orders create potential turning points in price movements, allowing them to position themselves strategically.

- Market Sentiment Awareness: By being aware of the sentiment behind institutional trading actions, participants can align their strategies with the prevailing market mood, ensuring that they are not acting contrary to large-scale movements.

Summary of Connections:

- Price Movement Insight: Understanding institutional trends informs future price predictions.

- Liquidity Focus: Critical for predicting price action based on market behavior.

- Sentiment Alignment: Positioning in line with market movements improves trading outcomes.

Resources for Further Learning in ICT Trading

For traders eager to delve deeper into the ICT trading methodology shaped by Dan Dowd, various resources can supplement their understanding and application of trading strategies.

- Inner Circle Trader (ICT) Materials: Often regarded as foundational, ICT’s teaching materials provide in-depth explanations and examples that form the groundwork for understanding market mechanics.

- Dan Dowd’s Educational Videos: Dowd leverages digital platforms to share valuable insights, tutorials, and experiences, making these publicly accessible for traders at all levels.

- Community Access: Joining the trading community helps facilitate networking with like-minded traders, sharing resources and strategies for mutual growth.

Summary of Resources:

- ICT Educational Materials: Foundational information crucial for understanding smart money concepts.

- Dan Dowd Videos: Accessible insights for various trader skill levels.

- Community Engagement: Connections for resource-sharing among fellow traders.

Through these resources, aspiring and current traders can enrich their learning experiences while uncovering deeper insights into market behavior, setting them on a path to long-term success.

In conclusion, Dan Dowd’s trading philosophy, deeply anchored in the ICT methodologies, provides a refreshing and modern approach to understanding financial markets. By fusing community interaction, focused education, and smart money insights, Dowd empowers traders at all levels to become more effective in their practices. With a steadfast commitment to continuous learning, participants of Dan Dowd Trading are well-equipped to navigate the complexities of the financial landscape, paving the way for sustainable and lucrative trading careers.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Dan Dowd Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.