DTD Credit Mentorship E-Course with Dion Coopwood

1.497,00 $ Original price was: 1.497,00 $.23,00 $Current price is: 23,00 $.

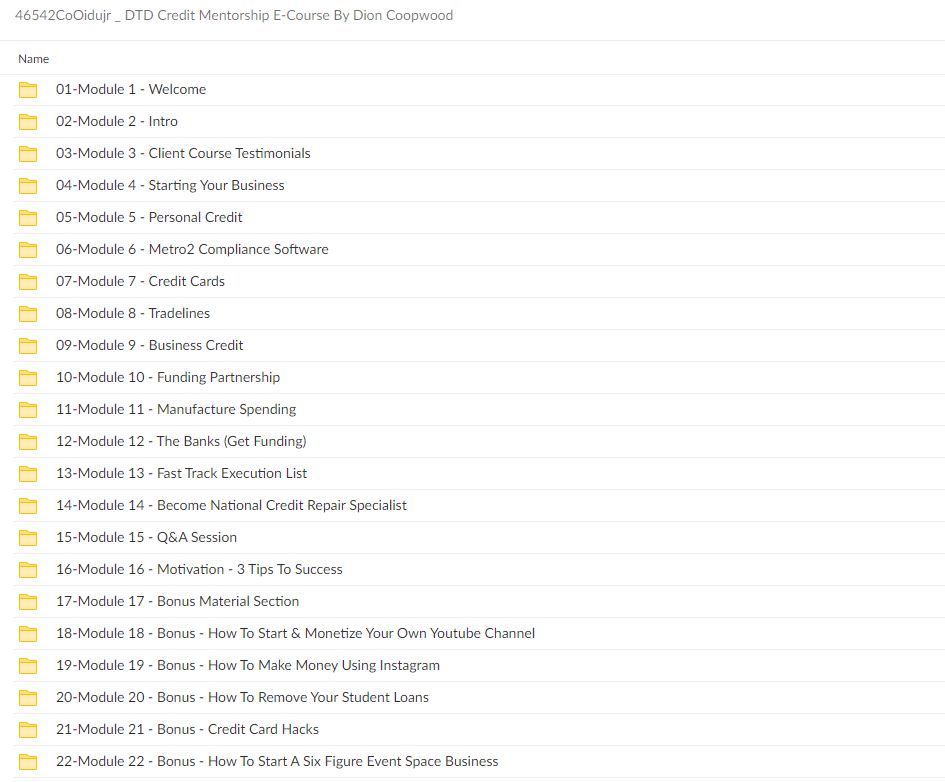

Download DTD Credit Mentorship E-Course with Dion Coopwood, check content proof here:

Unlocking Financial Potential: A Deep Dive into the DTD Credit Mentorship E-Course – Dion Coopwood

In today’s rapidly evolving financial landscape, understanding credit management is paramount. For many, the nuances of credit can feel overwhelming, akin to navigating a labyrinth without a map. Enter the DTD Credit Mentorship E-Course led by Dion Coopwood. This program is designed not only to demystify the intricacies of credit but also to empower participants to take control of their financial destiny. By promising a path to a credit score of 700 or higher in just 90 days, this course merges theoretical knowledge with practical application, making it a compelling choice for anyone looking to enhance their credit profile. Throughout this journey, we will explore the course structure, its benefits, the community aspect, and the potential for financial transformation.

Course Overview and Structure

Comprehensive Learning Experience

The DTD Credit Mentorship E-Course spans over a three-day period, presenting an intense and structured learning framework tailored for maximizing engagement and outcomes. Each session is meticulously crafted to cover critical facets of credit management, ensuring participants walk away with actionable knowledge. Participants can expect to invest over five hours in guided mentorship led by seasoned industry experts who bring practical insights and experiences to the table.

To illustrate the course’s breadth, here is a breakdown of key components:

| Day | Focus Area | Key Topics Covered |

| Day 1 | Credit Report Analysis | Understanding credit reports & scoring models |

| Day 2 | High-Limit Credit Acquisition | Strategies to secure premium credit cards |

| Day 3 | Manufactured Spending Techniques | Leveraging credit without significant cash outlay |

This structured approach ensures that participants not only learn relevant concepts but can also apply them in real-life situations. The course aims to equip individuals with a toolkit for navigating credit strategically, much like a sailor learning to read the stars for navigation each lesson guiding them toward financial ambitions.

Emphasis on Practical Skills

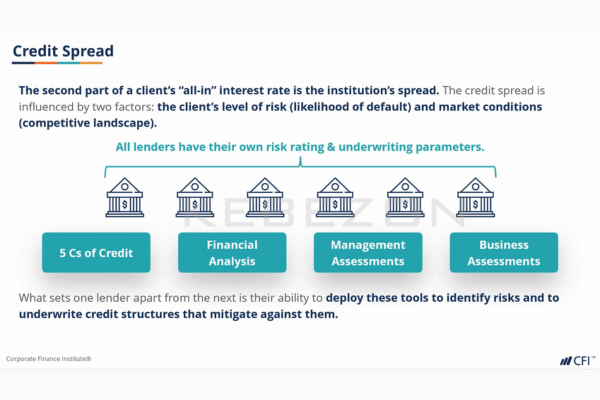

At the heart of this mentorship is an emphasis on practical skills. The DTD course does not merely scratch the surface; it dives deep into essential strategies that can elevate a participant’s credit score significantly. One of the standout features is the practical lessons on credit report analysis, which serve as the foundation for understanding how credit systems operate. Knowing how to dissect a credit report can feel like discovering a treasure map, revealing hidden gems that contribute to building a solid credit foundation.

Moreover, strategies for acquiring high-limit credit cards play a pivotal role for many participants. Imagine having access to a financial reservoir that can be tapped into for opportunities, be it for personal growth or entrepreneurial ventures. The course equips attendees with key tactics to approach lenders, effectively positioning them to secure higher credit limits and, consequently, greater financial flexibility.

Entrepreneurial Focus: Building Business Credit

A Pathway to Financial Independence

Dion Coopwood’s e-course uniquely addresses the intersection of credit management and entrepreneurship. The inclusion of a business funding list is not just an added bonus; it represents a significant opportunity for aspiring entrepreneurs. Participants are guided on how to secure over $100,000 in business credit, allowing them to lay the groundwork for sustainable business development.

The business world thrives on credit the lifeblood that fuels innovation and expansion. By integrating these strategies, the course aligns with the modern entrepreneur’s needs. It’s about fostering financial autonomy through informed credit practices, helping individuals transition from mere consumers to empowered business owners. The resources provided can act like a bridge over turbulent waters, enabling participants to navigate their unique financial journeys with confidence.

Credentials that Matter

Attendees of the program also have the chance to earn valuable certifications, such as Tradelines Specialist and Certified Credit Specialist. In today’s competitive job market, owning these credentials can differentiate an individual from their peers. It’s not just about accumulating knowledge; it’s about showcasing expertise and credibility within the vast world of credit management.

Having these certifications expands potential professional horizons, enabling participants to either advance in their current roles or explore new career paths entirely. This blend of education and certification empowers participants to create and communicate a robust personal brand, akin to a sculptor chiseling away at stone to reveal the masterpiece within.

The Community Aspect: Connecting with Like-Minded Individuals

Building a Supportive Network

One of the often overlooked yet immensely valuable aspects of the DTD Credit Mentorship E-Course is the opportunity to engage with a community of like-minded individuals. This network serves as a supportive ecosystem where participants can share experiences, challenges, and insights throughout their credit improvement journey.

The concept of community is reinforced through shared learning experiences, which foster camaraderie and collaboration. In this environment, participants can lean on each other, much like a group of hikers relying on one another for support as they traverse a challenging trail. Sharing victories and setbacks creates an atmosphere of accountability, motivating individuals to remain committed to their goals while learning from diverse perspectives.

Insights and Shared Experiences

Access to a vibrant community allows participants to gain insights that extend beyond the course curriculum. Each member brings unique experiences and knowledge, creating a tapestry of learning that enriches the entire group. Imagine gathering around a campfire, where each person shares stories that illuminate different paths taken this is comparable to the learning environment fostered within the course.

Furthermore, engaging with others who share similar objectives can significantly enhance the overall learning experience. Participants can exchange practical tips on navigating credit lenders, discuss effective strategies for improving credit scores, and celebrate milestones together. This collaborative spirit cultivates an environment that encourages growth both individually and collectively, ensuring that no participant feels isolated on their journey.

Benefits and Outcomes of the DTD Credit Mentorship E-Course

Transformative Financial Knowledge

The benefits of enrolling in the DTD Credit Mentorship E-Course extend far beyond the pursuit of a higher credit score. The program instills a sense of financial literacy that empowers participants to make informed decisions about their finances. Understanding credit management is akin to acquiring a superpower once acquired, individuals can harness it to influence various aspects of their financial lives.

Imagine being able to confidently negotiate terms with lenders, comprehending the nuances of interest rates, or effectively utilizing credit to create opportunities instead of pitfalls. Knowledge is indeed power, and this course positions enrollees to seize and wield that power with calculated precision.

Real-Life Applications and Case Studies

Real-life applications of learned concepts are the core of personal finance education. Participants often find themselves implementing strategies learned during the course almost immediately, leading to tangible results. Stories shared by past attendees exemplify this transformation individuals who entered the course with little understanding of credit have left with not just improved scores but also a robust plan to manage their financial future.

Consider the hypothetical case of Sarah, an attendee who diligently applies the principles learned in the course. With newfound knowledge, she secures a high-limit credit card, manages her spending effectively, and monitors her credit report within 90 days, Sarah achieves a credit score of 720. This firsthand experience not only validates the course’s framework but also serves as inspiration for others on the same journey.

Conclusion

In conclusion, the DTD Credit Mentorship E-Course by Dion Coopwood emerges as a powerful catalyst for financial transformation, equipping individuals with the skills, knowledge, and community support necessary to navigate the complexities of credit management effectively. With a well-rounded curriculum that encompasses practical lessons, entrepreneurial strategies, and invaluable credentials, this course is an investment in one’s financial literacy and future. As the proverbial saying goes, “knowledge is the key to success,” and in this case, the DTD Credit Mentorship E-Course serves as that key unlocking doors to new opportunities and paving the way toward a more informed and empowered financial existence.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “DTD Credit Mentorship E-Course with Dion Coopwood” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.