Financial Modeling for Mining with Gregory Ahuy & Bekzod Kasimov – Financial Model Online

165,00 $ Original price was: 165,00 $.23,00 $Current price is: 23,00 $.

Download Financial Modeling for Mining with Gregory Ahuy & Bekzod Kasimov – Financial Model Online, check content proof here:

Financial Modeling for Mining: A Comprehensive Review

In the world of mining finance, the ability to navigate the complexities of project finance is essential. The course “Financial Modeling for Mining” by Gregory Ahuy and Bekzod Kasimov not only promises a deep dive into this intricate area but also equips its participants with practical skills designed to tackle real-world financial scenarios in the mining sector.

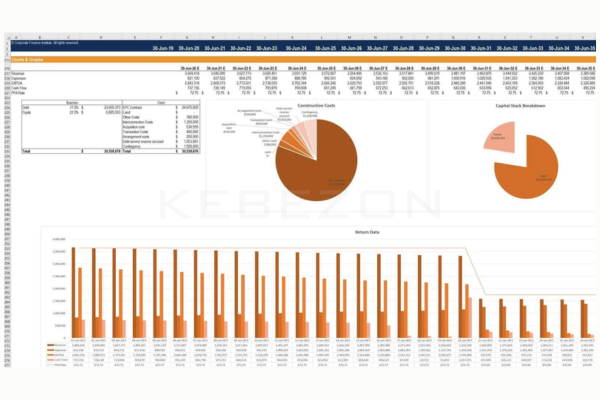

The course focuses on building substantial financial models tailored specifically for mining projects, where profitability and sustainability are tied to the intricate dance of risk, investment, and economic forecasting. Through compelling curriculum content and enlightening case studies, participants are primed to make informed decisions that can significantly affect the viability of their proposed mining ventures.

Course Overview

The curriculum of this course is structured to provide comprehensive training that covers a multitude of components necessary for effective financial modeling in mining operations. One of the standout features is the emphasis on constructing a project finance model for a gold open-pit project, which serves as an ideal example due to its frequent real-world application.

Students learn to navigate through the nuances of soft mini-perm debt structures, which are critical in obtaining financing for mining projects. These models incorporate intricate provisions for cash sweeps and refinancing strategies, showcasing how financial management in this sector requires a deft hand.

Participants are also introduced to critical financial mechanisms such as reserve accounts specifically the Debt Service Reserve Account (DSRA), Maintenance Reserve Account (MRA), and ramp-up cash reserves. Such tools are not simply theoretical; rather, they serve as safety nets designed to mitigate risks associated with cash flow variability in mining projects. Understanding these components provides a framework that allows students to appreciate how financial risks can be identified, analyzed, and ultimately managed.

| Financial Mechanism | Purpose |

| DSRA | To ensure sufficient funds are available for debt repayment. |

| MRA | To cover future maintenance costs and avoid operational disruptions. |

| Ramp-Up Cash Reserve | To facilitate smooth operational transitions and address early-stage cash flow challenges. |

This foundational knowledge sets the stage for the participants to explore more complex forecasting and sensitivity analysis tools, which are crucial for simulating different financial scenarios. By empowering participants with both theory and practical skills, the course establishes a strong groundwork for future learning and application in the mining finance sector.

Risk Management Focus

One of the remarkable aspects of the “Financial Modeling for Mining” course is its robust focus on risk management. In mining, where investments often run into millions of dollars, the ability to accurately forecast and mitigate risk becomes invaluable. The teaching methodology emphasizes the necessity of incorporating risk projections into financial models, and it begins with a detailed examination of the mining life cycle, including mine decommissioning expenses and reserve fund considerations.

As part of the curriculum, students delve into the intricacies of estimating mine decommissioning costs. Such expenses are often significant, yet they are frequently overlooked in preliminary financial models. Understanding these costs not only aids in better financial forecasting but also aligns ethical considerations with financial responsibilities within the mining industry. Furthermore, the sensitivity analysis tools taught provide the students with the capability to adapt their models according to different risk scenarios, allowing for proactive financial management.

Key Risk Management Elements:

- Decommissioning Expenses: Accounting for the future costs of closing and cleaning the mining site.

- Reserve Funds: Establishing financial safety nets to manage uncertainties.

- Sensitivity Analysis: A critical tool that allows for the simulation of various financial scenarios impacting the mining project’s viability.

Each of these elements is woven into the wider context of risk mitigation strategies, illustrating how they contribute to a more secure financial outlook for mining projects.

Hands-On Learning and Practical Application

In addition to theoretical instruction, the course emphasizes hands-on learning experiences that prepare participants for real-world challenges. This experiential approach fosters confidence and competence in applying financial modeling techniques within actual mining contexts. The use of practical case studies exemplifies the anticipated realities of the mining finance world, making the learning experience relevant and engaging.

Learning Modalities

The course leverages a blend of on-demand video content and interactive practical case studies. This flexible format caters to a wide range of learning preferences and makes it accessible to aspiring professionals across different backgrounds. The practical case studies are particularly beneficial, illustrating how to apply financial modeling principles to resolve complex financial situations in mining operations.

Benefits of Learning Modalities:

- On-Demand Video Content: Allows learners to access materials at their own pace, enhancing understanding and retention.

- Practical Case Studies: Bridging theory with real-world applications helps solidify key concepts.

Participants will emerge from the course not just with textbook knowledge, but also with practical insights that illustrate how financial models can be adjusted and modified to reflect the dynamism of the mining industry.

Enhancing Decision-Making Skills

At the core of the “Financial Modeling for Mining” course lies a commitment to enhancing decision-making skills. The comprehensive approach enables participants to evaluate investment opportunities critically and to steer mining projects toward financial sustainability. By simulating various scenarios through financial modeling, students learn to guide strategic decisions, balancing between risk and reward while aligning their financial strategies with overarching business objectives.

Core Decision-Making Outcomes:

- Critical Evaluation: Developing the ability to assess diverse financial opportunities with an analytical lens.

- Risk Mitigation: Implementing strategies to reduce potential financial losses within mining projects.

- Investment Justification: Building comprehensive financial models that serve as a foundation for decision-making.

In the rapidly evolving landscape of mining finance, where market conditions fluctuate and regulatory environments shift, the ability to make informed decisions becomes critical. The skills obtained from this course enhance participants’ competencies, ensuring they are well-equipped to tackle the complexities that lie ahead.

Conclusion

The course “Financial Modeling for Mining” by Gregory Ahuy and Bekzod Kasimov presents an invaluable resource for professionals within the mining sector. By blending theoretical knowledge with practical application, it addresses the multifaceted aspects of project finance in mining. Participants are not only taught how to build comprehensive and dynamic financial models but are also trained to think critically about risk management and decision-making in a volatile environment.

This integrated approach positions graduates for success in enhancing investment evaluations and optimizing financial strategies in mining investments, essential skills that will be instrumental as they navigate the industry’s ever-changing landscape. Ultimately, the course reflects a strong commitment to developing expert financial modelers who can contribute significantly to the mining industry’s sustainability and profitability.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Financial Modeling for Mining with Gregory Ahuy & Bekzod Kasimov – Financial Model Online” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.