Forex Eye

5,00 $

You may check content proof of “Forex Eye” below:

Forex Eye: Comprehensive Analysis and Review

Forex trading, or foreign exchange trading, presents one of the largest and most liquid financial markets on the planet. With a daily trading volume surpassing $6 trillion, the opportunities for profit and loss are as vast as the ocean itself, with traders navigating through waves of economic news, geopolitical tensions, and market sentiment. Understanding the nuances of the forex market is akin to mastering a complex dance; every step matters, and the rhythm of trading can change in the blink of an eye. This article delves deep into the forex landscape, exploring various facets such as market movements, currency pair analysis, sentiment shifts, risk management strategies, and the tools traders utilize to thrive in this challenging field.

The Forex Eye serves as a critical lens focusing on these elements, offering insights and guidance to both budding traders and seasoned veterans alike. By examining recent trends and market behaviors, we provide a holistic view that can enhance your understanding and improve trading prowess. This detailed exploration is aimed at equipping you with the knowledge necessary to seize opportunities while minimizing risks, ultimately guiding you to make informed decisions in the forex market.

Understanding Forex Eye Trends

Forex eye trends represent the underlying patterns that shape currency movements. Just like the seasons dictate the cycle of nature, economic factors and market sentiment influence how currencies behave. Traders often rely on these trends to time their entries and exits effectively, similar to how a gardener waits for the right season to plant seeds.

Take, for example, the classic adage in trading: “The trend is your friend.” This encapsulates the essence of trend-following strategies, where traders aim to align with the prevailing direction of a currency pair rather than attempt to fight it. In this context, understanding market trends can be as crucial as navigating a river’s current fighting against it often leads to exhaustion while going with the flow enhances progress.

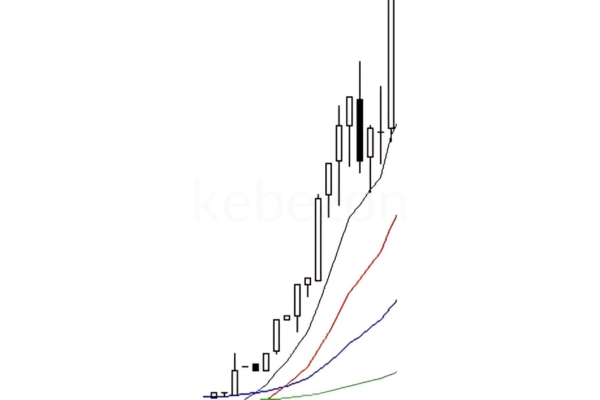

Recent data suggests that traders are increasingly leaning towards technical analysis to identify these trends. Technical indicators, such as moving averages and trend lines, act as essential tools, akin to a compass guiding sailors through foggy seas. By applying these indicators, traders can gain insights into potential reversal points or continuation patterns, providing clarity amidst the chaos of fluctuating exchange rates.

Moreover, the psychological aspect of trading cannot be overlooked. Market sentiment and the collective emotions of traders have a profound impact on price movements. When fear or greed takes the helm, even the most well-structured analyses can falter. Understanding sentiment shifts helps traders anticipate sudden market swings, allowing them to better position themselves against unexpected tides.

A comprehensive grasp of forex eye trends not only allows traders to enhance their strategies but also instills confidence in their decisions, echoing the age-old adage, “Knowledge is power.” Through informed trading practices, individuals can better navigate the intricacies of the forex market.

Recent Market Movements

In observing recent market movements, a wealth of dynamic interactions unfolds, fundamentally shaped by various economic indicators and geopolitical events. These shifts can be likened to the ebb and flow of tides, influenced by the gravitational pull of numerous factors central bank decisions, economic data releases, and investor sentiment are paramount among these.

- Key Interest Rates: Central banks such as the Federal Reserve, Bank of England, and European Central Bank play a pivotal role in shaping currency values. Recent decisions regarding interest rates have sparked volatility. A rise in US interest rates, for instance, generally strengthens the US dollar as higher returns attract investors. Conversely, a signal of possible cuts from the Federal Reserve may weaken the dollar.

- Economic Releases: Significant economic releases think of them as milestones in a long-distance race also pivot market movements. Recent data from the Non-Farm Payrolls and Consumer Price Index has been particularly influential. For instance, a stable NFP result can bolster confidence in the economy, thus driving the dollar up, while disappointing GDP growth might invite selling pressure.

- Technical Indicators: Recent trends indicated by moving averages show a bullish trajectory for certain major pairs, such as EUR/USD, when held above robust support levels. Trader sentiment shifts can correspondingly dictate behavior; an increase in retail sentiment often relates to a bullish phase.

- Global Outlook: Finally, global economic conditions such as the ongoing effects of the COVID-19 pandemic and recovery phases further complicate market dynamics. Observers are keenly watching how geopolitical tensions might introduce additional volatility into currency pairings.

In summation, recent market movements underscore the volatility intrinsic to forex trading as traders navigate complexities involving interest rates, economic data, and global sentiment. Keeping a vigilant eye on these developments is essential for traders seeking to harness potential opportunities while adeptly managing associated risks.

Major Currency Pair Analysis

Major currency pairs form the backbone of forex trading, akin to the major highways through which global trade and investments flow. These pairs involve the US dollar (USD), universally considered the world’s reserve currency, paired with other significant currencies such as the euro (EUR), Japanese yen (JPY), and British pound (GBP).

- EUR/USD (Euro/US Dollar): The EUR/USD pair remains a focal point for traders, often reflecting the economic health of both the Eurozone and the United States. Analyzing recent trends, the pair has displayed bullish characteristics when approaching key resistance levels. If the upcoming European Central Bank meetings suggest a strict stance on inflation, this may strengthen the euro against the dollar.

- USD/JPY (US Dollar/Japanese Yen): The interplay between the USD and JPY captures the market’s response to shifts in risk sentiment. When global uncertainties loom large, traders may flock to the JPY as a safe haven, leading to a depreciation of the USD. Conversely, in periods of economic stabilization, the dollar tends to appreciate, resulting in potential trading signals that can be capitalized upon.

- GBP/USD (British Pound/US Dollar): Political uncertainties surrounding Brexit have historically influenced this pairing. Recent developments in the UK’s economic recovery post-pandemic show signs of resilience, prompting potential bullish trades for GBP. Successful trades hinge on keeping abreast of upcoming economic announcements related to inflation and employment rates.

- USD/CHF (US Dollar/Swiss Franc): Known for being a stable pair, the USD/CHF is closely monitored for insights into global economic stability. A strengthening dollar accompanied by positive US economic indicators frequently leads to bullish movements for this pair.

- AUD/USD (Australian Dollar/US Dollar): This pair tends to be tied to commodity prices, notably iron ore and gold, making it particularly susceptible to shifts in commodity markets. Recent insights show that favorable prices for commodities can lead to bullish behavior for AUD.

Overall, analysis of these major currency pairs provides traders with compelling insights rooted in macroeconomic fundamentals, risk sentiment, and geopolitical realities. Staying informed about underlying trends empowers traders to make strategic decisions aligned with market movements.

Market Sentiment and Its Impact

Market sentiment encapsulates the overall attitude of traders towards a particular currency pair, serving as a compass guiding their trading decisions. Understanding market sentiment is akin to reading the mood of a crowd; it reveals collective emotions and expectations that can significantly sway currency prices, fundamentally reinforcing the need for traders to prioritize sentiment analysis alongside technical and fundamental strategies.

- Types of Sentiment: Sentiment can generally be categorized as bullish (positive), bearish (negative), or neutral (indifferent). Events such as central bank announcements or geopolitical developments can sharply influence these sentiments, creating waves in trader behavior that can be leveraged for profit.

- Economic Indicators: Economic news releases are critical sentiment shapers. For instance, positive employment data tends to strengthen bullish sentiment for the USD, while disappointing figures may lead to anxiety and consequently bearish trends. Analyzing how these indicators correlate with sentiment allows traders to anticipate potential market movements.

- Technical Analysis Tools: Tools like the Commitment of Traders (COT) report and sentiment indices provide traders with empirical snapshots of market sentiment. Using these tools helps traders gauge whether the market is skewed towards excessive optimism or pessimism, serving as crucial indicators for potential reversals.

- Social Media and News Influence: With the rise of digital communication, sentiment can also be influenced by discussions circulating on platforms like Twitter and financial news outlets. Awareness of trending topics and popular trader sentiment can offer valuable insights, enabling traders to better anticipate shifts.

The impact of market sentiment on major currency pairs is significant. For example, a strong bullish sentiment towards GBP, driven by positive economic outlooks, can lead to increased purchasing pressure, driving the GBP/USD pair higher. Conversely, a prevailing bearish sentiment can trigger profit-taking, resulting in price declines.

In summary, comprehending and integrating market sentiment analysis into trading strategies can prove invaluable for traders as they navigate the unpredictable waters of the forex market. By understanding the collective mindset of market participants, traders can seize opportunities aligned with overall sentiment trends.

Technical Analysis of Forex Eye

Technical analysis in forex trading revolves around studying historical price data and identifying potential future price movements through various analytical tools and patterns. Engaging in technical analysis is not unlike a scientist conducting experiments; traders look at past data and trends to formulate hypotheses about future price behavior.

- Chart Patterns: At the heart of technical analysis lie chart patterns that traders scrutinize to predict future price movements. Patterns such as Head and Shoulders, Double Tops, and Flags serve as potential indicators for market entries or exits. For instance, the Head and Shoulders pattern often indicates a reversal, signaling traders to prepare for a possible downward trend upon completion.

- Indicators and Oscillators: Various indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are essential companions in a trader’s toolkit. The RSI helps identify overbought or oversold market conditions, enabling traders to pinpoint potential reversal points. The MACD, on the other hand, provides insights into trend momentum and potential buy or sell signals through crossovers.

- Trend Analysis: Identifying trends form the core of technical analysis in forex trading. Traders frequently employ moving averages to assess the prevailing market direction. A bullish trend is often characterized by the price moving above a moving average, while bearish trends are recognized when the price moves below.

- Support and Resistance Levels: Technical analysts pay close attention to support and resistance levels, which act as psychological barriers in the market. Breakouts above resistance may signal further upward movements, while declines below support could indicate further downward momentum. Recognizing these levels enables traders to set entry and exit points strategically.

In summary, technical analysis serves as a vital tool for traders looking to navigate the forex market successfully. By understanding price patterns, employing indicators, and analyzing trends, traders are better equipped to make informed decisions and capitalize on potential opportunities.

Key Chart Patterns in Forex Trading

Chart patterns reflect the footprints of market sentiment and provide traders with crucial insights into potential future price actions. Understanding these patterns is akin to deciphering a language; each pattern speaks volumes about market behavior, facilitating more informed trading decisions. Below are some key patterns that forex traders frequently encounter:

- Head and Shoulders: This reversal pattern signifies a potential change in trend. Comprised of three peaks, it features a higher peak (the head) flanked by two lower peaks (the shoulders). The pattern is confirmed when the price breaks below the neckline, signaling a possible bearish reversal.

- Double Tops and Double Bottoms: These reversal patterns emerge after prevailing trends, indicating strong resistance (double top) or support (double bottom). A double top formation consists of two peaks, while a double bottom consists of two troughs. The breakout from the neckline connecting the peaks or troughs often serves as a signal for traders to enter positions.

- Triangles: Triangle patterns, including ascending, descending, and symmetrical triangles, represent continuation patterns. In an ascending triangle, for instance, the price consolidates with a flat top and rising bottom, hinting at bullish continuation.

- Flags and Pennants: These short-term continuation patterns signal brief periods of consolidation before the preceding trend resumes. Flags appear as rectangular shapes following strong price movements, while pennants feature converging trend lines. Traders typically wait for breakouts to capture the continuation of trend.

- Cup and Handle: Representing a bullish continuation pattern, the cup and handle resembles a drinkware’s form a rounded bottom (the cup) followed by a consolidation period (the handle). Traders often enter long positions upon price breakout above the resistance level established at the cup’s peak.

By mastering these patterns, traders can enhance their ability to identify market turning points and execute timely trades. Analogy and metaphor help demystify these patterns, emphasizing the importance of recognizing and interpreting market behaviors for successful trading endeavors.

Indicators to Consider: RSI, MACD, and Moving Averages

In the world of forex trading, technical indicators serve as critical tools that help traders analyze market conditions and identify trading opportunities. Understanding how the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Moving Averages contribute to trading strategies can enhance overall decision-making.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that ranges from 0 to 100, providing insights into overbought or oversold market conditions. Generally, a reading above 70 indicates overbought conditions, suggesting a possible price correction, while a reading below 30 suggests oversold conditions and potential bullish reversals. The RSI helps traders identify entry and exit points by signaling potential market reversals, akin to a lighthouse guiding sailors through treacherous waters.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. The MACD line is derived from subtracting the 26-day EMA (Exponential Moving Average) from the 12-day EMA. A bullish crossover occurs when the MACD line crosses above the signal line, suggesting a potential buy, while a bearish crossover signals a possible sell. Traders also look for divergences between the MACD and the price to anticipate potential trend reversals, much like noticing weather changes that may alter the course of a journey.

- Moving Averages: Moving averages (MA) play a key role in smoothening price data and identifying trends. The Simple Moving Average (SMA) calculates the average price over a set number of periods, while the Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to current market conditions. Traders commonly use crossovers when a shorter-term MA crosses a longer-term MA as potential buy or sell signals. By employing moving averages, traders can ensure they’re aligning with the market’s prevailing direction, akin to a compass pointing true north.

Utilizing these indicators effectively can help traders decode market behavior, enhance their trading strategies, and make data-driven decisions that bolster their chances of success in a dynamic trading environment.

Risk Management Strategies in Forex Trading

In forex trading, risk management serves as the bedrock of a sustainable trading strategy. Effective risk management is akin to wearing a life jacket while navigating turbulent waters it provides safety and resilience against unforeseen challenges.

- Position Sizing: Determining the amount to invest in each trade is crucial. Traders should establish a position size based on their total account balance and the percentage they are willing to risk per trade (typically between 1-2%). This calculation prevents substantial losses that can compromise the overall trading account and fosters sustainability in a trader’s performance.

- Setting Stop-Loss Orders: Implementing stop-loss orders is an effective risk management measure that enables traders to limit potential losses. By specifying a predetermined price level for exiting a trade in case it moves unfavorably, traders can shield their capital. This approach provides peace of mind, much like wearing protective gear in hazardous conditions.

- Diversification: Trading multiple currency pairs helps reduce risk exposure. Avoiding the concentration of capital in a single pair minimizes the impact of adverse events in any one currency. Diversification helps spread risk across varied trades and can serve as a buffer against sudden volatility, echoing the principle of not putting all eggs in one basket.

- Monitoring Market Conditions: Staying informed about economic news and events affecting currency prices is pivotal for maintaining an advantageous position. Economic announcements can introduce volatility, and traders should adjust their risk exposure accordingly. Awareness can prevent significant losses caused by miscalculating market reactions.

In summary, integrating robust risk management strategies allows traders to navigate the forex market with confidence and endurance. By balancing potential risks and rewards, traders can purposefully engage with market opportunities while safeguarding their investments.

Fundamental Analysis in Forex Eye

Fundamental analysis in the forex market centers around assessing economic indicators, which can significantly affect currency values. Conducting fundamental analysis is like putting together a puzzle; each economic indicator serves as a piece that helps traders gain a clearer picture of a currency’s likely movement.

- Gross Domestic Product (GDP): GDP serves as a comprehensive measure of a country’s economic performance. An expanding GDP often correlates with currency appreciation, while a contracting GDP can lead to depreciation. Keeping an eye on GDP growth trends helps traders anticipate potential shifts in currency pairs.

- Consumer Price Index (CPI): Tracking inflation through the CPI is integral to understanding currency value. Rising CPI indicates increasing prices, often prompting central banks to respond with interest rate adjustments. These rate changes can directly impact currency strength, highlighting the relationship between inflation and monetary policies.

- Employment Data: Reports such as the unemployment rate and Non-Farm Payrolls provide vital insights into economic health. Low unemployment correlates with a strong economy, fostering demand for a currency, while high unemployment signifies weakness, typically leading to currency depreciation.

- Retail Sales: Monitoring retail sales data allows traders to gauge consumer spending, a vital component of economic growth. A consistent upward trend in retail sales typically signals a robust economy, thus strengthening the associated currency.

- Interest Rates: Central bank policies on interest rates profoundly influence the forex market. Higher interest rates enhance returns on investments in that currency, drawing foreign capital and driving appreciation, while lower interest rates can lead to depreciation.

- Trade Balance: The trade balance measures the difference between imports and exports. A positive trade balance often supports currency appreciation, while a negative trade balance may weaken it, impacting overall currency health.

By incorporating fundamental analysis into their strategies, traders enhance their ability to anticipate potential currency movements based on economic events and indicator releases. This analysis type augments their insight and decision-making prowess, ultimately translating into well-informed trading positions.

Economic Indicators to Watch

Being aware of key economic indicators is crucial for forex traders looking to enhance their decision-making process. These indicators can be likened to signposts along a road, guiding traders toward better understanding and forecasting potential currency movements.

- Gross Domestic Product (GDP): As previously discussed, GDP growth or decline can strongly influence currency values. Traders should pay attention to GDP growth forecasts, as any upward adjustments by economists could strengthen the associated currency.

- Consumer Price Index (CPI): CPI readings provide essential insights into inflation rates. Quarterly releases and year-over-year comparisons help traders evaluate whether inflation is accelerating or cooling. These trends influence monetary policy, which in turn impacts currency strength.

- Unemployment Rate: This key indicator reflects the health of the labor market, and traders should consider the correlation between low unemployment rates and economic robustness. Moreover, changes in unemployment figures often lead to market volatility, which can generate opportunities for traders.

- Interest Rate Decisions: Central banks periodically announce their interest rate policy; these decisions directly impact currency values. Traders need to stay alert for such announcements and market expectations leading up to them, which shape trade flows.

- Retail Sales Reports: Retail sales significantly influence consumer sentiment and overall economic health. Monthly releases provide timely and actionable insights that can sway market sentiment regarding the currency tied to the reporting economy.

Staying attuned to these critical economic indicators cultivates a more informed trading strategy. By monitoring releases and fundamental shifts, traders enhance their ability to anticipate market movements and position themselves effectively.

Central Bank Policies and Their Influence

Central bank policies hold substantial sway over currency markets. Given their role as guardians of economic stability, the decisions made by institutions such as the Federal Reserve, European Central Bank, and Bank of Japan can shape the forex landscape, often likened to a conductor dictating the tempo of an orchestra.

- Interest Rate Adjustments: Central banks utilize interest rates as a primary tool for influencing economic growth. A higher interest rate typically results in currency appreciation, drawing foreign investment attracted by better returns. Conversely, lower interest rates may lead to currency depreciation as capital flows diminish.

- Quantitative Easing (QE): This unconventional monetary policy involves purchasing financial assets to stimulate the economy. While QE can lead to currency depreciation due to an increase in money supply, its actual impact often depends on market perception and context.

- Open Market Operations (OMOs): Central banks buy or sell government securities to adjust the money supply, impacting liquidity. For instance, buying securities injects money into the economy, potentially leading to currency depreciation, while selling securities can tighten liquidity and bolster the currency.

- Forward Guidance: Central banks communicate their outlook on future monetary policy, which can significantly shape trader expectations. These insights allow market participants to anticipate potential changes in interest rates, thereby influencing currency valuations.

- Direct Currency Interventions: Some central banks may intervene in the forex market directly to stabilize their currency or impact economic outcomes. Such interventions can create immediate price movements, presenting trading opportunities for savvy traders.

In essence, understanding central bank policies is vital for traders in the forex market. By closely monitoring these policies and anticipating their ramifications on currency movements, traders can position themselves advantageously.

Geopolitical Events Impacting Forex Markets

Geopolitical events present a dynamic layer of complexity in forex trading. Economic stability, political unrest, and diplomatic policies can sway trader sentiment and bring volatility to currency markets. Understanding the influence of such events is akin to keeping an eye on the weather patterns; knowing when storms are brewing can help traders prepare for turbulent trading conditions.

- Economic Sanctions: Sanctions can impose significant restrictions on a country’s economy, leading to currency depreciation. For example, economic sanctions on Russia have caused considerable fluctuations in the Russian ruble, representing how geopolitical actions can impact local and global markets.

- Political Instability: Elections, protests, and governmental changes often introduce uncertainty. Political unrest can deter investment, leading to currency declines. A contested election may lead traders to seek safe-haven currencies such as the US dollar or Swiss franc, pushing those currencies higher.

- Trade Agreements and Tariffs: The announcement of new trade agreements generally boosts currency values by enhancing trade possibilities, while tariffs can create hurdles, leading to depreciation. Market participants closely monitor news of such accords to adjust their positions accordingly.

- Terrorism and Armed Conflict: Areas experiencing conflict are often subject to significant currency volatility. Typically, investors retreat to safe-haven currencies during geopolitical tensions, impacting pairs associated with countries experiencing instability.

- Global Economic Conditions: The interconnectedness of global economies means that turmoil in one area can ripple through to others. Economic downturns or crises can create widespread risk aversion, affecting currency values and trader behavior.

By monitoring geopolitical events and their implications, traders can better anticipate market movements and position themselves alongside prevailing sentiments, ultimately enhancing their trading strategies.

Tools and Resources for Forex Traders

For forex traders striving to enhance their trading experience, employing various tools and resources is crucial. These tools act like the sails on a ship, helping traders navigate the expansive and often turbulent waters of the forex market with precision and purpose. Here are some essential tools and resources for successful trading:

- Trading Platforms: Popular platforms like MetaTrader 4 and 5 allow traders to analyze the markets, access real-time data, and execute trades efficiently. They come equipped with numerous technical indicators and charting tools that facilitate thorough analyses.

- Economic Calendars: Using an economic calendar can keep traders informed about upcoming economic events, such as GDP releases and employment data. Consider this a trading roadmap, aiding traders in planning their strategies based on forthcoming market-moving data.

- News Aggregators: Resources like Bloomberg and Reuters provide real-time news updates that can affect market dynamics. Staying informed on global events allows traders to adapt to volatility and seize potential opportunities promptly.

- Community Forums: Engaging with trading communities on platforms like Forex Factory and Myfxbook can offer valuable insights and shared knowledge. Interacting with fellow traders can enhance learning and provide unique perspectives on evolving market scenarios.

- Technical Analysis Software: Software that provides advanced technical analysis tools can help traders identify trends and potential trade setups. This software acts as a strategical compass, guiding traders through various analytical paths.

Utilizing these tools effectively can greatly enhance traders’ market understanding, refine their strategies, and ultimately elevate their trading performance by providing critical insights and facilitating informed decision-making.

Top Forex Trading Platforms

Choosing the right trading platform is crucial for a successful trading experience, as it serves as the environment where trades are executed and strategies are developed. The following platforms are considered among the top choices for forex traders:

- MetaTrader 4 & 5: As industry-leading platforms, MetaTrader offers comprehensive trading tools, including advanced charting, multiple timeframes, and the ability to implement automated trading strategies through Expert Advisors (EAs).

- eToro: Known for its user-friendly interface and social trading features, eToro allows traders to follow and copy the trades of successful investors. It’s an excellent platform for beginners seeking to learn from experienced traders.

- SaxoTraderGO: This platform is favored for its advanced trading capabilities, educational resources, and extensive asset offerings. Its sophisticated charting tools and market analysis reports complement traders’ decision-making processes.

- ThinkorSwim by TD Ameritrade: Renowned for its powerful trading analytics and robust charting tools, ThinkorSwim offers an integrated platform for forex trading along with education, research, and market news.

- Interactive Brokers: With access to a wide range of currency pairs and advanced trading features, Interactive Brokers is a popular choice for experienced traders. Its competitive fees and comprehensive tools make it a strong contender in the forex landscape.

By exploring these platforms and their features, traders can determine which aligns best with their trading style and objectives, enhancing their overall trading experience.

Analytical Tools for Forex Eye

A robust suite of analytical tools is indispensable for effective forex trading. These tools help traders decipher market conditions and fine-tune their strategies for optimal performance. Here’s a closer examination of key analytical tools available to traders:

- Technical Indicators: Platforms like TradingView offer a wide variety of technical indicators, exceeding hundreds of options, that allow traders to conduct detailed analysis. From trend-following indicators like Moving Averages to momentum indicators like the RSI, these can provide valuable signals for potential trade entries and exits.

- Economic Data Sources: Access to real-time economic data through tools and platforms helps traders stay updated on relevant economic reports. Sites like Investing.com offer comprehensive calendars with economic data releases that impact currency values.

- Market Sentiment Tools: Understanding trader behavior is pivotal. Platforms like Myfxbook provide sentiment analytics, reflecting the positioning of traders in the market. These insights can guide traders in anticipating potential market turning points.

- Backtesting Tools: Backtesting allows traders to simulate past trades using their strategies, helping evaluate their effectiveness. Many trading platforms offer built-in tools for this purpose, providing traders feedback on historical performance.

- Risk Management Tools: Tools that calculate risk-to-reward ratios, position sizes, and potential stop-loss levels empower traders to manage their risk effectively. This proactive approach to risk management can help traders preserve capital over the long term.

With the integration of these analytical tools into trading practices, traders can sharpen their strategies and decision-making processes, ultimately driving improved performance in the ever-changing forex landscape.

Community Resources and Forums for Traders

Engaging with trading communities and forums can significantly benefit traders by providing support, shared knowledge, and invaluable trading insights. These resources are akin to meeting places where traders exchange ideas and learn from one another’s experiences.

- Forex Factory: Renowned for its active community, Forex Factory features discussion forums, an economic calendar, and tools that allow traders to share insights on trading strategies and market trends.

- Myfxbook: This platform integrates community feedback with performance analytics. Traders can connect with one another, share strategies, and track their performance while learning from a diverse community of forex traders.

- BabyPips: Tailored primarily for novice traders, BabyPips offers an educational platform complete with forums where inexperienced traders can seek advice and guidance without hesitation.

- Reddit Forex Community: Hosting a diverse range of discussions, the Reddit Forex community allows traders to share strategies, market updates, and broker evaluations. The platform’s voting system helps surface reputable information and insights.

- MQL5 Community: Especially for those interested in automated trading, MQL5 provides a marketplace for trading robots and indicators, along with forums for traders to share their programming knowledge.

By actively engaging in these community resources, traders can enhance their understanding of market dynamics and share valuable insights that can significantly improve their trading strategies.

Expert Opinions and Insights

Leveraging expert opinions and insights is invaluable for traders looking to navigate the complexities of the forex market effectively. Access to seasoned traders’ perspectives often illuminates intricate strategies and offers broader market understanding. Here’s a synthesis of insights derived from expert analyses:

- The Necessity of a Trading Plan: Experts stress the importance of establishing a detailed trading plan. This plan acts as a comprehensive roadmap, outlining specific strategies, risk management techniques, and trade execution processes. By sticking to the plan, traders can cultivate discipline and consistency, essential elements for long-term success.

- Value of Continual Learning: Given the dynamic nature of forex markets, continuous education and adaptation of strategies are vital. Successful traders often utilize resources from webinars, books, and market analysis to stay current with new strategies.

- Psychological Discipline: Emotional management plays a significant role in trading performance. Experts advocate for cultivating a mindset that values rational analysis over emotional impulses. Remaining calm and focused during periods of market volatility may prove pivotal in successfully navigating trades.

- Risk Management Must Be Priority: Effective risk management techniques, such as setting stop-loss orders and determining appropriate position sizes, are deemed pivotal. Experts highlight that sound risk management allows traders to endure inevitable losses while remaining in the game.

- Understanding Market Sentiment: Analysts emphasize the significance of comprehensively understanding market sentiment. Awareness of prevailing opinions can provide traders insights into potential reversals or shifts in market dynamics, thereby guiding their positioning.

By applying these expert insights, traders can improve their strategies and decision-making processes, tailoring their approaches to better address the demands of the forex market.

Interviews with Forex Analysts

Conducting interviews with experienced forex analysts provides invaluable insights into practical trading strategies and market dynamics. Here are crucial takeaways based on perspectives shared during these discussions:

- Importance of Research: Analysts emphasize the need for in-depth research concerning economic indicators, historical price patterns, and geopolitical influences. Knowledge of these elements empowers traders to make sounder decisions amidst the chaotic landscape of the forex market.

- Behavioral Factors: Many analysts underscore how behavioral economics can often dictate market movements more than traditional theories. Understanding trader psychology can be invaluable, allowing traders to anticipate others’ moves, which can lead to informed trading decisions.

- Adoption of Multi-Timeframe Analysis: Analyzing markets across multiple timeframes can offer comprehensive insights into market trends and potential reversals. Analysts encourage traders to observe long-term trends on weekly or daily charts while identifying potential entry points on shorter timeframes.

- Patience in Execution: Forex analysts highlight the necessity of patience when executing trades. Impulsive decisions based on excitement or fear can lead to mistakes, hence the importance of waiting for optimal setups aligned with trading plans.

- Integration of Technology: The growing role of technology in trading is noted, particularly in the use of automated strategies and algorithms. Analysts point out that embracing technology can enhance efficiency and effectiveness, allowing traders to dynamically adapt to market changes.

By integrating the nuanced insights garnered from interviews with forex analysts into their practices, traders can cultivate a more comprehensive and effective trading approach, ultimately leading to success in navigating the forex market.

Case Studies of Successful Forex Trading Strategies

Analyzing case studies of successful forex trading strategies can provide practical insights into effective practices and methodologies. Below are notable strategies and examples that have proven effective for traders:

- George Soros and the British Pound: Soros famously shorted the British Pound in 1992, ******* against its value when many missed the signs. His strategy was based on extensive analysis of the economic fundamentals underpinning the currency. By recognizing the overvaluation within the European Exchange Rate Mechanism, he entered a short position that yielded extraordinary profits.

- Stanley Druckenmiller’s Macro Strategy: As a prominent figure in the trading world, Druckenmiller emphasizes a macroeconomic approach that combines both fundamental and technical analyses. His strategy focuses on understanding global economic trends and identifying where to allocate capital accordingly. He often expresses that knowing when to be inactive is as vital as knowing when to trade.

- Paul Tudor Jones’ Long-Short Strategy: Famous for predicting market movements, Paul Tudor Jones incorporates both long and short positions in his trading strategy in response to market sentiment. His success lies in employing a disciplined approach that combines technical and fundamental analyses to navigate market changes vigorously.

- Technical Excellence of Cynthia Kase: Kase’s focus on technical analysis leads to her distinct set of rules for trading. She highlights the importance of using multiple indicators to confirm movement and emphasizes the importance of tracking price levels relative to moving averages, ensuring she’s strategically positioned for entry and exit points.

These case studies highlight various successful trading strategies, underscoring essential principles like thorough market analysis, risk management, patience, and adaptability. By learning from these practices, aspiring traders can equip themselves with critical knowledge to successfully navigate their own forex trading journeys.

Forex Trading Strategies

Developing a robust trading strategy is crucial for consistent success in forex trading. Just like crafting a well-planned recipe, a well-defined trading strategy frames how traders engage with currency markets. Below are key strategies that successful traders often adopt:

- Scalping: Traders employing scalping techniques aim to capitalize on small price changes throughout the day. This strategy involves executing numerous trades within short timeframes, focusing on efficiency and speed. Scalpers often rely on technical indicators to identify entry and exit points quickly.

- Swing Trading: This strategy involves holding trades for several days to weeks, aiming to capture price swings. Swing traders analyze both technical indicators and fundamental data to make informed decisions about potential market moves.

- Position Trading: Position trading focuses on long-term trades based on fundamental analysis. Traders using this strategy typically hold positions for weeks or months to capitalize on broader market trends, relying significantly on major economic indicators.

- Day Trading: Day traders open and close trades within the same day, seizing short-term price movements. Their strategies often involve frequent analysis of intraday price charts, allowing them to respond swiftly to market changes.

- Trend Following: This approach capitalizes on identifying and following the direction of prevailing trends. Traders determine whether to buy or sell based on ongoing bullish or bearish trends, often utilizing trend lines and moving averages as essential tools.

By diligently developing and refining these selected strategies, traders can cultivate a tailored approach that aligns with their trading styles and risk tolerances. Employing robust trading strategies combined with disciplined execution can lead to sustained profitability and success.

Scalping Techniques in Forex

Scalping techniques represent a genre of forex trading characterized by quick trades aimed at capturing small price changes. This approach considers speed and precision as paramount, allowing traders to profit from minute fluctuations in currency prices. Below are successful scalping techniques utilized by traders:

- Short Time Frames: Scalpers primarily operate on short time frames, often employing one-minute or five-minute charts. This heightened focus facilitates immediate trading opportunities but also demands rapid decision-making and heightened awareness of potential false signals.

- Selecting Liquid Currency Pairs: The choice of currency pairs can significantly impact the success of a scalping strategy. Pairs with high liquidity and low spreads, such as EUR/USD or GBP/USD, allow for quick entries and exits, essential for scalpers.

- Technical Indicators for Entry/Exit Points: Scalpers often rely on technical indicators like Moving Averages, Bollinger Bands, and RSI to pinpoint entry and exit signals. These tools enhance the identification of market conditions, allowing traders to make data-driven decisions.

- Strict Risk Management: Implementing effective risk management is particularly critical for scalpers. Traders should clearly define stop-loss levels and position sizes, ensuring that potential losses do not exceed predetermined limits.

- Emotional Discipline: Given the rapid pace of scalping, maintaining emotional control is essential. Scalpers need to remain steadfast in their strategies and avoid impulsive decisions based on fleeting emotions, focusing instead on calculated actions that align with their trading plans.

By masterfully employing these scalping techniques, traders can navigate the fast-paced environment of forex trading, capturing profits while effectively managing risks inherent in rapidly changing conditions.

Swing Trading Tactics for Forex

Swing trading is a favored strategy among traders who seek to capitalize on price swings over days or weeks. This approach involves rigorous analysis of market trends and volatility, allowing traders to seize opportunities for profit. Here are effective swing trading tactics for forex:

- Identifying Market Trends: Successful swing traders prioritize recognizing prevailing market trends using various tools, such as trend lines and moving averages. Doing so enables them to position themselves correctly aligned with the direction of price movements.

- Utilizing Fibonacci Retracement Levels: Swing traders often use Fibonacci retracement levels to identify potential reversal points. By measuring price movements from recent high to low, traders can establish key support and resistance areas that guide trade entries and exits.

- Employing Candlestick Patterns: Recognizing candlestick patterns aids traders in identifying market sentiment and potential reversals. Patterns such as engulfings and hammers provide insights into trader behavior and guide trading decisions.

- Setting Clear Exit and Entry Points: Swing traders should establish clear entry and exit points based on their analysis. The implementation of stop-loss orders at well-defined levels minimizes risks while safeguarding profits.

- Patience in Holding Trades: Adopting a patient approach is paramount for swing traders. Unlike day traders, swing traders should avoid reacting impulsively to short-term price movements, maintaining focus on their established strategies and longer-term objectives.

By embracing these swing trading tactics, traders can effectively capitalize on medium-term price movements, enhancing successful outcomes while minimizing the risks associated with unexpected volatility.

Long-Term Investment Approaches in Forex Trading

Long-term investment strategies, often referred to as position trading, involve maintaining currency positions over extended periods, typically weeks or months. Understanding how to cultivate longer-term trading positions is integral to maximizing opportunities while balancing risk. Below are effective strategies for long-term forex trading:

- Fundamental Analysis: Successful long-term traders often rely on in-depth fundamental analysis that evaluates macroeconomic indicators and geopolitical factors impacting currency pairs. By developing a robust perspective of economic health, traders can gauge currency value potential.

- Utilizing Technical Analysis: While position trading leans heavily on fundamentals, technical analysis also plays a crucial role. Traders frequently employ moving averages, trend lines, and oscillators to time their entries or exits.

- Robust Risk Management: Implementing sound risk management strategies such as maintaining proportional trade sizes based on portfolio balance helps manage risk effectively. Developing a clear plan for setting stop-loss orders secures positions against unwanted downturns.

- Emotional Resilience: Patience and discipline are crucial when taking a long-term approach to trading. Traders must focus on maintaining a rational mindset, steering clear of emotional responses to short-term price fluctuations that may lead to poor decision-making.

- Choosing the Right Broker: The selection of a trustworthy broker is vital for long-term trading success. Evaluating brokers on criteria such as regulatory compliance, trading platforms, fees, and customer service ensures traders find a reliable partner.

By implementing these long-term investment approaches, traders can harness opportunities inherent in the forex market, fostering growth over time while mitigating risks influenced by market volatility.

Evaluating Broker Services for Forex Trading

Selecting the right forex broker is foundational to establishing a successful trading career. A broker acts as the gateway to the forex markets, and evaluating their services is akin to assessing the features of a ship before embarking on a voyage. Below are key criteria for evaluating broker services:

- Regulatory Compliance: Ensuring a broker is regulated by reputable authorities such as the FCA (UK) or ASIC (Australia) provides security and peace of mind. Regulated brokers adhere to strict guidelines that protect trader funds and ensure ethical trading practices.

- Spreads and Commission Structures: Analyzing transaction costs is crucial, as spreads and commissions can impact profitability. Traders should compare average spreads for the currency pairs they plan to trade, keeping an eye out for competitive rates.

- Leverage Options: Different brokers provide various leverage levels, often ranging from 1:50 to 1:500. Understanding the implications of leverage enables traders to manage risk effectively and align their trading strategies with their risk tolerance.

- Trading Platforms: The quality and usability of a broker’s trading platform are vital for executing trades efficiently. Consider features such as charting tools, order types available, and mobile trading options to ensure a seamless experience.

- Customer Support: Reliable customer service plays a significant role in the trading experience. Assessing a broker’s availability and responsiveness ensures support is accessible whenever the need arises.

- Deposit and Withdrawal Methods: Evaluating the variety of methods available for funding accounts and withdrawing funds is essential. Traders should explore potential fees and processing times associated with these methods.

- Account Types: Brokers may offer various account types suited to different trading styles and capitals. Demanding that special conditions apply, such as minimum deposits or spreads for high-volume traders, must be considered carefully.

Understanding these criteria allows traders to conduct thorough evaluations of prospective brokers, ensuring they choose a trustworthy partner suited to their trading needs.

Criteria for Choosing a Forex Broker

Selecting the right forex broker requires a discerning approach, as the choice can significantly influence a trader’s success. Below are detailed criteria for assessing forex brokers, ensuring informed decision-making that aligns with trading needs:

- Regulatory Oversight: Always select brokers regulated by respected authorities to guarantee a level of safety for funds. Authorities like the FCA (UK) and ASIC (Australia) impose strict regulations, protecting traders against malpractice and instilling confidence in the trading environment.

- Cost Structure: Evaluating the broker’s cost structure, including spreads, commissions, and swaps, is pivotal. Traders should compare average values across brokers and consider how fees may impact overall profitability.

- Trading Platforms: The user-friendliness and features of the trading platform merit careful consideration. Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) often provide comprehensive tools and functionality desired by traders.

- Leverage Offered: Different brokers extend varying levels of leverage, affecting potential returns and risks. Understanding how leverage ratios align with a trader’s risk tolerance is vital for responsible trading.

- Variety of Account Types: Brokers may offer different account types catering to diverse trading styles and capital levels. Traders should look for accounts suited to their preferred strategies, including accounts designed for scalping or long-term investing.

- Educational Resources: Accessibility to educational materials and resources reflects a broker’s commitment to supporting client development. Traders should assess the availability of webinars, guides, and market analyses to enhance their trading skills.

- Customer Support: A broker’s ability to provide efficient customer support is critical in times of need. Evaluating responsiveness across multiple contact channels helps ensure adequate assistance is available.

By prioritizing these criteria, traders can make well-informed decisions in choosing a forex broker and set the stage for a successful trading experience.

Comparison of Key Forex Brokers

When evaluating various forex brokers, a comparative analysis of essential features is crucial for successful trading endeavors. Below are key aspects and comparisons focused on several leading forex brokers based on the outlined criteria:

**Broker** **Regulatory Status** **Average Spread (EUR/USD)** **Leverage** **Trading Platform** **Customer Support** **IC Markets** FCA, ASIC 0.1 pips Up to 1:500 MetaTrader 4 & 5 24/5 via live chat, email **XM** FCA 1.0 pips Up to 1:888 MetaTrader 4 & 5 24/5 via phone, live chat **eToro** FCA 1.0 pips Up to 1:30 eToro Platform 24/5 via live chat **Saxo Bank** FCA, ASIC 0.7 pips Up to 1:30 SaxoTraderGO 24/5 via email, phone **OANDA** FCA, CFTC 1.2 pips Up to 1:50 OANDA Platform 24/5 via email, live chat

In summary, comparing key forex brokers based on regulatory status, transaction costs, leverage options, trading platforms, and customer support facilitates informed decision-making. By selecting a broker closely aligned with individual trading preferences, traders can maximize their opportunities in the dynamic forex environment.

Customer Reviews and Feedback on Forex Brokers

Customer reviews and feedback are pivotal resources for forex traders evaluating the quality of broker services. As peer insights often shed light on real experiences, potential clients can leverage this information to gauge broker reliability. Here’s an overview of feedback on several leading brokers based on user reviews across platforms:

- IC Markets: Users applaud IC Markets for its competitive spreads and fast order execution, with an overall rating of 4.7 out of 5. Traders appreciate responsive customer support and the wide variety of trading instruments available. However, some concerns arise around occasional withdrawal delays.

- Tickmill: Rated at 4.8 out of 5, Tickmill earns high marks for low spreads and efficient trading operations. Clients praise its no-requote policy and responsive customer service. There are minimal negative reviews regarding overall reliability and performance.

- XM: With a rating of 4.5 out of 5, customers commend XM for its educational resources and diverse account types, but some express concerns about the competitiveness of spreads relative to other brokers in the market.

- Saxo Bank: Known for robust educational content, but having an overall rating of 4.5 out of 5, Saxo Bank traders observed mixed feedback regarding spreads, with some noting them to be higher than average. Nevertheless, users often praise its trading platform’s sophistication.

- OANDA: OANDA holds a rating of 4.2 out of 5, recognized for a comprehensive trading experience. However, reviews indicate mixed opinions regarding customer support responsiveness, emphasizing the importance of research prior to engagement.

In summary, leveraging customer reviews offers critical insights into broker quality, sparking necessary considerations for traders seeking trustworthy partners. By evaluating user experiences, traders can make informed selections that bolster their trading endeavors.

In conclusion, navigating the forex market entails understanding myriad elements from market movements and currency pairs to trading techniques and broker evaluations. Mastery of these components, alongside leveraging expert insights and community resources, equips traders to make informed decisions, adapt strategies, and capitalize on opportunities within this ever-changing financial landscape. Engaging deeply with the concepts discussed herein fosters a holistic approach to successful trading in the forex sphere.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Forex Eye” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.