How to Prepare for Tax Day with Paul Haimowitz

6,00 $

Download How to Prepare for Tax Day with Paul Haimowitz, check content proof here:

How to Get Ready for Tax Day: Paul Haimowitz’s Advice

For independent contractors and small company owners, tax day frequently hangs over their heads like a threatening cloud, causing anxiety and uncertainty. It might be intimidating to consider negotiating complicated tax laws, but it doesn’t have to be that way. Paul Haimowitz, a tax expert, uses his perceptive approach to help those who are having trouble handling their tax obligations by offering them guidance and clarity. Haimowitz simplifies the complexities of tax preparation into doable tactics that enable people to maximize their financial results. Haimowitz has more than twelve years of expertise in tax consulting and compliance.

In this post, we examine Haimowitz’s suggestions for tax day preparation, highlighting important points that all taxpayers should be aware of. His advice may turn tax preparation from a dreaded chore into a more manageable procedure, from organizing company income to optimizing deductions. Let’s look at how to use anxiety to your advantage.

Understanding the Foundations of Tax Preparation

Haimowitz emphasizes the importance of grasping the fundamental aspects of tax preparation. For freelancers and small business owners, documenting income streams and expenses can be likened to a painter creating a detailed landscape; the more precise and vibrant the paint strokes, the clearer the picture becomes. Here, clarity in record-keeping serves to not only illuminate financial standing but also establishes a strong foundation for tax filing.

Organizing Business Revenue

Effectively organizing corporate income is one of Haimowitz’s fundamental ideas. Correct income classification is essential to a well-managed tax position, much like a strong foundation is necessary for a well-built home. Accurately classifying income requires freelancers to make a distinction between money received directly from customers and money from other sources. For example, a graphic designer should make sure that each kind of income is recorded individually if they also sell artwork:

- Client Income: Funds obtained for certain tasks.

- Sales Revenue: Earnings from the sale of digital goods, art, or items.

In addition to facilitating correct reporting, properly categorizing revenue paves the way for future deduction maximization.

Making the Most of Deductions

Finding hidden gems in a large environment is similar to following Haimowitz’s advice on maximizing deductions; many taxpayers fail to take advantage of possible deductions that may drastically lower their tax obligations. The following are typical deductions:

- Home Office Expenses: A portion of rent or utilities if they are utilized for company purposes.

- Education and Training: The price of classes or workshops aimed at enhancing one’s trade-specific abilities.

- Travel expenses are the costs associated with hotel, food, and transportation when on a business trip.

People can significantly reduce their taxable income by maintaining thorough records and knowing which costs are deductible. In order to guarantee that no deduction is overlooked on tax day, Haimowitz advises taxpayers to develop proactive routines throughout the year, such as keeping track of their spending and preserving receipts.

Maximizing Deductions

Haimowitz’s guidance on maximizing deductions is akin to finding hidden treasures in a vast landscape; many taxpayers overlook potential deductions that could significantly reduce their tax liabilities. Common deductions include:

- Home Office Expenses: A percentage of rent or utilities if used for business activities.

- Education and Training: Costs for courses or workshops related to improving skills in one’s trade.

- Travel Expenses: Costs incurred when traveling for business purposes, including transportation, lodging, and meals.

By keeping meticulous records and understanding which expenses qualify as deductions, individuals can substantially lower their taxable income. Haimowitz encourages taxpayers to adopt proactive habits throughout the year, such as saving receipts and tracking expenses, to ensure no deduction is left behind when tax day arrives.

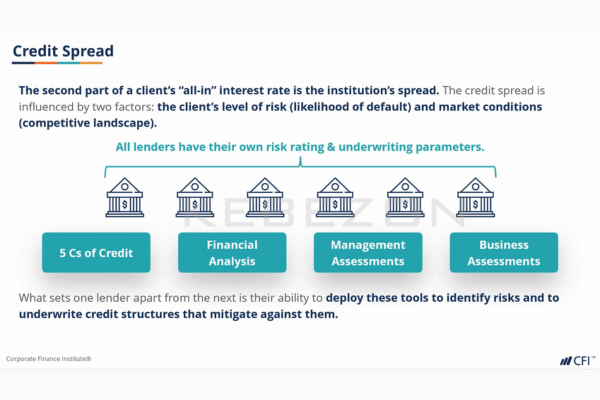

Selecting the Appropriate Business Organization

Another crucial element that Haimowitz addresses is choosing the right business structure. This choice has important tax ramifications and may affect liability as well as operating costs. By comparing several company entities, one may determine which one best suits their particular circumstances:

| Business Structure | Tax Implications | Liability | Best For |

| Sole Proprietorship | Pass-through taxation; reported on individual tax returns | Personal assets at risk | Freelancers wanting simplicity |

| LLC (Limited Liability Company) | Pass-through, but can elect to be taxed as a corporation | Protects personal assets | Business owners seeking flexibility and protection |

| S-Corporation | Pass-through; can reduce self-employment tax | Protects personal assets | Business owners with significant profit |

Understanding these differences allows taxpayers to make informed decisions that align with their financial goals. Haimowitz motivates freelancers to tailor their business structures not just for now but with future growth in mind.

Making Certain Appropriate Filing and Reporting Practices

The need of comprehending correct filing methods is a major subject in Haimowitz’s method; it’s comparable to sailing a wide ocean where mistakes might result in rough beaches. Avoiding severe fines and hassles can be achieved by making sure that filings are correct and submitted on time.

Important Filing Factors

Important filing factors consist of:

- Know Your dates: To prevent late fees, get familiar with both federal and state tax dates.

- Select the Correct Forms: To reduce misunderstanding, choose the correct tax forms based on your company’s structure.

- Use Reliable Software: To expedite the filing process, spend money on trustworthy tax software or get advice from a tax expert.

People may reduce the chance of issues and improve their readiness for tax day by being educated and proactive. This kind of attention to detail can make the difference between a hectic and a seamless filing experience.

Engaging in Continuous Learning

Haimowitz offers a course titled “How to Prepare for Tax Day,” available on platforms such as CreativeLive, where he breaks down these complex issues into digestible components. Engaging in continuous learning can significantly equip taxpayers with the skills needed to navigate the tax landscape seamlessly. Furthermore, Haimowitz’s webinars allow participants to access current tax strategies tailored to their unique situations. For instance, freelancers can learn how changes in tax laws can impact their deductions and liabilities effectively.

The Strength of Initiative and Well-Informed Choices

The main tenet of Haimowitz’s ideology is initiative. Taxpayers must be careful to comprehend the nuances of tax law and to prepare in advance, just like a gardener tends to their plants, fostering their growth. In order to prevent complacency, proactive measures include timely organization and regular information on tax changes.

Avoiding Typical Mistakes

Haimowitz cautions taxpayers against a number of typical problems that may result in fines, late files, or missing deductions:

- Ignoring Record-Keeping: Inaccurate reporting and expensive mistakes may result from a failure to routinely monitor revenue and spending.

- Last-Minute Filing: In an effort to meet deadlines, people frequently overlook or make mistakes while submitting their taxes.

- Underestimating Deductions: A lot of independent contractors understate their tax obligations by not claiming all of the allowed deductions.

Creating a Tax Preparation Checklist

To aid in staying ahead of these pitfalls, establishing a tax preparation checklist can serve as a roadmap to success. Below is an example checklist developed with Haimowitz’s insights:

- Organize financial records (income statements, receipts, expense logs)

- Determine your business entity and its implications

- Maximize deductible expenses

- Understand the necessary tax forms and deadlines

- Choose reliable tax preparation software or seek professional help

- Review past year’s tax filings for changes in income or deductions

By employing such a checklist, taxpayers can transform their preparation process, making it a systematic and stress-free endeavor.

In conclusion

Paul Haimowitz provides clarity and empowerment while negotiating the complexities of tax preparation, particularly for small company owners and independent contractors. His knowledge in tax advising highlights the need of comprehending a number of factors, from maximizing deductions to ensuring correct filing procedures to structuring business revenue. By following his guidelines, people may take an active approach to their tax obligations, turning what used to feel like a confusing maze into a methodical, self-assured strategy.

Haimowitz demystifies the tax preparation environment by emphasizing ongoing education and useful tactics, enabling taxpayers to take advantage of the possibilities presented by tax day rather than merely surviving it.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “How to Prepare for Tax Day with Paul Haimowitz” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.