ICT Style Trader By The Boss Traders

5,00 $

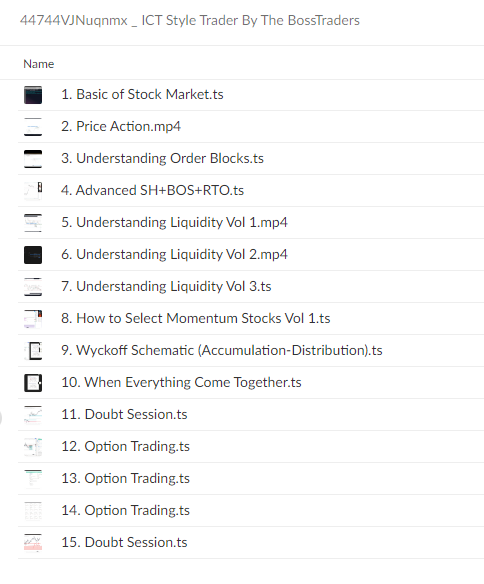

You may check content proof of “ICT Style Trader By The Boss Traders” below:

Review of ICT Style Trader by the Boss Traders

Finding a strategy that fits with one’s financial philosophy might be like trying to find a needle in a haystack in the fast-paced world of trading. For individuals who are keen to learn more about the workings of the market, Michael Huddleston‘s ICT (Inner Circle Trader) method provides a novel viewpoint. The ICT technique adopts a more thorough approach by concentrating on institutional trading tactics and the complex actions of major market participants, commonly known as “smart money,” in contrast to traditional trading methods that frequently depend primarily on technical indicators and patterns.

The subtleties of the ICT approach will be examined in this study, along with how they might enable traders to more confidently and perceptively traverse the intricacies of financial markets.

Overview of ICT Trading

Fundamentally, ICT trading aims to provide light on the market’s fundamental dynamics and structures via the prism of institutional trading procedures. Traders can gain a more sophisticated knowledge of market behavior by examining price fluctuations and the activities of key market participants. This technique incorporates a number of essential ideas, such as price imbalances, liquidity zones, and market structure.

The level of analysis is one of the most notable distinctions ***between ICT trading and conventional retail trading tactics. ICT explores more complicated areas, whilst many retail traders may only use technical indicators or simple price movement. For example, the process includes complex components including displacement, market structure changes, liquidity sweeps, and fair value disparities.

To illustrate, consider a trader utilizing traditional methods who only observes bullish or bearish price movements on a chart. In contrast, an ICT trader actively seeks to comprehend the why and how behind these movements, evaluating the underlying liquidity and identifying potential areas where the large market players operate. This depth of insight can significantly enhance their trading decisions, leading to more informed strategies.

Key Concepts

Understanding the foundational concepts of the ICT methodology is crucial for any aspiring trader. Here are several core elements that define this unique approach:

- Liquidity: The foundation of ICT trading is the idea of liquidity. There are two main types of liquidity: buy-side and sell-side. Traders can make well-informed judgments on entry and exit points by analyzing areas with liquidity. For example, ICT traders might predict possible market fluctuations by knowing where institutions would put their stop-loss orders.

- Market Structure Shifts: The capacity to identify changes in market structure is a key component of the ICT style. This idea aids traders in determining pivotal price points at which trends may persist or revert. For instance, an abrupt change might be a sign of a market correction, providing traders who are flexible with a favorable position.

- Optimal Trade entrance: Improving risk-reward ratios in ICT trading requires identifying the best trade entrance positions. After significant market movements, traders frequently use strategies like Fibonacci retracements, waiting for price action to recover to predetermined levels. By making transactions when conditions are good, this might optimize possible profits.

- Displacement and Fair Value Gaps: Fair value gaps indicate price ranges that usually fill over time, but displacement describes quick price swings brought on by strong buying or selling pressure. For traders hoping to predict future price movements and timing their entries efficiently, it is essential to comprehend these two occurrences.

Summary of Key Concepts in ICT Trading

| Concepts | Description |

| Liquidity | Understanding buy-side and sell-side liquidity to inform trading moves. |

| Market Structure Shifts | Recognizing changes in trends and significant price levels. |

| Optimal Trade Entry | Techniques like Fibonacci retracements to find favorable entries. |

| Displacement | Sharp price movements indicating substantial market pressure. |

| Fair Value Gaps | Price ranges that tend to be filled over time, crucial for timing. |

Pros and Cons

Every trading methodology comes with its strengths and weaknesses. The ICT trading approach is no different, and understanding these can help traders make more informed decisions.

Pros

- High Win Rate: A number of traders have claimed remarkably high win rates after successfully using ICT methods. This is frequently ascribed to a thorough comprehension of institutional traders’ methods and market dynamics. For instance, by correctly forecasting market moves based on the actions of major players, traders who concentrate on liquidity zones have achieved success.

- Adaptability: The adaptability of ICT techniques is among its most alluring features. The methods may be used in a variety of markets, such as commodities, equities, and currency. Because of its versatility, traders may use the approach in any market, opening them a wider range of possible trading possibilities.

Cons

- Complexity: A significant downside to the ICT approach is its complexity, which can prove challenging for beginners. The depth of knowledge required to master all concepts can overwhelm those new to trading. Mastery of ICT necessitates time, practice, and a willingness to engage with sophisticated ideas.

- Subjectivity: There is an inherent subjectivity in some aspects of ICT trading. Different traders might interpret the same market signals in varying ways, leading to inconsistencies in trading results. This variability can be particularly problematic for those looking to establish a reliable trading system based on precise parameters.

Summary of Pros and Cons

| Pros | Cons |

| High Win Rate | Complexity |

| Adaptability | Subjectivity |

Conclusion

The ICT trading technique gives traders a distinct viewpoint that can result in positive outcomes and provides a captivating insight into the inner workings of financial markets. It enables traders to more confidently negotiate the intricacies of trading by emphasizing a grasp of institutional trader behavior and the underlying market dynamics.

But not all traders will find its intricacy and subjectivity appealing, particularly those who like simple tactics. As a result, anyone hoping to fully profit from the ICT technique must be dedicated to lifelong learning and flexibility. Traders who are prepared to put in the required time and effort can get a new level of understanding that has a significant influence on their trading performance via practice and research.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “ICT Style Trader By The Boss Traders” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.