iMF Tracker – Order Flow Program 2023

5,00 $

You may check content proof of “iMF Tracker – Order Flow Program 2023” below:

IMF Tracker – Order Flow Program 2023

The financial markets can often feel like a whirlwind, with data and trends swirling around, making it difficult for traders to grasp opportunities effectively. The IMF Tracker – Order Flow Program, launched in 2023, emerges as a beacon of clarity in this chaos, providing traders a structured approach to understanding and capitalizing on market dynamics.

This cutting-edge program focuses on enhancing skills related to order flow sequencing a method that emphasizes the significance of real-time market information. By integrating theoretical knowledge with practical skills, the program aspires to elevate trading strategies to new heights, enabling participants to navigate the often-turbulent waters of trading with confidence and competence.

Moreover, the program does more than just teach techniques; it aims to empower traders with a robust educational framework that includes theoretical principles, real-world applications, and psychological resilience. No longer do traders have to rely solely on outdated technical indicators or patterns that paint a partial picture. Instead, the IMF Tracker equips participants with analytical tools, insights into institutional trading perspectives, and methodologies that are crucial for informed decision-making. Whether you’re an aspiring new trader or an experienced professional seeking to refine your skills, this program offers a comprehensive roadmap to success in the financial markets.

With the increasing complexity of trading mechanisms and the volatility of markets, having a trusted educational program like the IMF Tracker becomes essential. It provides the necessary resources and structured learning environment that can support traders in honing their craft and achieving desired financial results. From its innovative modules on order flow analysis to the support system that encompasses live training sessions, feedback, and community interaction, the IMF Tracker stands out as a leading educational initiative for modern traders looking to enhance their market performance.

Key Features of the IMF Tracker Program

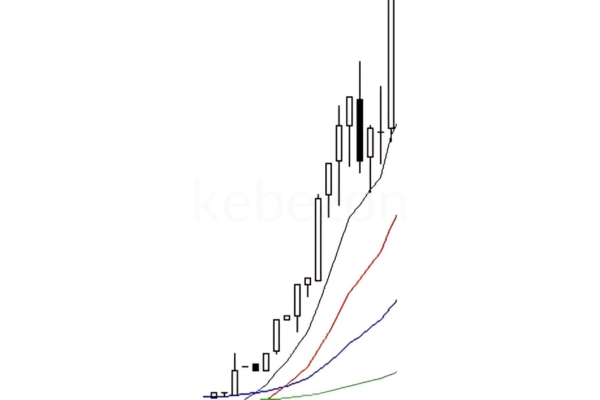

At the core of the IMF Tracker – Order Flow Program lies a series of key features designed to transform novice and experienced traders alike into adept market participants. One standout element is Order Flow Sequencing, a sophisticated approach that enables traders to analyze the market’s pulse in real time, drawing actionable insights from the constant flow of buy and sell orders.

Analytical Edge: Central to the program is the Order Flow Sequencing Factor (OFSF). This analytical strategy focuses on harnessing voluminous data from various market sources, making sense of it, and affecting informed trading decisions. The depth of insight provided by OFSF enables traders to understand market dynamics better and align their strategies with genuine market movements.

Comprehensive Resources: The program is not just theoretical; it incorporates a 72-page training manual brimming with real-world examples and structured guidance. This resource serves as an invaluable companion for traders, enhancing their learning while providing ongoing support as they navigate the complexities of order flow and market profiling.

Interactive Learning: With over 15 hours of engaging video content featuring advanced training sessions, traders can delve into topics such as auction market theory and footprint analysis at their own pace. Furthermore, participants have the opportunity to engage in live private training sessions, where real-time questions can be addressed and concepts clarified, creating a dynamic and interactive learning environment.

Practical Application: Learning doesn’t stop at theory. The IMF Tracker encourages applying learned principles through targeted drills focused on identifying market traps, thus fostering confidence in tackling real-market scenarios. By bridging theoretical concepts with practical skills, the program prepares traders to thrive in the unpredictable world of trading.

By integrating these features into a cohesive educational framework, the IMF Tracker – Order Flow Program serves as a comprehensive tool for traders seeking not only knowledge but also the confidence to exploit market opportunities successfully.

Analytical Strategies in Order Flow Sequencing

Analytical strategies in order flow sequencing are paramount for traders looking to navigate today’s intricate trading landscapes effectively. Order flow sequencing, at its essence, involves an in-depth examination of real-time buying and selling activities to predict price movements more accurately. Think of it as being akin to a conductor leading a symphony the conductor must interpret not only the notes being played but also the timing and dynamics involved to create harmony in the music.

The analytical strategies embedded in the IMF Tracker program leverage both quantitative and qualitative data, allowing traders to establish a comprehensive understanding of market behavior. For instance, rather than simply observing the volume of trades, traders are trained to assess the sentiment behind those trades whether they are from retail investors, institutions, or market makers. This multi-faceted approach ensures that participants can dissect complex market activities and make informed decisions.

Using tables to highlight specific analytical strategies:

**Analytical Strategy** **Description** **Order Flow Analysis** Examines buying and selling data to predict future price movements. **Market Sentiment Assessment** Evaluates the mood of the market based on trading activities and participant behavior. **Statistical Metrics Evaluation** Implements quantitative models to compare historical data with current trading patterns. **Real-Time Monitoring** Continuously tracks market changes, enhancing the ability to adapt strategies swiftly.

For example, traders can utilize statistical models to evaluate the effectiveness of their strategies based on past performance while continuously refining their approaches based on current trends. Furthermore, incorporating real-time monitoring allows traders to swiftly adapt their tactics in response to sudden market shifts, much like a seasoned sailor adjusting sails in response to changing winds.

Ultimately, the goal of these analytical strategies is to empower traders with profound insights that transcend mere numbers and price patterns, enabling them to understand the underlying forces that drive market movements. By leveraging these strategies, participants in the IMF Tracker program significantly enhance their trading acumen, equipping themselves to thrive in this fast-paced environment.

Order Flow Sequencing Factor (OFSF) Overview

The Order Flow Sequencing Factor (OFSF) is a cornerstone of the IMF Tracker – Order Flow Program, offering a multifaceted approach to trading that emphasizes the interconnection of various market forces. Just as an architect relies on a blueprint to construct a stable building, traders call upon OFSF to blueprint their strategies, leveraging data to make informed decisions in uncertain conditions.

OFSF is brilliantly designed to extract meaningful insights from the vast sea of market data. This strategic tool meticulously tracks order flows and price changes, allowing traders to interpret the underlying trends driving market dynamics. The emphasis on understanding the flow rather than just relying on historical data helps in discerning genuine liquidity and trading opportunities that can transform a trader’s approach.

Key features of OFSF include:

- Insights from Data: OFSF draws upon multiple data sources, amalgamating them into actionable insights. Traders learn how to make sense of received information actively rather than passively observing it.

- Enhanced One-on-One Learning: Each participant receives personalized training tailored to their experience level and trading goals, creating a unique learning trajectory that focuses on individual growth.

- Focused On Institutional Practices: Much like institutional traders who manage large portfolios and require a strategic understanding of the market, the OFSF equips individual traders with insights and methodologies that align with professional practices. This aspect of the program empowers participants to implement sophisticated strategies better suited to their trading styles.

In summary, the OFSF represents a powerful synthesis of market analysis and practical trading techniques. By delving into the intricacies of order flows, participants can navigate the complexities of the financial markets with a newfound confidence, almost as if they possess an innate understanding of the market’s pulse. With OFSF at their disposal, traders can elevate their trading strategies and gain a competitive edge unmatched by superficial analysis alone.

Comprehensive Trading Education Components

The comprehensive trading education components of the IMF Tracker – Order Flow Program are thoughtfully crafted to ensure that participants receive a well-rounded education. The program includes various resources that go beyond theoretical concepts, supporting traders in real-world applications of their newfound knowledge.

- Extended Content Delivery: The program offers over 15 hours of advanced video content featuring detailed discussions on critical topics such as auction market theory, footprint analysis, and order flow sequencing. This extensive material is not only informative but also engaging, facilitating effective learning.

- Interactive Training Manual: The 72-page training manual serves as a vital resource that complements the video content. It encapsulates crucial concepts, case studies, and insights, providing participants with a comprehensive guide for understanding market mechanics.

- Hands-On Exercises: Targeted drills form an essential part of the education components, focusing on identifying market traps and psychological scenarios that may derail decision-making. Engaging with these practical exercises allows traders to refine their skills methodically, preemptively addressing challenges often faced in real trading environments.

- Live Training Sessions: Two private live sessions are integral to the program, dedicated to Order Flow and Depth of Market (DOM) education. These interactive sessions promote real-time learning and foster engagement with instructors, addressing questions and offering personalized attention that enhances understanding.

Incorporating a blend of resources ensures that the IMF Tracker – Order Flow Program’s comprehensive educational components transform theory into practice. The goal is to empower traders with the tools and techniques necessary to function like seasoned professionals, capable of leveraging order flow analysis to navigate complex market scenarios. Participants leave the program better equipped and more confident, with a structured approach to trading that encompasses both the intellectual and emotional facets.

Video Training Session Breakdown

The video training sessions within the IMF Tracker – Order Flow Program represent a structured, interactive approach to mastering key trading concepts. Much like assembling a puzzle, each segment is a piece that contributes to a complete understanding of the trading landscape, creating clarity where chaos can often reign.

- Engaging Content Format: With over 15 hours of video content, the program offers dynamic sessions that vary in style. From straight instructional content to interactive quizzes, traders immerse themselves in learning that keeps them engaged while ensuring retention of information.

- Diverse Topics: The sessions cover essential trading concepts such as auction market theory, which elaborates on market dynamics, and footprint analysis, allowing for granular insights into trading behavior. This diversity is crucial for developing a well-rounded trading skill set.

- On-Demand Access: Unlike traditional courses where real-time participation is necessary, each video is recorded, allowing users to revisit lessons at their convenience. This flexibility empowers traders to absorb the material repeatedly, fostering deeper understanding.

- Real-World Applications: Video components include discussions centered on the practical application of theories a necessary bridge connecting classroom learning with trading realities. By contextualizing concepts, participants can quickly relate their knowledge to active trading scenarios.

- Immediate Feedback Features: Interactive elements woven into the video content, including discussions and Q&A segments, enhance the overall learning experience. Traders can ask questions in real time and receive instant feedback, enriching their understanding of the content.

The video training sessions serve as the backbone of the IMF Tracker – Order Flow Program, elevating the educational experience with engaging multimedia content. By breaking down complex theories into digestible segments and providing real-world context, participants are empowered to transform their theoretical expertise into actionable trading strategies.

Trading Tools and Resources

The trading tools and resources provided within the IMF Tracker – Order Flow Program serve as essential instruments for participants aiming to consolidate their trading knowledge and practical skills. These tools act as the arsenal every modern trader must have to succeed in the fast-paced financial environment we see today.

Comprehensive Learning Materials: With an extensive training manual accompanying the program, participants gain access to an indivisible resource filled with real-world examples. This manual not only reinforces the video content but acts as an ongoing reference tool for complex trading concepts, ensuring participants can apply the theoretical knowledge effectively in their trading practices.

Advanced Software Integration: The program is compatible with various trading platforms, including Bookmap, NinjaTrader, and Sierra Charts. This compatibility allows each user to select their preferred tools, enhancing their learning experience as they apply the techniques taught in actual market conditions.

Visualization Tools: Tools such as market profile and footprint analysis charts are introduced, providing participants with visual representations of market dynamics. These resources enable traders to grasp key concepts quickly, such as the categorization of price areas where trading occurs, aiding in developing precise trading strategies based on actual market sentiment.

Weekly Trading Checkpoints: Weekly assessments and trading checkpoints are structured into the program to track participants’ progress, ensuring they grasp each concept before moving on. This strategic pacing prevents knowledge overload, allowing for deeper retention of skills and techniques.

By arming participants with these useful tools and resources, the IMF Tracker – Order Flow Program goes beyond mere instructional content. It creates an engaging ecosystem where traders are better positioned to flourish while navigating the challenges of the trading environment. Ultimately, these resources help pave the way toward financial success and a greater understanding of market mechanics.

Auction Market Theory Application

Auction Market Theory (AMT) is a pivotal concept woven throughout the IMF Tracker – Order Flow Program. This theoretical framework posits that markets operate like ongoing auctions, where buyers and sellers engage to determine fair prices based on supply and demand dynamics. Understanding AMT equips traders with insights that extend beyond simple price movements, delving into the psychology of market participants.

- Price Discovery: At the heart of AMT is the notion of price discovery a continuous process wherein market participants negotiate price through transactions. Much like an antique auction, where the highest bidder determines the value of an item, market prices fluctuate based on the interplay of buyers and sellers. Each trade carries significance, revealing a portion of the broader economic narrative.

- Market Imbalance and Balance: AMT introduces the concepts of balance and imbalance within the market. In a balanced market, prices stabilize around a value area much like a scale evenly distributing weight. Conversely, imbalances signal potential price movement, prompting traders to adjust their strategies. By recognizing these shifts early, traders can align themselves with market trends, enhancing their trading effectiveness.

- Tools for Trading: AMT advocates for the utilization of analytical tools such as volume profiles and market profile charts. These tools aid traders in visualizing where price levels have significant trading activity, allowing them to identify potential support and resistance areas. By employing these resources, traders gain increased clarity on where market dynamics may shift, better informing their decision-making processes.

- Real-World Applications: The IMF Tracker emphasizes contextualizing AMT theories in real-world trading scenarios. Through engaging video content and targeted drills, participants learn to apply AMT principles systematically, bridging academic insights with practical trading experiences that showcase AMT in action.

By mastering Auction Market Theory and its associated principles, participants in the IMF Tracker – Order Flow Program can navigate their trading journey like seasoned auctioneers, adeptly interpreting market signals and extracting value amidst the noise of fluctuating prices. The application of AMT encourages a deeper understanding of market mechanisms, ultimately improving overall trading performance.

Footprint Analysis Techniques

Footprint analysis is a specialized technique employed within the IMF Tracker – Order Flow Program that focuses on visualizing order flow at specific price levels. This technique acts as a magnifying glass, allowing traders to see under the surface of market activity and understand what lies beneath the price action.

- Visual Representation of Orders: Footprint charts display the volume of buyer and seller activity at each price point, reflecting the balance of power between market participants. The footprint, much like footprints left in the sand, reveals the imprints of buyer and seller behavior, offering critical insights into market sentiment.

- Market Sentiment Evaluation: By analyzing the footprint chart, traders can discern whether buyers or sellers are dominating the market, allowing for strategic decisions based on sentiment trends. For instance, if traders observe high buying volume at a specific price level but weak selling pressure, they may infer strong support and adjust their positions accordingly.

- Integration with AMT: Footprint analysis dovetails seamlessly with Auction Market Theory, aiding in the identification of key support and resistance levels. When combined with volume profiles and AMT insights, traders can pinpoint historical price levels where significant trading occurred, providing a layer of predictive power for future price movements.

- Targeted Drills and Exercises: Within the program, targeted exercises involve interpreting various footprint patterns. Participants practice identifying market reversals and continuations based on their readings from the footprint charts, reinforcing their analytical skills and enhancing their confidence in making informed trading decisions.

By harnessing footprint analysis techniques, traders become adept at interpreting market nuances more effectively. This capability allows them to navigate the ebbs and flows of market activity with greater precision, enhancing their overall trading strategies and results.

Tape Reading Nuances

Tape reading is an essential skill emphasized in the IMF Tracker – Order Flow Program that incorporates the analysis of real-time market data to gauge price movements and volume activity. This technique enables traders to read the “tape” or a continuous stream of transaction data, much like reading the signs on a busy highway to gauge the flow of traffic.

- Real-Time Analysis: Tape reading involves monitoring time and sales data to understand how and where trades are occurring. This real-time analysis equips traders with insights into market sentiment, helping them capitalize on price movements as they happen.

- Volume Interpretation: Volume is a critical component of tape reading, as it provides context for price movements. Quantifying the number of trades occurring at specific price levels allows for a more nuanced understanding of supply and demand dynamics essential for discerning whether a price move is genuine or merely a fleeting surge.

- Market Timing: Successful tape reading aids in making timely trading decisions. Traders learn to identify significant buy or sell imbalances, recognizing moments when the market might pivot. This agility often distinguishes novice traders from seasoned professionals who can react swiftly to market changes.

- Emphasis on Training: The IMF Tracker program incorporates practical exercises that reinforce tape reading skills through live market interactions. Participants engage in real-time trading scenarios, practicing how to interpret data effectively and enhance their decision-making during high-stakes situations.

Through skillful tape reading, traders can develop an intuitive feel for the market’s rhythm. This nuanced understanding enhances their capacity to predict price movements, ultimately sharpening their trading edge in a competitive landscape.

Depth of Market (DOM) Insights

Depth of Market (DOM) is a powerful tool highlighted in the IMF Tracker – Order Flow Program that allows traders to visualize market liquidity and order flow. By peering into the DOM, traders can gauge the supply and demand levels at various price points, enabling more informed trading decisions.

- Visualizing Market Liquidity: The DOM displays the volume of buy and sell orders at different price levels, much like a bustling marketplace with vendors showcasing their wares. This visual representation helps traders identify critical support and resistance levels, providing essential insights into where the market might react.

- Order Management: Understanding the DOM gives traders an edge in managing their own orders. By recognizing how much liquidity exists at various price levels, traders can determine optimal entry and exit points that align with current market conditions, reducing the risk of slippage.

- Market Sentiment Assessment: The DOM serves as an immediate barometer for market sentiment. A surge in buy orders may suggest bullish market conditions, while a high volume of sell orders could indicate bearish sentiments. By interpreting this data, traders can align their strategies with prevailing market trends.

- Interactive Training Sessions: The program includes live sessions focused on understanding DOM dynamics. Participants learn how to navigate EXECUTION in the DOM and identify potential market-maker traps, enhancing their analytical skills through hands-on experience.

Utilizing Depth of Market insights empowers traders to possess a forward-looking perspective in their approach. By understanding the flow of orders and market liquidity, they can build stronger trading strategies that respond aptly to real-time market conditions, ultimately increasing their likelihood of success.

User Engagement and Support

User engagement and support form a fundamental aspect of the IMF Tracker – Order Flow Program, ensuring that participants feel connected, informed, and confident in their trading journey. The program emphasizes an active learning environment much like a well-tended garden flourishing under attentive care.

- Live Training Sessions: Two private live training sessions focus on Order Flow and Depth of Market (DOM). These interactive sessions allow participants to ask questions, engage with instructors, and gain clarity on complex concepts. Recording these sessions ensures that key teachings can be revisited anytime, thereby fostering a continuous learning experience.

- Tailored Guidance: The program’s design accommodates a diverse range of traders, whether they are using proprietary software or traditional data analysis tools. This flexibility ensures that users can integrate their preferred methods while still reaping the benefits of the training, increasing their engagement in the learning process.

- Comprehensive Resources: Participants receive a 72-page training manual packed with essential resources, case studies, and exercises that serve as a reference and guide. This ongoing support reinforces classroom concepts, allowing traders to dive deeper into topics with structured guidance.

- Community Feeling: The program encourages a community approach to learning. This sense of belonging and shared experience creates a nurturing environment where traders can share insights and strategies, enhancing their overall engagement in the program.

User engagement and support within the IMF Tracker – Order Flow Program are instrumental in forging deeper connections between participants and their learning experience. By delivering personalized attention and fostering a sense of community, the program aims to cultivate traders who are empowered to take control of their market journeys confidently.

Structure of Live Training Sessions

The structure of live training sessions forms a cornerstone of the IMF Tracker – Order Flow Program, designed to create a responsive and immersive educational experience. These sessions bring participants closer to the core concepts of order flow analysis and empower them with the ability to ask questions and engage directly with instructors.

- Interactive Format: Each live session focuses on critical topics such as Order Flow and Depth of Market (DOM), providing an interactive platform for participants to engage with instructors and clarify doubts. The ability to discuss real-time trading scenarios fosters deeper understanding and reflection on learned concepts.

- Recorded Accessibility: The recordings of these live sessions ensure that all participants can review detailed discussions at their convenience. This feature allows individuals to revisit specific segments, reinforcing their retention of key teachings and enhancing overall learning outcomes.

- Variety of Setups: Participants are accommodated across various setups that utilize different trading platforms, such as JigSaw, Sierra Charts, and Bloomberg. This commitment to inclusivity ensures that each trader can glean insights relevant to their trading style and preferences.

- Action-Oriented Training: The sessions are structured not only to impart knowledge but also to practice strategies through simulated market conditions. Participants engage in role-playing scenarios where they navigate actual order flow situations, gaining practical experience that translates to real-world trading.

The live training sessions within the IMF Tracker – Order Flow Program are instrumental in bringing theoretical knowledge to life. By fostering an interactive, accessible, and action-oriented environment, the program empowers traders to elevate their skills and confidence in the face of real market challenges.

Targeted Trading Drills and Exercises

Targeted trading drills and exercises play a vital role in the IMF Tracker – Order Flow Program, designed to reinforce key concepts while addressing the practical challenges that traders face. These drills serve as the training ground for honing skills, much like an athlete practices techniques, boosting readiness for competition.

- Focused Skill Development: Each exercise is carefully crafted to develop specific trading skills, such as identifying potential market-maker traps and understanding market sentiment shifts. By concentrating on relevant scenarios, traders can practice and refine their abilities consistently.

- Real-World Conditions: The drills simulate real trading environments, allowing participants to apply theoretical concepts to practical situations. For example, practicing order flow interpretation during market volatility helps build muscle memory, enabling traders to react swiftly in actual trading.

- Emotional Resilience: The program also addresses the emotional aspects of trading through targeted drills, enhancing participants’ mental fortitude. Exercises focus on challenging situations where traders need to manage risk, promoting psychological preparedness during moments of uncertainty.

- Interactive Feedback Mechanism: Participants receive feedback on their performance during drills, facilitating continuous improvement. This interaction encourages active participation and accountability, essential components in the journey toward becoming a proficient trader.

Through a well-structured combination of targeted drills and exercises, the IMF Tracker – Order Flow Program ensures that participants not only learn but practice, enabling them to build the confidence necessary to tackle financial markets’ complexities head-on.

Emotional Aspects of Trading Training

The emotional aspects of trading training stand as an integral part of the IMF Tracker – Order Flow Program, addressing the psychological challenges that traders encounter. Recognizing that trading is not merely a technical endeavor but also a mental and emotional one, the program emphasizes the importance of psychological resilience and emotional intelligence in trading success.

- Understanding Emotions in Trading: Trading can evoke a range of emotions including fear, greed, and anxiety that can skew decision-making. The program aims to create awareness of these feelings, equipping participants with strategies to manage their emotional states effectively.

- Drills for Emotional Control: The program includes specific exercises aimed at honing emotional resilience. For example, participants may engage in drills simulating high-pressure trading scenarios where they practice maintaining composure and clarity, cultivating the mental discipline essential for effective decision-making.

- Mindfulness Techniques: Techniques such as mindfulness and cognitive restructuring are introduced to help participants observe their emotions without being dominated by them. By fostering a mindset of awareness and control, traders can navigate psychological hurdles with greater ease.

- Community Support: The program encourages sharing experiences and challenges among participants, creating a sense of camaraderie and support. This community aspect fosters an environment where traders feel understood and less isolated in their trading journeys.

By acknowledging the emotional dimensions of trading and providing tools to manage them, the IMF Tracker – Order Flow Program empowers traders to conquer emotional barriers that may impede their success. This holistic approach ensures that participants are equipped not only with technical skills but also the mental fortitude to thrive in the ever-changing landscape of financial markets.

Pricing and Accessibility

The pricing and accessibility of the IMF Tracker – Order Flow Program reflect a commitment to providing valuable trading education without imposing burdensome costs. Central to this initiative is the understanding that quality trading education should be within reach for aspiring traders, regardless of their financial backgrounds.

- Cost Structure: The program is priced competitively at $1,550.00, which provides access to over 15 hours of instructional video content, a comprehensive 72-page training manual, and interactive training sessions. This investment in education not only covers the fundamentals of order flow analysis but also includes advanced strategies to enhance trading acumen.

- Promotional Offers: The program occasionally features promotional deals, significantly reducing costs. While the standard price is set at $1,550, discounts can bring this cost down to as low as $14.99, making it remarkably accessible for participants seeking quality education and insights without incurring significant expenses.

- Accessibility of Content: Accessible educational material is a hallmark of the IMF Tracker program, with training materials available for download shortly after registration. Members receive a link enabling them to access content conveniently and at their own pace, ensuring that understanding and engagement are prioritized.

- Continued Support: Participants are encouraged to reach out for support whenever needed. This fosters a community-focused approach where questions and concerns can be addressed promptly, ensuring that traders maximize their learning experience.

Pricing and accessibility are cornerstones of the IMF Tracker – Order Flow Program, ensuring that valuable trading education is available for all. By maintaining a commitment to affordability and support, the program strives to empower traders from various backgrounds to enhance their skill sets and navigate the complexities of financial markets confidently.

Cost Analysis of the IMF Tracker Program

The cost analysis of the IMF Tracker – Order Flow Program reveals a carefully structured pricing strategy that emphasizes value for participants. By evaluating both the tangible and intangible benefits, potential users can understand the program’s advantages in enhancing their trading skills.

- Comprehensive Training Offering: At a base price of $1,550.00, participants gain access to a wealth of resources, including over 15 hours of video content covering critical areas like auction market theory, footprint analysis, and order flow sequencing. This wealth of material translates into approximately $103 per hour of instructional content, indicating that the program offers considerable value for its price.

- Supplemental Resources: Alongside the video content, the program includes a 72-page manual that serves as an ongoing reference tool. This manual, comprised of explanations, exercises, and real-world examples, enhances the educational experience and ensures that participants can access knowledge well beyond the video sessions.

- Live Training Value: The inclusion of two live training sessions adds immeasurable value to the program. These sessions provide opportunities for real-time inquiries and tailored support, significantly enhancing the interactive nature of the learning experience.

- Promotional Opportunities: Discounted rates can reduce the overall investment significantly, with occasional offers bringing the price to as low as $14.99. This accessibility allows individuals from varying financial backgrounds to partake in a program that might otherwise be out of reach.

Overall, the cost analysis highlights a program designed with participant needs in mind, balancing affordability while maintaining a high-quality educational standard. Users can confidently invest in the IMF Tracker – Order Flow Program, recognizing its potential to enhance their trading performance and market understanding.

Membership Options and Benefits

The membership options and benefits provided by the IMF Tracker – Order Flow Program are crafted to support traders at all stages of their journey. Through a variety of resources, the program ensures that participants can derive maximum value from their engagement, making it a worthwhile investment.

- Comprehensive Learning Modules: Members gain exclusive access to over 15 hours of video training that tackles essential trading concepts, including auction market theory, market profiles, and order flow sequencing. This breadth of content caters to diverse learning styles, facilitating comprehension and mastery.

- Extensive Training Manual: The 72-page training manual included within the membership is a robust resource that complements the video content. It offers crucial insights, illustrations, and examples to solidify understanding while also serving as a future reference for participants.

- Interactive Engagement: Membership includes participation in two private live training sessions, allowing traders to engage with instructors, seek clarification, and receive real-time feedback on their progress. This interaction fosters active learning in an inclusive environment.

- Diverse Tools and Resources: The program supports various trading setups compatible with tools such as JigSaw, Bloomberg, and Sierra Charts. This flexibility ensures that traders from different backgrounds can take full advantage of the program, applying learned principles to their preferred systems.

- Progress Verification: Checkpoints and assessments throughout the program ensure that participants can monitor their progress effectively. This commitment to accountability helps to keep learners engaged and focused while reinforcing their understanding of key concepts.

Through these robust membership options and benefits, the IMF Tracker – Order Flow Program creates an educational ecosystem where traders thrive. By providing resources, tools, and support, the program empowers participants to fully explore their potential as informed market players.

Download and Access Procedures

The download and access procedures for the IMF Tracker – Order Flow Program have been designed to ensure that members can easily access their materials and start their learning journey without unnecessary delays. The process is straightforward and emphasizes user convenience.

- Immediate Access Upon Registration: After successfully enrolling in the program, members receive an email with a link to download all course materials. This immediate access ensures that traders can jump right into the content and begin their education without waiting.

- Time-Efficient Processing: The procedure for accessing materials is processed typically within 15 minutes after purchase. This quick turnaround helps participants dive into the program’s wealth of resources almost instantly.

- User-Friendly Interface: The course materials are organized in a user-friendly format, allowing members to navigate through different modules seamlessly. The structured layout enhances the learning experience, ensuring traders can focus on mastering the content without distraction.

- Support for Premium Users: For premium users, options are available for free downloads and additional content. This commitment to accessibility accentuates the program’s objective of providing inclusive education, making it suitable for all participants.

By incorporating these streamlined download and access procedures, the IMF Tracker – Order Flow Program prioritizes user experience, allowing participants to focus their energy on learning rather than logistical hurdles. This convenience is integral to fostering a positive learning journey for all members.

User Reviews and Feedback

User reviews and feedback on the IMF Tracker – Order Flow Program often emphasize the program’s comprehensive approach to trading education, with participants noting various advantages that contribute to their learning experiences. These testimonials provide valuable insights for potential users seeking reliable education in trading.

- Comprehensive Content: Many participants praise the extensive nature of the course, highlighting the over 15 hours of video content that delve deeply into trading concepts. Users appreciate the inclusion of advanced topics and practical exercises, making the program thorough and informative.

- Interactive Elements: The live training sessions are frequently noted as a significant feature. Participants enjoy the opportunity to engage with instructors in real time, raising questions, sharing experiences, and clarifying doubts that arise throughout the learning process.

- Practical Application: Reviews often highlight the emphasis on real-world applications of trading principles. The targeted drills and practical exercises resonate with users aiming to foster a solid understanding of how to translate theory into actionable trading strategies.

- Community Engagement: Users express satisfaction with the sense of community fostered by the program, where they can connect with like-minded traders. Such interactions enhance learning and allow participants to exchange valuable insights and experiences.

- Feedback on Improvements: While many reviews are positive, some participants mention the initial learning curve associated with the program’s advanced concepts. This feedback indicates the value of ongoing support and structured guidance as individuals pursue the educational journey.

Overall, user reviews and feedback reflect a strong consensus about the IMF Tracker – Order Flow Program’s capacity to enhance trading proficiency. By providing a blend of comprehensive educational resources, practical applications, and supportive community engagement, the program establishes itself as a pivotal resource for traders seeking to refine their skills and thrive in the financial markets.

Success Stories from Participants

Success stories from participants in the IMF Tracker – Order Flow Program exemplify the program’s transformative impact on traders’ abilities and confidence in the financial markets. These narratives, shared by traders who have engaged with the curriculum, illuminate how education translates into tangible successes.

- Heightened Market Understanding: Many participants report a marked improvement in their ability to interpret market dynamics, attributing this success to the program’s emphasis on auction market theory and order flow analysis. Traders often express newfound skills to identify trends and make informed decisions more confidently.

- Enhanced Trading Performance: Participants commonly reflect on their enhanced trading performance following their engagement with the program. Numerous success stories highlight improved win ratios and more effective risk management strategies, showcasing how the skills learned directly impact trading outcomes.

- Real-World Application: Success stories frequently underscore the program’s focus on applying learned concepts in real-time trading environments. Users often share anecdotes of how implementing new strategies led to profitable trades and a deeper understanding of market behavior.

- Increased Confidence: Traders often describe a significant boost in confidence as a result of their participation. By mastering complex concepts and understanding order flow mechanics, participants feel empowered to navigate the market landscape decisively.

These success stories emphasize the efficacy of the IMF Tracker – Order Flow Program and illustrate how participants transform their trading skills and overall approach. By embracing the program’s teachings, traders can unlock their potential, embodying the evolution from novice to informed market participants.

Common Challenges Faced by Users

While the IMF Tracker – Order Flow Program provides valuable insights and resources, it is not without its challenges. Participants often face hurdles as they navigate the complexities of market dynamics and enhance their trading skills. Understanding these challenges can help potential users prepare effectively.

- Complexity of Material: Many users note that the depth of content can be overwhelming, particularly for those unfamiliar with advanced trading concepts. As the program dives into intricate topics like order flow sequencing and auction market theory, traders may grapple with absorbing the material initially.

- Emotional Resilience: One of the most common challenges highlighted is the emotional strain that trading can impose. Participants frequently report their struggle with managing fear and greed during live trading scenarios, which can lead to impulsive decisions contrary to learned strategies.

- Application of Knowledge: Despite completing the program, some participants find that their application of learned concepts in live trading conditions is slower to yield results than anticipated. This lag may stem from external market factors, variability in personal trading styles, or simply a need for additional practice to internalize training effectively.

- Balancing Theory with Practice: Some traders experience difficulty bridging the gap between theoretical knowledge acquired through the program and real-world applications. This challenge underscores the importance of ongoing practice and support as participants strive to consolidate their skills.

Despite these challenges, many users find the IMF Tracker – Order Flow Program to be a rewarding educational journey. The insights gained often outweigh the hurdles faced along the way as participants gain confidence and develop skill sets that empower them to navigate increasingly complex trading landscapes successfully.

Impact on Trading Performance

The impact on trading performance resulting from participation in the IMF Tracker – Order Flow Program is profound. As traders immerse themselves in the curriculum, they often observe significant changes in their abilities and overall market engagement. Here’s an overview of how the program influences performance:

- Informed Decision-Making: Participants note that the program enhances their ability to make informed trading decisions grounded in solid analytical frameworks. This informed approach leads to improved trading outcomes as they apply order flow analysis and market profiling effectively.

- Risk Management: Many users highlight the emphasis on risk management strategies taught throughout the program. With better knowledge of market dynamics and deeper insights into when to enter and exit trades, participants experience reduced exposure to unnecessary losses and heightened profitability.

- Consistency and Discipline: The teachings surrounding psychology and emotional aspects of trading play a pivotal role in fostering consistency. Traders gain valuable tools to manage their emotional responses, allowing them to adhere to their strategies with increased discipline.

- Increased Confidence: A recurring theme among participants is the newfound confidence in their trading abilities. Many traders report feeling empowered to engage markets actively, exhibiting a strong willingness to implement learned skills and strategies in daily trading.

- Adaptability and Growth: The knowledge obtained through the program positions traders to adapt to various market conditions adeptly. Delivering a comprehensive understanding of order flow dynamics lays the groundwork for ongoing growth, encouraging participants to continue developing their trading practices even after the program concludes.

Ultimately, the impact on trading performance showcases the program’s effectiveness at transforming traders into informed, resilient, and confident market participants. By fostering a holistic understanding of trading principles and practices, the IMF Tracker – Order Flow Program provides participants with robust tools for thriving in the complexities of financial markets.

Comparisons with Other Trading Programs

When considering the IMF Tracker – Order Flow Program, it becomes essential to compare it against other trading programs available in the market. The following points illustrate how the IMF Tracker distinguishes itself as a premier educational initiative:

- Focus on Order Flow Analysis: Unlike many traditional trading programs that primarily emphasize technical analysis and chart patterns, the IMF Tracker centers its curriculum around the use of order flow sequencing. This unique focus allows traders to gain deeper insights into market movements, positioning them advantageously for interpretations that are less reliant on historical data alone.

- Extensive Video Content: With over 15 hours of comprehensive video content, the IMF Tracker offers a depth of training unmatched by many other programs. Many competing courses may provide only a fraction of that in terms of video instruction, often resulting in superficial learning experiences.

- Live Interactive Training: The provision of multiple live training sessions enhances engagement significantly. Many trading programs do not offer this direct access to instructors and real-time learning, which can detract from the overall educational experience.

- Psychological Focus: The IMF Tracker incorporates a unique emphasis on the psychological aspects of trading, including emotional control and mindset management. This holistic approach is not universally acknowledged in other programs, where technical execution is frequently prioritized over mental discipline.

- Community and Support: Participants in the IMF Tracker benefit from a sense of community, sharing experiences and insights that foster collaborative learning. More conventional programs may lack this support network, leading to feelings of isolation for individuals seeking to improve their trading capabilities.

By highlighting these points of comparison, it becomes clear that the IMF Tracker – Order Flow Program offers a distinctive and comprehensive educational experience aimed at reshaping how traders approach the markets.

Distinctions from Traditional Trading Courses

The IMF Tracker – Order Flow Program demonstrates several key distinctions from traditional trading courses, cementing its status as a cutting-edge educational initiative designed for today’s traders:

- Integrated Real-Time Learning: Traditional courses often consist of pre-recorded videos lacking interactivity. In contrast, the IMF Tracker incorporates live training sessions, enabling participants to engage directly with instructors and receive real-time feedback, enhancing the overall learning experience.

- Focus on Market Realities: The program emphasizes practical application with real-world examples woven into the curriculum. Instead of disconnecting theory from practice, each concept taught is contextualized, bridging the gap between what is learned and how it applies to live trading scenarios.

- Emphasis on Order Flow Sequencing: Traditional courses often prioritize broader market theories and technical indicators. However, the IMF Tracker focuses specifically on order flow analysis, providing participants with critical insights into the the underlying mechanics driving market movements.

- Mindfulness and Psychology: While traditional courses might offer rudimentary discussions on the psychology of trading, the IMF Tracker delves deeper. By incorporating exercises and training aimed at emotional resilience and self-awareness, participants are better equipped to handle psychological challenges.

- Community Engagement: Through collaborative learning and community interaction, the IMF Tracker fosters a support network that traditional courses may lack. Building connections with other traders cultivates a sense of accountability and shared learning that strengthens the overall educational journey.

These distinctions position the IMF Tracker – Order Flow Program as a formidable contender in the landscape of trading education, providing traders with the vital skills and knowledge necessary to compete effectively in an increasingly complex financial environment.

Competitive Edge of IMF Tracker Program

The competitive edge of the IMF Tracker – Order Flow Program lies in its innovative approach to trading education and real-world application. Participants in the program benefit from several strategic advantages that position them uniquely in the market.

- Institutional Trading Perspective: Delivered from the viewpoint of seasoned professionals, the program teaches participants how to think and operate like institutional traders. This perspective sharpens the decision-making process, enabling traders to develop strategies that resonate with large portfolios and informed processes.

- Actionable Insights: The concentration on order flow analysis provides traders with actionable insights gleaned from real-time data. This analytical approach empowers participants to anticipate market movements more effectively and act with precision, setting them apart from those relying solely on lagging indicators.

- Comprehensive Resource Allocation: With an extensive array of resources, including video content, manuals, and live sessions, the program arms participants with tools necessary for ongoing learning. This expansive education model ensures that traders are consistently engaged and challenged, maximizing their growth.

- Accessibility and Affordability: The program offers promotional discounts that make it significantly more affordable than many other programs charging similarly for less comprehensive content. This commitment to accessibility broadens the participant pool, allowing individuals from diverse backgrounds to enhance their trading skills.

- Holistic Support System: The program integrates emotional resilience training and practical drills designed to strengthen traders’ capacities to manage psychological hurdles. By fusing cognitive development with trading strategies, participants mature not only as traders but also as adaptable market players.

Through these strategic advantages, the IMF Tracker – Order Flow Program not only provides comprehensive educational materials but also enhances overall trading performance. This unique blend of theory, practical application, and psychological preparation secures its position as a leading offering in the trading education sector.

User Experience Compared to Alternatives

The user experience within the IMF Tracker – Order Flow Program contrasts notably with other trading programs, providing an educational journey that is both enriching and empowering for participants. By evaluating various aspects of the user experience, it becomes apparent how this program excels in cultivating trader proficiency.

- Intuitive Learning Platform: Users frequently commend the structured and user-friendly format of the program. Unlike alternative courses that might overwhelm participants with information, the IMF Tracker’s comprehensive yet digestible format promotes a clear trajectory for learning and skill development.

- Interactive Engagement: The provision of live training sessions is a significant element that enhances user experience. Many alternative programs lack this feature, leading to passive learning environments where participants may struggle to grasp complex concepts without real-time support.

- Feedback and Community: The sense of community fostered within the program encourages users to share experiences and insights, significantly enhancing the learning process. Many traders appreciate this interaction, as it promotes collaborative learning and counteracts feelings of isolation that can arise in less interactive environments.

- Diverse Learning Resources: The availability of multiple learning materials ranging from videos and manuals to live sessions ensures that users can approach the content in ways that suit their learning styles. This contrasts sharply with traditional courses that may rely heavily on text or recorded lectures.

- Focus on Practical Application: The emphasis on real-world scenarios and targeted drills provides a depth of learning that engages participants actively. This hands-on approach stands in stark contrast to many alternative programs that remain theoretical without offering practical pathways to implement skills.

The user experience within the IMF Tracker – Order Flow Program reflects a thoughtful design geared toward fostering growth and success among traders. By prioritizing interactivity, community engagement, and a comprehensive approach to learning, the program establishes a supportive environment where participants can thrive.

Conclusion

The IMF Tracker – Order Flow Program of 2023 stands as an innovative educational initiative that successfully equips traders with the essential skills and insights needed to navigate the complexities of the financial markets. By focusing on order flow sequencing, auction market theory, and the emotional aspects of trading, it offers a holistic approach that effectively bridges the gap between theoretical knowledge and practical application. Participants experience the benefits of engaging real-time learning, comprehensive resources, and supportive community engagement, all designed to transform them into confident and adaptive market players.

As the landscape of trading evolves, the IMF Tracker keeps pace with relevant content and methodologies that resonate with modern traders. By fostering emotional resilience, analytical skills, and practical strategies, it empowers individuals to make informed decisions while navigating volatile markets. Ultimately, the program not only enhances participants’ trading journey; it instills lasting confidence and competence that can lead to sustainable success in the dynamic world of finance.

Through its unique blend of education, real-world applicability, and psychological preparedness, the IMF Tracker – Order Flow Program serves as a cornerstone for traders striving to refine their skills and achieve greater performance in an ever-changing environment. By participating in this program, traders are not only investing in their immediate knowledge but also in their long-term growth and resilience as informed market participants.

![]()

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “iMF Tracker – Order Flow Program 2023” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.