-

×

The FOREX Blueprint - The Swag Academy

1 × 5,00 $

The FOREX Blueprint - The Swag Academy

1 × 5,00 $ -

×

Trading Hub 4.0 Ebook

1 × 5,00 $

Trading Hub 4.0 Ebook

1 × 5,00 $ -

×

Atlas Forex Trading Course

1 × 5,00 $

Atlas Forex Trading Course

1 × 5,00 $ -

×

Elite Trader Blueprint 2020 with Axia Futures

1 × 17,00 $

Elite Trader Blueprint 2020 with Axia Futures

1 × 17,00 $

Introduction To Fundamental Investing with Invictus Research

599,00 $ Original price was: 599,00 $.34,00 $Current price is: 34,00 $.

SKU: KEB. 45746U0AuHGTB

Category: Finance

Tags: Introduction To Fundamental Investing, Invictus Research

Download Introduction To Fundamental Investing with Invictus Research, check content proof here:

Review of Fundamental Investing Introduction

A common analogy for investing is building a solid foundation; the more robust your foundation, the more durable your structure will be throughout market turbulence and economic downturns. That core information is what Invictus Research’s “Introduction to Fundamental Investing” course seeks to impart, giving both seasoned experts and aspiring investors a strong basis. In order to enable people to confidently and clearly traverse the intricate world of financial markets, this course aims to demystify the art of investing research through a series of captivating films.

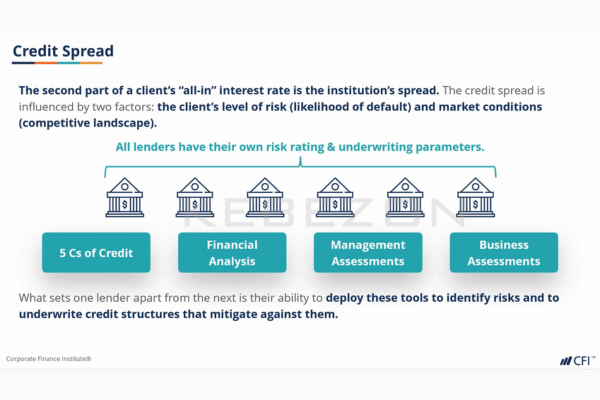

Fundamental analysis becomes essential in a world where every investing decision might feel like walking onto a perilous ledge. This course has been carefully designed to incorporate the essential ideas that characterize profitable investing plans. It serves those who are eager to improve their analytical abilities by giving them insights similar to those of experts in the field. Participating in this course is expected to improve one’s capacity to critically assess companies and their management teams in addition to honing investing acumen. This all-encompassing strategy is essential for making wise investment choices and guaranteeing that participants become capable contributors to the financial world.

Key Components of the Course

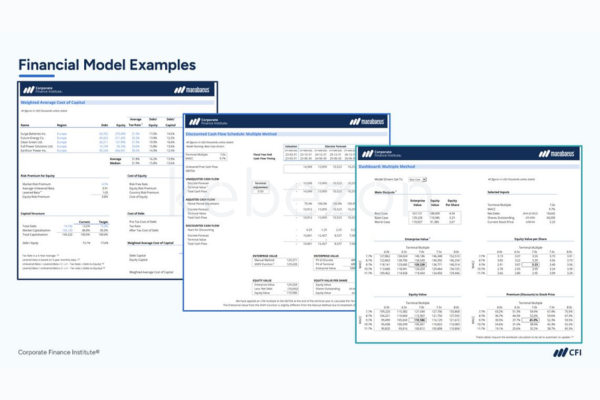

Understanding Financial Statements

One of the cornerstones of the “Introduction to Fundamental Investing” course is financial statement analysis. This fundamental skill is akin to learning the language of finance, enabling participants to decode the financial health of businesses they might invest in. Financial statements act as a window into a company’s soul, revealing its profitability, liquidity, and operational efficiency.

- Balance Sheet: Offers a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Understanding this document is pivotal in assessing a firm’s financial stability.

- Income Statement: Illustrates the revenue, expenses, and profit over a certain period. Analyzing this can help investors gauge a company’s performance and profitability trajectory.

- Cash Flow Statement: Details the inflows and outflows of cash, providing insights into the company’s liquidity. This statement answers the crucial question: Is the company generating enough cash to meet its obligations?

By mastering these documents, learners can develop a keen eye for spotting potential investment opportunities and risks.

Evaluation of Market Opportunities and Competitive Analysis

Students study competitive analysis and market opportunity evaluation, two pillars that assist well-informed decision-making, in addition to financial statements. Consider them to be the map and compass that help an investor navigate the broad array of market alternatives.

- Analyzing a company’s position in the market in relation to its competitors is known as competitive analysis. Students obtain a thorough grasp of a company’s position in its sector by comprehending strengths, weaknesses, opportunities, and threats, often known as SWOT analysis.

- Evaluation of Market Opportunities: This module gives participants the skills they need to spot new trends and potential investments. Developing successful investing plans requires an understanding of the development potential in different areas.

The Interplay of Macroeconomic Insights and Fundamental Investing

A standout aspect of this educational program is its emphasis on incorporating macroeconomic insights into fundamental investing. This holistic integration ensures that while you might scrutinize a company’s inner workings, you are also aware of the broader economic environment impacting that company’s performance.

- Economic Indicators: Participants learn to analyze indicators such as GDP growth rates, unemployment figures, and inflation. Understanding these data points helps in forecasting market trends and identifying investment risks.

- Market Dynamics: The course teaches how macroeconomic factors influence market behavior, equipping learners to anticipate changes and adjust their investment strategies accordingly.

By merging both fundamental and macro investing techniques, participants develop a comprehensive toolkit, allowing for a richer understanding of market dynamics.

Course Design and Methodology: Using Video Format

The seven well-organized films that make up the course last anywhere from 25 to 50 minutes each. In addition to accommodating different learning styles, this structure makes difficult ideas easy to understand. Participants may interact with the content at their own speed and go back and watch videos as needed.

Real-world examples and case studies are included in the carefully constructed curriculum to encourage active participation and make sure students understand how their studies are applied in the real world. In order to translate theoretical information into practical insights, the course provides pertinent scenarios.

Focus on Practicality and Real-World Application

Another significant attribute of this course is its focus on practical application. For instance, students are encouraged to participate in practical exercises, such as analyzing live market data and applying fundamental analysis techniques in simulated environments.

This hands-on approach not only reinforces learning but also simulates actual investment decision-making scenarios. By the completion of the course, participants are not just armed with knowledge; they possess a confidence that translates to real-world investment environments.

In conclusion

Fundamentally, investing involves making well-informed decisions that might result in either profitable gains or catastrophic losses. For individuals who are keen to learn the nuances of investing research, Invictus Research’s “Introduction to Fundamental Investing” course is a shining example. With its focus on macroeconomic insights, competitive market assessment, and financial statement analysis, this course gives learners the well-rounded viewpoint they need to successfully navigate the investing landscape.

Its captivating structure and emphasis on practical application prepare students to approach investing decisions with confidence and clarity. This course is the perfect place to start if you’re a beginner trying to get into investing or an experienced investor wishing to hone your analytical abilities. In the end, it’s not only about the numbers on a balance sheet; it’s also about comprehending the narrative those figures convey, which can help you create a solid investment portfolio that can endure any market storm.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Introduction To Fundamental Investing with Invictus Research” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.