-

×

Gut Health Makeover with Kim Foster

1 × 179,00 $

Gut Health Makeover with Kim Foster

1 × 179,00 $ -

×

Noisia Style Neuro Drum and Bass Start to Finish with Dan Larsson

1 × 15,00 $

Noisia Style Neuro Drum and Bass Start to Finish with Dan Larsson

1 × 15,00 $

Investment Tax Strategies with Sharon Winsmith

550,00 $ Original price was: 550,00 $.132,00 $Current price is: 132,00 $.

Download Investment Tax Strategies with Sharon Winsmith, check content proof here:

Investment Tax Strategies – Sharon Winsmith

Navigating the complex landscape of taxation when investing can often feel overwhelming for many. However, it is essential to understand that the right tax strategies can mean the difference between substantial wealth growth and substantial tax liabilities. Sharon Winsmith, a seasoned tax professional, emphasizes that investment tax strategies are about much more than simply minimizing taxes. They are a means to create a pathway for long-term wealth, aligning financial goals with tax efficiency. In this article, we will explore various tax strategies designed for investors, focusing on essential concepts such as understanding tax planning, the importance of timing, and leveraging specific approaches that can yield better financial results.

As we proceed, it is crucial to recognize that tax legislation is continuously evolving and can significantly impact individual circumstances. Thus, assessments of investment tax strategies need to be both fluid and personalized. Winsmith advocates for a proactive approach toward tax planning one that not only prepares for immediate situations but also anticipates future changes in regulations that could affect investment outcomes. By integrating insights into tax-efficiency with intentional investing, individuals can significantly enhance their potential for wealth accumulation. This article aims to provide insights derived from Winsmith’s principles, helping readers to think creatively about their investment choices and tax strategies.

Understanding tax planning for investments

Tax planning for investments is the practice of organizing one’s financial portfolio in a way that maximizes after-tax returns while adhering to tax regulations. At its core, it is akin to navigating a complex maze. Each turn you make represents a financial decision influenced by tax implications. Just as in a maze, where one wrong turn can lead you astray, poor tax planning can result in paying more than necessary in taxes diminishing your overall investment returns.

Understanding how to structure your investments and strategically use tax-advantaged accounts, like IRAs or 401(k)s, helps investors stay on the right path. For instance, contributions to traditional IRAs reduce your taxable income in the year they are made, allowing your investments to grow tax-deferred until withdrawal. In contrast, Roth IRAs offer tax-free withdrawals, making them a prominent choice for long-term investors anticipating higher taxes in the future.

With ever-changing tax laws, a comprehensive strategy must adapt to maintain effectiveness. Regular review and collaboration with a knowledgeable tax professional, such as Sharon Winsmith, ensures that individuals can fine-tune their strategies. This adaptability is essential when influencing the outcome of investment decisions based on fluctuating tax obligations, similar to changing route directions in response to new traffic patterns.

To summarize, strategic tax planning for investments provides the framework through which investors can navigate their journeys more successfully, with minimized liabilities and heightened returns.

Key Principles of Tax Efficiency

Tax efficiency involves structuring investments to minimize tax burdens while maximizing investment growth. The key principles include:

- Investment Choice: Selecting tax-efficient investments helps in maximizing after-tax returns. For instance, municipal bonds generate tax-exempt income, while index funds typically produce lower turnover, translating to fewer taxable events.

- Asset Location: Determining which assets to hold in taxable versus tax-advantaged accounts is crucial. Generally, higher-yielding investments are placed in tax-deferred accounts, while low-turnover investments can be held in taxable accounts.

- Tax-Loss Harvesting: This strategy involves selling investments at a loss to offset capital gains taxes. By strategically realizing losses, investors can minimize their overall tax liabilities while improving portfolio performance.

- Long-Term Orientation: Holding investments for more than a year qualifies them for lower long-term capital gains tax rates, thus benefiting from preferential tax treatment integral to effective tax planning.

- Maximizing Deductions: Donating appreciated securities to charities can yield tax benefits, such as avoiding capital gains taxes on the donation while receiving a deductible amount equivalent to the fair market value of the asset.

By incorporating these principles into their investment strategies, individuals align their portfolios more closely with their financial goals while effectively managing the tax implications of those decisions. Executing tax-efficient approaches leads to potentially enhanced asset growth over time, reminding investors that every strategy carried out in the present can result in future financial flexibility.

Importance of Timing in Tax Strategy

The timing of various investment decisions is pivotal in tax strategy. Investors must grasp the principle that timing can dictate tax implications significantly, much like how a well-timed pitch can dictate the outcome of a baseball game. Here is a closer examination of how timing plays a critical role:

- Sales Timing: Understanding when to sell an asset can determine whether the gains are classified as short-term or long-term. Long-term capital gains are subject to a different, often lower tax rate compared to the ordinary income tax rate applied to short-term gains, making timing a strategic aspect of investment sales.

- End-of-Year Tactics: The conclusion of a tax year allows opportunities for tax-loss harvesting. Selling losing investments shortly before year-end can offset gains realized throughout the year, optimizing tax outcomes.

- Purchase Timing: Investors should also pay attention to market conditions to make thoughtful purchasing decisions. Buying during market dips can yield long-term benefits and lower tax implications by postponing any taxation on profits until selling occurs.

- Retirement Contributions: The timing of contributions made into retirement accounts can maximize growth potential. Contributions made early in the tax year can provide a longer duration of growth before taxation becomes relevant, impacting overall returns.

- Capital Gains Events: Understanding personal income thresholds and expected fluctuating income levels throughout the year can tailor the timing of capital gains realization to minimize the tax impact.

In summary, timing is not arbitrary; it is strategic and can profoundly impact an investor’s financial journey. Those who thoughtfully align their actions with market fluctuations and tax timelines position themselves for greater success in building their investment portfolios efficiently.

Strategic Asset Allocation for Tax Benefits

Strategic asset allocation directly impacts an investor’s ability to optimize tax benefits. A well-thought-out allocation strategy ensures your money is working smartly for you, much like a balanced diet promoting overall health. Here are essential considerations:

- Tax-Smart Investing: Investors can secure tax-efficient investments, prioritizing those that generate lower tax-induced costs, such as index funds, municipal bonds, or ETFs with lower turnover. Mindfully selecting investments fosters sustainable long-term growth while minimizing immediate tax consequences.

- Asset Location Strategy: Implementing an asset location strategy involves differentiating which investments belong in tax-advantaged accounts versus taxable accounts. High-yielding assets, like bonds, are better suited for tax-deferred accounts, while stocks expected to appreciate significantly benefit from the capital gains treatment when held in a taxable account.

- Avoiding Unnecessary Distributions: Investors should select investments that generate minimal capital gains distributions. Low-turnover funds reduce unwanted taxable events, preserving more capital for investment.

- Rebalancing for Efficiency: Regular portfolio rebalancing can inadvertently trigger tax implications through realized gains on sold securities. Choosing to rebalance tax-advantaged accounts first can help mitigate overall tax exposure.

- Diversification: Just as a well-rounded diet includes a variety of food groups, a diversified investment portfolio helps manage risks. Balancing between and within asset classes creates an effective way to achieve the desired returns while adhering to tax-efficiency principles.

Investors strategically adopting these allocation principles can not only secure continued wealth growth but also ensure that their tax obligations remain manageable, yielding a net positive outcome aligned with long-term financial aspirations.

Buy, borrow, die strategy

The “Buy, Borrow, Die” strategy is a savvy tax approach utilized primarily by high-net-worth individuals to manage their investment tax liabilities efficiently. This strategy consists of three decisive phases buying appreciating assets, borrowing against these assets, and passing them onto heirs without incurring hefty taxes.

- Buy: At the outset, individuals acquire assets that are likely to appreciate, such as stocks, real estate, or art. This phase emphasizes the notion that as long as these assets are not sold, no capital gains taxes have to be paid. Imagine it as planting seeds in a garden; as you nurture them, they grow without immediate concern for what lies beneath the surface.

- Borrow: The second phase allows individuals to leverage their investments to access liquidity without selling their assets. By taking loans against appreciating holdings, borrowers can avoid capital gains taxes since selling the asset is not involved. This liquidity can then be used for personal expenses, additional investments, or business ventures. The interest on such loans may be tax-deductible, further enhancing financial benefits.

- Die: In this final phase, upon the death of the asset owner, the appreciated assets are inherited by heirs, who benefit from a “step-up” in basis. This critical feature resets the tax basis of the asset to its current market value at the time of inheritance, effectively eliminating the capital gains taxes that would have been due had the original owner sold the asset. This allows the heirs to potentially sell the assets without triggering capital gains taxation, akin to hitting a home run that caps a well-played game.

This strategy is notable for its ingenious ability to sidestep substantial tax liabilities while preserving generational wealth. However, it is not without risks, especially when considering market volatility and loan agreements. Overall, the “Buy, Borrow, Die” strategy requires meticulous management to navigate effectively.

Mechanics of the Buy, Borrow, Die Approach

Understanding the mechanics of the “Buy, Borrow, Die” approach involves a grasp of how to utilize assets efficiently to mitigate taxes while ensuring the growth and protection of wealth. Below are the critical components:

- Asset Ownership: Successful implementation begins with acquiring appreciating assets, such as real estate, stocks, or collectibles, effectively building a land of wealth. For instance, wealthy individuals often own diversified portfolios that buffer against market fluctuations while providing solid returns.

- Leveraging Against Assets: Instead of liquidating investments to access cash, individuals can utilize loans against their assets. For instance, if an investor borrows against their stock portfolio, they maintain ownership of the assets allowing them to continue benefiting from potential appreciation and dividend income without initiating a tax event. The loan is not taxable, presenting a potential financial windfall.

- Generational Wealth Transfer: When the individual passes on, heirs benefit from the step-up basis of inherited assets, which conveys a tax advantage. If a stock worth 500 million VND is inherited, the heirs have a cost basis reset to 500 million VND, ensuring they only pay capital gains tax on any appreciation post-inheritance, minimizing tax liability down the line.

- Minimizing Loan Risks: While leveraging investments can prove beneficial, managing risk remains paramount. Market fluctuations can lead to margin calls, forcing asset liquidation during unfavorable market conditions. Therefore, investors must maintain a diversified portfolio and refrain from over-leveraging to keep risks in check.

- Strategizing for Longevity: A long-term approach is necessary, as strategies must evolve alongside changing tax laws and market dynamics. Ongoing consultation with tax professionals such as Sharon Winsmith can refine the approach over time.

By mastering these mechanics, individuals aiming to grow and preserve their wealth can utilize the “Buy, Borrow, Die” strategy effectively, ensuring the longevity of their financial legacy while minimizing tax burdens.

Benefits of Leveraging Investments

Leveraging investments can offer substantial advantages, particularly for high-net-worth individuals aiming to optimize their wealth strategies. Here are several key benefits associated with leveraging investments:

- Capital Gains Tax Mitigation: One significant benefit of leveraging investments is the avoidance of capital gains taxes. When individuals borrow against their appreciating investments rather than selling them, they can access liquidity without triggering tax liabilities. By effectively sidestepping taxable events, investors can retain more wealth and expand their investment base.

- Continued Asset Appreciation: Leveraging investments allows individuals to tap into the power of compounding by retaining ownership of their appreciating assets. For example, by using borrowed funds for further investments while their original assets grow in value, investors can foster wealth accumulation. This scenario is akin to using a stable foundation to build a tall structure, ensuring that the growth potential is maximized.

- Tax-Deductible Interest Payments: Depending on the type of loan taken out, the interest paid on secured loans could be tax-deductible. This aspect serves to further enhance the financial benefits of leveraging. When well-managed, these tax advantages can offset the costs associated with borrowing, improving net returns for the investor.

- Preservation of Wealth: The strategic employment of leveraged investments not only helps in wealth expansion but also in its preservation across generations. As heirs inherit assets under a step-up basis, they avoid paying taxes on accumulated gains. This effectively ensures that the wealth remains intact and continues to grow, often resulting in a well-cultivated financial legacy.

- Flexibility and Strategic Opportunities: Leveraging provides flexibility investors can meet cash flow needs or seize opportunities without liquidating core holdings, which can be especially vital during market downturns or periods of reduced liquidity. This flexibility often allows for strategic maneuvering, maximizing long-term investment potential.

In conclusion, leveraging investments serves as a potent tool to enhance wealth building while minimizing potential tax liabilities. The effective application of this technique requires careful management and strategic planning, and consulting professionals like Sharon Winsmith can help tailor leverage strategies that align with individual financial goals.

Risks Associated with the Buy, Borrow, Die Strategy

While the “Buy, Borrow, Die” strategy offers significant benefits, it is not without its risks. Understanding these potential pitfalls helps individuals manage their investment portfolios thoughtfully and strategically. Here are some risks to consider:

- Market Volatility: One of the most pressing risks associated with this strategy is market volatility. A significant downturn could lead to substantial losses in the value of the underlying assets, potentially triggering margin calls on leveraged loans. If the investor cannot maintain sufficient asset values to cover loan obligations, they may be forced to sell investments at a loss.

- Interest Rate Fluctuations: Borrowing against investments often entails variable interest rates. As interest rates rise, the cost of borrowing increases, which can eat away at investment returns. This unpredictability necessitates careful planning and consideration of the larger economic landscape when deciding to leverage investments.

- Regulatory Changes: Tax laws and regulations regarding the inheritance of wealth can change, impacting the effectiveness of the “Buy, Borrow, Die” strategy. Any legal modifications that could eliminate or reduce the step-up basis benefit for heirs would have significant implications for estate planning and wealth transfer.

- Over-leveraging Risk: Investors who become too aggressive in leveraging may find themselves stripped of the safety nets provided by their investments. As a rule of thumb, experts recommend keeping leverage levels manageable typically, no more than 25% of an individual’s investment portfolio to mitigate the risk of forced liquidations during turbulent market conditions.

- Tax Implications Post-Demise: While inheritors benefit from a step-up basis, any value appreciation occurring post-inheritance will be subject to capital gains tax when sold. This is a crucial consideration for heirs who must adeptly plan the timing of their asset sales to minimize future tax liabilities.

Each of these risks underscores the necessity for a robust plan, which includes thorough knowledge of one’s financial situation and market conditions. Engaging with a tax advisor like Sharon Winsmith enhances risk understanding and informs individuals on best practices in employing this tax strategy.

Wealth Building Through Tax Strategies

Building wealth through effective tax strategies is a vital component of achieving long-term financial stability and growth. Understanding how to navigate tax implications allows investors to maximize returns while minimizing their overall tax burdens. Here are essential principles:

- Utilizing Tax-Advantaged Accounts: One of the most effective strategies for wealth building is to properly utilize tax-advantaged investment accounts. Contributions to accounts such as 401(k)s and IRAs lead to immediate tax savings, allowing investments to grow tax-deferred. This means that capital gains, interest income, and dividends are not taxed until fund withdrawals, often allowing individuals to benefit from potential compounding.

- Long-Term Capital Gains Management: Capital gains taxes are significantly lower for assets held longer than a year. By adopting a long-term investment philosophy, individual investors can strategically benefit from reduced capital gains taxes, ultimately bolstering financial outcomes significantly.

- Strategic Asset Location: By disambiguating asset types and intelligently locating them based on their tax implications, individuals can effectively reduce their tax liabilities. For instance, placing assets that produce ordinary income such as bonds in tax-advantaged accounts while keeping equities in taxable accounts optimizes growth potential.

- Regular Portfolio Review: Conducting regular assessments of portfolios ensures that tax strategies remain optimal while adapting to changing tax laws and personal circumstances. Monitoring investment performance and aligning with tax liabilities supports proactive financial management.

- Engaging in Philanthropy: Charitable giving can mitigate tax exposure while aligning with personal values. Donating appreciated assets or establishing donor-advised funds maximize both philanthropy and tax advantages, enabling investors to fulfill philanthropic goals while enjoying tax deductions.

Overall, employing effective tax strategies can lead to accumulated wealth over time, allowing individuals to realize their long-term financial aspirations. Consulting professionals like Sharon Winsmith can provide personalized insights tailored to enhance wealth-building efforts.

Long-term Growth and Tax Implications

The journey toward long-term growth is intricately tied to understanding tax implications. For investors, recognizing the relationship between investment choices and their future tax obligations is critical. Here are several key considerations when contemplating long-term growth:

- Asset Holding Period: Holding investments for extended periods grants considerable tax advantages, particularly regarding capital gains taxation. Investors realize lower rates on long-term capital gains compared to short-term gains, necessitating a buy-and-hold approach for optimal returns.

- Compounding Growth: The power of compounding can enhance long-term investment growth. Tax-efficient funds reinvest income and capital gains within accounts, avoiding immediate taxation and allowing for tax-deferred growth. This compounding mechanism amplifies total returns over time, securing financial benefits well into the future.

- Planning for Withdrawal Timing: Integrating withdrawal strategies can determine the long-term growth trajectory of an investment portfolio. Understanding the tax implications of each account type during the withdrawal phase especially between traditional and Roth accounts enables individuals to optimize withdrawal strategies that minimize tax burdens while maximizing access to funds.

- Diversification to Mitigate Tax Risks: Maintaining a diversified portfolio can help hedge against risks associated with taxation. For instance, having a blend of assets, such as stocks, bonds, and real estate, distributes exposure and creates overall financial resilience, allowing for better management of growth over time.

- Informed Decision-Making: Ongoing education about tax implications associated with various investment vehicles fosters informed decision-making. Staying aware of changing tax laws empowers investors to refine their strategic choices, ultimately yielding superior results over the long haul.

By understanding the ramifications of long-term growth decisions and aligning them meticulously with tax considerations, investors can cultivate substantial wealth while managing overall tax obligations. Collaborating with tax professionals specializing in investment strategies can enhance the effectiveness of growth initiatives.

Utilizing Tax-Deferred Accounts

Utilizing tax-deferred accounts effectively can play a pivotal role in wealth building and mitigating capital gains liabilities. Here’s how individuals can maximize the benefits:

- Understanding Types of Accounts: Tax-deferred accounts like traditional IRAs, 401(k)s, and certain annuities enable individuals to contribute pre-tax dollars, effectively reducing their taxable income for the year. For instance, if someone contributes 10 million VND to their traditional IRA, they reduce their taxable income by that same amount, resulting in tax liabilities on only 90 million VND instead of 100 million VND.

- Long-Term Growth Potential: Investments within tax-deferred accounts grow tax-free until withdrawn. This structure allows for more capital to be reinvested over time, truly harnessing the power of compound growth. It enables individual investors to realize greater asset accumulation throughout their working years, prior to potential withdrawals during retirement.

- Timing Withdrawals Strategically: By timing withdrawals during years when an individual is in a lower tax bracket e.g., early retirement or partial retirement years investors can undermine potential tax obligations and secure funds with favorable tax implications.

- Maximizing Contributions: Being fully cognizant of contribution limits ensures that investors can maximize their tax-deferred growth potential. For example, the contribution limit for a 401(k) in 2024 is set at 22 million VND, which presents a robust opportunity to shelter income from taxes.

- Avoiding Penalties: Investors should maintain awareness of withdrawal rules for tax-deferred accounts. Early withdrawals can incur penalties and taxes, diminishing the accrued investment capital. Therefore, a disciplined approach to account management can optimize both growth and access.

Through adeptly utilizing tax-deferred accounts and aligning investment strategies with long-term financial goals, individuals can significantly enhance their wealth-building potential while minimizing overall tax responsibilities. Engaging with tax advisors can unveil further personalized strategies for effective account utilization.

Strategies for Minimizing Capital Gains Tax

Minimizing capital gains tax is essential for maximizing returns on investment. Here are effective strategies to mitigate the impact of these taxes:

- Utilizing Long-Term Investment Strategies: Committing to holding investments for longer than one year allows capital gains to qualify for lower long-term rates rather than being taxed at higher short-term rates, significantly reducing tax obligations.

- Tax-Loss Harvesting: This technique entails selling investments at a loss to offset realized gains elsewhere within the portfolio. By taking strategic losses, investors can optimize tax liabilities. For instance, if an investor realizes a gain of 5 million VND and also sells a loss of 2 million VND, they only pay taxes on 3 million VND in realized gains.

- Investing in Tax-Efficient Funds: Selecting mutual funds or exchange-traded funds (ETFs) designed for tax efficiency can minimize capital gains distributions, leading to reduced tax events throughout the year, allowing investors to enjoy enhanced after-tax returns.

- Timing Sales Carefully: Being strategic about when investments are sold allows individuals to capitalize on market conditions while aligning with their broader financial outlook or changing tax situations, optimizing capital gains exposure.

- Gifting Appreciated Securities: For high-net-worth individuals, donating appreciated securities to charity allows them to avoid capital gains taxes entirely, while receiving a deduction for the fair market value of the security. This dual benefit exemplifies a strategic way to minimize tax burdens while promoting philanthropy.

By implementing these strategies, individuals can effectively manage and minimize capital gains tax implications, preserving more wealth and facilitating continued long-term investment growth.

Structuring Investments for Optimal Tax Outcomes

Structuring investments for optimal tax outcomes requires a well-thought-out strategy designed to maximize wealth while minimizing tax burdens. Here are several critical considerations that inform this approach:

- Entity Structure Considerations: The type of legal entity used to hold investments profoundly impacts tax outcomes. Sole proprietorships, LLCs, S-Corporations, and C-Corporations each have distinct tax implications that can affect overall tax liability. Understanding the pros and cons associated with each can help investors make informed decisions.

- Diverse Asset Allocation: Implementing asset allocation strategies that focus on the unique tax attributes of each investment class can optimize outcomes. For example, allocating stocks in taxable accounts to benefit from long-term capital gains treatment while holding interest-earning assets in tax-advantaged accounts offers strategic tax efficiency.

- Tax Overlap Awareness: Managing passive and active income types can ensure that investors do not inadvertently push themselves into higher tax brackets. Actively managing mixed revenues allows for appropriate planning to control taxes effectively.

- Regular Tax Review: Continuous assessment of investments in relation to evolving tax laws is crucial. Regulations frequently change, meaning individual strategies must stay relevant to optimize tax outcomes and potentially capitalize on newly introduced tax incentives.

- Professional Advisory Support: Consulting with tax advisers familiar with the nuances of investment tax strategies can yield tailored recommendations to enhance investment structures. These experts can help structure portfolios efficiently, aligning with both individual financial goals and compliance requirements.

By understanding and applying these structuring strategies, individuals can effectively navigate investment tax landscapes, ensuring optimal outcomes while bolstering their overall financial health.

Entity Structures and Tax Considerations

Understanding the tax implications of various entity structures is fundamental to optimizing investment outcomes. Here are the common structures one might consider, along with their respective tax considerations:

- Sole Proprietorship:

- Tax Implications: Income is taxed as personal income, with no separation between personal assets and business liabilities.

- Benefit: Simplicity in management and taxation.

- Limited Liability Company (LLC):

- Tax Implications: Can be taxed as a sole proprietorship, partnership, or corporation, providing flexibility.

- Benefit: Protects personal assets from liabilities while allowing for pass-through taxation.

- S-Corporation:

- Tax Implications: Income passes through to shareholders, avoiding double taxation, but with limits on shareholders.

- Benefit: Offers liability protection while retaining the advantage of avoiding corporate taxes.

- C-Corporation:

- Tax Implications: Subject to corporate tax rates; dividends paid to shareholders face additional taxation, leading to double taxation.

- Benefit: Offers potential benefits like employee benefits and a more extensive capital base.

When structuring investments, consider critical factors such as capital gains versus ordinary income taxation, tax loss harvesting techniques, and the “Buy, Borrow, Die” strategy.

Role of Trusts in Wealth Preservation

Trusts serve as essential tools in wealth preservation and tax planning a bit like using a protective shield in battle. By carefully structuring trust arrangements, individuals can effectively safeguard their assets from unforeseen tax events and economic uncertainties. Here are various roles trusts play:

- Wealth Protection: Transferring assets into a trust reduces the taxable estate of an individual, effectively shielding assets from creditors and other claims. By taking advantage of irrevocable trusts, significant reductions in estate tax liabilities can be achieved, preserving wealth for future generations.

- Trust Types for Specific Benefits:

- Irrevocable Trusts: Permanently remove assets from a grantor’s taxable estate, providing substantial tax reductions.

- Revocable Trusts: Offer flexibility for asset control during an individual’s lifetime, seamlessly facilitating transfers upon death and potentially avoiding probate complications.

- Philanthropic Considerations: Charitable trusts can synchronize wealth preservation and philanthropic goals, allowing individuals to engage in meaningful giving while reaping tax benefits.

- Strict Compliance with Tax Regulations: Trusts require adherence to regulatory guidelines to ensure tax advantages are realized. Non-compliance can result in severe repercussions, emphasizing the need for expert guidance throughout structuring processes.

- Enhanced Planning for Future Generations: Trusts can set specific terms regarding how and when assets are distributed to heirs, aiding in strategic financial planning that aligns with an individual’s long-term wealth preservation goals.

By leveraging trusts skillfully, investors can safeguard their financial legacies through intricate structures designed to optimize growth potential while minimizing tax implications across generations. Wealth-preservation strategies through trusts should always include professional oversight to ensure compliance and address individual circumstances effectively.

Importance of Compliance and Tax Planning

The significance of compliance in tax planning cannot be overstated. Maintaining adherence to tax laws and regulations is crucial to avoiding penalties that can arise from oversight or noncompliance. Here are several compelling reasons why compliance is essential:

- Avoiding Penalties: The penalties for failing to adhere to tax regulations can be steep, leading to both financial losses and legal complications. By ensuring compliance with evolving tax laws, individuals can protect themselves and their investments from unnecessary financial strain.

- Strategic Planning Alignment: Individuals who maintain tax compliance can strategically align their investment planning with permissible tax-advantaged approaches. Planning investments alongside compliance fosters an environment of proactive decision-making.

- Holistic Wealth Strategy: Building a holistic strategy that considers compliance as a core element encourages individuals to actively manage tax implications, ensuring that they maximize growth opportunities available within current laws.

- Professional Guidance: Engaging with tax professionals and legal advisors allows individuals to understand tax obligations comprehensively. This knowledge enables investors to structure their portfolios in ways that comply with regulations while seeking optimal tax benefits.

- Staying Updated: Tax laws are dynamic, prompting regular updates and changes. Staying informed about new regulations and compliance requirements supports proactive tax planning that aligns with changing legal frameworks.

In conclusion, prioritizing compliance while maintaining a strategic approach to tax planning can greatly enhance the effectiveness of investment tax strategies, ensuring sustained growth and safeguard against future liabilities.

Advanced Tax Strategies for High-Net-Worth Individuals

Advanced tax strategies tailored to high-net-worth individuals (HNWIs) are vital for optimizing wealth management and minimizing tax exposure. Here are critical strategies that can significantly benefit them:

- Utilizing Tax-Advantaged Investment Vehicles: Vehicles such as Roth IRAs, Health Savings Accounts (HSAs), and 529 Plans can provide tax-free growth or tax-deductible contributions, making them ideal for long-term wealth accumulation.

- International Diversification: HNWIs can diversify investments across jurisdictions, helping reduce tax exposure through foreign tax credits and treaties. Establishing residency in countries with favorable tax regimes substantially minimizes tax obligations.

- Income Splitting: Utilizing Family Limited Partnerships (FLPs) or Limited Liability Companies (LLCs) enables income splitting among family members in lower tax brackets, managing overall tax liabilities within the family unit.

- Tax-Loss Harvesting: Regularly selling losing investments to offset capital gains from other transactions minimizes taxable income, particularly for HNWIs with substantial portfolios.

- Charitable Remainder Trusts: These trusts allow individuals to donate a significant asset while retaining an income stream from that asset over time. This dual benefit of immediate tax deductions and ongoing income proves advantageous for effective tax management.

To navigate this advanced landscape of tax legislation successfully, HNWIs should consistently consult with a financial adviser well-versed in tax strategies who can tailor solutions to their unique financial situations and evolving market circumstances.

Techniques for International Tax Planning

International tax planning is integral to the wealth management practices of high-net-worth individuals and investors with assets spread across borders. Here are several techniques that can optimize international tax efficiency:

- Understanding Tax Treaties: HNWIs can benefit from tax treaties that reduce or eliminate double taxation on income earned abroad, such as dividends or interest. Awareness of these treaties enables individuals to structure investments to leverage potential advantages.

- Establishing Foreign Trusts: Utilizing foreign trusts can offer asset protection and potential tax deferrals under specific conditions. It’s crucial to navigate domestic and international regulations carefully when employing this strategy to ensure compliance.

- Income Diversification: Attempting to generate income from diverse international sources can minimize exposure to a single country’s tax regime, aiding in strategic tax planning and potentially reducing overall liabilities.

- Compliance with FCC and IRS Laws: Navigating the regulations of each jurisdiction while remaining compliant with foreign account reporting and IRS laws is vital for HNWIs with international investments. Striking the correct balance between establishing offshore accounts and complying with existing investment regulations safeguards against penalties.

- Working with Global Advisors: Engaging professionals who specialize in international tax law and financial planning enhances understanding and navigation through international tax landscapes, ensuring informed decision-making.

By integrating these techniques, individuals can harness opportunities for strategic international tax planning that ultimately supports long-term wealth growth and robust estate management practices.

Mitigating Tax Liabilities through Philanthropy

Philanthropy serves as a powerful tool for high-net-worth individuals seeking to mitigate tax liabilities while fulfilling charitable goals. Here are essential strategies to consider:

- Direct Charitable Donations: Cash contributions to qualified charitable organizations can reduce taxable income significantly. For instance, direct donations made to charities lower the immediate tax burden without incurring capital gains.

- Donor-Advised Funds (DAFs): Establishing a DAF allows individuals to contribute and claim a tax deduction immediately while retaining the ability to decide how charitable money is disbursed over time. This flexible approach maximizes both philanthropic impact and tax benefits.

- Gifting Appreciated Securities: Donating appreciated stocks or real estate offers individuals the chance to avoid capital gains tax while securing a fair-market-value tax deduction. This strategic decision fosters significant tax advantages alongside charitable contributions.

- Charitable Trusts: Utilizing charitable remainder trusts (CRTs) enables individuals to donate assets while retaining income for a specified time. This approach generates substantial tax deductions and allows individuals to engage actively in philanthropy.

- Strategic Philanthropic Planning: Creating a structured approach to philanthropy, including leveraging gifts and establishing family foundations, enhances both individual tax efficiency and community benefit.

In conclusion, mitigating tax liabilities through philanthropy not only aligns financial management with personal values but also provides tangible financial benefits. Individuals seeking to optimize their tax obligations should consider integrating charitable efforts thoughtfully into their financial planning strategies.

Evaluating Investment Tax Strategies

Evaluating investment tax strategies is essential for optimizing financial positions. Here are some components of evaluating the effectiveness of these strategies:

- Tax-Loss Harvesting: Investors should assess whether they are consistently engaging in tax-loss harvesting to offset capital gains. This practice involves regularly reviewing their portfolios to identify opportunities to realize losses strategically.

- Maximizing Tax-Advantaged Accounts: Individuals must continually evaluate their contributions to tax-advantaged accounts and ensure they are maximizing their potential. Understanding how to approach retirement account withdrawals more strategically can lead to greater wealth retention with minimized tax obligations.

- Client-Centric Asset Selection: The choice of tax-efficient investments such as low-turnover mutual funds or ETFs requires ongoing evaluation to ensure alignment with personal financial goals while minimizing unnecessary tax liabilities.

- Roth IRA Conversions: Assessing the suitability of converting traditional IRAs to Roth IRAs is crucial, especially in years when tax liability is comparatively lower. Evaluating the long-term benefits could lead to significant savings in the face of rising taxes in the future.

- Case Studies: Analyzing case studies of successful tax strategies provides insights into best practices. Documenting real-world examples allows for benchmarking and establishing effective approaches to optimizing personal investment strategies.

Investors must remain vigilant in evaluating the performance of their investment tax strategies to ensure continuous alignment with their financial objectives. Engaging with professionals presents a helpful avenue for obtaining tailored insights based on individual circumstances.

Assessing the Effectiveness of Various Approaches

Assessing the effectiveness of different investment tax strategies involves careful consideration of numerous factors. Here are key metrics to evaluate their performance:

- Tax Efficiency Metrics: Analyzing how well the selected investments and strategies minimize tax liabilities while maximizing returns remains critical. Long-term capital gains and net investment income taxes should be thoroughly assessed.

- Return on Investment (ROI): Examining the overall ROI after accounting for taxes reflects the effectiveness of the investment strategy. Tracking net gains to confirm the success of tax strategies drives informed decision-making.

- Overall Tax Burden: Measuring overall tax liabilities and how they correlate with investment performance helps clarify which tax strategies yield the best outcomes. Understanding the impact of tax liabilities on investment profits highlights the criticality of tax planning.

- Benchmarking Against Peers: Comparing one’s performance against similar portfolios or selected benchmarks provides insight into relative efficiency. This benchmarking process reveals opportunities for improvement and refinement in one’s investment approach.

- Regular Reevaluation: Ongoing evaluation is essential, as tax strategies must evolve alongside changes in tax laws and individual financial circumstances. Regular reviews allow for timely adjustments that optimize investment tax strategies.

Through diligent assessment of investment tax strategies, individuals can effectively measure their alignment with financial goals while ensuring their investments remain tax-efficient and productive.

Case Studies on Successful Tax Strategies

Examining case studies of successful tax strategies offers valuable insights into practical applications and best practices that can inform individual investment decisions. Here are illustrative examples:

- Case Study: Tax-Loss Harvesting: An investor using tax-loss harvesting effectively sold a stock at a loss to offset gains realized on another investment. By strategically managing their portfolio this way, they minimized taxable income for the year, allowing for compounded growth on their remaining investments.

- Case Study: Buy and Hold Strategy: Consider an investor who held a diversified stock portfolio for multiple years, realizing lower long-term capital gains tax rates. Their disciplined approach to investing ensured average annual returns exceeded market performance, and by adhering to a buy-and-hold strategy, they gained maximum tax efficiency.

- Case Study: Charitable Contributions: An individual who donated appreciated stock to a charitable organization maximized tax deductions while avoiding capital gains taxes. This approach not only fulfilled their philanthropic goals but also optimized their overall tax situation significantly.

- Case Study: Entity Selection: A high-net-worth individual structured their investments through an LLC, allowing for personalized taxation while providing robust liability protection. This move resulted in more favorable tax outcomes without sacrificing asset growth opportunities.

- Case Study: Utilizing Trusts for Estate Planning: By establishing a revocable trust, an investor was able to protect their assets, streamline estate processing, and lower overall taxable estate value. The structure ensured a seamless transfer of wealth while maintaining compliance with regulatory requirements.

By reviewing and analyzing these case studies, investors can draw inspiration from proven success stories, tailoring their investment tax strategies to achieve similar outcomes in their financial endeavors.

In conclusion, understanding investment tax strategies and implementing them effectively is essential for optimizing tax liabilities and enhancing wealth-building opportunities. Sharon Winsmith provides invaluable insights into navigating complex tax regulations while exploring multiple avenues for tax efficiency.

By employing sound practices, maintaining flexibility, and engaging with skilled advisers, individuals can successfully navigate the labyrinth of investment taxation and secure a prosperous financial future for themselves and their heirs. Ultimately, optimizing tax strategies is not just about minimizing liabilities; it’s about maximizing one’s potential for wealth creation and preservation through informed financial choices.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Investment Tax Strategies with Sharon Winsmith” Cancel reply

You must be logged in to post a review.

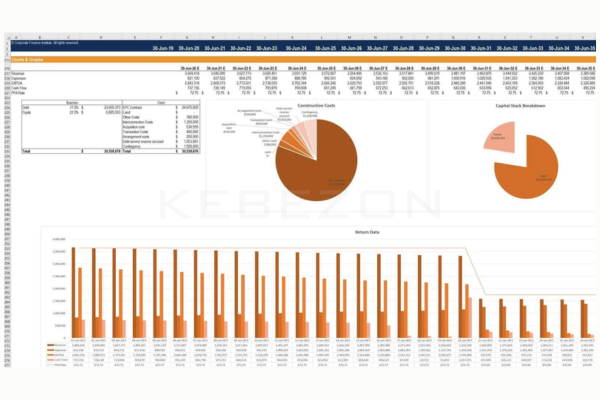

Related products

Finance

Reviews

There are no reviews yet.