Liquidity University 2023 with Liquidity University

5,00 $

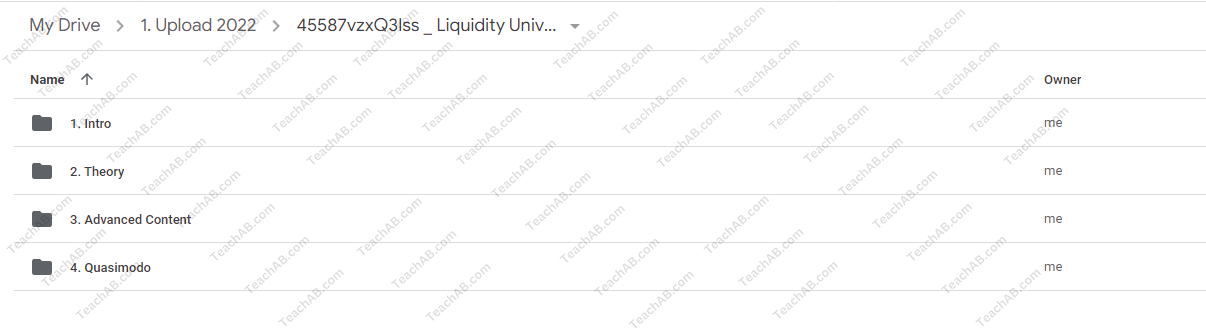

Download Liquidity University 2023 with Liquidity University, check content proof here:

Understanding the Flow of Financial Markets: An Extensive Analysis of Liquidity University 2023

Knowing liquidity is like knowing the pulse of the market in today’s fast-paced financial world, where every second matters and the stakes are bigger than ever. As a knowledge-based institution, Liquidity University 2023 illuminates the way for both newcomers and seasoned pros. The course material has been carefully crafted to give students the essential knowledge and sound tactics that influence liquidity management and its complex connection to more general financial indicators. This organization serves as a crucial resource for negotiating the ever-changing financial landscape by combining academic frameworks with real-world applications.

Liquidity University goes beyond simple textbook definitions by including current market forces and trends, especially in light of expected central bank rate changes—a situation that everyone is keeping a careful eye on. Knowing the intricacies and ramifications of liquidity is crucial as it plays a bigger role in determining financial strategies and operational effectiveness. This article explores the core ideas, curriculum highlights, and wealth of materials offered by Liquidity University 2023 in order to develop sophisticated techniques for managing liquidity.

Curriculum Overview: Bridging Theory and Practice

Liquidity University’s curriculum is a meticulously crafted skeleton that supports a rich array of educational flesh aimed at fostering comprehensive knowledge in liquidity dynamics. Participants can expect an engaging learning experience that encompasses several key subjects, such as liquidity management, cash strategies, and the interplay between liquidity and capital structure.

Core Topics Covered

- Liquidity Management: This foundational pillar addresses the fundamental principles that promote robust liquidity strategies. Participants explore various liquidity measurements, enabling them to evaluate financial health accurately.

- Cash Strategies: Learners delve into effective cash management techniques that ensure liquidity sufficiency while optimizing overall financial performance. This module is particularly poignant, given the challenges businesses face in maintaining cash flow in turbulent economic times.

- Profitability and Capital Structure: This segment investigates how liquidity decisions resonate through profitability and the overall capital structure. Students will learn to recognize the intricate balances that organizations must strike to maintain not only liquidity but also sustainable growth.

Associated Resources

Liquidity University takes pride in offering a variety of resources that improve the educational process in addition to a well-organized curriculum. The abundance of materials includes articles and in-depth research papers from credible academic databases such as LatIndex and Scopus. The university’s dedication to using up-to-date, practical facts to enhance the teaching process is demonstrated by this varied collection of books.

| Resource Type | Description |

| Articles | In-depth analysis of liquidity issues |

| Research Papers | Scholarly articles from leading academics |

| Case Studies | Real-world examples to ground theory into practice |

These resources are ever-evolving, drawing from the latest financial research and market insights. Participants can expect to remain at the cutting edge of liquidity discussions, making this university a dynamic learning hub.

Managing Market Conditions: A Present-Day View

Although the unpredictability of financial markets can be intimidating, Liquidity University provides important insights on how to handle these choppy seas. It is anticipated that central banks would raise interest rates globally, which will have a ripple impact on liquidity plans. Liquidity University makes sure that its lessons have real-world application by establishing itself as a company that capitalizes on current market events.

The Significance of Time

Timing might be crucial in the financial industry. Liquidity management requires an understanding of the effects of central bank interest rate choices. The tactics used in response change along with the liquidity conditions.

An example of a market strategy

Think of a company that postpones a capital investment in expectation of increasing rates. They can better handle any liquidity issues brought on by higher borrowing costs if they save money. This methodical approach to decision-making demonstrates how Liquidity University’s education is applied in real-world situations.

| Scenario | Strategy Employed |

| Anticipated rate hike | Delay on new capital expenditures |

| Economic uncertainty | Enhanced cash reserves |

| Improved profitability requirements | Streamlined cash management |

Such examples elucidate how participants can apply their knowledge directly to real-world scenarios, equipping them with the tools necessary for success in volatile financial environments.

Network Building: Interaction and Cooperation

Liquidity University 2023’s emphasis on networking and teamwork among attendees is one of its most notable features. The idea is straightforward yet effective; conversation frequently improves learning. The university helps students to exchange ideas and tactics by creating a collaborative atmosphere, which enhances their comprehension of liquidity management.

The Strength of Community

Through seminars, workshops, and online forums, students may interact with alumni, industry professionals, and other students, providing a wealth of networking possibilities. Consider the abundance of information that is shared in these kinds of situations, when seasoned experts provide their perspectives gleaned from years of negotiating financial environments.

Establishing Lifelong Relationships

Participants in these exchanges not only get a variety of viewpoints on liquidity tactics, but they also forge important professional relationships that might benefit them in the future. Long after they have completed their education, graduates are frequently drawn back to these prospects.

Conclusion: A Vital Resource in Financial Literacy

In summary, Liquidity University 2023 stands as a vital resource for those eager to deepen their understanding of the intricate dynamics surrounding liquidity. Its comprehensive curriculum, grounded with practical applications, equips learners with essential strategies to navigate complex market conditions. By prioritizing collaboration and up-to-date resources, Liquidity University not only educates but also cultivates a thriving community of finance professionals. For anyone serious about mastering liquidity’s role in global finance, this institution is undoubtedly a springboard to success.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Liquidity University 2023 with Liquidity University” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.