MASTERING SWING TRADING May 2024 with Roman Bogomazov

500,00 $ Original price was: 500,00 $.194,00 $Current price is: 194,00 $.

Download MASTERING SWING TRADING May 2024 with Roman Bogomazov, check content proof here:

Mastering Swing Trading May 2024 with Roman Bogomazov

As the financial landscape continuously evolves, mastering swing trading has become a paramount skill for traders looking to capitalize on short to medium-term price movements. Roman Bogomazov, a recognized authority in the field, has developed a comprehensive course on swing trading aimed at empowering both novices and experienced traders. Set to launch in May 2024, this program emphasizes not just trading techniques but also the psychological fortitude required for consistent success. The course is structured around a methodology inspired by the renowned Wyckoff Method, focusing on price action, volume analysis, and market psychology. Participants will gain insightful perspectives and hands-on approaches that can significantly enhance their trading performance and decision-making processes.

This article delves into various aspects of the course, beginning with an overview of its structured layout, key concepts, the duration and format of the sessions, and the practical benefits for participants. By examining these elements, prospective traders can better understand how Bogomazov’s teachings can equip them with the essential tools for mastering swing trading effectively.

Course Structure

The “Mastering Swing Trading” course by Roman Bogomazov is meticulously structured into three distinct sessions, each lasting two hours. This structured approach is akin to stepping stones, where each session builds on the previous one, thereby enhancing the overall learning experience. In comparing traditional educational formats with this course structure, it becomes clear that the interactive and concentrated nature of Bogomazov’s program promotes deeper understanding and application.

Session Overview

- Session 1: Swing Trading Definition and Market Analysis

- Discussion of short-term, long-term, and long-term campaigns in swing trading.

- Insight into global market structures and current market swings.

- Session 2: Selection and Global Structural Analysis

- Focus on identifying leadership stocks, sector rotation, and momentum selection.

- Daily and intraday structural analysis, alongside comparisons to market and peer structures.

- Session 3: Swing Character Analysis, Trade Management, and Mindset

- Emphasizes swing character analysis, reversals, and tactical execution.

- Development of mindset strategies necessary for trading success.

This approach clearly delineates the learning journey, highlighting the complexities and nuances of swing trading while ensuring that learners engage with both the theoretical and practical components of the subject matter.

Session Breakdown

Exploring the course’s session breakdown reveals how each segment is designed to immerse participants deeply into the art of swing trading. During the first session, participants are introduced to fundamental concepts such as swing trading definitions and market analysis, akin to laying down a solid foundation before building the walls of a house. Short-term and long-term swing trades are dissected with real-world examples, illustrating how to successfully navigate market fluctuations.

In the second session, the focus shifts to selection strategies, teaching participants how to identify market leaders and recognize shifts in momentum. It’s much like a treasure hunt for stocks that exhibit potential for significant movement. Consequently, traders can fine-tune their abilities to analyze daily and intraday charts, gaining skills that are immediately applicable.

By the final session, participants engage in swing character analysis, exploring trade management techniques and mindset development crucial for maintaining discipline during volatile periods. This session acts as the finishing touch, ensuring that participants understand both the mechanics of trading and the psychological tenets that underpin successful trading decisions.

Duration and Format

Scheduled over a total of six hours, the course’s format combines both live interactions and recorded sessions, a convergence that makes learning flexible and accessible. Each participant will not only benefit from direct engagement with Roman Bogomazov, but they will also have the opportunity to review recorded classes, ensuring that they can revisit complex concepts at their own pace.

Advantages of the Format

- Flexibility: Recorded sessions provide learners the option to catch up on missed content or reinforce learning, making this an ideal choice for traders with demanding schedules.

- Interactive Learning: Live sessions foster engagement, allowing participants to ask questions and receive immediate feedback, enhancing understanding and retention of the material.

- Visual Aids: Accompanying slides help simplify intricacies with visual illustrations, which can be invaluable for conceptualizing trading strategies.

In essence, the course’s structure, combined with the interactive format, makes it distinctly effective. Bogomazov has designed a learning experience that effectively balances theory with practical application, creating a conducive environment for traders to flourish.

Core Concepts

At the heart of the “Mastering Swing Trading” course lie foundational concepts that encapsulate the essence of swing trading. These concepts serve as the building blocks essential for executing trades with confidence and clarity.

Key Core Concepts Include:

- Swing Trading Definition: A thorough induction into what constitutes swing trading, including terms and principles that lay the groundwork for further learning.

- Market Analysis: Emphasis on understanding global market structures and identifying current market swings to recognize potential trade opportunities.

- Selection Strategies: Focus on selecting leadership stocks and identifying sector rotations, which are crucial for maximizing trading efficiency.

- Swing Character Analysis: Analyzing market behavior using indicators and understanding swing points to anticipate future price movements.

Through these core concepts, participants are equipped with the essential toolkit to analyze, select, and execute trades effectively, making informed decisions in various market conditions.

Selection Strategies

One of the defining features of Bogomazov’s approach to swing trading is his comprehensive suite of selection strategies, which aid traders in discerning opportunities amidst market noise. Participants learn tactics to identify what may be termed the “leaders of the pack,” or stocks that exhibit the most reliable potential for price movements.

Developing Effective Selection Strategies

- Select Leadership: Participants are equipped to identify stocks that lead uptrends. Much like an orchestra conductor, recognizing the principle instruments allows traders to focus their attention where the action is most promising.

- Select Rotation: Understanding sector rotation enables traders to capitalize on changing market dynamics. This is akin to surfing the wave; traders find opportunities where momentum shifts, maximizing their chances of profit.

- Select Momentum: Educating traders to recognize high-momentum stocks ensures they can ride the trends effectively. This strategy highlights the importance of not merely hopping on any moving train but ensuring it’s heading in the right direction.

By integrating these selection strategies into their trading toolkit, participants learn to sift through the myriad of market options and hone in on the most promising stocks, increasing their potential for successful trades.

Analysis Techniques

The course emphasizes several analysis techniques vital for swing traders. As a trader, possessing a systematic approach for analyzing opportunities is akin to a sailor who studies the wind patterns before setting sail. This skill can mean the difference between a successful voyage and a disastrous storm.

Key Analysis Techniques

- Swing Character Analysis: This method enables traders to gauge the nature of price movements. It involves understanding swing reversals, identifying points of control, and recognizing shifts in market force, similar to reading signals during a game of chess.

- Market Analysis: Traders learn to assess market structures, enabling them to determine the underlying strengths and weaknesses affecting price movements.

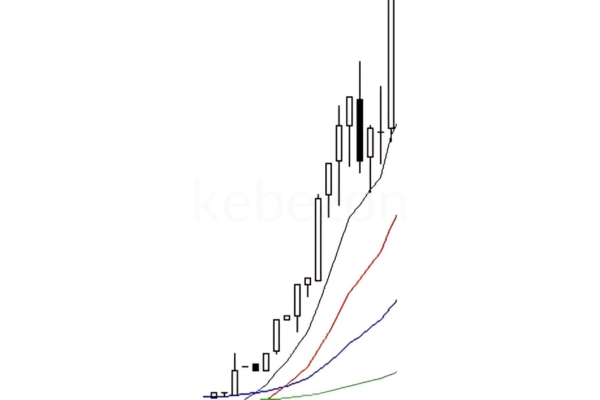

- Volume Spread Analysis (VSA): This technique combines volume metrics with price action analysis. Here, traders learn to interpret market sentiment effectively, allowing them to anticipate potential price movements based on trading volumes.

With proficiency in these analysis techniques, participants achieve a more profound comprehension of the dynamics at play in the markets, empowering them to make informed and timely trading decisions.

Execution Tactics

The execution phase is where many traders falter, but Bogomazov addresses this through detailed execution tactics that ensure participants are well-prepared to manage their trades in real-market conditions. Much like a seasoned athlete practices their moves, traders must rehearse their execution strategies to refine their responses to various scenarios.

Essential Execution Tactics

- Point of Entry: Learning precise entry timing is paramount. Participants are taught how to identify moments of force reversal, similar to feeling the right moment to press the accelerator while driving through a sharp curve.

- Add-ons: Techniques for adding to existing positions offer traders the chance to maximize potential returns, ensuring that they can capture gains as market momentum builds.

- Trims: Understanding when to trim positions can protect profits and minimize losses. This tactical foresight is vital in navigating the ups and downs of market volatility.

- Position Sizing: Adequate size management based on market character is emphasized to help traders determine how much capital to risk on each trade. This is akin to pacing oneself in a race, ensuring that one does not exhaust their resources too quickly.

Through a combination of these execution tactics, participants gain hands-on skills necessary for effective trading in fluctuating markets, setting them up for success.

Course Benefits

The “Mastering Swing Trading” course presents an array of benefits designed to foster growth and development in traders. Bogomazov’s expertise enhances the learning experience, akin to having a seasoned guide while traversing uncharted territory.

Highlights of Course Benefits

- In-Depth Insights: Participants receive thorough insights into swing trading strategies that enhance overall proficiency.

- Practical Knowledge: The course bridges the gap between theory and practice, allowing students to apply learned concepts in real-world scenarios.

- Expert Instruction: With over 25 years of trading experience, Bogomazov provides authoritative education supported by hands-on examples and case studies.

- Interactive Learning: Live sessions encourage engagement, enhancing understanding through conversation and collaboration.

- Lifetime Access: One full year of access to course materials allows for continual learning and reinforcement of skills.

These benefits culminate in an educational experience that is both holistic and pragmatic, ultimately shaping well-rounded traders ready to navigate the complexities of swing trading.

Insights from Expert Roman Bogomazov

Roman Bogomazov shares invaluable insights throughout the “Mastering Swing Trading” course. His extensive experience and expertise provide a comprehensive understanding that participants can leverage in their trading strategies.

Key Insights Include:

- Comprehensive Framework: The structured approach to swing trading outlined in the course equips learners with the tools needed to analyze and execute trades efficiently.

- Market Structure Patterns: Learning to recognize and analyze market structure and dynamics allows participants to identify potential trade opportunities more effectively.

- Practical Application: The emphasis on real-time analysis and recent market events ensures that participants can apply theoretical insights to current trading conditions.

- Interactive Learning Environment: Bogomazov fosters a community of traders where participants can share experiences and strategies, enhancing the collective learning experience.

By highlighting these insights, Bogomazov cultivates an environment where traders can grow and refine their methodologies confidently.

Real-World Application of Strategies

The transformation of knowledge into practice is critical for success in trading. Bogomazov ensures that participants in the “Mastering Swing Trading” course leave with practical strategies ready for implementation in the live markets.

Practical Applications Include:

- Market Scenario Analysis: Using real-world scenarios to assess market movements, helping participants understand how to react under live conditions.

- Simulated Trading Exercises: Engaging in simulated exercises reinforces learned concepts and allows participants to practice without financial risk.

- Feedback Mechanisms: The course emphasizes post-trade analysis, empowering students to comprehend outcomes and refine their strategies based on experiences.

By focusing on real-world applications, Bogomazov’s course ensures that traders can seamlessly integrate learned strategies into their trading practices, thereby enhancing their likelihood of success.

Networking Opportunities with Fellow Traders

A critical element of the trading experience is the community that participants can tap into for support and collaboration. The “Mastering Swing Trading” course by Roman Bogomazov offers numerous networking opportunities among fellow traders.

Networking Benefits Include:

- Shared Learning: Connecting with peers allows for the exchange of ideas, strategies, and experiences, fostering deeper understanding and collaborative growth.

- Support System: Engaging with a community provides encouragement and motivates traders to remain committed to their trading development.

- Collaborative Discussions: Accessing various perspectives during discussions nurtures new viewpoints and enhances problem-solving capabilities.

By actively participating in the networking opportunities presented, traders can benefit from a wealth of collective knowledge that bolsters their trading journey.

Resources and Materials

The course offers a wealth of resources designed to reinforce participant learning and enhance the overall educational experience. Just as a skilled chef relies on high-quality ingredients, successful traders benefit from a rich array of learning tools.

Key Resources Include:

- Recorded Sessions: All live sessions are recorded, ensuring participants can revisit complex topics as needed.

- Accompanying Slides: Slide materials facilitate note-taking and help visualize complex strategies.

- Homework Assignments: Participants engage in practical assignments that reinforce concepts learned during live sessions.

These resources provide a comprehensive and flexible learning experience that supports the mastery of swing trading techniques.

Recommended Reading

To complement the course, various recommended readings enhance participants’ understanding of swing trading principles and strategies. These reading materials serve as valuable references, akin to an atlas for travelers seeking direction on a journey.

Suggested Books and Courses:

- “A Beginner’s Guide to Short-Term Trading” by Toni Turner: This book is particularly beneficial for those new to swing trading, laying down foundational knowledge and strategies.

- “Wyckoff Trading Course (WTC)”: This course offers in-depth insights into price structural analysis and institutional trading dynamics crucial for swing traders.

- Webinars on Wyckoff Analytics: These interactive sessions provide practical trading tools based on the Wyckoff Method, vital for swing trading strategies.

By leveraging these resources, participants can further broaden their trading knowledge and strategies, ensuring a well-rounded approach to swing trading.

Supplemental Tools and Software

Participants will benefit greatly from understanding the various tools and software available to enhance their swing trading strategies. Just as a mechanic relies on tools to fix a car, traders can utilize specialized software to facilitate their decision-making processes.

Recommended Tools:

- Trading Platforms: Utilizing platforms supporting technical analysis based on Wyckoff principles can significantly enhance trading efficiency.

- Charting Software: Tools enabling real-time market analysis are essential for effective swing trading, allowing traders to monitor opportunities effortlessly.

- Economic Calendars: Keeping abreast of economic indicators can help traders align their strategies with market-moving events.

Arming themselves with these tools prepares traders for effective execution in both volatile and calm markets.

Participant Experience

The participant experience in the “Mastering Swing Trading” course is designed to cultivate growth and exploration in a supportive environment. Just as a gardener nurtures their plants, this course creates an atmosphere where traders can flourish.

Elements of Participant Experience:

- Interactive Learning Environment: Engaging lessons encourage active participation and foster a sense of community among traders.

- Direct Instructor Interaction: Participants can ask questions and receive personalized feedback, enhancing their understanding of complex concepts.

- Supportive Community: Building connections with fellow traders creates a supportive network that motivates traders to advance.

Through a focus on participant experience, Bogomazov ensures an engaging educational journey primed for personal and professional growth in swing trading.

Testimonials from Previous Courses

Although specific testimonials for the May 2024 course are not available, feedback from previous iterations of Bogomazov’s courses underscores the effectiveness of his teaching methodologies. Much like artists draw inspiration from the works of others, participants often share their experiences to motivate future students.

Common Themes in Testimonials:

- Effective Teaching Style: Participants commend Bogomazov’s clear and structured teaching, which makes complex topics accessible.

- Actionable Strategies: Many testimonials highlight the practicality of the strategies shared, allowing participants to implement techniques immediately.

- Community and Support: Participants frequently mention the sense of camaraderie established through networking opportunities, contributing to their overall learning experience.

These recurring themes showcase the quality and impact of Bogomazov’s courses, establishing a solid reputation for effective swing trading education.

Live Interaction Opportunities

The course places significant emphasis on live interaction opportunities, allowing participants to engage directly with both the instructor and fellow traders. This interactive component is a vital part of the educational journey, facilitating immediate feedback and discussion.

Benefits of Live Interaction:

- Real-Time Q&A: Participants can address their queries during live sessions, promoting a deeper understanding of the material covered.

- Collaboration: Engaging in discussions with fellow traders fosters collaborative learning, enhancing comprehension through diverse perspectives.

- Dynamic Learning Environment: The interactive nature of the course creates an engaging and stimulating atmosphere for all participants.

By prioritizing live interaction, Bogomazov cultivates an enriching learning environment that encourages active participation and idea exchange.

Comparative Analysis

When analyzing the “Mastering Swing Trading” course against other trading programs, several distinctive features emerge, highlighting Bogomazov’s unique approach to swing trading education.

Comparative Aspects:

- Emphasis on the Wyckoff Method: Unlike many courses, Bogomazov integrates the Wyckoff Method into his teachings, providing a well-rounded perspective on market dynamics.

- Structured Curriculum: The methodical breakdown of sessions ensures that participants absorb concepts progressively, a feature often lacking in more generalized trading courses.

- Focus on Psychological Aspects: The course incorporates psychological principles necessary for trading success, while many other courses primarily concentrate on technical skills.

These comparative aspects position Bogomazov’s program as a comprehensive and holistic training option for those looking to master swing trading.

Comparison to Other Trading Courses

While numerous trading courses exist, the “Mastering Swing Trading” course by Roman Bogomazov sets itself apart through its rigorous structure and unique focus.

Key Differences:

- Unique Methodological Approach: Bogomazov’s course leverages the Wyckoff Method, emphasizing a nuanced understanding of supply and demand, as opposed to purely indicator-based strategies common in many other courses.

- Flexible Learning Format: The combination of live and recorded sessions offers a degree of flexibility that enhances the learning experience, which may not be equally available in other courses.

- Focus on Practical Implementation: The course stresses real-world applications of swing trading strategies, ensuring that participants are well-prepared for actual market conditions.

By offering these unique features, Bogomazov’s course provides participants with an educational experience that is both enriching and empowering.

Unique Features of Bogomazov’s Methodology

Roman Bogomazov’s methodology showcases several unique features that enhance students’ learning experiences and outcomes compared to other trading systems.

Distinctive Features:

- Swing Character Analysis: This specialized focus enables traders to dissect price movements effectively, leading to a nuanced understanding of market behavior.

- Mental Technologies: Incorporating psychological tools into the curriculum empowers participants to develop essential emotional resilience and discipline while trading.

- Lifetime Access to Materials: The additional year of access to recorded sessions, slides, and resources ensures participants can revisit complex topics as needed.

These unique aspects of Bogomazov’s methodology foster a holistic education that extends beyond basic trading techniques, emphasizing the importance of analytical depth and psychological preparedness.

Market Trends and Analysis

As momentum in swing trading reflects broader market trends, understanding these trends becomes paramount for traders. Current market dynamics greatly influence swing trading decisions, making it essential to stay abreast of emerging trends.

Current Trends in Swing Trading:

- Increased Volatility: Market environments characterized by fluctuations present ample opportunities for swing traders willing to adapt their strategies.

- Rise of Technology: The use of automated trading systems and algorithmic approaches is on the rise, enhancing precision in executing trades.

- Focus on Technical Analysis: There is an ongoing emphasis on technical indicators and patterns, which are vital for swing traders in making informed decisions based on price movement.

Traders who stay informed on these trends can adjust their tactics accordingly, maintaining a competitive edge in the swing trading arena.

Historical Performance of Techniques

Regarding historical performance, Bogomazov’s course includes detailed discussions on the effectiveness of various swing trading techniques. Empirical data supports the viability of many strategies taught, affirming that experienced traders can adapt their approaches based on proven methodologies.

Key Historical Performance Insights:

- Backtested Strategies: The strategies taught, such as identifying support and resistance levels, have demonstrated significant effectiveness based on historical price movements.

- Case Studies: Review of actual trades from past markets helps elucidate successful strategies and enhances students’ understanding of market dynamics.

- Evolution of Techniques: Understanding how swing trading methodologies have evolved alongside changes in market structure can guide participants to refine their practices effectively.

Historical performance data, combined with Bogomazov’s robust teaching style, ensures participants are equipped with techniques that have stood the test of time in diverse market environments.

Outcomes and Goals

The course ultimately aims to transform participants into well-rounded swing traders who can navigate market dynamics effectively. By emphasizing both practical skills and psychological frameworks, Bogomazov cultivates a complete trading approach.

Expected Outcomes:

- Technical Proficiency: Mastery of key technical analysis tools enables traders to identify viable trade opportunities effectively.

- Risk Management Skills: Participants will gain strategies for managing risk, which is crucial in the swing trading domain.

- Psychological Resilience: Development of an appropriate trading mindset fosters discipline and emotional control, allowing traders to thrive amidst volatility.

Overall, the course’s structured approach ensures that participants emerge with a robust skill set tailored for long-term trading success.

Expected Skills Development

Through engaging with the swing trading methodologies presented in the course, participants can expect significant skills development across multiple dimensions.

Anticipated Skills Growth:

- Market Analysis: Proficiency in assessing market conditions using indicators and price movements will enhance decision-making capabilities.

- Trade Execution: Refined execution tactics, including timing and position sizing, allow traders to capitalize on opportunities effectively.

- Psychological Mastery: Participants will focus on developing emotional fortitude to handle the psychological pressures associated with trading.

By addressing these areas, the course prepares traders to engage confidently and successfully within the complexities of the financial markets.

Long-Term Trading Strategies

In addition to swing trading skills, the course also emphasizes the importance of long-term trading strategies, providing a holistic approach to trading education.

Focus on Long-Term Strategies:

- Capital Growth: Insights into identifying and holding quality stocks for long-term appreciation, allowing traders to capture larger uptrends.

- Income Generation: Strategies focusing on dividend-paying stocks enhance portfolio growth through reliable income streams.

- Portfolio Management: Participants learn to rebalance and manage their investment portfolios strategically, optimizing risk and return dynamics over extended periods.

By integrating these long-term strategies with swing trading tactics, traders cultivate a diversified skill set that enhances their overall trading acumen.

Review and Feedback Mechanism

An essential feature of the “Mastering Swing Trading” course is the built-in review and feedback mechanism designed to support continuous learning.

Review Mechanisms Include:

- Q&A Sessions: Throughout the course, participants can ask questions, ensuring active engagement and understanding of the material.

- Post-Trade Analysis: By reviewing their trades, participants can evaluate outcomes and refine techniques, leading to ongoing improvement.

- Collaborative Feedback: Engaging with fellow traders fosters peer-to-peer feedback, enriching the learning experience.

These systems help reinforce concepts and ensure that participants leave with a complete understanding and a plan for continued growth in their trading careers.

Course Feedback Process

The course feedback process further exemplifies Bogomazov’s commitment to creating an enriching educational environment.

Feedback Elements:

- Surveys Post-Course: Participants are encouraged to fill out surveys regarding their course experience, enabling iterative improvements in course offerings.

- Instructor Reviews: Feedback regarding instructor effectiveness is collected, ensuring that teaching methods evolve to meet participant needs.

- Continuous Improvement: Regular updates based on participant feedback help enhance course content and delivery methods.

By implementing this systematic feedback process, Bogomazov ensures that his course remains relevant and impactful for traders of all backgrounds.

Continuous Improvement Initiatives

In alignment with modern educational philosophies, the course includes continuous improvement initiatives designed to enhance the learning experience over time.

Core Elements of Improvement:

- Iterative Curriculum Updates: Based on participant input, content is regularly reviewed and modified to incorporate the latest market trends and insights.

- Enhanced Learning Materials: Incorporating participant feedback into materials assures that resources remain engaging and beneficial.

- Dynamic Teaching Approaches: As the trading landscape evolves, so do teaching strategies, ensuring that participants receive cutting-edge education.

Through these initiatives, Bogomazov fosters a culture of ongoing improvement, ensuring that his course remains highly effective and relevant.

Conclusion

To summarize, “Mastering Swing Trading” by Roman Bogomazov offers a rich, comprehensive educational experience that equips traders with critical skills and insights necessary for today’s trading environment. Through its structured curriculum, extensive resources, and emphasis on live interaction and practical application, this course stands as a formidable option for those looking to enhance their swing trading abilities.

By delving deep into key concepts such as selection strategies, execution tactics, and ongoing performance analysis, participants are positioned for success in navigating the complexities of swing trading. Ultimately, this course embodies a holistic approach to trading education, fostering an environment where traders can flourish both individually and collectively.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “MASTERING SWING TRADING May 2024 with Roman Bogomazov” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.