-

×

Wealth Beyond Reason 2.0 with Bob Doyle

1 × 93,00 $

Wealth Beyond Reason 2.0 with Bob Doyle

1 × 93,00 $

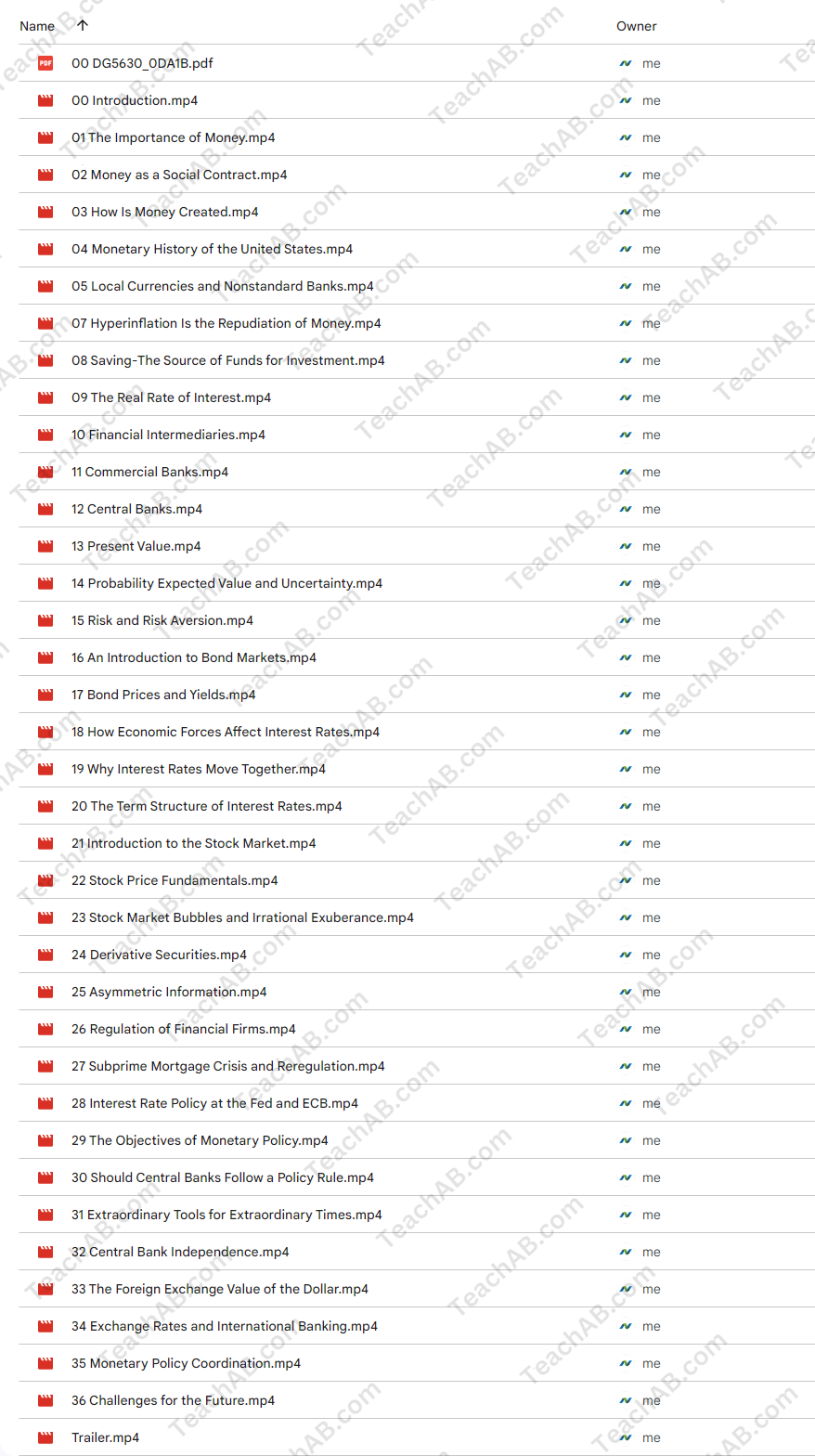

Money and Banking: What Everyone Should Know with Michael Salemi

339,00 $ Original price was: 339,00 $.5,00 $Current price is: 5,00 $.

SKU: KEB. 52514kyNSjT

Category: Finance

Tags: Michael Salemi, Money and Banking, What Everyone Should Know

Download Money and Banking: What Everyone Should Know with Michael Salemi, check content proof here:

Money and Banking: What Everyone Should Know

In today’s rapidly evolving financial landscape, understanding the mechanisms of money and banking has never been more crucial. Michael K. Salemi’s educational series, Money and Banking: What Everyone Should Know, serves as a beacon for those navigating the often murky waters of economic principles. This comprehensive exploration uncovers the core components of our monetary system and delineates the intricate network of banking institutions that orchestrate economic activity.

With a foundation based on empirical knowledge and engaging storytelling, Salemi’s lectures bridge the gap between complex financial theories and the everyday realities faced by individuals. As we delve deeper into this rich educational resource, we will uncover not only the theoretical underpinnings but also the practical implications of Salemi’s teachings on our financial habits and decisions.

The Nature of Money and Its Evolution

Understanding money is akin to grasping the essence of a living organism; it evolves to meet the needs of society. Salemi introduces money as fundamentally a social contract, a tool that facilitates the exchange of goods and services. This concept can be likened to the roots of a tree that nourish and stabilize its growth. Just as trees need strong roots to thrive, economies require a reliable monetary system to flourish.

The evolution of money, as outlined in Salemi’s series, takes us from primitive barter systems to the sophisticated fiat currencies we use today. The barter system, although functional, posed significant challenges, such as the “double coincidence of wants.” This is where two parties must desire what the other offers, a cumbersome process reminiscent of trying to fit square pegs into round holes. The introduction of money resolved these contradictions, allowing for a more fluid economy. It subsequently led to the establishment of banking systems that could facilitate not just transactions, but also credit and investment.

Key Phases in the Evolution of Money:

- Barter System: Direct exchange of goods/services.

- Commodity Money: Use of items with intrinsic value (e.g., gold, silver).

- Fiat Currency: Government-issued money not backed by a physical commodity but recognized as legal tender.

This historical progression demonstrates that the nature of money is intrinsically linked to societal development and technological advancements that transcend mere transactions, affecting how resources are allocated and how value is perceived.

The Role of Banking Institutions

Salemi’s exploration goes beyond the basic understanding of money to emphasize the pivotal role of financial institutions in shaping our economic landscape. In today’s world, banks are much more than just vaults holding money; they are the architects of economic growth and stability. Central banks and commercial banks act as the lifeblood of the economy, providing funding and facilitating transactions that keep the wheels of commerce turning.

Central banks, like the Federal Reserve in the United States, have a crucial function in regulating monetary policy. They adjust interest rates to influence money supply, a delicate balancing act often compared to a maestro conducting an orchestra. Too much liquidity can lead to inflation, while too little can stifle growth. The interplay of interest rates and inflation is a classic example of the tightrope that financial institutions walk. In Salemi’s lectures, he articulates how monetary policy decisions can have sweeping impacts on everyday life, affecting everything from home mortgages to the prices of groceries.

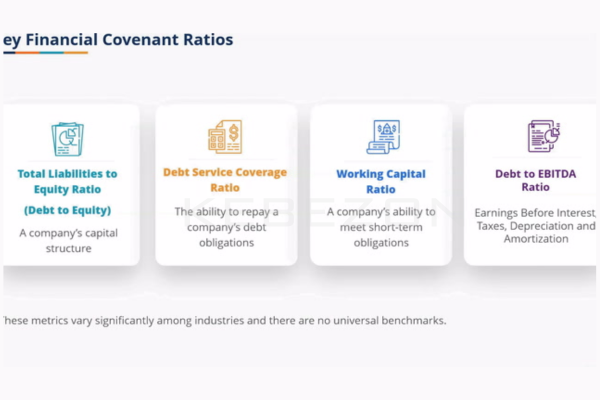

Key Functions of Banking Institutions:

- Lending and Credit Creation: Banks’ ability to lend money contributes to consumer spending and business investment.

- Interest Rate Regulation: Central banks manipulate interest rates to control economic expansion or contraction.

- Financial Intermediation: Banks connect savers who deposit money with borrowers in need of funds.

Salemi also emphasizes the psychology underlying stock markets, which adds another layer of complexity. Investor sentiment can create volatile market conditions, with prices driven by speculation rather than fundamentals. This psychological aspect of finance is often underappreciated but is critical for understanding market dynamics.

Understanding Inflation and Hyperinflation

A cornerstone of Salemi’s educational approach is the dissection of inflation, a phenomenon that directly impacts standard of living and economic stability. Inflation can be seen as the silent thief robbing individuals of purchasing power, manifesting in everyday expenses. Understanding the mechanisms of inflation is akin to learning the rules of a game only then can individuals strategize effectively.

Salemi educates that inflation occurs when there is an excess of money chasing too few goods, a situation reminiscent of a party where there are more guests than there is food. This leads to a bidding war for the limited resources available, driving prices up. Conversely, deflation can be like a drought; it stifles economic activity as consumers hold off on spending, anticipating lower prices in the future.

Types of Inflation:

- Demand-pull Inflation: Caused by increasing demand for products/services.

- Cost-push Inflation: Results from rising production costs, leading to decreased supply.

- Built-in Inflation: Related to adaptive expectations; workers demand higher wages, leading to increased costs to employers.

Hyperinflation, an extreme form of inflation, can devastate economies, often leading to the collapse of financial systems. Historical examples such as Zimbabwe in the late 2000s serve as stark reminders of this phenomenon. Salemi uses narratives from these historical events to illustrate the dangerous cycles of inflation and the consequences of poor monetary policy choices.

The Interconnectedness of Money, Banking, and the Economy

One of the more profound lessons Salemi imparts is the interconnectedness of money, banking, and the broader economy. It is a web wherein each strand influences the others, creating a complex tapestry that is ultimately woven from human behavior and policy decisions. He likens this system to a delicate ecosystem, where the health of one component impacts the others. A disruption in one area be it a financial crisis or a significant policy shift can ripple through the entire economy, affecting job markets, investment flows, and consumer confidence.

Salemi emphasizes that individuals must understand this interconnectedness to navigate their financial futures successfully. By grasping how monetary policy, banking operations, and economic indicators converge, people can make more informed decisions regarding investments, savings, and expenditures.

Understanding Key Economic Indicators:

- GDP Growth Rate: A measure of economic performance.

- Unemployment Rates: Reflects labor market strength.

- Consumer Confidence Index: Gauges public sentiment about the economy.

Such metrics serve as barometers of economic health, guiding individuals and policymakers alike in making strategic choices.

Empowerment Through Knowledge

At the heart of Salemi’s series is the empowering notion that knowledge is a powerful tool. By demystifying the complexities of financial concepts, he equips individuals to exert greater control over their financial lives. His engaging narrative style, illustrated with relatable stories, transforms what could be dense material into accessible learning experiences.

Salemi’s approach fosters a sense of agency among listeners as they gain insights into how economic forces shape their realities. He underscores that understanding money and banking is not just for financial professionals; it is essential for everyone. Those who grasp these concepts can navigate the financial world with confidence, making educated decisions that yield positive outcomes.

Benefits of Financial Literacy:

- Informed Decision-Making: Awareness allows for better financial choices.

- Increased Confidence: Understanding reduces anxiety about financial management.

- Future Planning: Knowledge aids in long-term investment strategies and retirement planning.

Salemi’s educational series acts as a torchbearer, illuminating pathways for those eager to enhance their financial literacy. The positive reception, reflected in the 4.7-star rating on platforms like Audible, attests to the effectiveness of his methodology.

Conclusion

In a world brimming with financial complexities, Michael K. Salemi’s Money and Banking: What Everyone Should Know stands out as an invaluable resource for individuals seeking to understand the financial systems that shape their lives. By weaving together historical narratives, economic theory, and practical applications, Salemi empowers listeners to navigate the intricate landscape of money and banking with informed confidence.

The series not only demystifies key concepts but also encourages individuals to take charge of their financial destinies. The rich tapestry of insights found in Salemi’s lectures opens doors to better decision-making and enhances comprehension of the factors influencing economic behavior. Whether you are a newcomer to the financial world or seeking to brush up on your knowledge, this educational journey offers the wisdom needed to thrive in an ever-changing economic environment. Embrace this opportunity to enrich your understanding after all, in the realm of finance, knowledge is indeed power.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Money and Banking: What Everyone Should Know with Michael Salemi” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.