-

×

Option Buying Course

1 × 5,00 $

Option Buying Course

1 × 5,00 $ -

×

Brad’s Lifestyle Academy Platinum Edition

1 × 5,00 $

Brad’s Lifestyle Academy Platinum Edition

1 × 5,00 $ -

×

The Measurement Matrix with Chris Mercer

1 × 39,00 $

The Measurement Matrix with Chris Mercer

1 × 39,00 $ -

×

Developing Characters, Environments, and Story Boards - Mary Jane Begin

1 × 5,00 $

Developing Characters, Environments, and Story Boards - Mary Jane Begin

1 × 5,00 $ -

×

LIIFT MORE Super Block by Joel Freeman

1 × 5,00 $

LIIFT MORE Super Block by Joel Freeman

1 × 5,00 $ -

×

The Complete PUA Books Collection

1 × 5,00 $

The Complete PUA Books Collection

1 × 5,00 $

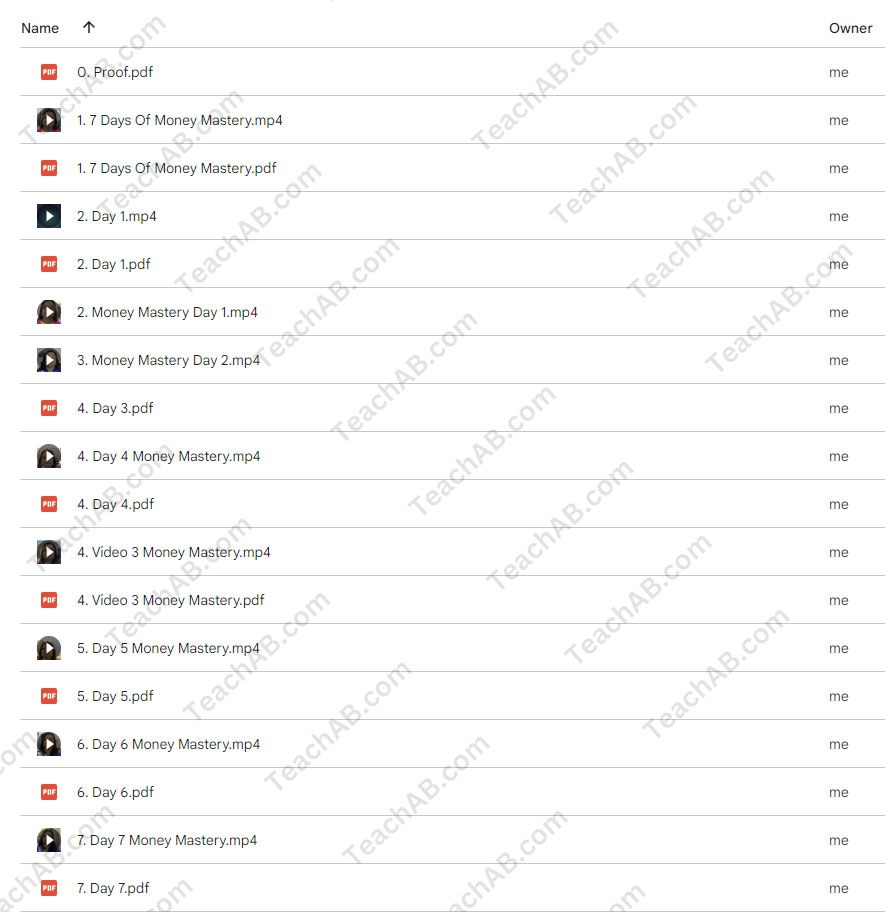

Money Mastery with Nilofer Safdar

199,00 $ Original price was: 199,00 $.15,00 $Current price is: 15,00 $.

Download Money Mastery with Nilofer Safdar, check content proof here:

Money mastery: A comprehensive review of Nilofer Safdar’s transformative guide

In today’s fast-paced world, the way we manage our finances can dictate not only our economic stability but also our overall well-being. Money mastery by Nilofer Safdar offers a refreshing perspective on financial management, intertwining life coaching with practical advice, thereby promising not just to educate but to empower individuals.

This book aims to reshape our understanding of money and its role in our lives, advocating for a deeper relationship with our finances that transcends mere numbers. By recognizing our beliefs surrounding money and learning how to effectively budget, readers can embark on a path toward financial abundance. Through comprehensive teachings, Safdar makes financial literacy accessible and engaging, aiming to resonate with readers seeking both knowledge and inspiration.

Understanding net worth: The foundation of financial health

Net worth is often the first term that comes up when discussing financial stability; it is a snapshot that determines where we stand financially at any given moment. Nilofer Safdar outlines that one’s net worth is fundamentally the difference between assets and liabilities. In simpler terms, assets are what you own be it property, investments, or cash while liabilities encompass your debts. By examining these two facets, individuals can glean a clearer picture of their financial standing, thus paving the way for informed decision-making.

The importance of calculating net worth

- Financial Assessment: Regularly assessing one’s net worth helps track progress over time, much like weighing oneself during a fitness journey. It can provide motivation and insight into whether you are moving in the right direction financially.

- Goal Setting: Understanding your net worth allows for realistic financial goal-setting. Just as athletes set targets based on performance metrics, individuals can set factual financial goals informed by their current net worth.

- Budget Planning: This financial snapshot aids in creating a more effective budget. By knowing your assets and liabilities, you can adjust your spending and saving habits accordingly.

Incorporating the practice of calculating net worth into your financial routine can be the glide path to greater financial awareness. It encourages not only accountability but also a proactive approach toward reaching your financial goals.

Budgeting as a compass for financial management

In money mastery, Nilofer Safdar refers to budgeting as a ‘compass’ that guides one’s expenditures and savings. This metaphor provides a vivid representation of how budgeting works like a compass directing you on a journey toward financial security.

Crafting an effective budget

- Income Tracking: Before establishing a budget, Safdar encourages readers to meticulously track their sources of income. Understanding where your money comes from can clarify how much you can afford to allocate to savings and expenses.

- Expense Categorization: Categorizing expenses into fixed (like rent and subscriptions) and variable (such as entertainment and dining out) allows individuals to identify areas where they can cut costs. This distinction can lead to a more strategic approach to expenditures.

- Review and Adjust: Safdar emphasizes the need for continual evaluation of your budget. The financial landscape changes, and so should your budget to reflect these shifts.

A well-crafted budget can reduce financial stress by providing clarity and a sense of control over one’s financial destiny. Like a well-marked trail in the woods, good budgeting allows us to navigate through potential pitfalls and explore the paths to financial freedom.

Challenging limiting beliefs about money

One of the most illuminating aspects of Safdar’s approach is her focus on the deep-seated beliefs individuals harbor about money. According to her, many of us carry disempowering views that limit our financial flow.

The framework for transforming beliefs

- Awareness Exercises: Safdar encourages readers to identify their money beliefs through reflective exercises. By first acknowledging these beliefs, individuals can begin to challenge and change them.

- Destruction and Recreation: The concept of “destroying and uncreating” these limiting beliefs acts like a reset button. This transformational approach seeks to foster a mindset that embraces abundance rather than scarcity.

- Empowerment Tools: Safdar provides various tools and methods to cultivate a healthier relationship with money, reinforcing the idea that financial success begins with one’s mindset.

Understanding how these beliefs shape our financial behaviors is a pivotal step towards achieving the financial success we strive for. Much like overcoming obstacles in a race, challenging these limiting beliefs can clear the path toward our financial finish line.

Connection between financial health and emotional well-being

Nilofer Safdar draws a compelling link between financial management and other life domains, particularly emotional health. She suggests that financial issues often mirror deeper personal challenges, and as such, improving one’s financial situation can lead to enhanced overall life quality.

The broader impact of financial wellness

- Stress Reduction: Gaining control over personal finances can significantly lower stress levels. As Safdar acknowledges, money worries often translate into anxiety and interpersonal conflicts.

- Relationship Improvement: Financial clarity can foster stronger relationships, as partners learn to navigate their goals and values together.

- Personal Healing: Addressing financial issues can open avenues for personal growth, promoting healing and fulfillment in other aspects of life.

By appreciating the interconnectedness of financial stability and personal wellness, readers can pursue holistic improvement. This idea encapsulates the core philosophy of money mastery: a life well-managed financially results in broader happiness and fulfillment.

Conclusion: The transformative journey of financial mastery

In summary, money mastery by Nilofer Safdar serves as both an educational resource and a motivational guide, creating a space for individuals to confront their financial realities and reshape their relationship with money. Through careful analysis of net worth, effective budgeting practices, challenging limiting beliefs, and recognizing the intersection of finances with emotional health, readers are poised to embark on a transformative journey.

With recognizable metaphors and actionable strategies, Safdar emphasizes that financial bliss is not an elusive dream but an achievable reality for those equipped with the right mindset and tools. By embracing these teachings, anyone can navigate the often treacherous waters of financial management, steering themselves toward a life of abundance and fulfillment.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Money Mastery with Nilofer Safdar” Cancel reply

You must be logged in to post a review.

Related products

Personal Development

Personal Development

Personal Development

Personal Development

Overcome Neediness, Attachment, Fears (Audio Seminar) by Apollonia Ponti

Personal Development

Reviews

There are no reviews yet.