Money Wellness – Self-Study Online Course By Ready2Go Marketing Solutions

579,00 $ Original price was: 579,00 $.23,00 $Current price is: 23,00 $.

Download Money Wellness – Self-Study Online Course By Ready2Go Marketing Solutions, check content proof here:

Review of Money Wellness – Self-Study Online Course by Ready2Go Marketing Solutions

It’s critical to comprehend financial wellbeing in the fast-paced world of today. The goal of Ready2Go Marketing Solutions’ “money wellness – self-study online course” is to equip people with the skills and information they need to manage their financial journeys. This course seeks to rethink our approach to financial management by challenging conventional ideas about earning, saving, and spending money. By directly challenging the prevailing mindset of “spend now, pay later,” the program encourages participants to develop better money management practices that will lead to long-term wellbeing. This post will offer a thorough analysis of the course, including its design, subject matter, and the possibility for participant transformation.

Course Structure and Modules

The “money wellness” course boasts a well-structured design, divided into multiple informative modules that employ various educational strategies. Participants are introduced to core financial concepts through interactive handouts, participant exercises, and thought-provoking discussion questions. This modular approach not only enriches the learning experience but also fosters a sense of community and introspection, allowing learners to reflect on their financial habits and attitudes.

Each module serves as a building block, addressing different aspects of financial well-being and reinforcing the overall objective of the course. For instance, one module may focus on earning strategies, while another delves into effective saving techniques. By alternating ***ween theory and practice, the course guarantees that participants not only understand financial theories but also learn how to apply them in real life.

Key Features of the Course Structure:

- Several Modules: Guarantees thorough discussion of the fundamentals of financial wellbeing.

- Interactive exercises encourage participation and real-world comprehension from students.

- Discussion topics: Promote introspection and conversation among participants.

- Self-guided learning enables customized pacing according to each learner’s need.

By employing these strategies, the course guides students through the intricacies of personal finance while promoting responsibility and introspection. Through structured information designed for today’s challenges, learners may anticipate developing a deeper understanding of financial management.

Practical Strategies and Financial Concepts

At the heart of the “money wellness” course lies a treasure trove of practical strategies aimed at helping participants effectively manage their finances. One of the core tenets is instilling a balanced approach to spending, saving, and investing. The course emphasizes that financial wellness is not merely about accumulating wealth but cultivating a mindset that prioritizes intentional financial choices.

Key Financial Concepts Covered:

- Budgeting Strategies: Knowing how to make a long-term budget that fits with individual objectives.

- Savings Strategies: Examining practical ways to boost savings and improve financial stability.

- Debt management: Acquiring the skills necessary to appropriately manage and lower debt.

- Understanding the foundations of investing for future growth is known as “investment basics.”

- Financial Mindset Shift: Adopting a more cautious stance and opposing the “spend now, pay later” mentality.

Through these ideas, participants will develop a comprehensive perspective of their economic environments in addition to understanding the basic ideas of financial management. By giving students the tools to rewrite their financial stories, the course promotes stability and control.

Example Strategies:

- 50/30/20 Rule: A recommended budgeting method where 50% of income goes towards needs, 30% for wants, and 20% towards savings and debt repayment.

- Emergency Fund Creation: Establishing a fund that covers at least three to six months of living expenses as a financial safety net.

These strategies, combined with real-life examples and case studies, create a dynamic learning environment where participants can see the practical implications of their newfound knowledge.

Self-Reflection and Accountability

One of the unique aspects of the “money wellness” course is its emphasis on self-reflection and accountability. Participants are prompted to evaluate their current financial habits, assess the impact of their choices, and identify areas for improvement. This introspective process is not only essential for growth but also fosters a genuine connection with financial wellness concepts.

Importance of Self-Reflection:

- Awareness of Spending Habits: The first step to more mindful spending is realizing where money is going.

- Establishing Achievable, Individualized Financial Goals: Encourages participants to establish realistic financial goals based on their evaluations.

- Accountability Mechanisms: Encourages the formation of accountability groups or partners in order to increase dedication and motivation.

Because of the way the course is structured, participants are encouraged to maintain a financial journal, which supports continuous self-evaluation and reinforces the knowledge gained from the modules. This method transforms the educational process into one of active engagement and self-discovery.

Benefits of Accountability:

- Enhanced Motivation: Sharing goals with others can drive individuals to stay committed.

- Community Support: Accessing support and encouragement from fellow participants fosters a sense of unity.

By interweaving these elements into the course, Ready2Go Marketing Solutions successfully creates an environment that not only educates but also inspires participants to make lasting changes in their financial lives.

Flexibility of Learning Format

One of the standout features of the “money wellness” self-study course is its flexible learning format. Participants can progress at their own pace, connecting the course content with their personal lives without feeling rushed or overwhelmed. This adaptability makes it a suitable choice for individuals with varying schedules, ensuring that anyone can embark on their journey to financial wellness regardless of time constraints.

Advantages of a Self-Study Format:

- Personalized Learning: For a deeper comprehension, participants can go back and review tasks and modules as needed.

- Convenience: Learning becomes accessible when one can study at any time and from any location.

- Focused Attention: Students are able to focus on the things that most interest them.

- Time management: The ability to arrange education around obligations, both personal and professional.

The course eliminates the obstacles that frequently discourage people from pursuing financial education by adopting a self-guided style. By democratizing access to important resources, this strategy enables people from all backgrounds to adopt the concepts of financial wellness.

Overall Assessment and Recommendations

The “money wellness – self-study online course” by Ready2Go Marketing Solutions emerges as a valuable resource for anyone looking to enhance their financial literacy. The course not only focuses on fundamental financial concepts but transforms how individuals perceive and engage with their finances. Participants can expect an educational experience that promotes accountability, self-reflection, and the adoption of healthier financial habits.

Pros:

- Comprehensive coverage of financial wellness topics.

- Practical strategies for real-world application.

- Emphasis on self-reflection and accountability.

- Flexible learning format catering to diverse needs.

Cons:

- Potentially overwhelming for complete beginners without prior financial knowledge.

- Requires self-motivation and discipline for optimal learning.

Final Thoughts

To sum up, the “money wellness” course is a model offering in the field of financial education since it effectively combines theory and practice to help students gain a deeper understanding of the fundamentals of personal finance. This course has the potential to empower you on your path to financial well-being, regardless of your level of experience or desire to brush up on your financial knowledge. Participants are starting along the path to a financially secure future marked by wise decisions and a better relationship with money by opting to invest in this opportunity.

Frequently Asked Questions:

Business Model Innovation:

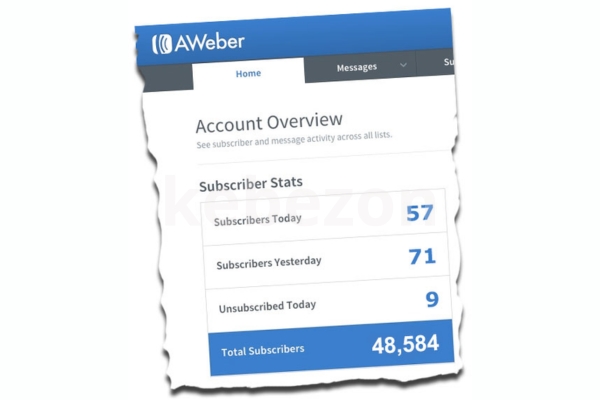

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Money Wellness – Self-Study Online Course By Ready2Go Marketing Solutions” Cancel reply

You must be logged in to post a review.

Related products

Marketing

Marketing

Reviews

There are no reviews yet.