Nico FX Journal (SMC)

5,00 $

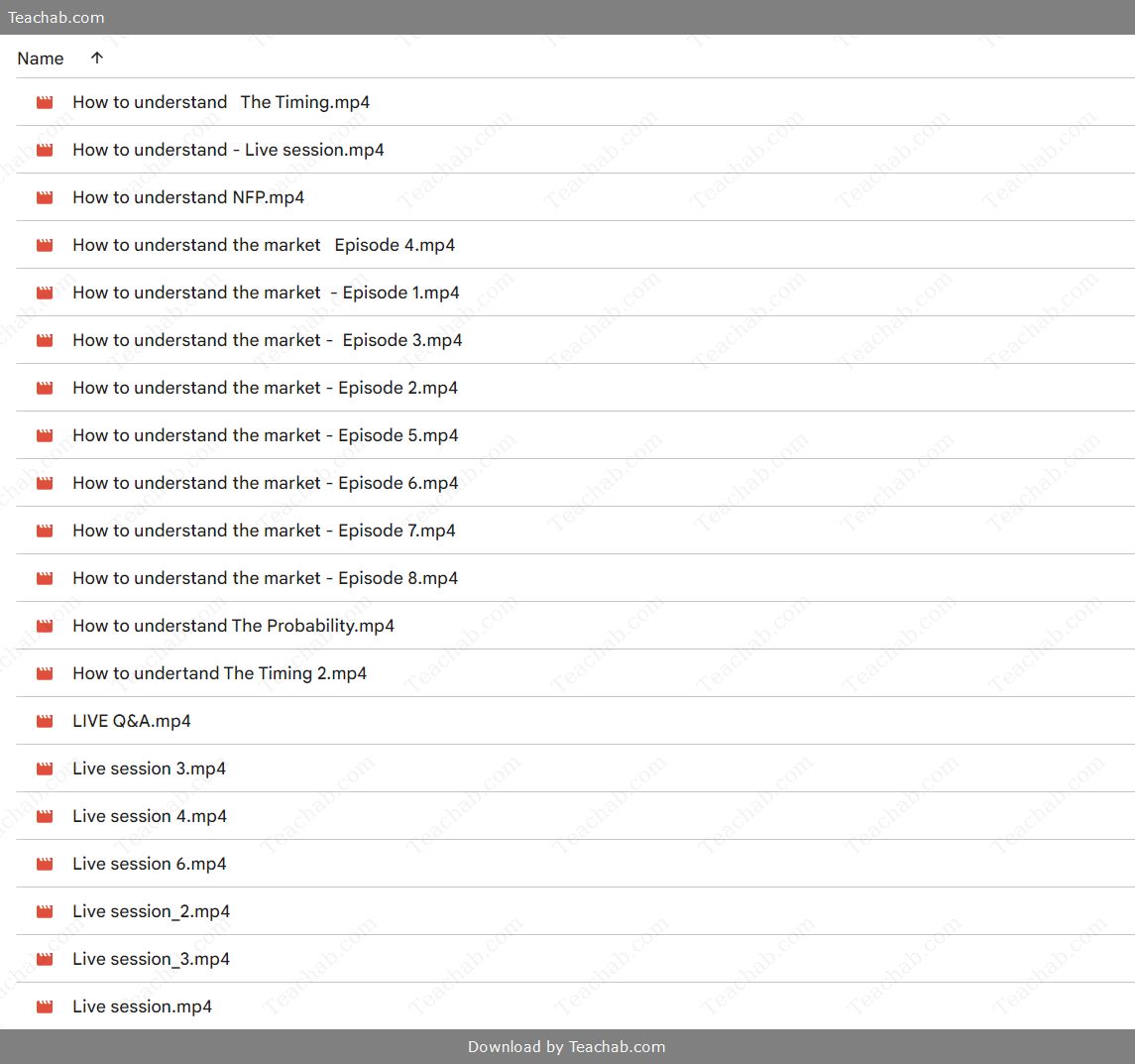

You may check content proof of “Nico FX Journal (SMC)” below:

Nico FX Journal (SMC) Evaluation

The Nico FX Journal (SMC) represents a unique educational resource at the intersection of trading and financial literacy, offering tools and insights primarily focused on Smart Money Concepts (SMC). Designed for both novice and experienced traders, it seeks to demystify the intricacies of the financial markets, showcasing how institutional trading activities can influence price movements. The journal aims not just to educate but to empower traders to refine their strategies in alignment with market dynamics dictated by institutional players.

In a world where the financial landscape is continually evolving, the Nico FX Journal provides comprehensive frameworks and methodologies to support traders in improving their decision-making capabilities. With a promotional price reduction from $999 to $92, it becomes markedly more accessible, inviting a diverse audience to explore sophisticated trading strategies and insights. This comprehensive evaluation dissects various aspects of the journal, from its purpose and target audience to its central features and content types, shedding light on its overall impact in the realm of trading education.

Overview of Nico FX Journal (SMC)

The Nico FX Journal (SMC) serves as a vital educational platform dedicated to fostering an understanding of Smart Money Concepts. It’s akin to possessing a compass in a dense forest; it offers direction and clarity to traders navigating the complexities of the forex market. By elucidating the behaviors and strategies of institutional traders often referred to as “smart money” the journal helps users understand how to align their trading strategies accordingly.

Key Comparisons:

Attributes Nico FX Journal (SMC) Traditional Trading Journals Focus Smart Money Concepts in Forex trading Broader market analysis, often covering stocks and commodities Target Audience Forex traders (novice to advanced) General traders, including equity investors Educational Approach Detailed tutorials and case studies General market commentary and news Accessibility Discounted price and multimedia content Often subscription-based with longer content

In essence, the Nico FX Journal mirrors the principles of guided education, unraveling complex trading dynamics into manageable segments and practical insights that traders can implement in real-time. This structured methodology sets it apart from more traditional approaches, making it a valuable resource for those keen on tactical learning.

Purpose and Target Audience

The Nico FX Journal (SMC) was designed with a clear pedagogical purpose: to educate its audience about the intricacies of forex trading through the lens of institutional strategies. The journal focuses on interpreting market movements and understanding the underlying factors influencing price shifts particularly those orchestrated by credible, institutional players who represent smart money within the market. This engaging approach helps traders not only recognize trends but also makes informed decisions based on the collective behavior of market movers.

Targeting an expansive audience, the journal is particularly beneficial for:

- New Traders: Eager to understand foundational concepts without overwhelming complexity.

- Experienced Traders: Seeking nuanced insights into advanced strategies associated with smart money, including liquidity zones and order blocks.

- Traders Seeking an Edge: Individuals wishing to align their personal strategies with the market behaviors exhibited by institutional investors.

Like a lighthouse guiding ships through fog, the Nico FX Journal illuminates the often murky waters of forex trading, ultimately helping traders chart a successful course in their financial journeys. Through its in-depth analysis and curated content, it stands as a model for educational resources in trading, fostering a community of knowledgeable practitioners equipped to navigate the challenges of the forex landscape.

Key Features of the Journal

The Nico FX Journal (SMC) includes several distinctive features that enhance its utility and appeal:

- Educational Content: The journal hosts a myriad of articles that are deeply rooted in the Smart Money Concept, providing readers with actionable insights and examples.

- Terminology and Concepts: Readers are introduced to critical vocabulary such as order blocks, breaker blocks, and fair value gaps foundational elements for any trader wishing to grasp the nuances of SMC.

- Visual Aids: The inclusion of charts and graphs aids in visual learning, simplifying the comprehension of complex concepts and helping readers apply theoretical insights to practical scenarios.

- Supplementary Resources: Links to downloadable PDFs and other valuable tools ensure that users can further consolidate their learning experience.

- Interactive Opportunities: Elements of engagement through discussions and community feedback create an interactive environment conducive to deeper learning.

When it comes to evolving as a trader, having access to comprehensive educational resources is crucial. The Nico FX Journal prides itself on being a dynamic educational platform, putting significant emphasis on equipping users with the skills and knowledge necessary to excel in forex trading.

Types of Articles Published

The types of articles featured in the Nico FX Journal (SMC) expand the learning experience, encompassing several thematic areas that cater to the diverse needs of traders:

- Educational Guides: Cover fundamental principles and practical applications of Smart Money Concepts to help traders make informed decisions.

- Market Analysis: Timely discussions on current market trends and analyses of how institutional trading activities shape price movements.

- Strategy Tutorials: Step-by-step instructions for implementing various SMC strategies, breaking down entry and exit points based on identifiable market patterns.

- Case Studies: Real-world applications of SMC strategies, enabling readers to learn from successful trades and scenarios.

- FAQs and Clarifications: Ongoing updates that address community inquiries about SMC, ensuring clarity and reinforcing complex concepts.

By curating a blend of educational, analytical, and practical content, the Nico FX Journal effectively caters to a variety of learning styles and user preferences. This diversity not only enhances user engagement but also elevates overall comprehension, allowing traders to step into the world of SMC with confidence.

Evaluation Criteria for Journals

In assessing the efficacy of journals, particularly in financial spheres, certain criteria significantly inform one’s evaluation:

- Journal Impact Factor: This metric illustrates the journal’s relevance and notoriety within the field, reflecting citation frequency. Journals with higher impact factors are often viewed as more authoritative.

- Comprehensive Evaluation: Criteria like editorial board composition, peer reviews, and publication ethics can reveal a journal’s credibility and commitment to quality.

- Transparency: A clear depiction of the journal’s peer review and publication processes allows readers to ascertain the integrity of the content.

- Usage Metrics: How often the journal is referenced in professional and academic evaluations can speak to its significance and reliability in influencing broader literature.

- Alternative Metrics: The rise of altmetrics and other qualitative evaluations highlight the journal’s societal impact and relevance beyond traditional citation metrics.

For any financial resource aspiring to gain trust and traction, a rigorous adherence to these evaluation criteria is paramount. Regarding the Nico FX Journal (SMC), prospective users may wish to explore these factors further, especially as they determine the journal’s overall reception and potential contributions to the trading community.

Impact Factor and Relevance

The impact factor and relevance of a journal serve as essential barometers of its influence and standing in the field. A high impact factor indicates that work published within the journal is widely cited, suggesting that it produces content of significant academic or professional interest. In the finance and trading sectors, impact factors play a crucial role not only in defining a journal’s worth but also its applicability to new traders looking to harness the latest research and methodologies.

When examining the Nico FX Journal (SMC):

- Relevance: Positioned as a specialized resource explicitly for forex traders, the journal addresses specific needs within a niche audience, covering tailored topics that resonate with its readers.

- Utilization in Academia: Although more geared toward practical trading education rather than purely academic pursuits, the foundation of SMC principles can find grounding in academic evaluations.

By measuring impact and relevance, traders utilizing the Nico FX Journal can gauge its potential benefit in not just acquiring knowledge, but also applying these insights effectively in their trading activities.

Peer Review Process

The peer review process remains a cornerstone of academic integrity in journal publishing, delineating how academic content is evaluated and vetted before publication:

- Transparency: It is crucial that a journal is upfront about the processes it employs for reviewer selection and the extent of the review, be it single-blind, double-blind, or open.

- Review Criteria: Fundamental aspects such as originality, relevance, and clarity are closely examined during peer reviews, ensuring that published works maintain a high standard.

- Ethical Commitments: A journal’s adherence to ethical practices, including handling conflicts of interest and reviewer biases, can positively impact its reputation.

- Engagement and Accessibility: The ability for authors and readers to navigate the peer review process contributes to the journal’s quality assurance, making it an essential aspect for evaluation.

For potential subscribers of the Nico FX Journal (SMC), understanding its peer review methodology can enhance trust in the materials presented, fostering a sense of credibility and assurance about the content’s reliability.

Accessibility and Transparency

Accessibility and transparency in journals are increasingly vital, especially in the digital era where information democratization is critical. This entails making content available without economic barriers and providing clear insights into the publication processes.

- Open Access: Availability of content, such as granting free access to certain articles or materials, widens the readership and promotes wider dissemination of information, enriching the trading community.

- Process Transparency: Clarity regarding how submissions are evaluated, starting from submission through peer review to publication, reassures users regarding the integrity of published research.

The Nico FX Journal (SMC) seeks to embody these principles of accessibility and transparency, enhancing trust and engagement amongst users. While exploring the metrics of journal effectiveness, it is essential that both these components are prioritized, ensuring a robust interaction between the journal and its audience.

Detailed Review of Content

The content of a journal is paramount in its evaluation and engagement with the audience. For the Nico FX Journal (SMC), the content landscape is framed around Smart Money Concepts, focusing on providing traders with actionable insights. The depth of analysis, clarity of presentation, and relevance of the material all contribute to the journal’s impact.

Several aspects stand out regarding its content:

- Informative and Educational: Articles are crafted to be educational, catering to the distinct knowledge levels and experiences of traders.

- Relevant Topics: By honing in on Smart Money Concepts, content stays relevant to real-world trading, making it practical and applicable.

- Diverse Formats: Utilizing various content forms from tutorials to analysis serves to enhance reader engagement and accommodate different learning styles.

In conclusion, the content produced by the Nico FX Journal (SMC) is a reflection of its commitment to the educational ambitions of the trading community, substantiating its role as a valuable resource for traders eager to enrich their knowledge and performance.

Analysis of Recent Publications

Recent publications within the Nico FX Journal (SMC) demonstrate a continuing commitment to leveraging Smart Money Concepts, integrating thorough research and analysis that enhance the journal’s educational offerings. The articles often dissect market behavior, emphasizing how institutional trading can impact price fluctuation and liquidity dynamics within forex markets.

- Trends Analysis: Each publication typically integrates historical market actions and current patterns, allowing readers to contextualize movements and forecast potential shifts.

- Insight Generation: Through data-driven narratives, publications spark conversations around trading strategies derived from real-world scenarios, promoting critical thinking among readers.

- Case Studies: By dissecting specific trading instances through an SMC lens, the journal enhances practical comprehension important for integrating theoretical concepts into actual trading practices.

Overall, an analysis of recent publications indicates that the journal is not merely reporting trends; it actively participates in cultivating informed, strategic traders who can navigate the complexities of financial markets effectively.

Subject Matter Coverage

The subject matter covered by the Nico FX Journal (SMC) is centered primarily around Smart Money Concepts and the forex trading environment. This concentrated focus allows traders to acquire a targeted skill set, emphasizing critical aspects like:

- Market Analysis: Insight into price movement and institutional trading techniques.

- Order Blocks and Liquidity Zones: Understanding the behavior of institutional traders helps retail traders identify sustainable trading frameworks.

- Educational Framework: The journal underscores essential elements discussing topics like breaks of structure and fair value gaps which are crucial for executing successful trades.

The structured depth of content ensures that readers can deeply understand forex trading, thereby making better-informed decisions in their trading strategies.

Author Expertise and Contributions

Given that the Nico FX Journal (SMC) is positioned as a resource for forex trading, it is undoubtedly bolstered by contributions from individuals well-versed in financial markets. While specific author information might not always be available, several characteristics can be noted regarding the contributions:

- Expertise in Finance and Trading: Authors likely include seasoned traders and financial analysts who bring real-world experience and insights into their writing.

- Educational Background: Many contributors may possess academic qualifications in economics, finance, or related fields, helping ground their articles in credible theories and methodologies.

- Community Engagement: Contributions may also stem from active community feedback, allowing novice traders to engage with experts in a collaborative learning environment.

Understanding the author pool contributing to the Nico FX Journal offers potential readers assurance about the quality and reliability of the content they consume ultimately forming a support network among traders striving for success.

User Engagement and Community Feedback

An active community is an excellent indicator of a journal’s effectiveness and overall health. The Nico FX Journal (SMC) is anticipated to maintain a vibrant relationship with its users, enabling feedback loops that enhance content relevance and appeal:

- Community Forums: Platforms may be used where traders can discuss ideas, share strategies, and seek clarification on complex topics a vital avenue for enriching content through real-time user interaction.

- Feedback Mechanisms: The journal likely provides channels for readers to voice their thoughts or issues, thus fostering greater engagement and continuous improvement of the content provided.

- Audience Interaction: Through social media and newsletters, the community can stay updated on recent articles, changes to strategies, and important market news, thereby amplifying overall user engagement.

By prioritizing community feedback and enhancing user interaction, the Nico FX Journal strengthens its position as a resource where learning and exchange thrive, further cementing its role within the forex trading community.

Reader Demographics

Understanding the demographics of readers engaging with the Nico FX Journal (SMC) is critical for tailoring content to fit the needs of its audience. The journal primarily attracts:

- Retail Traders: Both new and seasoned individuals looking to expand their knowledge of forex markets.

- Young Adults: An increasing number of younger traders are seeking flexible trading options and educational resources that fit their lifestyles.

- Global Audience: Active traders from diverse backgrounds and regions may access it online, increasing its reach and influence across various markets.

By catering to a wide range of demographic profiles, the Nico FX Journal can ensure that its content remains relevant, practical, and valuable to its readership.

Feedback from Contributors

The feedback from contributors serves as a lens into the journal’s impact. Contributors’ experiences may include:

- Contribution Quality: Insights regarding the depth and clarity with which they can share information about Smart Money Concepts and trading strategies.

- Community Interaction: Levels of engagement with readers may provide feedback on how well the content resonates and invites discourse among users.

- Supportive Environment: Contributors might express gratitude for the ecosystem surrounding the Nico FX Journal, as feedback can create a dynamically improving educational framework.

Continued contributor engagement is vital for ensuring that the journal adapts and evolves, maintaining its relevance and effectiveness in the realm of forex trading education.

Community Involvement and Events

The Nico FX Journal (SMC) most likely incorporates community involvement and events as significant elements within its overall framework. This may include:

- Webinars and Live Sessions: Offering traders opportunities to learn in real-time, interact with experts, and deepen their understanding of Smart Money Concepts.

- Contests and Challenges: Engaging the audience actively through trading competitions, allowing participants to showcase their skills and strategies.

- Collaborative Learning Events: Workshops where traders can collaborate on strategies, thereby promoting a cohesive learning community.

Such initiatives not only strengthen community ties but also infuse energy and enthusiasm into the trading experiences of participants. They also serve to enhance learning opportunities, breaking down barriers between novice traders and seasoned professionals.

Comparisons with Other Financial Journals

When juxtaposing the Nico FX Journal (SMC) with other financial journalism offerings, distinct differences and commonalities emerge, setting it apart in several key areas:

- Specialization vs. Generalization: Unlike broader financial journals that may cover diverse sectors, the Nico FX Journal zeroes in on forex trading and Smart Money Concepts, allowing for niche specialization. This focus provides depth but may limit its audience.

- Interactivity vs. Traditionalism: Comparative journals often adopt traditional formats with less audience engagement; however, the Nico FX Journal incorporates multimedia elements and community participation, creating a more dynamic reader experience.

- Accessibility: Many traditional journals are behind paywalls, while the Nico FX Journal boasts a promotional pricing strategy, widening its accessibility and appeal to many traders.

Comparison Aspect Nico FX Journal (SMC) General Financial Journals Focus Forex and SMC strategies Wide-ranging financial subjects Community Engagement High (interactive features, webinars) Low to Moderate (often one-sided) Accessibility Discount pricing for users Typically subscription-based Specialization Niche (forex-centric) General (broader market coverage)

This comparative analysis highlights the distinctive positioning of the Nico FX Journal as both an accessible and specialized resource, appealing primarily to a community of traders focused on enhancing their understanding of forex dynamics.

Strengths and Weaknesses Relative to Competitors

A deeper evaluation of the Nico FX Journal (SMC) against its competitors reveals both strengths and weaknesses that can influence its attractiveness to prospective readers:

- Strengths:

- Niche Expertise: Focused content specifically for forex and smart money strategies caters effectively to a dedicated audience.

- Engagement Opportunities: Community-focused approaches like webinars and forums foster a vibrant learning experience.

- Cost-Effective Learning: The journal’s promotional pricing allows broader accessibility for traders without substantial investment.

- Weaknesses:

- Narrower Audience Appeal: Its specific focus on forex might deter traders interested in other market segments.

- Credibility Concerns: As a newer entity, it may struggle to achieve the authoritative status seen in established journals.

- Potential for Limited Content Diversity: With specialized topics, there may be less exploration of broader financial concepts which might be of interest to some.

Addressing these strengths and weaknesses is vital for the Nico FX Journal as it seeks to evolve and solidify its standing in a competitive financial journalism landscape.

Unique Selling Points

The Nico FX Journal (SMC) encompasses several unique attributes that set it apart from traditional financial journals:

- Focused Educational Framework: Heavy emphasis on Smart Money Concepts empowers traders to make informed decisions, honing in on institutional strategies that affect market movements.

- Interactive Learning Environment: Engagement through community discussions, webinars, and feedback loops fosters an enriched learning space uncommon in many financial journals.

- Diverse Content Formats: By offering resources through articles, visual aids, and practical tutorials, the journal meets various learning preferences, reinforcing trading strategies aligned with current market dynamics.

- Promotional Pricing: The significant discount from the original price not only increases accessibility but also positions the journal as an affordable learning tool among competing resources.

These unique selling points highlight the journal’s commitment to enhancing trader competencies and promoting a deeper understanding of the intricate relationships governing forex markets.

Future Prospects and Recommendations

The future of the Nico FX Journal (SMC) appears promising, especially given the increasing interest in forex trading and the necessity for robust education in this domain. To maintain momentum and further its influence, several recommendations may be beneficial:

- Expand Educational Offerings: Increasing the variety of content covering more advanced topics or emerging trading tools could cater to a broader range of trading interests.

- Develop Community Platforms: Creating dedicated forums or social media groups might enhance audience interaction and retention, fostering a sense of belonging among traders.

- Leverage Technology: Embracing technology through app developments or mobile-friendly access could attract younger audiences familiar with digital tools.

- Partnerships for Broader Reach: Collaborating with educational institutions or trading platforms could amplify the journal’s visibility and credibility within the trading community.

By adapting to emerging trends and addressing its audience’s evolving needs, the Nico FX Journal (SMC) can solidify its role as an essential educational tool for forex traders.

Potential Areas for Improvement

Although the Nico FX Journal (SMC) maintains a robust educational framework, certain areas could benefit from improvement:

- Broader Topic Range: Integrating content related to other financial markets may attract a wider audience base and enhance overall relevance.

- Direct User Feedback Implementation: Establishing more defined lines of user feedback can allow the journal to adapt its content more closely to what its audience seeks, creating a responsive educational environment.

- Enhanced Marketing Strategies: Expanding visibility through improved marketing methods would help capture the attention of potential users who may not be aware of its existence.

- Author Diversity: Engaging a broader array of contributors from diverse financial backgrounds may enrich content perspectives and expertise level, providing users a multifaceted comprehension of the subject matter.

By implementing such recommendations and refining its strategies, the Nico FX Journal can enhance its trajectory and expand its influence in the trading education sector.

Trends in Financial Journalism

In the evolving landscape of financial journalism, certain trends emerge that could influence how the Nico FX Journal (SMC) develops moving forward:

- Digital Transformation: The shift towards online and multimedia content delivery is pivotal. Integrating video, podcasts, and interactive articles can increase engagement and meet user preferences for varied content consumption.

- Sustainability and Ethics: As environmental concerns grow, financial journalism focuses on ethical investing and sustainable trading practices. Addressing these themes might enhance the journal’s relevance in modern discourse.

- Diverse Perspectives: Emphasizing diverse voices and experiences enhances credibility and resonates with a wider audience, reflecting growing demographic dynamics within trading communities.

- Focus on Personal Finance: Including personal finance topics can assist readers in applying trading knowledge to their broader financial goals, expanding the journal’s utility beyond just trading.

- Real-Time Insights: Editors curating timely analyses and rapid response articles can significantly enhance the journal’s value during volatile market periods.

Recognizing these trends allows the Nico FX Journal to position itself advantageously within the competitive financial journalism landscape, optimizing engagement and learning opportunities for its readership.

Vision for the Coming Years

Looking ahead, the Nico FX Journal (SMC) exhibits potential for broadening its impact through several key focuses:

- Increased Accessibility: Ensuring content is available on mobile platforms and various digital media can help reach a more extensive audience.

- Adaptation to Market Trends: Continuously evolving educational offerings to match current and emerging trading tools and strategies will keep the content relevant and actionable.

- Strengthening Community Relationships: Fostering meaningful interactions among traders encourages collaboration and a shared ownership of the learning journey, cultivating a loyal following.

- Collaborative Partnerships: Engaging with other educational platforms, services, or content creators can amplify reach and improve credibility.

Emphasizing these areas will shape the Nico FX Journal’s evolution and significance, crafting it as a vital resource for current and future traders navigating the fluctuating waters of the forex trading world.

In conclusion, the Nico FX Journal (SMC) stands out as an essential instrument for traders seeking to harness Smart Money Concepts in their trading strategies. Through thorough evaluations, it presents itself as an accessible, educational resource that encourages both individual and collective growth within the trading community. As the landscape of financial journalism transforms, this journal’s adaptability, commitment to engagement, and user-centered strategies will determine its enduring impact in supporting and empowering traders to achieve their financial aspirations.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Nico FX Journal (SMC)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.