Option Buying Course

300,00 $ Original price was: 300,00 $.5,00 $Current price is: 5,00 $.

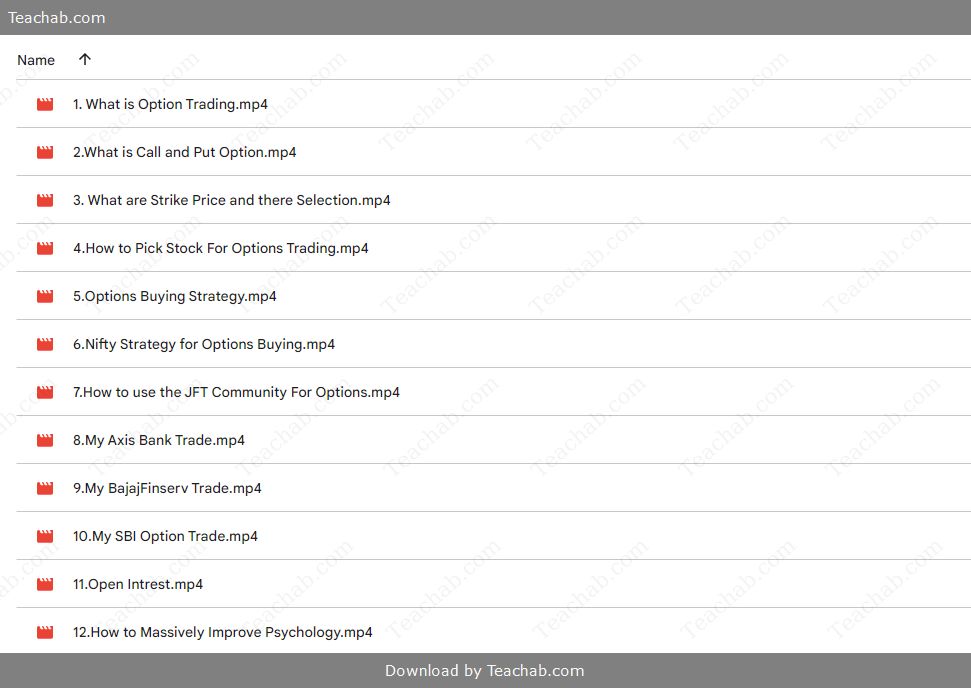

You may check content proof of “Option Buying Course” below:

Option Buying Course Outline

Introduction

Engaging in the world of options trading can seem daunting to newcomers. The intricate web of terminologies, strategies, and market behaviors can be overwhelming. However, understanding options trading is akin to mastering a complex instrument; once learned, the potential for harmony creating profit and opportunities exceeds initial reservations. An options buying course can be your guide through this financial labyrinth. Designed to demystify the fundamental principles, these courses equip learners with the necessary skills to effectively engage in options trading, ultimately leading to informed and confident investment decisions.

The objective of this article is to provide an extensive exploration of the key concepts surrounding options buying, offering summaries and detailed insights on essential topics such as options types, premiums, time frames, and market sentiment indicators. Each section will elaborate on how these elements interconnect and influence trading strategies. By the end of this comprehensive guide, readers will be better prepared to navigate the complexities of options trading, allowing them to harness this powerful financial tool with confidence.

Key Concepts of Option Buying

Mastering options buying requires an understanding of a few foundational concepts that are pivotal in guiding traders to make informed decisions. Options are financial derivatives that provide the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price before a set expiration date.

- Call Options: Think of these as a ticket to a concert that lets you buy a general admission seat for $50. If the prices surge to $100 upon the concert day, your ticket gives you leverage you can purchase it for the original price, pocketing the difference.

- Put Options: Conversely, imagine having a warranty on a car that ensures your sale price remains at current value even if prices plummet. If the car’s value drops, your contract safeguards your investment.

The components that constitute an option contract like the strike price, expiration date, and premiums form the backbone of options trading. Understanding these elements is vital for trading success.

Option Premiums: This price reflects the cost of purchasing the option, influenced by various factors, including the underlying asset’s volatility and time until expiration. The internal value and time value are critical aspects to assess; an option’s premium is a blend of intrinsic and time value.

Lastly, grasping the implications of implied volatility can provide an edge. It embodies the market’s expectations of future fluctuations. Higher expected volatility generally leads to increased premiums, as it heightens the likelihood that options will become profitable.

Navigating these core concepts is the first step for aspiring options traders, preparing them for more advanced strategies and analyses.

Types of Options

In the world of options trading, two main types dominate the landscape: call options and put options, each serving different trading strategies based on market expectations.

- Call Options: Call options are contracts that give the holder the right, but not the obligation, to purchase an underlying asset at a predetermined strike price before the option expires. Investors typically buy call options when they anticipate that the price of the underlying asset will rise. For example, if a trader expects Stock A’s price, currently at $50, will increase in the next few months, they might buy a call option with a strike price of $55. If the stock rises to $70, the trader can exercise the option, purchasing shares at the lower price of $55 and selling them at the current market price of $70, thus locking in a profit.

- Put Options: Conversely, put options give the buyer the right to sell an asset at a predetermined strike price before expiration. These options are generally used by investors who predict a decline in the underlying asset’s price. For instance, if a trader holds a put option for Stock A with a strike price of $50, and the stock price plummets to $30, the trader can sell it at the higher strike price of $50, thereby profiting from the downward movement.

Comparison Table: Call Options vs. Put Options

Characteristic Call Options Put Options Right Buy an asset at strike price Sell an asset at strike price Market Outlook Bullish (expect prices to rise) Bearish (expect prices to fall) Risk Profile Limited to premium paid Limited to premium paid Profit Potential Unlimited (if prices keep rising) High (if prices fall significantly)

Understanding the nuances of these two main types allows traders to align their strategies with their market predictions effectively. Engaging with strategies such as spreads or straddles may provide even more refined approaches utilizing both calls and puts.

Understanding Premiums

Premiums are a crucial aspect of options buying, serving as the initial cost of entering an options contract. The premium can be likened to the entry fee of a concert; you pay it to gain access to an event that could yield great enjoyment or, in this case, profit.

Calculating the premium involves intricate factors, prominently including:

- The Underlying Asset’s Price: The proximity of the asset’s current price to the option’s strike price significantly affects the premium. Generally, options that are “in-the-money” (where the asset price is favorable compared to the strike price) command higher premiums due to their intrinsic value. Conversely, “out-of-the-money” options (those with strike prices less favorable) typically cost less.

- Time Until Expiration: Options have a finite lifespan, and the time value of these options decays as expiration approaches a phenomenon known as Theta decay. An option with a longer time to expiration generally has a higher premium as there is more time for potential favorable price movements.

- Implied Volatility: This measure of market expectations of future price fluctuations is vital. Higher implied volatility indicates a greater expected fluctuation in the asset price, leading to higher option premiums, as traders are factoring in risks associated with greater swings in market movements.

- Market Sentiment: Changes in market sentiment can drive premiums up or down. For instance, news affecting a company’s stock can cause drastic shifts in premiums based on how traders anticipate the asset might react moving forward.

In conclusion, understanding premiums is vital for successful options trading, as they represent both the cost of the option and a reflection of the market’s expectations regarding volatility and time. A savvy trader must carefully assess these factors when purchasing options to optimize their entries and potential profitability.

Strike Prices and Expiration Dates

When engaging with options buying, strike prices and expiration dates are pivotal elements that can influence a trader’s strategy and potential outcomes. Understanding these components is akin to navigating a map for a journey you must know your destination and how to get there.

- Strike Prices: The strike price signifies the predetermined price at which the option holder can buy (in the case of call options) or sell (in the case of put options) the underlying asset. The relationship between the strike price and the market price of the underlying asset at expiration heavily influences the option’s intrinsic value.

- In-the-Money (ITM): This is when the underlying asset’s market price exceeds the strike price for call options (and is below the strike price for put options). For instance, a call option with a $50 strike price becomes valuable when the asset reaches $70.

- Out-of-the-Money (OTM): This is the opposite scenario when the underlying asset’s price is below the strike price for calls or above it for puts. For example, a call option with a $50 strike that is trading at $45 is considered OTM, lacking intrinsic value.

Choosing the right strike price involves balancing cost and profit potential. Risk management is critical here; conservative investors might lean toward ITM strikes as they are less risky, while aggressive traders might pursue OTM options for potentially higher rewards.

- Expiration Dates: The expiration date marks the final day on which the option can be exercised. Options can expire in a matter of days or stretch out to several years, widely referred to as long-term equity anticipation securities (LEAPS).

- Impact on Premiums: The closer an option gets to its expiration date, the less time it has to make a favorable price shift, leading to time decay. Options with longer expiration periods are typically associated with higher premiums because they have more time to gain value.

- Planning Strategies: Traders must align their strategies with the expiration dates. For example, if a trader anticipates a near-term price increase, they might opt for shorter-term options to capitalize on the anticipated movements quickly.

In conclusion, strike prices and expiration dates carry significant weight in options trading. By carefully evaluating both, traders can align their strategies with their market predictions to effectively manage risk while optimizing profit potential.

Strategies for Buying Options

When navigating the landscape of options buying, several strategies can be employed to maximize gains while effectively managing risk. These strategies allow traders to leverage market movements and capitalize on various scenarios.

- Long Call Options: This strategy involves buying call options to profit from an anticipated increase in the underlying asset’s price. Traders choose this when they expect significant rises; selecting the right strike price and expiration date remains critical. Timing is also crucial, with traders benefiting from low implied volatility, expecting it to rise, consequently boosting option premiums.

- Long Put Options: Similar to long calls, long puts are employed when traders anticipate a decline in stock prices. This allows them to sell an asset at a predetermined price even if the market plummets. The ability to limit risk (limited to the premium paid) makes this strategy attractive, combining bearish sentiment with a defined exit.

- Utilizing Spreads: Implementing spreads involves simultaneously buying and selling options to minimize risks and costs. For example, a bull call spread entails purchasing a call option at a lower strike price while selling a call at a higher strike price, limiting potential losses.

- Monitoring Implied Volatility: As volatility rises, option prices can increase, thus benefiting long options. Traders who buy during low implied volatility periods often maximize profits when volatility spikes.

- Exit Strategies: A successful options trader must establish clear exit strategies in advance. Setting profit targets and employing stop-loss orders can help protect investments.

Incorporating these strategies into your options buying approach enhances your trading prowess, combining informed decisions with market movements to navigate the complexities of the options landscape successfully.

Long Call Options

Long call options present a compelling strategy for investors who anticipate an upward trend in the price of an asset. Understanding the mechanics behind this approach is crucial for making informed decisions in the dynamic world of options trading.

- Mechanics of Long Calls: A long call option gives the buyer the right, but not the obligation, to purchase a specific number of shares at a predetermined strike price before the expiration date. This strategy is utilized when traders expect the price of the underlying asset to soar, allowing them to lock in profits as prices rise.

- Selecting Strike Prices and Expiration Dates: Choosing the right strike price is fundamental. Buying an in-the-money (ITM) call offers higher intrinsic value and a greater likelihood of profitability, albeit at a higher cost. On the other hand, engaging with out-of-the-money (OTM) options may be less expensive but requires significant price movement to yield substantial returns. Similarly, picking an optimal expiration date plays a vital role; longer-dated options provide more time for positive price movements, thus reducing the impact of time decay.

- Market Considerations: Timing is paramount when dealing with long call options. Traders should monitor market conditions and develop strategies in line with anticipated price movements. Engaging with technical analysis can provide insights into potential price trajectories, aiding decision-making.

- Risk Management: A well-formed risk management strategy serves as a safety net. Since the risk in long call options is confined to the premium paid, investors should plan exit points. Setting profit goals or implementing stop-loss orders caters to both risk aversion and profit-taking.

- Exit Strategies: Traders have options on how to approach exits. Selling the long call prior to expiration when achieving target prices, or exercising the option if it’s profitable, offers avenues for unlocking gains.

In summary, long call options can serve as a valuable strategy in an investor’s toolkit. By understanding the mechanics, making deft choices regarding strike prices and expiration dates, and implementing suitable risk management strategies, traders can harness the earning potential of this strategy effectively.

Long Put Options

Long put options serve as a formidable strategy for investors adopting a bearish outlook on an asset. By acquiring the rights to sell at a predetermined price, traders position themselves to minimize losses or profit from price declines.

- Mechanics of Long Puts: A long put option grants the holder the right, but not the obligation, to sell shares of the underlying asset at a strikingly low price before the expiration. Traders typically engage with this strategy when they anticipate declines in an asset’s price. For example, if a trader expects a decline in Stock A from $100 to $70, acquiring a put option allows them to sell shares at $100, securing potential profit by purchasing shares on the open market at lower valuations.

- Selection of Strike Prices and Expiration Dates: The efficacy of long puts hinges heavily on strike price selection. Traders often prefer higher strike prices, as this amplifies intrinsic value and potential profitability if the market price drops. Regarding expiration dates, options with longer time frames tend to command higher premiums and provide sufficient window for downward price movements to realize gains.

- Risk Management: Similar to call options, the risk in long puts is delineated to the premium paid. However, to mitigate potential losses further, traders could implement strategies such as bear put spreads, wherein a put option is bought while simultaneously selling another put option at a lower strike, thus capping maximum losses while allowing profit potential.

- Market Conditions: A keen awareness of market conditions is essential. Long put strategies are particularly effective during periods of heightened market uncertainty or anticipated downturns. An adept trader aligns their analysis of market sentiment with their positions in long puts.

- Exit Options: Various exit strategies can be pursued when managing a long put position. Traders can choose to sell the put option prior to expiration, exercise their rights if ITM, or allow it to expire worthless should market conditions shift favorably. Timing these exits right is crucial to preserving profits or limiting losses.

In conclusion, long put options stand as a solid strategy for bearish investors seeking protection or profit from downturns in asset prices. With an understanding of the mechanics, strategic risk management, and careful selection of strike prices and expiration dates, traders can effectively leverage the benefits of this approach.

Risk Management in Option Buying

Risk management forms an integral component of successful options trading strategies, protecting traders from potential losses while maximizing the chance for gains. Navigating the unpredictability of market movements necessitates strategic planning for managing risk effectively.

- Defined Risk: When buying options, the risk is confined to the premium paid for the option. This clear delineation simplifies risk management compared to owning equities where potential losses can be extensive. For instance, if a trader purchases a call option for a $200 premium, their maximum loss if the option expires worthless is strictly $200, which is manageable compared to holding a depreciating stock.

- Setting Profit and Loss Targets: Establishing clear profit and loss targets is paramount. Traders should decide at what percentage gain or loss they will exit the trade, allowing them to maintain discipline and avoid emotional decision-making actions. For example, a trader may set a target to exit a long call option when it reaches a 50% increase in premium value.

- Diversification: Like balancing a diet with various nutrients, diversification serves to spread risk across different assets or strategies. Traders can engage in various options contracts to mitigate the risk associated with a single concentrated view on an asset, allowing for a buffer should one position underperform.

- Utilizing Stop-Loss Orders: A stop-loss order serves as a safety net against unwanted losses. Setting up exit points where trades will automatically close if they reach certain thresholds allows traders to maintain control even in volatile market conditions.

- Monitoring Implied Volatility: Understanding the implications of changes in implied volatility is beneficial for effective risk management. When volatility increases, option premiums rise and can create profitable positions traders should evaluate market conditions periodically and adapt their strategies accordingly.

In conclusion, risk management is a cornerstone of options buying. By defining risks, establishing targets, diversifying positions, utilizing stop-loss orders, and staying attuned to market volatility, traders can navigate the complex landscape of options trading with confidence and strategic foresight.

Analyzing Market Conditions

A pivotal aspect of options trading involves analyzing market conditions to make informed and strategic decisions. Traders must continuously assess various market forces to align their options buying strategies accordingly.

- Market Environment: Understanding the overall direction of the market bullish or bearish can significantly influence options trading strategies. In a bullish environment, traders may prefer buying call options, while in a bearish scenario, purchasing puts could be more advantageous.

- Technical Analysis: Traders often rely on technical analysis to gauge market conditions through price chart evaluations and indicators such as moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). Technical indicators can offer predictive insights into potential price movements, guiding decisions on when to buy or sell options.

- Economic Indicators: Broader economic indicators also play a crucial role in shaping market sentiment. Factors such as GDP growth, unemployment rates, and inflation can indicate the general health of an economy and impact asset prices. For instance, declining unemployment rates may lead to increased consumer spending, driving asset prices upwards.

- Market Sentiment Indicators: Understanding market sentiment through indicators like the VIX (Volatility Index) can inform traders about levels of fear or euphoria in the market. A high VIX often correlates with market instability, influencing trading behaviors and option pricing.

- News and Events: Key news releases, earnings announcements, and geopolitical tensions can create significant price movements. Traders should remain vigilant about upcoming events that may impact the underlying assets they are invested in.

In conclusion, effectively analyzing market conditions is critical for options traders seeking to capitalize on market movements. Utilizing technical analysis, monitoring economic indicators, assessing sentiment, and staying informed about upcoming events allows for well-informed trading decisions.

Using Technical Analysis

Technical analysis is a vital tool for options traders looking to gauge market conditions and optimize their strategies. It involves studying historical price patterns, volume, and technical indicators to predict future price movements. Employing technical analysis can significantly influence the timing and selection of options buying.

- Chart Patterns: Recognizing chart patterns forms the basis for technical analysis. Patterns such as head and shoulders, triangles, and double tops/bottoms indicate potential price reversals or continuations. For instance, a head and shoulders pattern may signal a bearish reversal, prompting traders to consider buying put options.

- Technical Indicators: Tools like moving averages, RSI, and Bollinger Bands provide insights into market trends and potential entry or exit points. Moving averages smooth out price data over time and help define the trend direction whether bullish or bearish thus assisting traders in determining when to buy calls or puts.

- Support and Resistance Levels: Identifying support and resistance levels reveals critical price points where trends may reverse. For example, if a stock has consistently struggled to break above a specific resistance level, traders might view this as a potential point to enter short positions (buying puts).

- Volume Analysis: Trading volume indicates the strength behind price movements. High trading volume accompanying a price increase may signal a continuation of the upward trend, while low volume could raise questions about the sustainability of that move. Traders should consider volume metrics when making decisions regarding option positions.

- Timing Trades: Timing is a crucial aspect, and technical analysis aids in pinpointing optimal entry and exit points. Utilizing strategies like Fibonacci retracement can help identify future support and resistance levels, guiding traders on where to enter or exit options trades effectively.

In summary, effectively using technical analysis empowers options traders to make strategic decisions in alignment with market conditions and underlying asset behavior. By recognizing chart patterns, applying indicators, analyzing volume, and identifying support/resistance levels, traders can navigate the complexities of options trading with greater confidence.

Fundamental Analysis for Options

Fundamental analysis serves as an essential counterpart to technical analysis, focusing on evaluating the intrinsic value of underlying securities and their potential to impact options pricing. This method delves into economic, financial, and other qualitative and quantitative factors that influence asset valuation.

- Company Performance: Assessing a company’s financial health is critical for options trading. Traders should analyze earnings reports, revenue growth, earnings per share (EPS), and profit margins to ascertain the company’s ability to generate sustained profit. Strong performance factors may lead to bullish sentiment, increasing demand for call options.

- Macroeconomic Trends: Broader economic indicators such as GDP growth, unemployment rates, and inflation directly influence market sentiment and investment behavior. For example, rising inflation may prompt central banks to adjust interest rates, impacting market dynamics and the valuation of underlying assets.

- Market Sentiment: Understanding consumer sentiment and market psychology provides context for how traders perceive potential outcomes. Are consumers feeling optimistic or fearful? Tools such as the Consumer Confidence Index (CCI) offer insights into overall market sentiment, guiding traders in their options purchasing decisions.

- Competitive Landscape: Grasping the competition’s strength and weaknesses can shed light on a company’s future sustainability. Analyzing peer performance, market share, and competitive advantages helps traders gauge potential risks and rewards.

- Event-Driven Analysis: Special corporate events such as mergers and acquisitions, stock splits, and product launches can add volatility and drastically affect stock prices. Traders should stay tuned to corporate announcements and industry trends that could impact their options positions.

In conclusion, incorporating fundamental analysis into options trading strategies equips traders with a comprehensive understanding of the intrinsic value of underlying assets. By scrutinizing company performance, macroeconomic factors, market sentiment, and competitive landscapes, traders can make informed choices about buying and selling options to optimize profits and manage risk effectively.

Market Sentiment Indicators

Market sentiment indicators provide insight into the prevailing mood of the market, informing options traders about potential sentiment shifts that may impact their decisions. Understanding these indicators is essential for reacting to changing market dynamics.

- Put/Call Ratio: This ratio compares the volume of put options to call options. A high put/call ratio suggests bearish sentiment, indicating more traders are buying puts (******* against the market). Conversely, a low ratio signals bullish sentiment, as more investors are confident in upward price movements. Tracking this ratio enables options traders to gauge market sentiment regarding potential price movements.

- Volatility Index (VIX): Often referred to as the “fear index,” VIX reflects market expectations for future volatility based on options prices. A high VIX typically indicates increased uncertainty or market fear, influencing traders’ strategies. For instance, perception of greater volatility might encourage traders to seek protective puts.

- Advance/Decline Line: This breadth indicator measures the net difference between advancing stocks and decliners within a certain timeframe. A rising advance-decline line generally signifies bullish sentiment, suggesting upward momentum in the market, while a dropping line indicates bearish sentiment.

- Market Momentum Indicators: Metrics such as moving average convergence divergence (MACD) help gauge trend strength and momentum. A bullish MACD crossover might lead traders to consider call options, while bearish crossovers might prompt put purchases.

- Economic Reports and Announcements: Major economic releases, such as employment numbers and inflation indices, can heavily influence market sentiment. Traders should stay informed of these reports and how they may impact the overall market landscape, adjusting their strategies accordingly.

In conclusion, utilizing market sentiment indicators empowers options traders to navigate market fluctuations with greater acumen. By monitoring elements such as the put/call ratio, VIX, advance-decline line, momentum indicators, and economic reports, traders can refine their strategies and enhance their market timing for options buying.

Evaluating Option Buying Courses

Evaluating the effectiveness of options buying courses is fundamental to ensuring you receive high-quality education that aligns with your trading goals. Here we delve into the key aspects to assess when selecting an options trading course.

- Comprehensive Content: Look for courses that cover not only the basics of options buying but also delve into complex strategies and risk management. A well-structured course should walk you through every relevant concept, from defining options to advanced strategies.

- Credible Instructors: Consider the background of the instructors. Experienced traders with proven track records in options trading provide invaluable insights. Their practical examples and real-world experience enhance understanding and relatability.

- Reviews and Testimonials: User experiences offer insight into the effectiveness of a course. Seek platforms with verified student testimonials and reviews. High ratings especially feedback that highlights successful application of learned skills are indicators of valuable content.

- Practical Application: Effective courses should incorporate practical applications in their curriculum. Real-world scenarios, case studies, and hands-on trading simulations can deepen your understanding of options trading and prepare you for actual market engagement.

- Course Accessibility: Evaluate the platform’s usability. A user-friendly interface and readily accessible resources enhance the learning experience. Flexibility in accessing course materials at your convenience is also valuable for accommodating various learning paces.

In summary, a critical approach to evaluating options buying courses can significantly elevate the quality of your education. By emphasizing comprehensive content, esteemed instructors, insightful reviews, practical application, and accessibility, learners can position themselves to excel in options trading.

Criteria for Selecting Courses

When it comes to selecting options buying courses, several criteria can be pivotal in finding the right fit to enhance your trading knowledge and skills.

- Course Content: The depth and breadth of the course content are crucial. A well-rounded course should cover fundamental concepts like calls and puts, premiums, and expirations, along with advanced strategies that enhance risk management and trading skills.

- Price Evaluation: Pragmatically assess course pricing against the value offered. Consider whether the course delivers reasonable content depth and additional resources, such as webinars, community access, or ongoing support.

- Instructor Credibility: Investigating the instructor’s background is important to ensure a knowledgeable education. Experienced instructors who have made a name for themselves in the options trading community add credibility and enhance the course experience.

- Audience Fit: Understand whether the course caters to beginners, intermediates, or advanced traders. Selecting a course that aligns with your current skill level and learning goals ensures you receive targeted education that builds upon existing knowledge.

- Offers and Discounts: Keep an eye out for promotions or discounts that can make high-quality education more accessible. Limited-time offers may allow you to enroll at a reduced price or pair courses for comprehensive learning at better value.

In summary, choosing the right options buying course hinges on evaluating course content, pricing, instructor credibility, audience suitability, and availability of offers. These parameters enhance the chances of selecting a course that meets your educational goals and financial expectations.

Comparing Course Length and Content

Comparing options trading courses based on length and content ensures that learners can assess the depth of learning they will receive. Here’s a breakdown of prominent courses focused on option buying:

- Benzinga Options:

- Length: Annual subscription with ongoing alerts

- Content: Course centered on real-time trade alerts and analysis

- Efficacy: Strong for learners seeking practical, hands-on experiences rather than traditional coursework.

- Udemy’s Options Trading Basics:

- Length: Approximately 11.5 hours of video content

- Content: Comprehensive introduction covering essential strategies and market analysis

- Efficacy: Well-rated and suitable for beginners looking for a structured approach in options education.

- TD Ameritrade:

- Length: Flexible content available online

- Content: Extensive library of articles, videos, and workshops on options trading

- Efficacy: Offers a broad range of resources for varying skill levels; strong credibility in the industry.

- Option Alpha:

- Length: Varies based on user engagement; extensive resources available

- Content: Comprehensive curriculum from beginner to advanced levels, including free material

- Efficacy: Highly regarded for fostering a solid foundation in options trading.

- Simpler Trading:

- Length: Varied course lengths focused on specific strategies; some courses are condensed

- Content: A mix of practical strategy and theory

- Efficacy: Features experienced instructors, with dynamic and interactive lessons appealing to active traders.

In summary, comparing course lengths alongside content breadth provides crucial insights into the depth of learning available. By evaluating courses like Benzinga Options, Udemy’s Options Trading Basics, TD Ameritrade, Option Alpha, and Simpler Trading, potential learners can select options educational programs that match both their schedules and learning preferences.

Reviewing Instructor Credibility

Instructor credibility is paramount when considering options trading courses, as a knowledgeable and experienced teacher can have a profound effect on the learning outcomes. Here are key elements to assess instructor credibility in this educational space.

- Background Experience: Review the instructor’s professional track record in options trading. Look for industry certifications, contributions to the field, or experience working with reputable financial institutions that lend authority to their teaching.

- Success Rate: Inquire into the instructor’s past trading success. Metrics indicating a strong win rate in options trading, proven strategies, and mentorship can provide insight into their effectiveness as educators.

- Student Testimonials: Assess feedback from previous students. Effective instructors typically have positive reviews outlining their teaching methods and impact on student success.

- Availability for Interaction: An accessible instructor who fosters communication may enhance the learning experience. Engagement through discussion forums, live Q&A sessions, or mentorship initiatives increases value for students.

- Online Presence: Investigating an instructor’s presence on educational platforms or social media can give insights into their dedication to sharing knowledge and staying active in the trading community. A strong online reputation further supports credibility.

In conclusion, scrutinizing instructor credibility ensures learners derive maximum value from their courses. A solid background, successful trading experience, positive student feedback, availability for interaction, and online presence collectively indicate a credible instructor likely to enhance the educational experience.

Top Recommended Option Buying Courses

When exploring options buying courses, several reputable courses stand out as top recommendations for both beginners and seasoned traders.

Benzinga Options Course:

- Overview: A unique options alert service aimed at educating traders while providing actionable trade alerts.

- Content: Subscribers receive biweekly trade alerts accompanied by insightful analysis, designed to teach the rationale behind every trade.

- Cost: Approximately $297 per year, making it a competitive choice for hands-on learning.

- Efficacy: Particularly beneficial for learners who prefer a hands-on approach, as it emphasizes real-time trading insights.

Udemy’s Options Trading Basics:

- Overview: A foundational course featuring around 11.5 hours of comprehensive video content.

- Content: Covers essential concepts, from the basics of options, to various strategies, and practical applications.

- Cost: Prices vary, but regular discounts make it accessible.

- Efficacy: With a high rating and extensive enrollment, it’s proven effective for beginners seeking foundational knowledge.

Option Alpha Free Courses:

- Overview: A well-structured platform offering various free courses on options trading.

- Content: Ranges from beginner to advanced levels, covering essential strategies with practical applications.

- Cost: Access to a wealth of information without monetary commitment, making it an excellent option for budget-conscious learners.

- Efficacy: Highly valued for its educational quality, catering to diverse learning pathways.

These recommended options buying courses provide significant flexibility and content depth, catering to aspiring traders while enhancing their understanding of the intricacies involved in options buying.

Benzinga Options Course

The Benzinga Options course is renowned for bridging the gap between education and actionable trading, encompassing practical experiences that set it apart from traditional courses. Here’s an outline of what this course entails:

- Course Type: Rather than a conventional course, Benzinga’s offering is centered around an options alert service that emphasizes real-world application and live trading insights.

- Cost: Priced at approximately $297 annually, this subscription provides sustained access to expert analysis and real-time trade opportunities.

- Content Overview: Subscribers gain access to biweekly trade alerts accompanied by detailed analyses from trader Nic Chahine, aimed at teaching the reasons behind each trade action and the strategies employed.

- Audience Suitability: The course is designed for traders at different experience levels. Novices can learn through executed alerts while more experienced traders benefit from the actionable insights and strategies.

- Learning Methodology: The focus is on learning through doing actively participating in trades provides immediate feedback and fosters independent trading skills among learners.

- Flexibility: Trades cater to varying account sizes and assist traders in adapting strategies based on their risk tolerance and financial goals.

In summary, the Benzinga Options course effectively combines education with practical application. It equips traders with insights from real-time market analyses, allowing them to enhance their understanding and apply strategies confidently in real-world scenarios.

Udemy Options Trading Basics

Udemy’s Options Trading Basics course serves as an exemplary foundation for aspiring options traders. Here’s a detailed overview of this highly rated course:

- Course Structure: Spanning approximately 11.5 hours, this course integrates video lectures, downloadable resources, and quizzes that bolster understanding and retention of concepts.

- Course Content: It covers essential topics from the basics of options to practical strategies including risk management practices, market analysis, and various strategies for trading calls and puts.

- Rating and Feedback: With an average rating of 4.4 stars from over 56,700 students, the course has garnered substantial positive feedback, establishing a reputation for effectiveness in teaching newcomers.

- Cost: Udemy frequently offers discounts that can reduce the purchase price, making it budget-friendly for learners seeking quality education without a high investment.

- Audience Target: This course is ideally suited for beginners who wish to develop a solid grounding in options trading principles, although more experienced traders may find refreshment in the content.

In summary, Udemy’s Options Trading Basics course provides an engaging entry point for those new to options trading. It emphasizes clear and structured content, fostering comprehension while maximizing access to vital learning resources.

Option Alpha Free Courses

Option Alpha is a recognized hub for options trading education, particularly valued for its free resources. Here’s an overview of what learners can expect from Option Alpha’s offerings:

- Comprehensive Curriculum: Option Alpha provides structured curriculum-based training that covers everything from beginner to advanced strategies in options trading.

- Cost-Effective Learning: All courses available on Option Alpha are free, making it a perfect entry point for those looking to dip their toes into options trading without financial commitment.

- Content Diversity: The platform offers a range of educational materials, including video content, downloadable resources, and articles focusing on the nuances of buying options.

- Mentorship Opportunities: The community aspect of Option Alpha allows participants to engage with experienced traders and receive mentorship, significantly enhancing their learning experience.

- User-Focused Design: The site’s user-friendly interface makes navigation seamless, allowing learners to discover resources that cater to their individual learning goals.

In summary, Option Alpha’s free courses provide an excellent opportunity for aspiring traders to absorb options trading concepts without requiring a financial investment. This platform stands out for its commitment to comprehensive education and community support.

User Reviews and Testimonials

User reviews and testimonials play a vital role in assessing the overall effectiveness and value of options trading courses. Analyzing firsthand accounts reveals insights directly from course participants, providing clarity on what learners can expect.

- Positive Transformations: Numerous testimonials reflect how graduates of these courses gained confidence and a deeper understanding of options trading concepts, ultimately leading them to make informed trading decisions. For example, students have reported successfully executing trades based on strategies learned, leading to substantial profits.

- Engaging Content Delivery: Many users appreciate engaging content and teaching styles, praising instructors who incorporate practical examples and real-world applications into their lessons. Reviews commonly highlight those who walk the learners through trade scenarios, reinforcing applies knowledge.

- Course Experience: Testimonials frequently discuss the overall course experience regarding accessibility, availability of support, and interactivity. Effective courses encourage student engagement and foster community learning, often resulting in supportive networking opportunities among learners.

- Credibility Boost: Positive user experiences serve as social proof, often influencing prospective students’ decisions to enroll in specific courses. High ratings and encouraging reviews can sway cautious individuals seeking quality education.

- Addressing User Concerns: While many testimonials are positive, constructive criticism also aids prospective learners in choosing the right options trading course. Addressing concerns like unclear content or lack of hands-on practice informs potential buyers of the resources that require careful consideration.

In conclusion, user reviews and testimonials provide valuable insights into the actual impacts of options trading courses. They illuminate the necessary elements that contribute to effective learning, ultimately guiding prospective students toward making informed decisions about their educational investments.

Success Stories from Course Graduates

Success stories from graduates of options trading courses provide inspirational and motivational insights that showcase the practical application of learned skills. They serve as testimonials to the profound impact of comprehensive options education.

- Real Examples of Profitability: Many graduates share accounts of entering the options market with little knowledge, only to transform their educational experiences into successful trading careers. Some highlight significant profits made through trades directly following their learning, emphasizing how effective education can substantially elevate trading success.

- Transitioning Careers: Some learners recount shifting careers due to their newfound passion and success in options trading. With solid foundations in the subject, individuals now enjoy financial independence and fulfilling careers in trading markets, showcasing the transformative power of effective learning.

- Overcoming Challenges: Several success stories include narratives of overcoming initial hesitance or struggles with complex concepts. By persevering through challenging concepts presented in their training, these graduates managed to gain the confidence to execute trades in real-time markets successfully, emphasizing the importance of persistence.

- Building a Community: Graduates often attribute their success to the supportive learning environment created by their courses. Many report forging lasting connections and collaborative partnerships in trading networks, which have enhanced their skills and broadened their trading perspectives.

- Emphasis on Continuous Learning: Many success stories underscore the ongoing nature of learning in options trading, encouraging graduates to stay updated with market trends and strategies. They often stress the importance of building upon foundational knowledge and seeking advanced resources that continuously sharpen their skill set.

In summary, success stories from course graduates inspire potential learners by illustrating the transformative power of options trading education. These narratives highlight how effective courses empower individuals to overcome challenges, achieve profitability, and foster a collaborative trading environment.

Common Challenges Faced by Learners

Despite the potential rewards of options trading, learners often encounter several common challenges that can impede their progress. Identifying these obstacles is crucial for ensuring a successful learning journey.

- Navigating Complexity: The intricate nature of options trading can overwhelm newcomers. Faced with a plethora of jargon, concepts, and strategies, learners may find it challenging to grasp essential principles. A well-structured course that distills complexity into manageable lessons helps alleviate this concern.

- Emotional Decision-Making: Trading inherently comes with emotional highs and lows. Some learners wrestle with anxiety, fear, or overconfidence, leading to impulsive decision-making in trading. Learning effective risk management and discipline can greatly mitigate emotional impacts.

- Lack of Practice: Gaining theoretical knowledge is crucial, but many learners struggle to bridge the gap between theory and practice. Engaging in simulated trading or using paper trading strategies before committing real money can help build practical skills.

- Information Overload: The vast resources available online may contribute to information overload. Many people face difficulties sorting through varying strategies and opinions within the trading community, leading to confusion. Curating reliable sources of information and focusing on structured courses can enhance clarity.

- Time Constraints: With busy schedules, many learners find it difficult to consistently commit time to studying options trading. Creating a structured, blended learning experience, such as short daily practice sessions, can prove beneficial for fitting education into tight schedules.

In summary, recognizing the common challenges faced by learners can facilitate more effective and supportive educational environments. By addressing issues like complexity, emotional decision-making, lack of practice, information overload, and time constraints, educational resources can be tailored to help learners navigate these hurdles and foster successful outcomes in options trading.

Expert Opinions on Course Effectiveness

Experts in the field of finance and trading frequently share opinions on the effectiveness of options trading courses, providing valuable insights that help aspiring traders make informed decisions.

- Credibility of Instructors: Many experts emphasize the importance of learning from credible instructors with proven experience in trading. Their unique insights and real-world examples can provide significant value, enhancing students’ understanding of complex concepts.

- Content Relevance: Experts advocate for courses that focus on relevant and practical content. They stress the need for courses that adapt to current market conditions and provide ongoing updates for students, ensuring that trading strategies remain applicable and effective.

- Behavioral Elements: A growing number of experts highlight the psychological aspects of trading as pivotal for success. They recommend courses that include behavioral finance teachings, equipping learners with the tools to navigate emotional challenges associated with trading activities.

- Community and Support: Several experts assert that learners benefit from access to a supportive trading community. Engaging in peer discussions and mentorship fosters collaborative learning, encouraging students to share insights and challenges encountered during their trading journeys.

- Continuous Improvement: Expert opinions largely support the notion of continuous education. Successful traders often emphasize lifelong learning, advocating for ongoing education that encompasses new strategies and market dynamics as essential for long-term success.

In conclusion, expert opinions on the effectiveness of options trading courses guide aspiring traders to consider factors such as instructor credibility, relevant content, psychological training, community involvement, and the value of continuous improvement. Incorporating these elements into the selection process ultimately enables learners to optimize their paths to success in options trading.

Additional Resources for Option Buyers

For those eager to enhance their understanding of options trading, supplemental resources such as educational books, webinars, and online communities provide valuable insights and learning opportunities.

Educational Books and Articles

- Options as a Strategic Investment by Lawrence McMillan:

- This comprehensive guide offers in-depth strategies designed to maximize profitability while minimizing risk, catering to both beginners and seasoned traders.

- Options Trading for Dummies by Joe Duarte:

- A user-friendly introduction breaking down complex concepts into digestible terms, equipping beginners with the tools to understand options trading fundamentals.

- Understanding Options by Michael Sincere:

- This handbook makes critical principles accessible, covering buy/sell strategies and practical tips, making it ideal for newcomers exploring options trading.

- Option Volatility and Pricing by Sheldon Natenberg:

- Provides deep insights into options pricing and market volatility’s impact, complementing the knowledge necessary for effective trade execution.

- The Ultimate Options Trading Strategy Guide for Beginners by Abraham:

- Aimed at entry-level traders, this guide outlines effective low-risk techniques for identifying opportunities in options trading.

Webinars and Live Trading Sessions

- Elearnmarkets:

- Offers various webinars focused on options trading strategies, featuring topics like identifying low-risk setups and trading based on volatility levels.

- Firstrade:

- Provides weekly morning market overviews with options trading strategies, featuring an interactive format that encourages discussion.

- Online Broker Resources:

- Brokerages such as Interactive Brokers and TD Ameritrade host regular webinars and workshops, covering fundamentals of options trading and strategy applications.

Online Communities and Forums

- Elearnmarkets Community:

- Engages participants in discussion groups after webinars, fostering collaboration among traders to share strategies and outcomes.

- Reddit and StockTwits:

- Popular platforms where traders share insights on options trading strategies and market trends, fostering a sense of community support.

In conclusion, leveraging additional resources like educational books, webinars, and online communities significantly enriches the learning experience in options trading. By combining these resources with formal courses, learners can develop a well-rounded understanding of options trading and enhance their proficiency.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Option Buying Course” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.