Project Finance Modeling for Renewable Energy with Gregory Ahuy & Bekzod Kasimov – Financial Model Online

165,00 $ Original price was: 165,00 $.23,00 $Current price is: 23,00 $.

Download Project Finance Modeling for Renewable Energy with Gregory Ahuy & Bekzod Kasimov – Financial Model Online, check content proof here:

Review of Project Finance Modeling for Renewable Energy

In recent years, the world has pivoted dramatically towards renewable energy as the globe grapples with climate change and dwindling fossil fuel reserves. The transition necessitates a new breed of financial expertise capable of navigating the complexities of financing projects in wind and solar energy. This is where the course “Project Finance Modeling for Renewable Energy,” led by the insightful Gregory Ahuy, comes into play.

Hosted on platforms like Udemy, this course is not merely an academic exercise; it provides a bridge between theory and practice, empowering participants with the skills necessary to construct comprehensive financial models tailored to the unique demands of renewable energy projects.

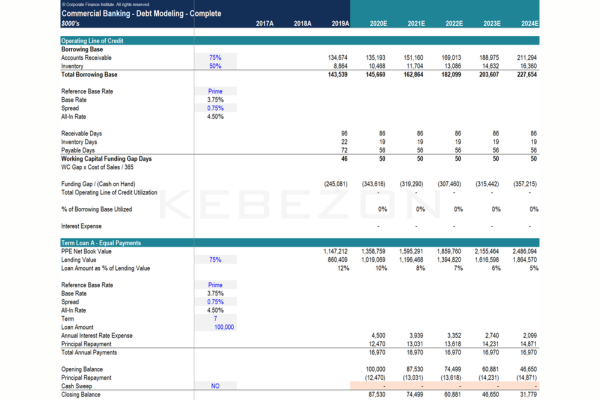

The essence of the course lies in its structured approach, focusing on essential tools like Excel to create intricate financial models from scratch. This capacity is vital for effective investment analysis, structuring intricate debt arrangements, and evaluating operational scenarios that can make or break green projects.

By marrying theoretical concepts with hands-on practice, participants unlock a wealth of knowledge, allowing them to move confidently in the renewable energy arena. The course is methodical, ensuring that even novice learners emerge proficient in financial modeling, equipped to tackle real-world challenges endemic to renewable project financing.

Course Overview and Curriculum

Theoretical Foundation and Practical Applications

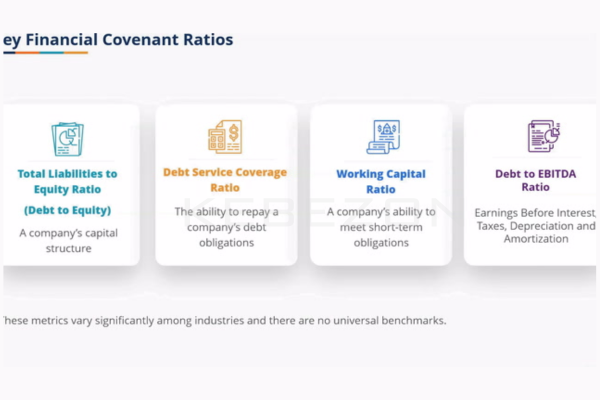

At the heart of Gregory Ahuy’s course is a curriculum designed to navigate the labyrinth of project finance modeling specifically for renewable energy initiatives. The learner embarks on a journey where foundational knowledge meets practical applications. The program’s comprehensive structure encompasses vital topics necessary for financial modeling, including debt sizing, cash flow modeling, and integrating pivotal performance profiles like P50 and P99 into their analyses. P50 and P99 refer to the expected energy output of the project at a confidence level of fifty and ninety-nine percent, respectively, thus providing critical insights into risk management and revenue forecasting.

This structured learning environment is akin to building a skyscraper; one must lay solid foundations before constructing higher stories. The course adeptly teaches participants to create robust financial frameworks that withstand scrutiny from investors and stakeholders. Just as a well-engineered building remains standing against the worst of weather, a well-designed financial model provides stability to renewable projects under volatile market conditions. Furthermore, the incorporation of advanced Excel features, including Visual Basic for Applications (VBA) to address circularities, presents students with useful skills for managing complex financial scenarios, thus enhancing the practicality of the learning experience.

Advanced Features and Specialized Knowledge

One of the distinguishing attributes of this course is its in-depth exploration of advanced financial instruments tailored for renewable energy projects. Participants delve into the intricacies of tax equity structures, understanding how these arrangements can optimize returns and mitigate risk exposure. Such specialized knowledge enables participants to grasp the nuances of financing arrangements, equipping them with tools to structure transactions effectively. The challenge of designing cash flows and investment returns is approached systematically, breaking down complex components into digestible modules that foster understanding.

Moreover, understanding the regulatory landscape is integral to the curriculum. It emphasizes how regulations shape renewable project financing and highlights financial instruments designed to manage inherent risks within this sector. This dual focus on technical modeling and regulatory considerations mirrors the multifaceted demands of the industry, ensuring learners are well-prepared to enter the workforce with a competitive edge.

Real-World Application and Career Preparation

The course stands out as a facilitator of real-world applications. Beyond understanding theoretical constructs, participants are challenged to confront actual scenarios faced by professionals in investment banks, private equity firms, and financial advisory roles. By immersing themselves in this learning experience, participants gain not only the analytical prowess but also the confidence to navigate the complexities of financing renewable energy projects. Thus, the course becomes a springboard into careers that demand a delicate balance between finance and environmental stewardship.

This alignment with industry needs is further reinforced by the excellent reviews the course has garnered from previous participants. Many have noted its effectiveness in enhancing their practical skills and confidence levels in project finance modelling for renewable energy contexts, illustrating a track record of producing highly competent professionals ready to tackle contemporary challenges.

Key Components of the Course

| Component | Description |

| Debt Sizing | Strategies for determining the optimal level of debt to maximize returns while minimizing risks. |

| Cash Flow Modeling | Techniques to create realistic cash flow projections vital for investor analysis. |

| Performance Profiles (P50, P99) | Tools to model various operational scenarios, understanding risk and probability in energy output. |

| Excel VBA for Circularities | Advanced skills for managing complex financial modeling challenges, increasing model efficiency. |

| Tax Equity Structures | In-depth examination of tax benefits and financing options to optimize project investment returns. |

| Regulatory Considerations | Exploration of regulatory frameworks affecting project financing in the renewable energy sector. |

The Unique Nature of Renewable Energy Projects

In addressing the specifics of renewable energy projects, the course highlights their distinct financial landscapes compared to traditional energy projects. One of the most striking differences is the reliance on federal and state incentives that can significantly impact project viability. Unlike conventional projects that may not rely as heavily on such incentives, renewable energy initiatives often incorporate mechanisms like feed-in tariffs and tax credits, which are integral in shaping financial models.

This distinction emphasizes the need for a robust understanding of project finance modeling, as successful investors must discern how these elements interplay to affect cash flow and overall project feasibility. Gregory Ahuy’s emphasis on these unique requirements ensures that participants are not only equipped to build models but understand the nuances that differentiate renewable projects in the financial landscape.

Closing Thoughts on Course Value

The value embedded in Gregory Ahuy’s course extends beyond mere numbers and equations. It integrates a passionate commitment to developing the next generation of financial analysts who will play a crucial role in promoting sustainable energy solutions. By fostering critical thinking and a comprehensive approach to project financing, participants can emerge as leaders equipped to confront the exigent challenges presented by the transition to a renewable economy. It’s not just a course; it’s a transformative journey that equips individuals to contribute meaningfully towards a sustainable future.

The decision to enroll in “Project Finance Modeling for Renewable Energy” is a step toward future-proofing one’s career while contributing to an imperative global cause. The blend of theoretical grounding and practical training prepares the groundwork for individuals aspiring to make substantial impacts in their chosen fields while addressing pressing environmental challenges.

Conclusion

As the demand for renewable energy continues to rise inexorably, the need for skilled financial professionals who can successfully navigate this sector becomes ever more critical. Gregory Ahuy’s course on project finance modeling serves as an essential resource for those looking to harness their abilities in a meaningful way.

As participants learn to build sophisticated financial models and understand the unique challenges surrounding renewable energy projects, they are not only preparing for robust careers but also championing the transformation of our global energy landscape toward a sustainable future. This course represents a courageous march into the realm of renewable energy finance, armoring participants with the skills, knowledge, and confidence they need to succeed.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Project Finance Modeling for Renewable Energy with Gregory Ahuy & Bekzod Kasimov – Financial Model Online” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.