Real Estate Fundamentals – Kyle Peterdy – CFI Education

15,00 $

You may check content proof of “Real Estate Fundamentals – Kyle Peterdy – CFI Education” below:

Real estate fundamentals – Kyle Peterdy: An In-depth Exploration

In the ever-evolving landscape of finance, understanding the nuances of various asset classes is imperative for success. One of the most significant asset classes, real estate, stands out for its inherent complexities and opportunities. “Real estate fundamentals” by Kyle Peterdy serves as a beacon of knowledge for those eager to navigate this intricate domain.

This book is not merely a collection of theories; it is a robust groundwork that equips readers with practical skills and insights into real estate investment and management. Through Peterdy’s comprehensive approach, readers from various backgrounds can grasp the essential principles that govern real estate markets, making it an invaluable resource for both novices and seasoned professionals.

Introduction to Real Estate Fundamentals

The book encompasses various aspects of real estate, shedding light on property types, market dynamics, investment analysis, and financing options. Each section is meticulously crafted to ensure a well-rounded understanding of real estate as an asset class. Delving into these topics, Peterdy offers a blend of theoretical frameworks and practical advice, making complex concepts digestible for readers new to the field.

Moreover, “Real estate fundamentals” serves as a bridge, connecting abstract financial theories to tangible real-world applications. Through Peterdy’s keen insights, readers can effectively transition from mere knowledge acquisition to the practical implementation of strategies in real estate transactions. Given the volatility of the market and shifting economic indicators, this book equips individuals with the necessary tools to make informed decisions, assess risks effectively, and seize opportunities as they arise.

Key Aspects of Real Estate

One of the book’s standout features is its thorough exploration of different property types. Understanding the distinctions between residential, commercial, and industrial real estate is essential for anyone looking to invest or engage in property management. Peterdy also discusses niche markets such as retail spaces and mixed-use developments, allowing readers to appreciate the diverse spectrum of opportunities within the real estate landscape. Below is a summary of property types and their characteristics:

| Property Type | Characteristics | Investment Potential |

| Residential | Homes, apartments, condominiums | Steady demand, but can be sensitive to market fluctuations. |

| Commercial | Office buildings, shopping centers | Higher yields, long-term leases but involves more risk. |

| Industrial | Warehouses, manufacturing facilities | Growing demand due to e-commerce expansion. |

| Retail | Stores, shopping malls | Vulnerable to economic downturns but essential for community. |

| Mixed-Use | Combines residential, commercial, and retail elements | Diverse income streams, resilient in varying markets. |

Within each category lies unique dynamics and investment strategies, and Peterdy provides practical examples to illustrate these distinctions, enabling readers to step beyond the definitions and appreciate the real-world relevance of each type.

Market Dynamics and Investment Analysis

A significant section of “Real estate fundamentals” is dedicated to market dynamics, offering insights into factors that influence real estate value and investment viability. Market trends, economic indicators, and demographic shifts are examined in detail. For instance, the impact of interest rates on property affordability and investment attractiveness is a crucial component Peterdy highlights, informing readers how macroeconomic changes can ripple through the real estate sector.

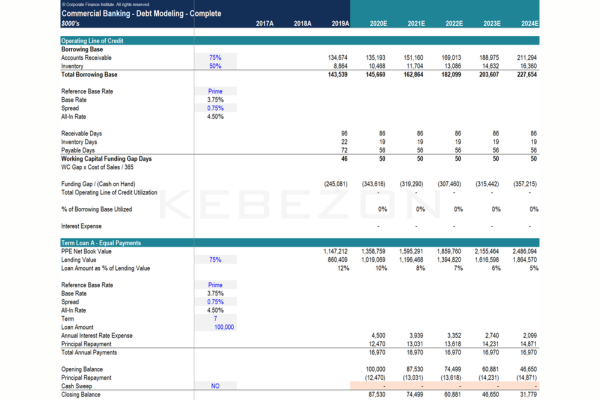

Furthermore, investment analysis is essential for anyone considering real estate as a viable asset. Peterdy introduces various analytical frameworks, including market research methodologies, financial modeling, and cash flow analysis. An emotional connection emerges when discussing the potential for creating long-term wealth through astute investment decisions. By providing a sound analytical approach, the author enables readers to make data-driven decisions that can lead to fruitful investment opportunities.

As Peterdy emphasizes, understanding the interplay of market forces can transform one’s investment strategy. He draws on various case studies, illustrating how shifts in consumer behavior or economic conditions have historically impacted property values, making the content not just theoretical but also deeply applicable.

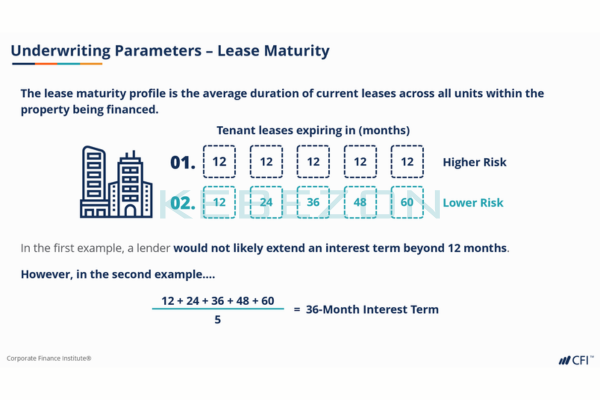

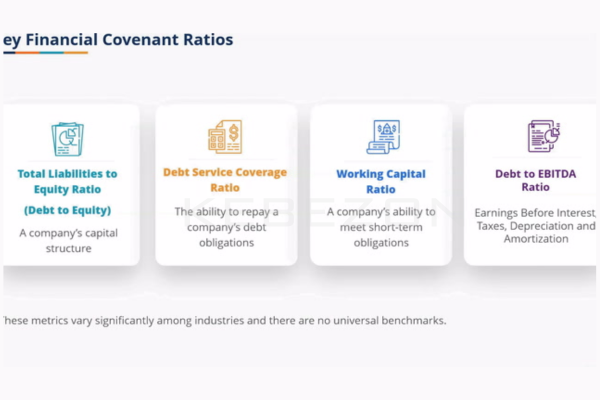

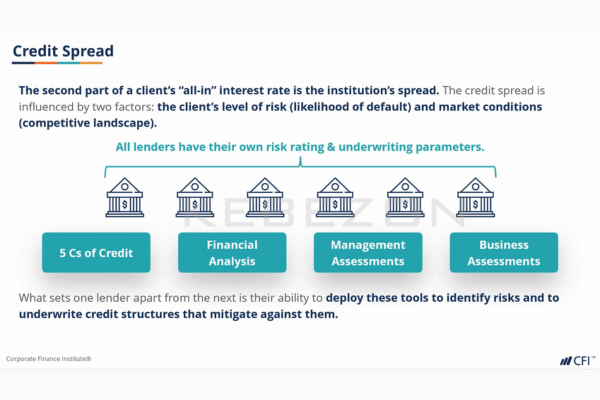

Financing Options and Risk Management

Financing is at the core of real estate transactions, and understanding the various avenues for acquiring funding is essential for any aspiring investor. “Real estate fundamentals” delves into traditional financing methods, such as mortgages and commercial loans, as well as alternative options like crowdfunding and partnerships. Peterdy’s extensive background in commercial banking and credit shines through in this section, as he elucidates the complexities of financing, breaking down critical terminology and concepts for clarity.

Additionally, risk management is a paramount concern within real estate investing. Peterdy offers comprehensive advice on identifying potential risks ranging from property market downturns to changes in legislation and employing strategies to mitigate these pitfalls. His hands-on approach reinforces the notion that while risks exist, informed decision-making and strategic planning can lead to favorable outcomes.

To enhance the reader’s understanding, Peterdy lists several common financing options with their respective advantages and disadvantages, which may look something like this:

| Financing Option | Advantages | Disadvantages |

| Conventional Mortgage | Lower interest rates, predictable payments | Strict qualification requirements, can involve lengthy approval processes. |

| Commercial Loans | Higher loan amounts, tailored terms | Often requires substantial collateral to secure a loan. |

| Crowdfunding | Access to capital without large individual investments | Often involves higher risk and less control over investments. |

| Partnerships | Allows sharing of risk and responsibilities | Potential for disputes among partners over decisions. |

By clearly stating these options, Peterdy ensures that readers can make informed choices, depending on their unique financial circumstances and investment objectives.

Practical Applications and Real-World Examples

Peterdy’s commitment to a practical understanding of real estate is evident throughout the book. He illustrates key concepts using real-world examples drawn from his extensive experience in managing commercial real estate transactions. This practical lens allows readers to connect theoretical knowledge to the realities of the marketplace, instilling confidence as they consider their own endeavors in real estate.

The use of case studies throughout “Real estate fundamentals” serves as powerful reinforcement of the concepts introduced earlier. By showcasing real-life scenarios successes, challenges, and lessons learned Peterdy offers invaluable insights into the complexities of real estate investment. For instance, he reviews projects that succeeded through innovative financing structures or detailed market analysis, as well as those that failed due to oversight or lack of due diligence.

The emotional weight of these stories can also resonate deeply with readers. The challenges faced by real estate investors juggling financial constraints, tenant relationships, and market volatility are real and palpable. In sharing these experiences, Peterdy creates a sense of camaraderie, inspiring readers to embark on their own journeys with both caution and enthusiasm.

Conclusion

In conclusion, “Real estate fundamentals by Kyle Peterdy” stands as a seminal work for anyone looking to deepen their understanding of real estate as an asset class. Whether you are a bright-eyed newcomer or an experienced professional, this book equips you with the knowledge and tools necessary to navigate the complex world of real estate investment.

Through a blend of theoretical principles and practical application, Peterdy lays a solid foundation for readers to build upon, fostering a sense of empowerment and confidence in their real estate endeavors. Understanding the fundamentals is key to unlocking the doors of opportunity in this thriving sector, and with Peterdy’s insights, readers are well on their way to achieving their financial goals in real estate.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Real Estate Fundamentals – Kyle Peterdy – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.