Renewable Energy – Solar Financial Modeling with Antoine Bishara – CFI Education

15,00 $

You may check content proof of “Renewable Energy – Solar Financial Modeling with Antoine Bishara – CFI Education” below:

A Comprehensive Review of Renewable Energy: Solar Financial Modeling – Antoine Bishara

As the world edges closer to greener alternatives, the importance of understanding the financial dynamics that underpin renewable energy projects becomes paramount. The “renewable energy – solar financial modeling” course led by Antoine Bishara through the Corporate Finance Institute (CFI) is designed to illuminate the path for finance professionals navigating the solar energy sector.

With a focus on financial modeling tailored to solar projects, this course combines theoretical foundations with practical applications, empowering participants with the requisite skills to evaluate renewable energy ventures effectively. This article delves into the course’s curriculum, participant feedback, and its relevance in today’s rapidly evolving energy landscape, revealing both its strengths and areas for improvement.

Overview of the Course Content

Curriculum Highlights

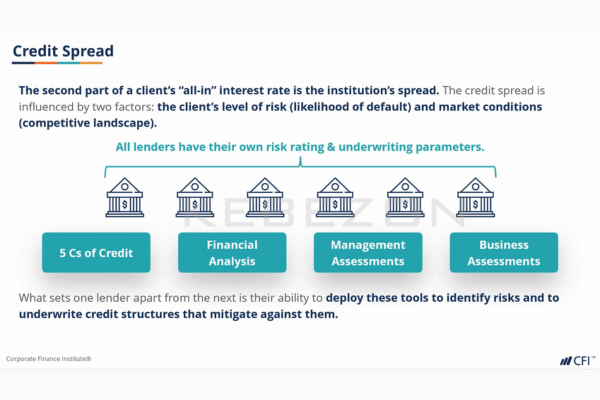

Antoine Bishara’s course covers an array of essential topics catered specifically to the intricacies of solar energy projects. The curriculum begins by addressing the development timeline of solar initiatives, a critical component for anyone involved in the planning and execution of these projects. Understanding the timeline aids professionals in grasping how long each phase from inception to operation takes and what milestones are critical for success. Additionally, the course emphasizes the funding structure of solar projects, which is fundamental for financial modeling and investment evaluation.

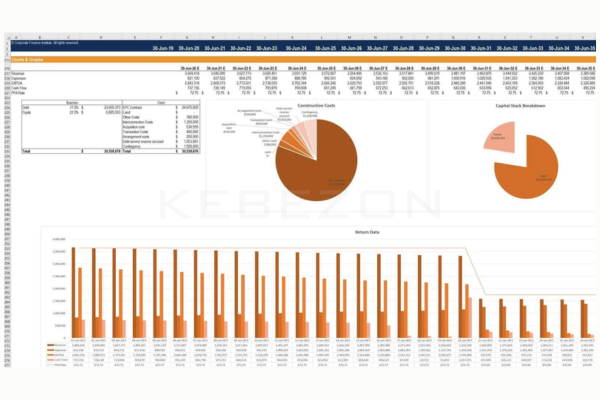

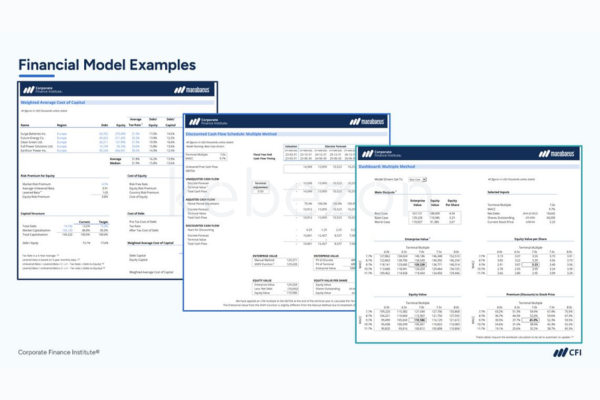

To provide a comprehensive learning experience, the course includes vital financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and in-depth cash flow analysis. Each of these components plays a critical role in assessing the feasibility and profitability of solar projects. For instance, NPV assists in determining the value of future cash flows relative to their present value, providing a snapshot of a project’s potential profitability.

Moreover, participants engage with a practical case study that utilizes a confidential information memorandum containing essential financial details. This hands-on approach reinforces the theoretical knowledge gained through the coursework, allowing students to apply learned concepts to real-world scenarios, transforming abstract numbers into tangible insights.

Skills Development

An important prerequisite for this course is a basic understanding of Excel and financial modeling. Due to the sophisticated nature of financial concepts introduced, proficiency in applying these techniques is crucial for participants to fully benefit from the curriculum. By fostering a solid skill set in Excel, learners can navigate complex data and employ advanced formulas to project future cash flows effectively an invaluable skill in an industry where every penny counts.

This blending of theoretical and practical skills creates a dynamic learning environment where finance professionals emerge with a heightened ability to analyze, model, and ultimately make informed decisions regarding solar investments. Participants leave with a robust understanding of how to operationalize financial strategies in a burgeoning sector that is steering the world toward sustainability.

Participant Feedback and Course Impact

Mixed Reactions

The feedback from participants who have undertaken this course presents a nuanced perspective. Many students commend the clarity and depth provided, expressing that the course equips them with crucial knowledge that is directly applicable to their careers in renewable energy. Anecdotal evidence suggests that several professionals felt a marked increase in confidence when addressing renewable energy financial models, illustrating the course’s impact on career growth and professional development.

However, not all responses have been universally positive. A subset of students has highlighted areas for improvement. For instance, there are mentions of the need for more detailed explanations in specific sections of the curriculum. While the course material is rich, some learners found that certain concepts could benefit from added clarity. Furthermore, participants noted challenges regarding the pacing of instruction. The balance between providing sufficient detail and maintaining a steady workflow is delicate, and adjustments may enhance the overall learning experience for future cohorts.

Real-World Applicability

The course’s relevance in the evolving renewable energy landscape cannot be overstated. As global investments in solar energy surge, the skills acquired through Bishara’s course provide an essential toolkit for finance professionals. According to a report by the International Energy Agency, solar energy could become the dominant source of electricity by 2030, underscoring the urgent need for trained professionals capable of navigating this field.

The ability to model financial data accurately is increasingly sought after in job markets that emphasize sustainability and renewable energy expertise. The skills learned in this course can pave the way for numerous career opportunities, enabling participants to position themselves favorably in a competitive job landscape.

Conclusion

Antoine Bishara’s “renewable energy – solar financial modeling” course is a significant learning opportunity for finance professionals engaged in or pursuing careers in the solar energy sector. By covering essential topics such as timelines, funding structures, and key financial metrics, the course equips participants with both theoretical knowledge and practical skills necessary for effective decision-making. Despite mixed feedback regarding certain instructional aspects, the overall educational experience appears valuable for those looking to deepen their understanding of solar finance.

As the renewable energy sector continues to expand, the importance of adept financial modeling cannot be overstated. The knowledge and skills gained from this course reinforce not only individual careers but also contribute to the broader goal of transitioning the world toward sustainable energy sources. As funding structures and timelines remain complex, courses such as this provide an irreplaceable foundation for success in this vital industry. With each student who completes the course, the ripple effect enhances the capacity of finance professionals to contribute to a greener future.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Renewable Energy – Solar Financial Modeling with Antoine Bishara – CFI Education” Cancel reply

You must be logged in to post a review.

Related products

Finance

Finance

Reviews

There are no reviews yet.