Scalping Dow Jones 30 (DJI30) course – Live Trading Sessions with ISSAC Asimov

5,00 $

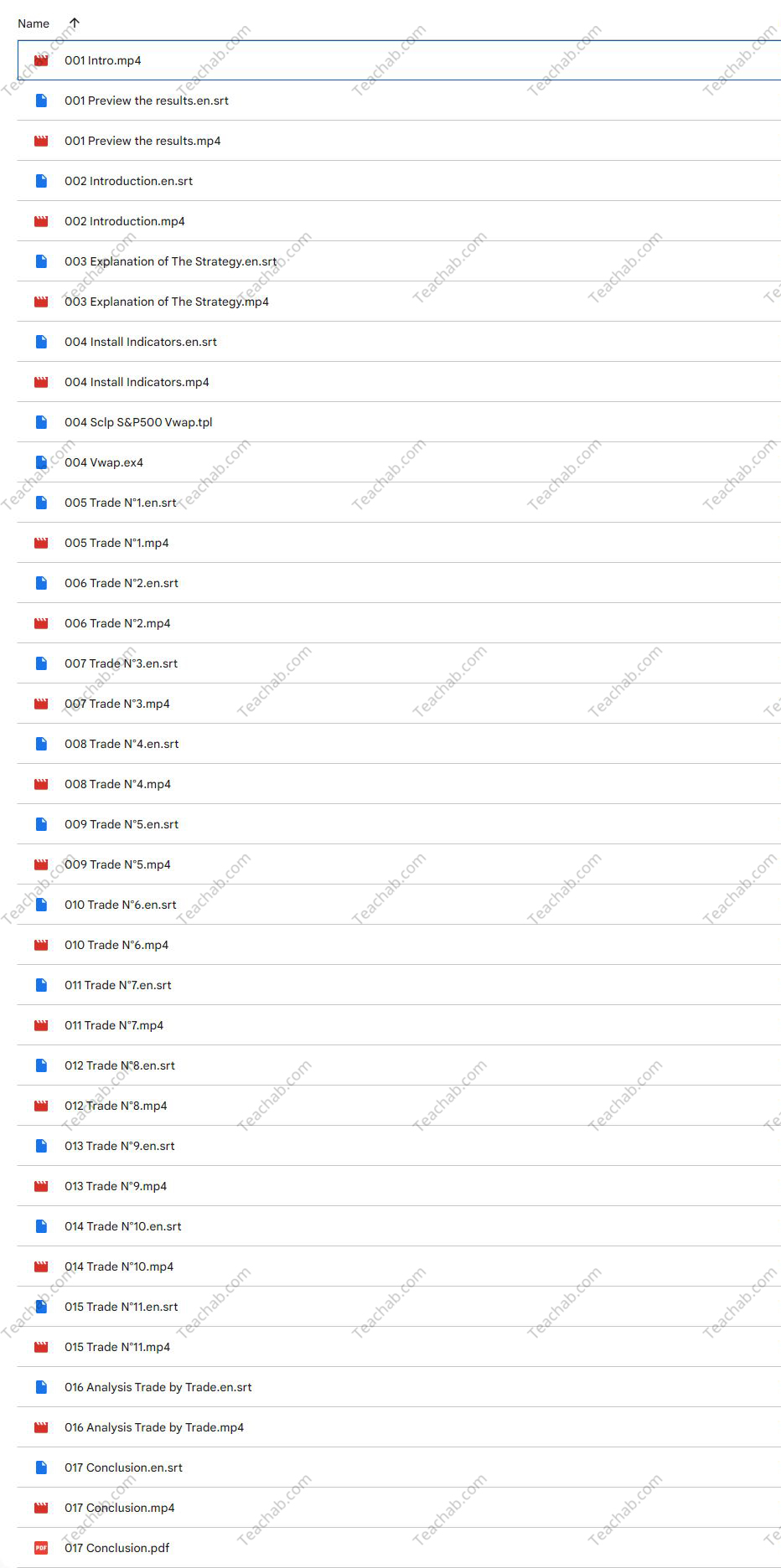

You may check content proof of “Scalping Dow Jones 30 (DJI30) course – Live Trading Sessions with ISSAC Asimov” below:

Scalping Dow Jones 30 (DJI30) Course – Live Trading Sessions – Isaac Asimov

In the frenetic world of financial trading, particularly when maneuvering the volatile waters of the Dow Jones Industrial Average (DJIA), traders constantly seek strategies that promise efficiency without undue stress. The “Scalping Dow Jones 30 (DJI30) Course – Live Trading Sessions” by Isaac Asimov emerges as a beacon for both newcomers and seasoned traders alike.

With its focus on scalping a strategy that prioritizes quick, decisive trades the course not only demystifies trading concepts but also engages participants through live demonstrations, offering a unique hands-on learning experience. As we delve deeper into this course, we will explore the feedback it has garnered, breaking down its methodologies, techniques, and the overall sentiment surrounding its effectiveness.

Course Overview and Core Principles

The course is designed around the principles of scalping, where traders make multiple small profits throughout the day by entering and exiting positions quickly. By condensing complex trading strategies into digestible segments, the course makes skill acquisition feel less daunting. Asimov places significant emphasis on practical applications, which resonates deeply with participants. This hands-on approach transforms theoretical knowledge into actionable trading strategies.

Key Components of the Course

The curriculum is robust, covering various essential aspects vital for any trader seeking success in the stock market, particularly within the Dow Jones. Below is a summary of some pivotal topics included in the course:

- Effective Trading Methods: Strategies tailored for low-frequency trading that focus on precise timing rather than sheer volume.

- Risk Management: Understanding how to mitigate losses while maximizing gains.

- Emotional Control: Techniques to maintain composure and make sound decisions during trading volatile markets.

These components are not standalone lessons but interlinked concepts essential for building a cohesive trading strategy. Asimov’s methodology roots itself in understanding market rhythms and reacting to them with measured responses rather than frantic maneuvers.

The Scalping Strategy: An In-Depth Look

What distinguishes Asimov’s course from other trading tutorials is its focus on a scalping strategy that prioritizes fewer transactions with heightened accuracy. The emphasis on low-frequency trading underpins a philosophy of quality over quantity, steering away from the frantic pace that often characterizes trading. This strategy not only aids in minimizing transaction costs but also grants traders the necessary breathing room to reflect on their moves.

Advantages of the Scalping Approach

- Reduced Transaction Costs: By making fewer trades, traders can save on commissions and other fees that can accumulate with higher-frequency trading.

- Less Stress and Overtrading: The calmer approach allows traders to avoid the pitfalls of emotional, impulsive decisions which often lead to losses.

- Concentration on Strategy: A well-timed trade can be far more effective than a barrage of smaller, less calculated ones.

In terms of psychological resilience, Asimov places significant weight on managing emotions a crucial yet often overlooked element of trading. By promoting a disciplined mindset, the course aims to build traders capable of enduring market reversals without succumbing to panic, akin to a sailor navigating stormy seas.

Live Demonstrations and Practical Applications

One of the standout features of Asimov’s course is the inclusion of live trading sessions. During these segments, participants are granted candid insights into the mind of an experienced trader, allowing them to witness strategies in action. This immersive experience fractures the isolation that often accompanies online learning, fostering community and engagement among participants.

Participant Experiences and Testimonials

Feedback from individuals who have taken the course has overwhelmingly been positive, particularly regarding the clarity of explanations and the live sessions. Many have noted the following aspects:

- Clear and Simple Explanations: Complex ideas are translated into accessible language, making the learning curve less steep.

- Real-World Applications: Live demonstrations enable learners to connect theory with practice effectively.

- Community Engagement: A motivated cohort of students allows for collaborative learning and support.

While these elements contribute significantly to the course’s success, some critiques have emerged regarding technical issues. Several participants reported challenges with tools such as the volume-weighted average price (VWAP), which is critical to the scalping strategy. Audio quality issues during sessions have also been flagged, indicating areas in need of improvement.

The Impact of Emotional Control in Trading

The course further advocates for the mental fortitude required to thrive in trading. Recognizing that trading is as much a psychological game as it is a tactical one, Asimov emphasizes emotional control as a fundamental pillar of successful trading. This focus on the trader’s mindset is paramount, especially during times of market turbulence.

Emotional Training Techniques

To enable traders to harness emotional intelligence, Asimov incorporates various techniques into the curriculum. Some key elements include:

- Meditation and Mindfulness: Practices to enhance focus and reduce stress during trades.

- Scenario Analysis: Evaluating past trades to understand emotional triggers and developing counter-strategies.

- Setting Realistic Goals: Establishing clear, attainable objectives fosters a sense of accomplishment without overwhelming pressure.

These components serve to develop traders who are not only skilled in transactions but are also resilient in their approach, capable of navigating the emotional highs and lows that come with trading.

Concluding Thoughts

The Scalping Dow Jones 30 (DJI30) Course – Live Trading Sessions by Isaac Asimov stands out for its approachable yet thorough examination of trading the Dow Jones. By blending theoretical knowledge with practical skills, it creates a comprehensive learning experience. Engaging live sessions further enhance the learning curve, making it more relatable and applicable to real-life trading situations.

Final Evaluation

In conclusion, this course is a remarkable resource for learners seeking to build a solid foundation in trading. With its structured approach, focus on emotional resilience, and tailored strategies, it is an excellent pathway for anyone looking to sharpen their trading prowess. Participants have faith that with the tools and insights they receive, they can venture into the trading world equipped to double their investments an aspiration that resonates deeply in the hearts of many traders. This promises not just knowledge but the potential for personal financial growth, encapsulating the hope and ambition that drives all traders forward.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Scalping Dow Jones 30 (DJI30) course – Live Trading Sessions with ISSAC Asimov” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Reviews

There are no reviews yet.