Securitized Products Part 1 By Andrew Loo – CFI Education

15,00 $

You may check content proof of “Securitized Products Part 1 By Andrew Loo – CFI Education” below:

A Deep Dive into Securitized Products: Part 1

Gaining an understanding of the complex world of securitized products is both thrilling and intimidating, much like traversing a wide ocean. In this intricate financial environment, Andrew Loo’s course, provided by the Corporate Finance Institute, acts as a lighthouse by shedding light on fundamental elements including structure, value, hazards, and the crucial function these products play in our financial system. This course encourages everyone to start a learning and discovery journey, regardless of whether they are seasoned professionals looking to expand their knowledge or beginners venturing into the world of finance.

In this article, we will dissect key components of the course, unraveling the magic behind the pooling of loans into marketable securities and delving into the mechanics of various types of securitized products. We will compare significant aspects of mortgage-backed securities (MBS), asset-backed securities (ABS), and collateralized loan obligations (CLO), while also engaging in an emotional exploration of risk, valuation, and practical applications.

Understanding Securitization and Its Importance

In contemporary finance, securitization is a crucial tool that connects investors and debtors. Imagine an artist painstakingly choosing several paint colors to build a gorgeous mural to get a sense of this process. Comparably, securitization enhances the financial environment by carefully combining individual loans to produce marketable securities.

What is Securitization?

The process of turning illiquid assets, such loans, into liquid and tradeable securities is known as securitization. This change gives investors a means to build diverse portfolios in addition to giving lenders liquidity. The basic phases of securitization are described throughout the course, including:

- Individual loans, such as mortgages, credit cards, or auto loans, are created at the loan origination stage.

- Pooling: A collection of assets intended for securitization is created by combining loans with comparable features.

- Tranching: After the financial instruments have been pooled, they are separated into several groups (tranches), each of which offers a distinct risk and return profile.

- Issuance: Lastly, investors receive the securities that are secured by these assets.

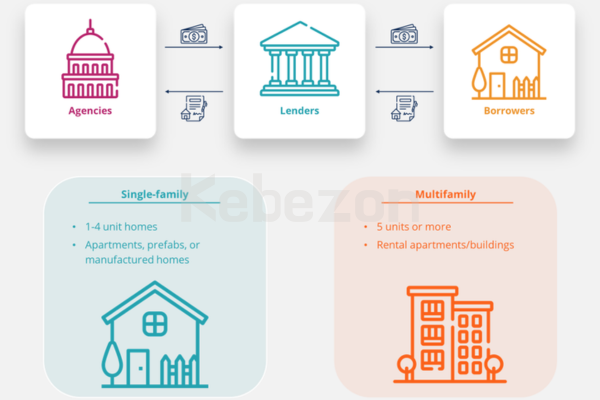

The Role of Different Market Participants

Navigating through securitized products requires an understanding of the key players involved. Each participant plays a vital role, working in synchrony like parts of a well-oiled machine:

- Originators: These are the institutions that create loans, such as banks and finance companies.

- Underwriters: They assess the risk of the loans and facilitate the sale of the securitized products.

- Servicers: These entities manage the ongoing cash flows from the underlying assets, ensuring timely payments to investors.

- Investors: They purchase the securities, providing the necessary capital for the origination of new loans.

With this collaborative effort, the strength of the securitization process is unveiled, illuminating how various market participants contribute to the financial ecosystem.

Types of Securitized Products

The course delves deep into three primary types of securitized products: Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS), and Collateralized Loan Obligations (CLO). Understanding these products is akin to identifying different species in a diverse ecosystem; each has its unique characteristics and appeal.

Mortgage-Backed Securities (MBS)

Mortgage loans are combined to generate MBS, which are subsequently offered for sale to investors. They fall into two primary categories:

- Pass-Through Securities: The cash flows produced by the underlying mortgages are used to pay investors directly.

- Mortgage payments are split up into many tranches with varying maturities and risk profiles in collateralized mortgage obligations (CMOs), which are more intricate arrangements.

Example of MBS

- Fannie Mae and Freddie Mac: These government-sponsored enterprises (GSEs) play a critical role in the MBS market, guaranteeing timely payment to investors to stimulate the mortgage market.

Asset-Backed Securities (ABS)

ABS stands for a range of debts, including credit card debt and school loans. Beyond conventional stocks and bonds, they give investors the chance to diversify their holdings. Important traits consist of:

- Student loans, home equity loans, and vehicle loans are examples of underlying assets.

- Cash Flow Structure: Investors get cash flows from the underlying assets in different security tranches, much like with MBS.

Example of ABS

- Credit Card ABS: When firms package credit card receivables into ABS, it creates an opportunity for investors to earn fixed returns based on consumer spending patterns.

Collateralized Loan Obligations (CLO)

CLOs are an advanced type of asset-backed securities that mostly consists of business loans. Their intricacy and possible rewards have attracted attention. Among the characteristics of CLOs are:

- Tranching Structure: To accommodate a broad spectrum of investor appetites and risk tolerances, CLOs are divided into many risk categories.

- Active Management: In contrast to static pools, portfolio managers actively manage CLOs, allowing them to purchase and sell loans in reaction to market circumstances with the goal of maximizing profits.

Understanding Valuation and Risks

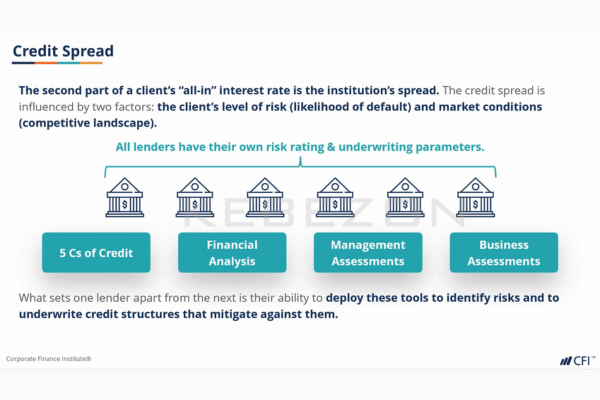

As we embark on the next section of the course, we must acknowledge the interplay ***ween valuation and risk. The nuances of assessing the value of securitized products are vast, often resembling a high-stakes balancing act.

Valuation Fundamentals

Securitized product valuation necessitates a thorough comprehension of cash flow analysis and the influence of several economic variables. Important ideas include:

- A popular valuation technique that involves discounting future cash flows to their present value is called discounted cash flow (DCF).

- Prepayment Speeds: Investor earnings are impacted by how quickly borrowers repay their loans; faster prepayments may result in lower interest revenue.

- Risk-Adjusted profits: To make well-informed allocation decisions, investors must weigh possible profits against the risks involved.

Risks in Securitized Products

The course dedicates significant attention to understanding the risks associated with securitized products, which can be likened to navigating through treacherous waters. Key risks include:

- Credit Risk: The risk that borrowers may default on their payments, leading to losses for investors.

- Interest Rate Risk: Fluctuating interest rates can impact the value of existing securities; a rise in rates may decrease the attractiveness of fixed coupon payments.

- Liquidity Risk: Certain securitized products may be challenging to sell quickly, especially in volatile markets.

Example of Credit Risk

- The risks of excessive leverage and the significance of due diligence in the underwriting of mortgage-backed securities were brought to light by the 2008 financial crisis. A sobering warning of the possible consequences of credit risk is provided by this catastrophe.

Practical Applications and Learning Tools

The course isn’t just about theory; it emphasizes practical applications and engaging learning tools that make the material accessible and actionable.

Interactive Learning Experience

Andrew Loo’s course incorporates a myriad of engaging formats to enhance the learning experience:

- Instructional videos: These help with comprehension by offering visual insights into difficult subjects.

- Interactive Exercises: To foster a practical grasp of securitization mechanics, participants are urged to apply newly taught principles.

- Assessments: By ensuring that information is firmly established, quizzes and assessments serve to reinforce learning.

Real-World Applications

The knowledge gained through this course is invaluable for various aspects of finance-related careers. Professionals equipped with an understanding of securitized products can make informed investment decisions, assess risk implications, and navigate the securitization landscape more efficiently. Here are a few career paths that benefit significantly from this course:

- Investment banking: Experts in the creation and marketing of securitized securities.

- Risk management: Positions that call for evaluating and reducing the risks connected to securitized product investments.

- Portfolio management: People who use securitized goods as part of a diversified investment plan in an effort to maximize profits.

Conclusion

For both novice and seasoned financial professionals, Andrew Loo’s thorough course on securitized securities is an invaluable resource. Participants are better prepared to handle the intricacies of the financial system if they comprehend the dynamics of securitization, which range from the fundamental structure of MBS and ABS to the complicated valuation and risk components. In a world where risk and reward are always interacting, the knowledge acquired from this course acts as a compass, helping people make wise choices in the complex realm of finance.

In addition to gaining theoretical knowledge, students who investigate the basic concepts of securitized goods also develop practical skills that are necessary for success in the financial industry. It is a journey of growth opening doors to new opportunities and deeper understanding, making it an invaluable part of any finance professional’s toolkit.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Securitized Products Part 1 By Andrew Loo – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.