The Full EMA Strategy with King Of Forex

249,00 $ Original price was: 249,00 $.5,00 $Current price is: 5,00 $.

You may check content proof of “The Full EMA Strategy with King Of Forex” below:

The Full EMA Strategy by King of Forex

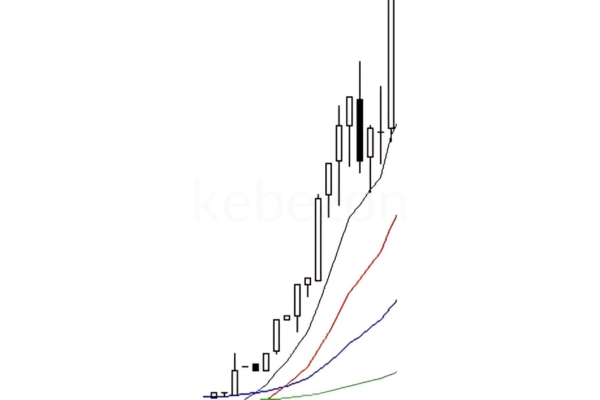

The realm of forex trading can often feel like navigating a stormy sea, with waves of price fluctuations threatening to capsize even the most seasoned traders. In this tumultuous environment, strategies for effective trading can serve as beacons of hope, guiding traders toward profitable shores. One such strategy that has garnered significant attention is the Full EMA Strategy by the King of Forex.

This approach leans heavily on Exponential Moving Averages (EMAs) to identify trends, determine entry and exit points, and mitigate risks associated with trading. What sets this strategy apart is its simplicity, objectivity, and the way it adeptly adapts to the ever-changing market dynamics. For novice and experienced traders alike, understanding and implementing this strategy could yield promising results, offering clarity amidst the chaos of forex trading.

In this article, we will delve deeply into the key elements of the Full EMA Strategy, ranging from its primary components to its pros and cons. We will explore how to effectively identify trends using EMAs, recognize entry and exit signals, and evaluate the strategy’s performance through backtesting, while emphasizing the importance of emotional discipline and risk management. By the end, you will not only gain insight into this trading methodology but also acquire knowledge that can be applied to improve your trading practices.

Key Components of the Full EMA Strategy

To truly grasp the Full EMA Strategy, it is essential to understand its foundational components. The essence of this strategy lies in its objective use of Exponential Moving Averages (EMAs) a tool that prioritizes recent price movements, making it responsive to fluctuations in the market. This responsiveness is akin to a torchbearer on a dark night, illuminating the path ahead and guiding traders towards potential opportunities.

- EMA Settings:

- Setting the right EMAs is crucial. Common settings include the 9-day, 20-day, and 50-day EMAs. Each of these EMAs serves a unique purpose shorter EMAs react quickly to price changes, making them suitable for short-term trading, while longer EMAs provide a smoothed view, offering insights into longer-term market trends.

- Trend Identification:

- A critical aspect of the Full EMA Strategy is identifying market trends. A bullish trend is often signaled when a short-term EMA crosses above a longer-term EMA, indicating potential buying opportunities. Conversely, a bearish trend occurs when the short-term EMA crosses below the longer-term EMA, suggesting selling actions.

- Entry and Exit Points:

- Entry points are determined based on EMA crossovers. A buy signal typically arises when the short-term EMA crosses above the long-term EMA. Conversely, an exit signal is generated when the opposite occurs. This mechanism serves as an easily digestible guide for traders to follow, reducing the chances of emotional decision-making.

- Risk Management Techniques:

- Effective risk management is paramount in the Full EMA Strategy. This includes implementing stop-loss orders and ensuring traders do not risk more than a certain percentage of their capital on a single trade. This protective measure acts as a safety net, preventing significant losses.

- Combining with Other Tools:

- The Full EMA Strategy can be enhanced by using additional technical indicators. Combining EMAs with tools like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) allows traders to refine their decisions, ensuring that they base their actions on a comprehensive analysis rather than solely on EMA signals.

Summary

Understanding the key components of the Full EMA Strategy is crucial for its effective implementation. By focusing on precise EMA settings, trend identification, and entry and exit signals, traders can establish a solid foundation to navigate the tumultuous waters of forex trading. Implementing these components with a strong emphasis on risk management and integration with other tools further strengthens the strategic approach.

EMA Settings and Configuration

When delving into the Full EMA Strategy, one of the first steps is to configure the EMA settings effectively. The chosen EMA periods significantly affect the strategy’s performance, much like the choice of a fishing rod can determine the size of the catch.

- Understanding EMA Settings:

- EMAs are calculated using various periods, with the most popular ones being the 9-day, 20-day, and 50-day EMAs. The concept is straightforward shorter EMAs (like the 9-day) are more sensitive to price changes and register quicker shifts in momentum, while longer EMAs provide a broader view of market trends.

- Why Configure Multiple EMAs:

- By combining multiple EMAs, traders can create a more nuanced approach. For example, using a combination of the 9-day and 50-day EMA can yield insight into both immediate market actions and longer-term trends. This dual approach empowers traders to strategize around potential crossover points.

- Incorporation Into Trading Platforms:

- Most trading platforms allow for easy integration of EMAs into charts. It’s essential to become familiar with your chosen platform’s tools so you can adjust the EMA settings smoothly. The clarity provided by visualizing EMAs on your charts aids in making timely decisions.

- Fine-Tuning Configurations Based on Personal Trade Style:

- Customization is vital. A day trader may opt for shorter EMAs for rapid trading decisions, whereas a swing trader might prefer longer EMAs that encompass greater price movements. Tailoring your EMA settings to match your investment style can enhance the effectiveness of your trading strategy.

- Regularly Reviewing EMA Settings:

- Markets evolve, and so should your EMA settings. Regularly reassessing your EMA configurations in response to changing market conditions allows you to stay adaptive and optimize your trading strategy over time.

Summary

Setting the right EMA configurations is essential to successfully implementing the Full EMA Strategy. By understanding different EMA settings, leveraging multiple EMAs for nuanced strategies, and adapting them to suit personal trading styles, traders can improve their decision-making processes and capitalize on lucrative opportunities in the marketplace.

Identifying Trends Using EMAs

Identifying market trends accurately is one of the most critical elements of the Full EMA Strategy. Trends act as the undercurrents guiding price movements, and understanding these can lead to more strategic trading decisions.

- Understanding Market Trends:

- When employing EMAs, traders primarily look for upward or downward trends. An increasing EMA indicates a potential bullish trend, while a decreasing EMA signals a bearish trend. Recognizing these trends helps traders make informed decisions buying or selling based on the underlying market direction.

- Identifying Crossover Points:

- Crossover points offer crucial signals. A golden cross, where a short-term EMA crosses above a long-term EMA, indicates a bullish signal for traders, suggesting a potential buying opportunity. Conversely, a death cross, where the short-term EMA crosses below the long-term EMA, provides a bearish signal, indicating selling may be prudent.

- Dynamic Support and Resistance:

- EMAs can serve as dynamic support and resistance levels, offering traders additional context. When prices bounce off a rising EMA, it suggests strong buying interest, while prices rejecting a falling EMA may indicate selling pressure. This information aids traders in determining optimal entry and exit points in real time.

- Trend Strength Confirmation:

- Beyond mere direction, understanding the strength of the trend is crucial. Traders often pair the EMA strategy with other indicators like the Average True Range (ATR) to gauge volatility. This combined analysis helps in confirming trend strength and avoiding false signals in illiquid market conditions.

- Adapting to Different Market Conditions:

- It’s paramount for traders to remain adaptable. Recognizing whether the market is trending or ranging assists in adjusting trading strategies accordingly. For example, while EMAs are powerful indicators in trending markets, they may produce unreliable signals in sideways or choppy markets, where price movements are inconsistent.

Summary

Effectively identifying trends using EMAs is fundamental to the Full EMA Strategy. By understanding market dynamics, recognizing crossover signals, and employing dynamic support and resistance techniques, traders can gain deeper insights into market movements. Adaptability and the ability to evaluate trend strength further enhance overall trading strategies.

Entry and Exit Signals in EMA Strategy

The importance of clear entry and exit signals cannot be overlooked in the Full EMA Strategy. These signals serve as guiding stars, helping traders navigate through the complexities of the forex market.

- Establishing Entry Points:

- Entry signals are primarily derived from EMA crossovers. A bullish entry signal is typically generated when the price crosses above a specified EMA, suggesting a potential start of an upward trend. For instance, if the price closes above the 9 EMA and simultaneously breaches the 20 EMA, it reinforces the bullish outlook.

- Volume Confirmation:

- Volume plays a critical role in validating entry signals. For example, if the price crosses above an EMA accompanied by a significant volume spike, the likelihood of the trend continuing upward increases. This confirmation acts as a safety net, reducing the risk of entering false trades based on noise or market fluctuations.

- Setting Exit Points:

- Exit signals operate on a similar principle as entry signals. When the price crosses below the EMA, it signals a potential exit opportunity, particularly in bullish scenarios. This ensures that traders capitalize on their gains and limit losses by securing profits before market reversals occur.

- Stop-Loss Placement:

- Using EMAs for setting stop-loss orders is a common practice. Traders may choose to establish stop-loss levels just below the EMA for long positions or just above the EMA for short positions. This strategy effectively secures positions while allowing for price fluctuations within a trend.

- Combining Signals for a Holistic Approach:

- To enhance trade precision, traders are encouraged to combine EMA signals with other indicators. For instance, validation from oscillators and momentum indicators can substantially reinforce entry and exit signals, curbing the risk of taking trades based solely on EMA crossovers.

Summary

Establishing clear entry and exit signals using EMAs is a cornerstone of the Full EMA Strategy. By recognizing crossover signals, confirming volume, and employing strategic stop-loss placements, traders can effectively manage their trades while protecting their capital. Combining these insights with additional analytical tools further enhances the accuracy and confidence in trade execution.

Advantages of the Full EMA Strategy

The Full EMA Strategy offers various advantages that make it a favored choice among forex traders. Its simplicity, adaptability, and effectiveness are a few of the key benefits that contribute to its popularity.

- Simplicity in Application:

- The Full EMA Strategy is easy to understand and implement, making it accessible to traders of all experience levels, especially beginners. The straightforward concept of using EMAs to identify trends and signals allows traders to focus on executing trades without getting bogged down by complex calculations.

- Quick Responsiveness to Market Changes:

- The design of EMAs gives more weight to recent prices, allowing them to react promptly to market fluctuations. This quick responsiveness is vital in the fast-paced world of forex trading, where delays in reaction can mean missed opportunities.

- Effective Trend Identification:

- The ability to identify both short-term and long-term trends is a critical advantage of the Full EMA Strategy. Employing different EMAs allows traders to navigate various market cycles, enhancing their decision-making for entry and exit points based on current momentum.

- Combines Well with Other Indicators:

- The EMA strategy can be effectively complemented with other technical indicators, such as the RSI or MACD. This combination bolsters the accuracy of trading signals, allowing traders to make better-informed decisions that are corroborated by multiple analyses.

- Adaptability Across Different Markets:

- Beyond forex, this strategy can seamlessly transition to other markets, such as stocks and commodities. This versatility allows traders to fine-tune their strategies for diverse asset classes, adapting them according to market conditions.

- Support for Informed Decision-Making:

- The Full EMA Strategy promotes structured decision-making. By relying on data-driven signals rather than impulsive reactions, traders can enhance their emotional discipline, reducing the influence of fear or greed on their trading practices.

Summary

The Full EMA Strategy stands out for its accessibility, quick adaptability, and comprehensive approach to identifying market trends. Its simplicity encourages effective trading practices among traders of all skill levels while the ability to complement it with other tools and diverse asset markets adds to its widespread appeal.

Simplicity and Accessibility for Traders

One of the standout features of the Full EMA Strategy is its simplicity and accessibility, which appeal to both novice and seasoned traders. This inherent quality acts as a double-edged sword, making the strategy easy to engage with while also ensuring that it remains powerful and effective across varying market conditions.

- User-Friendly Setup:

- Setting up EMAs on a trading platform involves minimal technical navigation. Traders can easily apply the EMA studies to their charts and quickly observe price fluctuations against the trademark EMA lines. This user-friendliness enhances the likelihood that traders will engage inconsistently and strategically, bolstering their decision-making capabilities.

- Minimal Calculation Required:

- Unlike certain complex trading strategies that demand extensive calculations or intricate algorithms, the Full EMA Strategy allows traders to focus on price movements and trends. This minimal reliance on calculations reduces the cognitive load and helps traders analyze market behavior more effectively.

- Straightforward Trading Signals:

- EMAs provide clear trading signals, allowing traders to comprehend when to enter and exit trades. This straightforward process enables traders to make quick trading decisions based on visual cues rather than becoming overwhelmed by conflicting information.

- Educational Resource for Beginners:

- The simplicity of the Full EMA Strategy makes it an excellent learning tool for new traders. As they become familiar with price action, trends, and indicators, they build a foundational understanding that prepares them for more advanced trading techniques in the future.

- Reducing Emotional Trading:

- Simple signals from EMA crossovers help mitigate emotional trading tactics driven by fear or euphoria. Traders are less likely to overthink potential trades when a clear signal presents itself, leading to more consistent and disciplined trading practices.

Summary

The Full EMA Strategy’s simplicity and accessibility have made it an attractive option for traders with different levels of experience. By offering a user-friendly setup, minimal calculations, clear signals, and educational resources, this strategy presents an excellent platform upon which traders can build their trading knowledge and skills.

Objective Signals for Trading Decisions

The Full EMA Strategy excels in providing objective signals that align closely with data-driven analyses, a strength that reinforces its position in the forex trading landscape. These signals allow traders to make decisions based on concrete evidence rather than emotions or speculation.

- Data-Driven Decision Making:

- The core of the Full EMA Strategy lies in the mathematical calculations that govern EMAs. This clear-cut approach removes any subjectivity from trading decisions, allowing traders to act on signals derived directly from price data.

- Reduced Emotional Bias:

- Traders are often prone to emotional decision-making, especially during periods of high market volatility. However, the objective nature of EMA signals diminishes this risk. When traders adhere to the signals dictated by the strategy, they are more likely to maintain discipline and consistency.

- High Validity of Signals:

- EMA signals generated through crossovers are generally high validity indicators of potential market movements. The lagging nature of the EMA means that traders receive signals that are more robust and reliable, reducing the occurrence of false positives.

- Easy Implementation:

- Because of the objectivity of the signals generated, traders can implement the strategy with minimal additional indicators. This simplicity allows traders to reduce clutter on their charts, leading to clearer visual cues on pricing actions and EMAs.

- Improvement Through Backtesting:

- The controlled nature of EMA signals makes them perfect candidates for backtesting. By running historical data through the EMA system, traders can assess previous performance metrics and enhance their strategies based on empirical evidence rather than conjecture.

Summary

The objective signals provided by the Full EMA Strategy empower traders to make more informed decisions in forex trading. With data-driven directives, reduced emotional bias, high validity rates, and simple implementations, this strategy solidifies its reputation as a reliable trading methodology.

Versatility Across Different Timeframes

One of the cornerstones of the Full EMA Strategy is its versatility across different timeframes, making it adaptable for traders with varying approaches and objectives. This flexibility allows traders to customize their strategies based on personal preferences and market conditions.

- Tailored to Individual Trading Styles:

- Traders can effectively use the Full EMA Strategy for both short-term and long-term trades. Day traders may favor using shorter EMAs, such as the 9-day or 20-day, while swing traders may opt for longer options, like the 50-day or 200-day EMAs. This flexibility enables traders to tailor their strategies to fit their trading goals.

- Identifying Opportunities Across Markets:

- The EMA Strategy can be implemented across a wide array of timeframes, from minutes to hours and even daily and weekly charts. This versatility allows traders to identify potential trades based on favored timeframes, ensuring access to opportunities in different markets and trading environments.

- Adapting to Market Conditions:

- When market dynamics shift, the Full EMA Strategy can effortlessly adapt. In highly volatile environments, traders can utilize shorter EMAs for timely entry and exit signals, while extending to longer EMAs during more stable periods for broader trend identification. This adaptability makes it resilient to changing market scenarios.

- Responding to Personal Risk Tolerance:

- Individual risk tolerance levels play a significant role in determining suitable timeframes. Traders who prefer less variance in their trades may lean towards longer-term EMAs, while those comfortable with increased risk can capitalize on rapid price movements through shorter EMAs. This customization enables traders to align their strategies with their comfort levels.

- Continuous Learning and Adjustment:

- As traders analyze their performance using different timeframes, they can learn which approaches yield the highest returns. This continual assessment and adjustment process encourages traders to refine their strategies to unlock greater effectiveness and profitability.

Summary

The Full EMA Strategy’s adaptability across different timeframes is one of its most appealing attributes. By allowing traders to tailor their strategies, respond to market changes, and align their tactics with personal risk tolerance, the strategy caters effectively to the needs of a diverse array of traders.

Limitations of the Full EMA Strategy

Despite its numerous advantages, the Full EMA Strategy does come with limitations that traders should consider. Understanding these restrictions can help traders navigate potential pitfalls while leveraging the strategy’s strengths.

- Risk of False Signals:

- One of the primary limitations is the susceptibility to false signals. Because EMAs are lagging indicators, they may not accurately predict price movements in rapidly changing market conditions. Traders should remain vigilant, particularly in volatile environments where price swings can lead to erroneous trade executions.

- Market Noise and Volatility:

- The Full EMA Strategy can be influenced heavily by market noise. In choppy or sideways markets, EMAs may generate frequent signals that do not translate into sustainable trends, leading to potential losses. Traders must closely analyze market conditions before executing trades based on EMA signals alone.

- Dependency on Market Trends:

- The effectiveness of the Full EMA Strategy is largely dependent on the presence of market trends. It performs well in trending markets but may struggle in range-bound conditions, where prices fluctuate between defined levels without clear directional movement.

- Lagging Nature of Signals:

- The inherent lag in EMA crossovers can result in missed opportunities. In fast-moving markets, traders may find themselves entering or exiting trades too late, which can diminish overall profitability. This lag highlights the importance of swift decision-making in conjunction with EMA analysis.

- Limited Scope Without Additional Analysis:

- While EMAs provide valuable insights, relying solely on this strategy can inhibit a trader’s success. It is beneficial to combine EMAs with various technical indicators and fundamental analysis for a more comprehensive market overview. Only then can traders reduce risks associated with over-reliance on a single metric.

Summary

While the Full EMA Strategy is a powerful tool in the trader’s arsenal, it is essential to acknowledge its limitations. The risk of false signals, dependency on market trends, and the importance of integrating additional analytical tools highlight the need for traders to exercise caution and diligence in their approach.

Risk of False Signals

Among the challenges associated with the Full EMA Strategy, the risk of false signals stands out prominently. Understanding the dynamics surrounding false signals can empower traders to mitigate potential losses and make informed decisions.

- Understanding False Signals:

- False signals occur when EMAs generate crossover alerts that do not materialize into actual trends. Particularly in volatile markets characterized by rapid price movements, false signals can lead traders to execute trades that do not align with broader market trajectories.

- Lagging Indicators:

- One inherent characteristic of EMAs is their lagging nature. This means that EMAs respond after price trends have already begun to change. For example, if a trader expects to capitalize on a new upward trend, a delayed signal can lead to missed opportunities or poor entry points.

- Market NoiseChallenges:

- Market noise can exacerbate the problem of false signals. In sideways markets, where price fluctuations occur frequently around specific levels, repeated crossover events can mislead traders. Hence, discerning genuine trends amidst noise becomes crucial for profitability.

- Combining with Other Indicators:

- To address the potential for false signals, savvy traders often combine EMAs with other technical indicators. Utilizing tools such as the RSI or MACD can help confirm EMA signals, reducing the likelihood of engaging in trades based solely on isolated EMA crossovers.

- Strategy Review and Adaptation:

- Regularly reviewing the effectiveness of the EMA strategy, especially regarding false signals, can lead to improvements. Backtesting historical data to assess response accuracy can be instrumental in fine-tuning the strategy and enhancing its predictive capabilities.

Summary

The risk of false signals is a challenge traders must navigate when utilizing the Full EMA Strategy. By recognizing these risks, combining EMAs with additional indicators, and continually reviewing and analyzing performance, traders can cultivate a more reliable trading approach.

Lack of Predictive Power in Markets

In trading, predictive power is a crucial aspect that traders strive for, yet the Full EMA Strategy may present limitations in this regard. Here’s an examination of how this strategy, while effective in many scenarios, tends to lack its inherent predictive capabilities.

- Dependence on Historical Data:

- EMAs are based on past price data, which means they inherently reflect historical trends rather than predict future movements. This backward-looking analysis may not adequately capture sudden market shifts brought on by unexpected news or events.

- Lagging Nature of EMAs:

- The lagging nature of EMAs means that while they can highlight existing trends, they struggle to predict market reversals or sudden breakouts. This delay can leave traders vulnerable, particularly in fast-moving markets where decisive action is necessary.

- Volatility and Uncertainty:

- Market volatility often disrupts the predictive accuracy of EMAs. In times of uncertainty, prices can fluctuate wildly, resulting in EMAs issuing signals that do not align with actual market sentiment or direction, increasing the chances of losses.

- Supplementing with Fundamental Analysis:

- While the Full EMA Strategy can provide valuable trend analysis, traders find it beneficial to incorporate fundamental analysis. By considering economic data, news events, and market sentiment, traders can develop a more well-rounded perspective, enabling them to gauge potential future price movements more effectively.

- Acknowledging the Limitations:

- Understanding that EMAs serve as tools rather than crystal balls is crucial. Traders should temper their expectations when employing this strategy, relying on EMAs in combination with other analysis techniques to enhance forecasting capabilities.

Summary

The predictive limitations of the Full EMA Strategy highlight the need for traders to approach the forex market with a comprehensive mindset. While EMAs can effectively identify trends and momentum, their reliance on historical data underscores the importance of integrating fundamental analysis and other indicators to paint a more accurate market picture.

Importance of Emotional Discipline in Trading

In the realm of forex trading, where market conditions can change rapidly, emotional discipline can be the pillar that sustains a trader’s success. The Full EMA Strategy, like all trading methodologies, requires not only technical acumen but also mental fortitude and emotional control.

- Navigating Market Fluctuations:

- Traders frequently experience emotional turmoil during price fluctuations. Emotional decision-making, often driven by fear, greed, or excitement, can derail even the most well-structured strategies. Emotional discipline enables traders to remain focused and maintain their trading plans, even in turbulent market conditions.

- Adhering to Trading Plans:

- A well-laid trading plan, inclusive of risk management practices, should guide every trader’s actions. Emotional discipline compels traders to adhere to these plans, refraining from impulsive decisions that deviate from their strategies. This steadfastness preserves both capital and integrity in trading.

- Overcoming Impulse Decisions:

- Fear of missing out (FOMO) and the desire to quickly recover losses can lead to impulse trading, which often results in subpar performance. Emotional discipline helps traders recognize these impulses and, instead, act based on structured analyses and EMAs, thus reducing the likelihood of detrimental trading actions.

- Building Confidence in Signals:

- With the Full EMA Strategy generating objective signals, emotional discipline aids traders in trusting these signals rather than second-guessing themselves. By building confidence through the consistent application of the strategy, traders can move more decisively in their trading decisions.

- Continuous Improvement and Learning:

- Emotional discipline fosters a mindset of continuous improvement. Traders who embrace discipline often engage in reflective practices, analyzing trades performed under emotional duress and learning from these experiences. This growth mindset is crucial for long-term success in trading.

Summary

Emotional discipline fosters successful trading practices in an environment characterized by unpredictability. By adhering to trading plans, refraining from impulsive decisions, and building confidence in sound signals, traders can equip themselves to navigate the highs and lows of forex trading with resilience and clarity.

Risk Management in the Full EMA Strategy

Risk management serves as a cornerstone for the Full EMA Strategy, allowing traders to minimize potential losses while maximizing profits in the complex world of forex trading. Recognizing and implementing effective risk management practices is essential for sustainable trading success.

- Implementing Stop-Loss Orders:

- Setting stop-loss orders is vital in limiting potential losses on trades. Traders often position stop-loss levels just below the EMA for long positions, preventing catastrophic losses during unexpected market downturns. This protective measure not only safeguards capital but also encourages discipline in trade execution.

- Defining Position Sizes:

- Proper position sizing is fundamental for managing risk. Traders generally abide by the rule of risking only a small percentage (1-2%) of their trading capital on any single trade. By adhering to this principle, a trader’s account can withstand multiple losing trades without significant damage.

- Establishing Risk-Reward Ratios:

- A favorable risk-reward ratio is essential for long-term profitability. Traders aim for a ratio of at least 1:2, meaning for every dollar risked, potential profits should be double that amount. This structure ensures that even with a low win rate, profitability remains achievable over time.

- Continuous Adaptation Based on Market Conditions:

- Effective risk management should include adaption according to prevailing market conditions. Volatile markets may require more conservative measures, while stable conditions may allow for slightly more aggressive tactics. Flexibility in risk management practices can enhance overall trading performance.

- Post-Trade Analysis for Future Improvement:

- Conducting a review of completed trades, particularly those that led to losses, provides valuable insights into both strategy performance and risk management effectiveness. By analyzing these trades, traders can identify patterns, learn from mistakes, and adapt their approaches in the future.

Summary

The importance of risk management within the Full EMA Strategy cannot be overstated. Implementing stop-loss orders, defining proper position sizes, establishing risk-reward ratios, and continually adapting to market conditions can significantly enhance a trader’s ability to navigate the inherent risks of forex trading successfully.

Essential Practices for Forex Traders

To optimize the Full EMA Strategy effectively, forex traders should adopt essential practices that enhance their approach. These practices encompass various facets of trading, from risk management to ongoing education.

- Consistent Risk Assessment:

- Conducting consistent assessments of one’s risk strategy is vital. Forex traders should continually analyze their risk tolerance and adjust their practices correspondingly. This ongoing evaluation ensures traders maintain an appropriate balance between risk and potential rewards.

- Backtesting Strategies:

- Engaging in systematic backtesting enables traders to evaluate the performance of their EMA strategies against historical data. This practice allows for adjustments and refinements based on findings, fostering greater confidence when entering live trades.

- Staying Informed:

- The forex market is influenced by various global economic factors and current events. Continuously monitoring relevant news and economic indicators can provide traders with necessary context, allowing them to anticipate potential impacts on price movements.

- Embracing Discipline:

- Developing and maintaining discipline is critical for adhering to trading strategies. Traders should establish clear plans, follow them closely, and avoid deviations caused by emotional triggers. Discipline cultivates a consistent and methodical approach to trading.

- Fostering a Learning Mindset:

- Embracing continuous improvement through education can significantly boost a trader’s success. Whether through reading about emerging trends or joining webinars, continuously seeking knowledge can expand a trader’s repertoire and adaptability.

Summary

Implementing essential practices can significantly enhance the effectiveness of the Full EMA Strategy for forex traders. Consistency in risk assessment, backtesting strategies, remaining informed, fostering discipline, and maintaining a learning mindset all contribute to sustainable trading success in the volatile forex landscape.

Strategies to Mitigate Trading Risks

Mitigating trading risks is a fundamental aspect of successful forex trading, particularly when using the Full EMA Strategy. Several strategies can help traders minimize their exposure to losses while maximizing potential gains.

- Diversification of Portfolio:

- Diversifying a trading portfolio across different currency pairs can help spread risk. Engaging with multiple assets reduces the impact of adverse price movements in any single position, thus protecting overall trading capital.

- Using Multiple Timeframes:

- Analyzing multiple timeframes can increase the likelihood of identifying trends and potential setups. By assessing both short-term and long-term EMAs, traders can align their trades with the dominant market direction while increasing confirmation of expected moves.

- Implementing Trailing Stops:

- Trailing stops allow traders to lock in profits as the market moves in their favor. As the price increases, trailing stops adjust accordingly, securing a predetermined amount of profit while safeguarding against reversals.

- Establishing Clear Exit Strategies:

- Traders should develop and define clear exit strategies that account for profit-taking and risk mitigation. Utilizing predefined exit points protects against emotional decision-making that can lead to premature exits or excessive holding during downturns.

- Engaging in Continuous Review:

- Regularly reviewing and analyzing past trades aids in recognizing what works and what doesn’t. This process allows traders to refine their strategies, making informed decisions that reduce risk exposure in future trades.

Summary

Mitigating trading risks when implementing the Full EMA Strategy requires a multi-faceted approach. By diversifying portfolios, using multiple timeframes, implementing trailing stops, establishing clear exit strategies, and conducting ongoing reviews, traders can effectively navigate the complexities of the forex market and improve their overall performance.

Importance of Stop-Loss Orders

Stop-loss orders are arguably one of the most crucial tools in a trader’s arsenal, especially when employing the Full EMA Strategy. Understanding how to effectively utilize stop-loss orders can greatly enhance risk management and minimize potential losses.

- Protecting Against Major Losses:

- The primary purpose of a stop-loss order is to protect a trader’s capital against significant losses. By setting predefined exit points, traders can effectively minimize damage when market movements move unfavorably, allowing them to maintain their overall account balance.

- Encouraging Discipline in Trading:

- Establishing stop-loss orders ensures that traders adhere to their predefined exit strategies. This discipline reduces the likelihood of emotional decision-making that often amplifies losses, especially during periods of unexpected volatility.

- Setting Stop-Loss Levels Based on EMAs:

- Traders using the Full EMA Strategy often determine their stop-loss levels based on the position of EMAs. For instance, placing a stop-loss just below the 50 EMA for long positions can allow room for price fluctuations without breaching the trend.

- Adjusting Stop-Loss for Profit-Locking:

- Once a trade becomes profitable, adjusting the stop-loss order to the breakeven point or in profit ensures that gains are secured. This approach helps mitigate losses if the market reverses unexpectedly.

- Emphasizing the Need for Flexibility:

- While stop-loss orders are essential, traders must remain flexible. Market conditions can evolve, and traders should be prepared to adjust their stop-loss levels as price movements dictate, maintaining a balance between protection and potential gains.

Summary

The importance of stop-loss orders within the Full EMA Strategy cannot be overstated. By protecting against major losses, encouraging disciplined trading, and allowing traders to manage risks effectively, stop-loss orders serve as essential tools that enhance overall trading performance.

Performance Analysis of the Full EMA Strategy

To effectively evaluate the Full EMA Strategy, conducting a thorough performance analysis is vital. Various aspects come into play when determining its effectiveness, including trend identification, risk management, and real-world application.

- Trend Identification Through EMA Crossovers:

- The Full EMA Strategy relies heavily on identifying trends through crossover points. A comprehensive analysis requires examining how effectively the strategy captures bullish and bearish trends in different market conditions.

- Backtesting Results:

- Backtesting plays a pivotal role in performance analysis. Traders can assess how the Full EMA Strategy has fared against historical data across various timeframes and currency pairs. By simulating trades, traders can identify potential weaknesses and refine their strategies accordingly.

- Reviewing Risk Management Practices:

- The strength of risk management techniques should also be analyzed. Evaluating how effectively stop-loss orders and position sizing practices have been implemented offers insights into how traders can mitigate losses and enhance profitability.

- Combining Indicators for a Holistic View:

- To further improve effectiveness, combining EMAs with other indicators can amplify their predictive capabilities. Analyzing how these integrations affect overall performance reveals the potential for optimizing trade signals.

- Continuous Adaptation to Market Conditions:

- Finally, understanding the performance of the Full EMA Strategy under varying market conditions is essential. Recognizing how the strategy distinguishes itself in trending vs. ranging markets allows traders to adapt and refine their tactics accordingly.

Summary

Conducting an extensive performance analysis of the Full EMA Strategy involves a multifaceted approach. By assessing trend identification effectiveness, reviewing backtesting results, evaluating risk management practices, and analyzing adaptability, traders gain the insights needed to enhance their performance in the forex market.

Backtesting Results and Historical Data

Backtesting the Full EMA Strategy is crucial for understanding its effectiveness in live market conditions. This process enables traders to evaluate historical data, optimize their strategies, and gain confidence before risking real capital.

- Understanding Backtesting Fundamentals:

- Backtesting involves applying trading strategies to historical price data to assess their potential effectiveness in real-world scenarios. For the Full EMA Strategy, this means simulating trades based on various EMA crossover signals to gauge past performance.

- Evaluating Historical Performance Metrics:

- Traders analyze key metrics such as profit-loss ratios, maximum drawdowns, and win rates during backtesting. These metrics provide valuable insights into the strategy’s overall reliability and robustness under varying market conditions.

- Identifying Performance Patterns:

- By reviewing backtested results, traders can identify patterns that may influence future performance. Recognizing which currency pairs or timeframes yield consistently positive results allows traders to focus their efforts more effectively.

- Fine-tuning Strategy Configuration:

- Backtesting results can guide traders in optimizing their EMA settings, aiming for better performance outcomes. Whether adjusting EMA periods or incorporating complementary indicators, traders can refine their strategies based on historical data.

- Combining Backtesting with Forward Testing:

- While backtesting provides valuable insights, traders should complement it with forward testing. This means applying the strategy in real-time, albeit in a demo account. This process helps verify the strategy’s performance in actual market conditions.

Summary

Conducting thorough backtesting of the Full EMA Strategy is vital for traders seeking to validate and refine their approaches. By evaluating historical performance metrics, identifying patterns, optimizing configurations, and combining backtesting with forward testing, traders can bolster their confidence and decision-making processes in live trading scenarios.

Evaluating the Strategy’s Effectiveness

The effectiveness of the Full EMA Strategy can be evaluated through both qualitative and quantitative analysis. By examining its strengths and weaknesses and measuring performance metrics, traders can gain a holistic understanding of its potential performance in varying market conditions.

- Strengths of the Full EMA Strategy:

- The Full EMA Strategy is lauded for its simplicity and user-friendly nature. The ability to identify trends through crossovers allows traders to make informed decisions, reinforcing its appeal among both novice and veteran traders.

- Quantitative Performance Metrics:

- Traders should focus on specific quantitative metrics such as win rates, risk-reward ratios, and return on investment (ROI). A comprehensive evaluation of these metrics provides a clearer picture of the strategy’s overall performance across different market scenarios.

- Adaptability and Flexibility:

- Evaluating the adaptability of the Full EMA Strategy in diverse market conditions is essential. Its performance in trending markets versus range-bound conditions can highlight its robustness or areas of vulnerability, ultimately guiding traders toward more informed decision-making.

- Combining with Other Analyses:

- For a more thorough evaluation, traders should incorporate other forms of analysis, such as fundamental factors or sentiment analysis. This multi-dimensional approach helps traders understand market behavior and enhance their overall effectiveness in applying strategies.

- Continuous Improvement Through Feedback:

- Feedback from backtesting results and real-time trading experiences fosters a loop of continuous improvement. Traders can assess their experiences, learning from both successes and failures to refine the Full EMA Strategy for optimized performance over time.

Summary

Evaluating the Full EMA Strategy’s effectiveness involves a multi-faceted approach that considers both qualitative and quantitative factors. By identifying strengths, analyzing performance metrics, assessing adaptability, and incorporating additional analyses, traders can gain valuable insights into enhancing their trading practices and long-term outcomes.

Case Studies of Successful Trades

Examining case studies of successful trades executed using the Full EMA Strategy can provide valuable insights into the strategy’s practical application. These real-world examples illustrate how effectively the strategy can be employed to capitalize on market opportunities.

- Example of a Bullish Trade:

- A trader utilizing the Full EMA Strategy identified an uptrend when the 9 EMA crossed above the 50 EMA on the EUR/USD pair. Accompanied by a notable surge in trading volume, the trader executed a buy order. By leveraging the clear entry signal provided by the EMA crossover, the trader managed to capture a profitable upward move, subsequently exiting at a predetermined target based on the risk-reward ratio established beforehand.

- Example of a Bearish Trade:

- Conversely, a trader observed a bearish trend with the 20 EMA crossing below the 200 EMA on the GBP/USD pair. Recognizing the downward momentum, the trader placed a sell order while employing a stop-loss just above the 20 EMA to safeguard capital. As price action directed downward, the trader capitalized on the trend, efficiently locking in profits along the way until exiting the trade when EMA indicators suggested a potential trend reversal.

- Integrating Additional Indicators:

- In another case, a trader successfully validated an EMA buy signal on the AUD/USD pair by also considering the RSI, which was in the oversold territory at the time of the crossover. This convergence of indicators provided the trader with additional confidence in executing the trade, resulting in a profitable outcome as market momentum shifted favorably.

- Reviewing and Learning from Trades:

- Each successful trade example underscores the importance of post-trade reviews. Successful traders continually analyze their results, identifying both what worked and what adjustments could improve future outcomes. This reflective practice cultivates a learning environment that enables traders to refine their strategies continuously.

- Emphasizing Emotional Discipline:

- Observing how emotional discipline influenced traders during these successful trades illustrates the importance of adherence to strategy amidst market fluctuations. Maintaining composure and following predetermined trading plans allowed traders to navigate complexities without succumbing to impulsive actions or emotional decisions.

Summary

Case studies of successful trades using the Full EMA Strategy highlight its practical application and effectiveness. By analyzing specific entry and exit points, integrating additional indicators, and emphasizing the need for emotional discipline, traders can derive valuable lessons that enhance their trading prowess and outcomes.

User Feedback and Reviews

User feedback regarding the Full EMA Strategy by King of Forex provides a rich tapestry of experiences, highlighting both positive testimonials and constructive criticisms. These insights are invaluable for traders seeking to understand both the strengths and limitations of this approach.

- Positive Experiences from Users:

- Many traders express appreciation for the simplicity and clarity of the Full EMA Strategy. Users often mention finding the straightforward crossover signals user-friendly, enabling them to implement the strategy without extensive technical knowledge. This ease of use proves beneficial for beginners eager to engage in forex trading.

- Immediate Benefits:

- Some users have noted immediate benefits after adopting the Full EMA Strategy, highlighting its effectiveness in providing clear entry and exit points. They report that observing the EMAs helped them make better-informed decisions and led to more consistent trading outcomes. Such positive experiences instill confidence in new traders, encouraging continued exploration of the strategy.

- Versatility Across Timeframes:

- Feedback from users frequently emphasizes the versatility of the Full EMA Strategy. Many appreciate that it can be tailored to fit different timeframes and asset classes, allowing for flexibility in their trading approaches. This adaptability has earned the strategy a favorable reputation across diverse trading environments.

- Combination with Risk Management:

- Another common theme in user feedback is that effective risk management practices alongside the Full EMA Strategy are paramount for success. Many users stress the importance of managing risk to complement their trading decisions based on EMAs. This integration helps optimize trading outcomes while protecting capital.

- Call for Continuous Learning:

- Users also underscore the significance of continuous learning and practice when employing the Full EMA Strategy. Many traders recommend backtesting their strategies before live trading to gain insights, maintain expectations, and build confidence. Such reflections empower traders to enhance their skills and develop their approaches over time.

Summary

User feedback and reviews related to the Full EMA Strategy by King of Forex highlight a mix of positive experiences and constructive insights. By underscoring simplicity, immediate benefits, versatility, the importance of risk management, and continuous learning, traders can glean valuable information that informs their understanding and application of the strategy.

Common Criticisms and Complaints

While many traders have had positive experiences with the Full EMA Strategy, a critical examination of common complaints and criticisms also emerges. Recognizing these viewpoints is essential for traders looking to implement the strategy effectively and responsibly.

- Concerns About Legitimacy:

- Some users raise questions about the legitimacy of King of Forex and the effectiveness of his strategy. This skepticism often stems from discussions around marketing tactics and the perception that results may not always align with genuine market strategies. Traders are encouraged to approach the strategy with a degree of caution and conduct independent research before proceeding.

- No Guarantees of Profit:

- Many reviews highlight that despite the clarity of signals provided by the Full EMA strategy, there are no guarantees of profit. Users urge that all trading carries inherent risks, and it’s crucial to maintain realistic expectations surrounding potential gains. This emphasis can help mitigate disappointment for new traders who may underestimate the uncertainty involved.

- Effectiveness in Varied Market Conditions:

- Feedback indicates that the Full EMA Strategy may not perform uniformly across different market scenarios. Users have commented that while it excels in trending markets, it may generate unreliable signals during choppy or sideways markets, leading to increased risk and confusion. Awareness of these market conditions can significantly influence trading strategy adaptation.

- Emotional Trading Challenges:

- Several users have remarked on the impact that emotional decision-making can have on trading outcomes, even when employing the Full EMA Strategy. Emotional responses to market volatility can lead to hasty trades or unjustified exits, underscoring the need for emotional discipline as an essential complement to the strategy.

- Backtesting as a Necessity:

- A recurring critique is the emphasis on backtesting. Experienced traders advocate for thorough backtesting of the Full EMA Strategy before committing real capital. Many users stress this practice is indispensable for evaluating performance under various market conditions and optimizing configurations.

Summary

Common criticisms and complaints related to the Full EMA Strategy underscore the necessity of conducting thorough research, managing expectations, and recognizing its effectiveness in diverse market conditions. Acknowledging these challenges can empower traders to approach the strategy with both critical thinking and informed perspectives.

Community Insights and Discussions

Community discussions around the Full EMA Strategy provide a wealth of insights, sharing experiences, tips, and critiques among traders. This collective knowledge fosters a sense of camaraderie and enables traders to learn from one another.

- Exchanging Personal Experiences:

- Many traders share their personal journeys with the Full EMA Strategy through forums and social media. These stories often touch upon their early struggles, successes, and how they navigated challenges in adopting the strategy. Such exchanges inspire traders, often helping others recognize their own potential setbacks as a normal part of their trading journey.

- Highlighting Best Practices:

- Community members frequently share best practices for effectively implementing the Full EMA Strategy. By trading using backtesting results, managing risk, and combining EMAs with other indicators, traders can benefit from the shared wisdom and collectively improve their strategies.

- Addressing Concerns and Misconceptions:

- Discussions around misconceptions frequently emerge, such as the belief that EMAs alone can guarantee successful trades. Community members often emphasize the importance of using EMAs alongside comprehensive market analyses, reinforcing the idea that no single strategy can serve as a silver bullet for all trading issues.

- Providing Emotional Support:

- The camaraderie established in these discussions fosters an emotional support network for traders struggling with discipline or market volatility. Community insights provide comfort and reinforce the notion that emotional challenges are an essential aspect of trading to navigate.

- Encouragement for Continuous Learning:

- A resounding theme in community discussions is the encouragement of ongoing education and adaptation to market trends. Traders highlight resources such as webinars, books, and seminars for acquiring broader industry knowledge, enabling them to refine their trading approaches continually.

Summary

Community insights and discussions surrounding the Full EMA Strategy play a crucial role in enriching traders’ experiences. By sharing personal anecdotes, best practices, addressing misconceptions, providing emotional support, and advocating for continuous learning, these exchanges enhance the broader understanding of the strategy and its application in the forex market.

Comparison with Other Trading Strategies

When examining the Full EMA Strategy, one must consider how it measures up against other trading strategies, including various EMA strategies and technical analysis methods. These comparisons highlight the strengths and weaknesses of the Full EMA approach.

- Full EMA Strategy vs. Other EMA Strategies:

- Unlike simpler EMA strategies, such as the 3 Bar EMA or 20 EMA strategy, the Full EMA Strategy focuses on dynamic crossovers between multiple EMAs, capturing short-term and long-term trends simultaneously. This broader perspective can yield a more comprehensive view of market movements, enhancing trading decisions.

- Effectiveness in Different Market Conditions:

- The Full EMA Strategy tends to excel in trending markets, aligning with other EMA-based strategies that also leverage crossover points. However, it may falter in range-bound markets, similar to other strategies reliant on EMA signals. A critical point of differentiation is the ability of the Full EMA Strategy to incorporate risk management protocols to minimize losses, a feature often not emphasized in other strategies.

- Flexibility Compared to Simplistic Methods:

- While simplistic strategies may appeal to beginners due to their ease of use, they often lack the adaptability offered by the Full EMA Strategy. The latter allows for significant customization according to individual trading styles and preferences in different market environments, whereas simpler methods may restrict traders to fixed parameters.

- Integration of Other Technical Analysis Methods:

- The Full EMA Strategy’s emphasis on integrating with other indicators such as MACD or RSI provides depth that some other strategies might not capture. This combination enhances trading signals and offers a more nuanced approach, improving the accuracy of entry and exit points compared to methods reliant solely on price action or single indicators.

- Risk Management Considerations:

- Effective risk management is embedded in the Full EMA Strategy, showcasing a key difference compared to other EMA strategies. The systematic use of stop-loss orders, position sizing, and defined exit points contributes to a safer trading environment, essential for sustainable trading success.

Summary

Comparative analysis of the Full EMA Strategy reveals its strengths relative to other trading methodologies, including both EMA-specific and general technical analysis strategies. By emphasizing trend identification, flexibility, integration with technical methods, and effective risk management, the Full EMA Strategy distinguishes itself as a robust tool for navigating the complexities of the forex market.

Full EMA Strategy vs. Other EMA Strategies

When comparing the Full EMA Strategy with other EMA strategies, distinct features emerge that highlight both its advantages and specific situations where other strategies may outperform it.

- Scope of EMA Combinations:

- The Full EMA Strategy typically utilizes multiple EMAs, such as the 9, 20, and 50-day EMAs, to identify trends across various timeframes. In contrast, simpler turnover-oriented strategies may focus on a single EMA or a limited combination of shorter EMAs, potentially limiting their effectiveness in longer-term trend identification.

- Crossover Flexibility:

- The flexibility of the Full EMA Strategy lies in its capability to adapt to various market conditions. By using various EMA lengths, traders can tailor their strategies to better respond to shifting trends something more simplistic strategies may struggle to accommodate adequately, particularly in volatile periods.

- Confirmation with Other Indicators:

- The Full EMA Strategy emphasizes the importance of combining EMA indicators with other technical tools. In comparison, other EMA strategies may solely rely on crossovers without further validation from alternative signals, raising the risk of false entries or exits.

- Backtesting Advantages:

- The comprehensive nature of the Full EMA Strategy lends itself well to backtesting across different timeframes and market conditions. Strategies that employ rigid EMA configurations may not yield as much data for thorough analysis, preventing traders from fine-tuning their approaches.

- Focus on Education and Skill Development:

- The Full EMA Strategy framework encourages traders to engage in ongoing learning and practice, thereby developing their overall trading skills. In contrast, other EMA strategies that rely on simpler mechanics may not promote the same level of engagement or critical thinking among traders.

Summary

Comparatively, the Full EMA Strategy demonstrates a robust capability to adapt to diverse markets through flexible configurations, comprehensive backtesting, and integration with additional indicators. These factors position it favorably against more straightforward EMA strategies, making it a valuable tool for traders who wish to enhance their trading approaches.

Comparing with Technical Analysis Methods

When the Full EMA Strategy is placed alongside other technical analysis methods, several distinctions emerge, highlighting the strengths and weaknesses of each approach.

- Focus on Price Action vs. EMA Dependence:

- While the Full EMA Strategy relies heavily on EMAs for trend identification, other technical analysis methods may prioritize price action, chart patterns, or support and resistance lines. Price action trading allows for greater flexibility, as traders can read market sentiment without being tied to specific indicators.

- Quantitative vs. Qualitative Analysis:

- Technical analysis methods often blend both quantitative and qualitative aspects. The Full EMA Strategy is firmly rooted in quantitative measures, focusing on mathematical calculations for EMAs. In contrast, other methods may incorporate qualitative interpretations of charts and patterns, providing a more holistic perspective on price movements.

- Error Margins and Predictability:

- The Full EMA Strategy’s reliance on past data makes it a lagging indicator. Conversely, methods that explore leading indicators, such as oscillators (RSI or Stochastic), may signal changes in momentum before price shifts occur, offering traders a chance to capitalize on impending trends.

- Integrative Nature of Other Strategies:

- Some technical analysis methods advocate for integrative approaches that combine multiple forms of analysis, such as oscillators and EMAs or Bollinger Bands. The Full EMA Strategy can benefit from integrated signals but may not emphasize this approach as heavily in its initial framework.

- Complexity and Learning Curve:

- Traders using the Full EMA Strategy experience a relatively shorter learning curve compared to those engaging with more complex technical analysis methodologies. This accessibility can be a substantial benefit for novice traders who may struggle with the multifaceted nature of more comprehensive technical analysis approaches.

Summary

When comparing the Full EMA Strategy with other technical analysis methods, each approach reveals unique strengths and weaknesses. The lagging nature of the EMAs emphasizes its quantitative focus, while the flexibility of price action trading offers differing insights for traders. Recognizing these distinctions can help traders identify which strategies align best with their trading styles and goals.

Effectiveness Compared to Fundamental Analysis

The effectiveness of the Full EMA Strategy can also be evaluated against fundamental analysis approaches, which focus primarily on economic indicators, news events, and overall market sentiment. These differing methodologies yield varying insights for traders.

- Market Influence Factors:

- The EPA strategy offers real-time analysis based on historical price movements, whereas fundamental analysis aims to assess the intrinsic value of an asset based on economic indicators, earnings reports, and financial news. Both approaches provide traders with unique insights but through different lenses.

- Adaptability to Market Conditions:

- Traders using the Full EMA Strategy can quickly adapt to changing market conditions by observing price movements through EMAs. Fundamental analysis, however, often requires more time and resources to assimilate comprehensive data points, which can delay reaction times under dynamic market conditions.

- Trade Timing and Execution:

- The Full EMA Strategy lends itself to precise trade timing based on mathematical calculations, allowing traders to act swiftly. Conversely, fundamental analysis may take time to interpret, potentially causing traders to miss entry or exit points due to the lag in data assimilation.

- Combining Both Approaches:

- Many successful traders employ a hybrid strategy that combines both technical and fundamental analysis. Understanding how market events might influence price movements can enhance the decision-making process, allowing traders to apply the Full EMA Strategy with greater context regarding external influences.

- Long-Term vs. Short-Term Focus:

- The Full EMA Strategy is often more suitable for shorter-term trading and momentum strategies, while fundamental analysis typically focuses on longer-term trends and valuations. Recognizing the relative merits of each approach can help traders identify which strategy suits their trading goals more closely.

Summary

Comparing the Full EMA Strategy with fundamental analysis reveals distinct differences in market influence, adaptability, trade timing, and focus. While the Full EMA approach prioritizes technical mathematics and real-time insights, fundamental analysis provides valuable long-term perspectives. Many traders find that integrating both methodologies allows for a more comprehensive trading strategy.

Next Steps for Interested Traders

For traders interested in implementing the Full EMA Strategy, actively taking the necessary steps to understand and refine their approach is essential. Below are outlined actionable steps that can lead to effective utilization of the strategy.

- Familiarize Yourself with EMA Basics:

- Begin by understanding the core principles behind Exponential Moving Averages and how they differ from other moving averages. Grasping the calculations and applications of EMAs will provide a solid foundation upon which to build.

- Set Up Your Trading Platform:

- Choose a trading platform that allows you to apply and visualize EMAs readily. Utilize various timeframes specific to your trading style and integrate multiple EMAs to gain insight into short and long-term trends.

- Define Your Trading Strategy:

- Establish clear rules for your Full EMA Strategy. Define your entry and exit points based on EMA crossovers, ensuring you have a structured methodology to guide decision-making.

- Engage in Backtesting:

- Before diving into live trading, backtest your strategy against historical data to assess its effectiveness. This process allows you to refine your approach and establish realistic expectations for performance.

- Implement Risk Management Protocols:

- Establish sound risk management practices, including stop-loss and take-profit levels that align with your trading strategy. Define how much of your capital you are willing to risk on each trade to maintain overall account integrity.

Summary

The next steps for traders interested in the Full EMA Strategy involve a comprehensive approach aimed at understanding EMAs, setting up trading platforms, defining strategies, and implementing robust risk management practices. Taking these steps lays the groundwork for informed and confident trading decisions.

How to Get Started with the Full EMA Strategy

Getting started with the Full EMA Strategy involves a systematic and well-planned approach that empowers traders to navigate the complexities of forex markets confidently. Below are key steps to effectively implement this strategy.

- Understand EMA Basics:

- Familiarize yourself with the underlying mechanics of Exponential Moving Averages. Learn how EMAs are calculated and the differences compared to other moving averages, instilling a foundational comprehension for effective implementation.

- Select a Trading Platform:

- Choose a trusted trading platform that offers easy charting capabilities to visualize EMAs. Platforms such as MetaTrader or TradingView provide ample tools for integrating EMAs into your trading strategies.

- Define Your EMA Settings:

- Decide on the EMA periods that align with your trading style. Common choices include the 9-day, 20-day, and 50-day EMAs; select those that allow you to identify trends effectively across different timeframes.

- Establish a Trading Plan:

- Create a detailed trading plan outlining your entry and exit strategies based on EMA crossovers. Define conditions for trade execution and criteria for adjusting stop-loss and take-profit levels.

- Backtest Your Strategy:

- Conduct thorough backtesting on historical data to gauge the effectiveness of your Full EMA Strategy. This validation will help you identify potential weaknesses and optimize trade parameters before live deployment.

- Risk Management Implementation:

- Determine how you will manage risks associated with trading. This includes setting stop-loss levels, defining position sizes, and calculating risk-reward ratios to ensure sound trading practices.

- Practice on a Demo Account:

- Before trading with real funds, practice your Full EMA Strategy on a demo account. This will provide you with practical experience and the opportunity to fine-tune your approach without financial risk.

- Begin Live Trading:

- Once confident with your strategy on a demo account, transition to live trading with a small capital allocation. Monitor trades closely and adjust strategies as needed, emphasizing emotional discipline throughout.

- Engage in Continuous Learning:

- Embrace continuous education by participating in webinars, reading educational materials, and engaging with forex trading communities. This ongoing learning process allows for personal growth and skill enhancement over time.

Summary

Getting started with the Full EMA Strategy requires a structured plan encompassing understanding EMA principles, selecting a trading platform, defining settings, creating a trading plan, conducting backtesting, and implementing risk management. By following these steps methodically, traders can increase their confidence and effectiveness in navigating the forex market.

Recommended Resources and Tools

For traders looking to enhance their understanding and implementation of the Full EMA Strategy, various resources and tools can provide valuable assistance. Here’s a list of recommended materials and tools designed to support traders on their journey.

- Online Courses:

- Consider enrolling in comprehensive online courses that outline the basics of forex trading, technical analysis, and EMA strategies. Platforms such as Udemy, Coursera, or specialized trading sites offer structured courses designed to build knowledge and skills effectively.

- Books on EMAs and Technical Analysis:

- Reading books dedicated to technical analysis and trading strategies will deepen traders’ understanding of EMAs. Titles like “Technical Analysis of the Financial Markets” by John Murphy provide valuable insights into applying moving averages within market analyses.

- Backtesting Software:

- Utilize backtesting software available on platforms like MetaTrader or TradingView to analyze historical market data. By evaluating previous price movements, traders can optimize their EMA strategy for improved performance.

- Demo Trading Accounts:

- Open a demo trading account with a reputable broker to practice your Full EMA Strategy without financial risk. Many brokers offer demo accounts that simulate live trading conditions, allowing traders to gain experience and assess their EMA strategy before trading real money.

- Technical Analysis Tools:

- Leverage technical analysis tools and indicators, such as the RSI or MACD, to enhance the Full EMA Strategy. These additional indicators can help confirm EMA signals, increasing the accuracy of decision-making.

- Webinars and Live Sessions:

- Participate in webinars and live trading sessions hosted by seasoned traders or educational platforms to glean insights from experienced professionals. These sessions often cover advanced EMA strategies and provide practical tips for successful trading.

- Trading Communities and Forums:

- Engage with online trading communities and forums, such as ForexFactory or TradingView, to share experiences and learn from other traders who have implemented the Full EMA Strategy. Collaborative discussions foster mutual learning and growth.

- Trading Journals:

- Maintain a trading journal to document your trades, observations, and emotional responses. Reflection on both successful and unsuccessful trades is fundamental for developing and refining your trading strategies over time.

Summary

Traders interested in adopting the Full EMA Strategy can benefit from a plethora of recommended resources, including online courses, books, backtesting software, demo accounts, technical analysis tools, webinars, community forums, and trading journals. Utilization of these resources enhances understanding, skills, and confidence within the forex trading landscape.

Continuous Learning and Improvement in Trading

Trading in the forex market is an ongoing journey that demands continuous learning and improvement. As traders strive to refine their skills and adapt to dynamic market conditions, adopting a mindset of lifelong learning is paramount. Here are effective strategies for encouraging continuous growth.

- Set Specific Learning Goals:

- Establish clear, achievable learning goals to maintain focus on skill development. Consider areas such as trading strategies, risk management techniques, or emotional discipline to prioritize for continuous improvement.

- Stay Informed About Market Trends:

- Continuously monitor market trends, economic indicators, and geopolitical events that impact currency movements. Remaining informed allows traders to adapt their strategies accordingly and seize trading opportunities.

- Engage in Reflective Practices:

- Regularly reflect on personal trading experiences to evaluate successes and failures. Analyze what worked and what didn’t, using insights to inform future decisions and adjustments to your Full EMA Strategy.

- Participate in Webinars and Workshops:

- Attend educational webinars, workshops, and trading seminars to absorb new perspectives and trading techniques. Engaging with industry professionals provides access to valuable insights that can enhance your trading approach.

- Read and Research Continuously:

- Dedicate time to read books, articles, and research papers on forex trading strategies and technical analysis. Consuming diverse content provides traders with a broader understanding and inspires innovative approaches.

- Practice in Demo Accounts:

- Leverage demo trading accounts to practice newly learned techniques without financial risk. This allows traders to incorporate fresh strategies into their trading repertoire while fostering confidence.

- Seek Mentorship or Coaching:

- Consider seeking mentorship from experienced traders or coaches who can provide guidance, support, and tailored feedback. A mentor can expedite the learning process and help refine your approach to trading.

- Foster a Supportive Network:

- Engage with peers in trading communities to share knowledge and experiences. Discussing challenges and successes creates a collaborative environment conducive to collective growth.

Summary

Continuous learning and improvement in trading are crucial for success in the ever-evolving forex market. By setting specific learning goals, staying informed, engaging in reflective practices, participating in educational opportunities, reading about strategies, practicing through demo accounts, seeking mentorship, and fostering a supportive network, traders can enhance their skills and achieve long-term success.

In conclusion, the Full EMA Strategy by King of Forex provides traders with a structured approach to navigating the complexities of the forex market. By understanding its core components, advantages, and limitations, as well as integrating solid risk management practices, traders can effectively utilize this strategy to enhance their trading results. Continuous learning and adaptation to market dynamics remain essential for ongoing success, paving the way for traders to achieve their financial goals in the dynamic world of forex trading.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “The Full EMA Strategy with King Of Forex” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.