-

×

Selling on Marketplaces with Michael Maher

1 × 39,00 $

Selling on Marketplaces with Michael Maher

1 × 39,00 $

The Methodology Revealed with Nick Santiago & Gareth Soloway – InTheMoneyStocks

999,00 $ Original price was: 999,00 $.209,00 $Current price is: 209,00 $.

SKU: KEB. 46863JcOEgZjy

Category: Forex Trading

Tags: Gareth Soloway, InTheMoneyStocks, Nick Santiago, The Methodology Revealed

Download The Methodology Revealed with Nick Santiago & Gareth Soloway – InTheMoneyStocks, check content proof here:

Review of the Methodology Revealed with Nick Santiago and Gareth Soloway

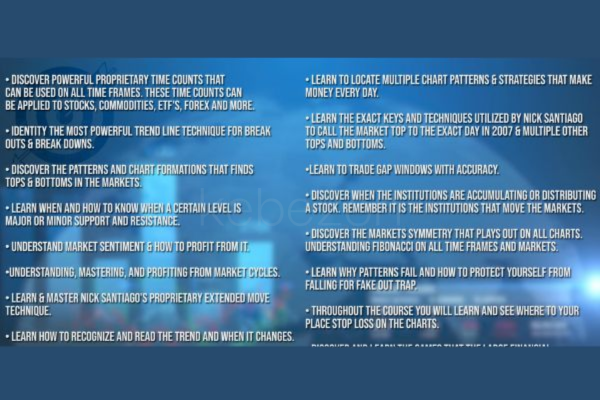

In the ever-evolving world of trading, having a robust methodology is like possessing a compass in uncharted waters. The PPT methodology developed by Nick Santiago and Gareth Soloway emerges as a guiding star for traders seeking both structure and insight in their trading journeys. This proprietary trading strategy, integrated within their educational platform, InTheMoneyStocks, provides a comprehensive framework for comprehending market behaviors across multiple asset classes stocks, commodities, forex, and cryptocurrencies.

Whether you are navigating the turbulent tides of day trading or exploring long-term investments, this methodology boasts an impressive success rate of around 82%, with day trading scenarios reaching a staggering 94%. However, does the promise of such high returns hold true when scrutinized? Let’s dive deeper into the intricacies of this methodology, its foundational principles, and the experiences of its practitioners.

Overview of the PPT Methodology

The PPT methodology stands for Patterns, Price Levels, and Timing. At its core, it leverages the recognition of patterns and cycles that frequent the markets, akin to a seasoned sailor reading the wind and waves. Santiago and Soloway emphasize that the key to successful trading lies in understanding market cycles and responding to notable price levels. By meticulously analyzing charts, traders can identify not only potential entry and exit points but also areas of significance regarding support and resistance.

Core Components of the Methodology

The following are the core principles that underscore the PPT methodology:

- Pattern Recognition: The ability to identify recurring patterns in historical price movements aids traders in forecasting future trends. This aspect relates to the art of trading where intuition meets informed decision-making.

- Key Price Levels: Understanding price action at specific levels can reveal the market’s sentiment. Professional traders often use these levels as decision points for entering or exiting trades, much like how a chess player strategizes their next move.

- Market Cycles: The concept of cycles helps traders grasp the market’s rhythm. Each asset class can exhibit its cycle length knowing this can be the difference between profit and loss.

These principles interlock like the pieces of a puzzle, creating a well-rounded approach to market analysis.

The Approach to Training

To facilitate the understanding and implementation of this methodology, Santiago and Soloway offer the “Methodology Revealed” training course. Conducted in a dynamic webinar format, the course serves as an introductory platform for participants.

Here is a breakdown of the essential components of the training course:

- Extensive Content: Covers the nuances of the PPT methodology ranging from basic concepts to practical applications.

- Real-World Scenarios: Incorporates live trading examples to showcase the methodology in action.

- Interactive Learning: Engages participants, allowing them to practice and refine their skills within a supportive environment.

This combination of theory and practice ultimately seeks to empower traders to confidently engage in the markets.

The Role of Discipline and Risk Management

Beyond the technical framework provided by the PPT methodology, Santiago and Soloway emphasize the critical roles of discipline and risk management a lesson that resonates deeply with traders across the spectrum.

Importance of Discipline in Trading

Discipline is the backbone of successful trading. It is what separates a novice trader from a seasoned professional. In their coaching sessions, Santiago and Soloway instill the idea that consistent application of the methodology, even in the face of losses, is paramount.

- Developing a Trading Plan: They encourage developing and adhering to a specific trading plan that outlines entry and exit criteria based on the PPT methodology.

- Avoiding Emotional Trading: The strategies taught aim to reduce impulsive decision-making, guiding traders to adhere strictly to their trading plans, akin to a pilot following their flight path.

Emphasizing Risk Management

Equally important is the concept of risk management mitigating potential losses to protect capital is essential for long-term success. Santiago and Soloway advocate for using stop-loss orders and adjusting the position sizes based on market conditions.

- Stop-Loss Orders: These automatically sell an asset when it reaches a specified price, acting as a safety net.

- Position Sizing: Appropriate sizing of trades based on account equity ensures that a trader doesn’t overextend themselves, no matter how confident they feel.

Through rigorous practice of both discipline and risk management, traders equipped with the PPT methodology can navigate the tumultuous waters of trading with greater assurance.

Experiences and Reviews from Participants

As with any educational program, the reception of the PPT methodology has varied among participants. Many have reported transformative experiences, claiming significant improvements in their trading practices. However, mixed reviews are equally noteworthy, hinting at the complexities involved in implementing such a methodology.

Positive Feedback

Numerous traders who have undergone training express gratitude for the structured learning environment provided. Some notable aspects include:

- Supportive Community: A community of like-minded traders encourages shared experiences and collective learning.

- Consistent Improvement: Many participants report a sharp increase in their understanding of market mechanics and an overall boost in confidence.

Traders who adhere to the methodology often voice how their focus on patterns and price levels has enhanced their decision-making process.

Critiques and Concerns

On the flip side, there are participants who have voiced concerns about the methodology’s effectiveness in certain market scenarios. Common critiques include:

- Accountability Issues: Some express frustration over a perceived lack of accountability for unexpected losses linked to recommended trades.

- Variable Results: Others note that while the methodology works well in certain markets, it may not deliver the same results in highly volatile conditions.

These mixed reviews underscore the importance of individual trader psychology and market dynamics. Ultimately, results can vary based on the trader’s experience level, market conditions, and adherence to the discipline emphasized in the training.

Conclusion

In summary, the methodology presented by Nick Santiago and Gareth Soloway offers a structured and disciplined approach to trading, promising an educational experience laden with actionable insights. Through the unfolding principles of pattern recognition, price level understanding, and market cycles, combined with a strong emphasis on discipline and risk management, traders are equipped to navigate the complexities of the financial markets.

While the experiences of participants may vary, the overarching narrative reflects a commitment to fostering growth and skill in a challenging environment. For those willing to embrace the learnings and apply them consistently, the PPT methodology may indeed illuminate the path to becoming a more proficient trader. Yet, as with all trading strategies, it is crucial to approach this journey with a blend of enthusiasm and pragmatism, continuously adapting to the winds of change within the market.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “The Methodology Revealed with Nick Santiago & Gareth Soloway – InTheMoneyStocks” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.