The Ultimate Note Investor 2020 with Paper Source

297,00 $ Original price was: 297,00 $.85,00 $Current price is: 85,00 $.

Download The Ultimate Note Investor 2020 with Paper Source, check content proof here:

The Ultimate Note Investor 2020: A Thorough Analysis by Paper Source

It might be difficult to become a successful note investor in the always changing world of financial options. Both new and seasoned investors may find it challenging to deal with the abundance of tactics and instructional materials accessible. This is the point at which Paper Source’s Ultimate Note Investor video library becomes useful. This extensive collection, which was released with the goal of empowering prospective investors, includes 65 movies totaling more than 43 hours of educational material.

With lessons from some of the most seasoned experts in the field of note investing, the content is masterfully written. In order to assess the library’s potential influence on your investing path, this assessment will analyze the breadth of knowledge it contains.

An overview of the video library

The Last Word For those who want to learn more about note investing, the Investor’s Video Library is an invaluable tool. It has a comprehensive seven-part video course on starting notes by W. J. Mencarow, which is thoughtfully made to accommodate fans of all skill levels. Whether you are a novice or want to improve your talents, this all-inclusive bundle promises to provide you the tools you need to succeed. Those who are serious about their financial pursuits will find it appealing because customers have lifelong access to all information for a one-time investment of $297.00.

Content Breakdown

The library is organized into a structured format, ensuring that viewers are not just consuming information, but actually learning and applying strategies in real-world scenarios. Here’s a breakdown of the key topics covered:

- Finding and Buying Notes:

- Identifying potential investments

- Evaluating performing vs. non-performing notes

- Navigating legal considerations

- Brokerage Strategies:

- How to broker notes effectively

- Building relationships with sellers

- Creating Income Streams:

- Techniques for generating multiple streams of income

- Case studies highlighting successful strategies

- Investment Structures:

- Utilizing IRA accounts for tax-free profits

- Understanding market trends that affect note values

Through this segmented approach, the videos encourage not just passive learning, but active engagement with the investment material, making the content both comprehensive and applicable.

Customer Experience and Testimonials

Testimonials from previous patrons add even more legitimacy to the library. The practical lessons gleaned from the films have led to many people reporting radical changes in their trading strategies. “I felt lost in my investment journey before accessing this library,” one customer said. I feel comfortable brokering notes now that I know how to locate and purchase them. Such comments highlight how the library can support an in-depth educational experience.

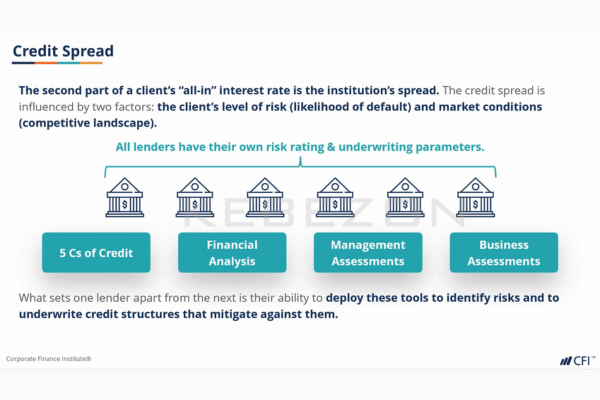

Comparing Different Investment Approaches

Comparing The Ultimate Note Investor library to other investment education tools might be helpful when assessing it. This is a brief table that highlights the salient characteristics of the many products available on the market:

| Resource | Content Type | Duration | Cost | Access |

| Ultimate Note Investor | Video Course | 43 hours | $297 | Lifetime access |

| Alternative Resource A | Webinar Series | 20 hours | $149 | Limited-time access |

| Alternative Resource B | E-book | 250 pages | $89 | One-time purchase |

| Alternative Resource C | Online Course | 15 hours | $199 | Yearly subscription |

As seen from this comparison, The Ultimate Note Investor distinguishes itself not only in content duration but also in the depth of practical knowledge shared by recognized experts in the field. For serious investors, the value achieved from a one-time fee with lifetime access significantly outweighs what other offerings provide.

Comprehensive Understanding and Techniques

Essentially, the Ultimate Note The investor library offers an action-oriented perspective in addition to theoretical understanding. Discussions on using IRA accounts to make tax-free earnings, for example, emphasize the significance of careful financial planning. Investors may maximize their financial return while navigating the complexity of real estate notes by adhering to these professional insights.

How to Put Acquired Strategies into Practice

This instructional resource’s emphasis on putting learnt techniques into practice is its real distinguishing feature. Based on the video series, the following practical actions can be taken:

- Research the Market:

- Engage in market analysis to identify favorable trends.

- Attend local real estate investment meetings.

- Network with Expert Investors:

- Connect with mentors who can offer guidance.

- Join online investment forums to exchange ideas.

- Utilize Technology:

- Take advantage of platforms that list notes for sale.

- Employ financial tools that help analyze investment viability.

Bridging the Gap to Financial Freedom

Investing in notes can serve as a bridge to financial freedom. The library’s teachings actively encourage viewers to consider not just immediate profits, but long-term wealth-building strategies. By creating a structured approach to investment, participants can develop a robust financial portfolio while enjoying the flexibility of multiple income streams.

In conclusion

To sum up, Paper Source’s The Ultimate Note Investor 2020 proves to be a game-changing learning tool for prospective investors. It gives people the resources they need to be successful in the note investing market with its vast content collection, well-organized courses, and abundance of professional information. Gaining proficiency in note investing may be the key to releasing future financial potential in a world where investment options are always changing. This resource is an excellent investment for your financial education, regardless of your level of experience or level of inexperience. In the same way that a lighthouse directs ships to land safely, embrace the information in this library and let it lead you on your investing journey.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “The Ultimate Note Investor 2020 with Paper Source” Cancel reply

You must be logged in to post a review.

Related products

Finance

Reviews

There are no reviews yet.