Trading Volatility – The Ultimate Course By Dan Gibby – Master Trader

997,00 $ Original price was: 997,00 $.69,00 $Current price is: 69,00 $.

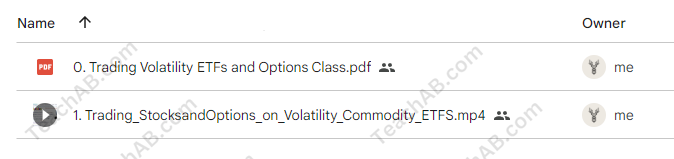

Download Trading Volatility – The Ultimate Course By Dan Gibby – Master Trader, check content proof here:

Dan Gibby’s Trading Volatility: The Ultimate Course: A Thorough Analysis

To successfully navigate the markets in the constantly changing world of finance, traders must grasp the subtleties of volatility. With a focus on volatility exchange-traded funds (ETFs) and options, Dan Gibby’s “Trading Volatility – The Ultimate Course” provides an in-depth exploration of the complex world of volatility trading. This course is designed for traders of all skill levels, from beginners who want to understand the basics to seasoned traders who want to improve their tactics. Gibby enables traders to make well-informed decisions despite market swings that might seem as erratic as a raging storm at sea by demythologizing the intricacies of volatility.

Understanding Volatility and Its Importance

Volatility is often referred to as the heartbeat of the market; it represents the degree of variation in trading prices over time. The primary instrument for gauging market volatility is the VIX, also known as the “fear index.” The VIX provides insights into market sentiment, indicating investors’ expectations regarding future volatility. A rise in the VIX often signals fear or uncertainty among investors, while a drop implies a more stable environment.

Key Concepts Covered in the Course

Participants of the course delve into vital concepts essential for mastering volatility trading:

- ETFs, or volatility exchange-traded funds, are financial products that expose investors to actual market volatility. Volatility ETFs are a great instrument for trading based on market mood since, in contrast to standard ETFs, they are created to capture changes in the market’s perception of risk.

- VIX Options: The course also teaches students about the VIX’s own options. In addition to learning how to profit from market expectations reflected in these financial derivatives, traders also gain knowledge of the distinctive pricing mechanisms that govern VIX options.

- Understanding the difference between contango, which occurs when a commodity’s future price exceeds its current price, and backwardation, which occurs when the reverse is true, is crucial for traders. These ideas have an impact on trading techniques and the long-term performance of volatility ETFs.

Emotional and Practical Techniques for Success

The emotional investment in trading can be intense, often resembling an adrenaline-fueled roller coaster. Gibby emphasizes the need to adopt a balanced mindset and practical techniques in his course. Here are some practical skills participants are encouraged to master:

- Identifying High-Probability Setups: The course equips traders with frameworks to identify scenarios with a higher likelihood of success, allowing for informed decision-making in the fast-paced trading environment.

- Risk and Opportunity Assessment: It’s critical to have a thorough awareness of the hazards connected to leveraged ETFs. Gibby guides participants through thorough risk assessments so they can distinguish between dangerous mistakes and possible possibilities.

- Follow-Up Coaching: The course ends with continuing coaching sessions to promote skill development and reinforcement. In the same way that a musician learns scales to keep up their abilities, this guarantees that players may hone their tactics and adjust to shifting market conditions.

Accessibility and Course Structure

The course is carefully designed to provide beginners a thorough understanding of volatility trading while also being beneficial for more experienced traders. Here is a detailed explanation of what to anticipate:

| Module | Focus Area |

| 1. Introduction to Volatility | Basics of volatility, VIX explanation |

| 2. Trading Strategies | Techniques for trading liquid VIX ETFs |

| 3. Market Dynamics | Understanding contango and backwardation |

| 4. Risk Management | Assessing risks related to leveraged ETFs |

| 5. Real-World Scenarios | Analysis of significant market events |

| 6. Follow-Up Coaching | Sessions dedicated to refining strategies |

Learning Environment

The delivery of the course is interactive and engaging, fostering a climate where participants can freely exchange ideas and experiences. This creates a network of knowledge sharing that can significantly benefit all involved, likened to a thriving ecosystem where diverse trading strategies can flourish.

The Usefulness of Volatility Trading

The unpredictable nature of market happenings is one of the most intimidating parts of trading. In order to combat this uncertainty, Gibby’s course teaches traders how to profitably take advantage of shifts in market sentiment.

Methods for Making Money with Volatility

Profitable possibilities are presented by trading on volatility, but there are hazards involved as well. The following are important tactics that participants can learn:

- Volatility Short Selling: In contrast to the fear-driven increases in volatility, traders who know how to short VIX ETFs may make money at times when the market is quiet.

- Options Strategies: The application of various options strategies, such as spreads and straddles, is highlighted to benefit from volatility spikes without risking exorbitant capital.

- Timing the Market: Learning to anticipate market reactions to news can be akin to catching a wave; the right timing can yield significant profits.

Practical Examples from the Course

Real-world case studies are an integral part of the course, providing illustration and context to the theoretical knowledge. For example, participants may analyze how volatility spiked following key economic announcements or geopolitical events, allowing them to apply learned strategies in context.

In conclusion

In conclusion, traders who are eager to understand the intricacies of volatility trading will find Dan Gibby’s “Trading Volatility – The Ultimate Course” to be a priceless resource. With its well-organized curriculum, instruction in emotional resilience, and continuous support, the course equips students to confidently traverse the market’s sometimes choppy seas. In the end, this course turns uncertainty into opportunity by giving traders the information and abilities they need to succeed in an environment where volatility is the rule rather than the exception. This course is worth considering as a crucial stage in your trading path since it may yield significant dividends for those who are prepared to put in the time and effort.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Trading Volatility – The Ultimate Course By Dan Gibby – Master Trader” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.