Understanding Options with Paul North – CFI Education

15,00 $

Download Understanding Options with Paul North – CFI Education, check content proof here:

Recognizing Choices: A Comprehensive Analysis

Trading options is like negotiating a challenging maze where every step might result in gains or loses. The trip may frequently feel daunting for inexperienced and intermediate traders as they struggle with a plethora of ideas and tactics. Michael Sincere’s book “Understanding Options” shines brightly in this regard, shedding light on the way with its approachable prose and useful advice. Although this article is not written by Paul North, it contains essential information on options trading that provides a strong basis for anybody hoping to learn more about this complex market.

The book is divided into parts that address a range of important subjects. Beyond simple definitions, Sincere gives readers the crucial tactics, risk-reduction methods, and psychological understanding they need to succeed in options trading. By providing a thorough analysis of the book’s substance, advantages, and disadvantages, this review seeks to dissect these elements.

Basics of Options Trading

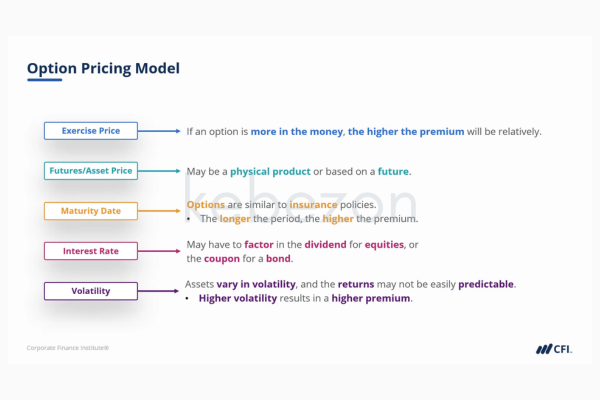

At its core, options trading revolves around a set of fundamental concepts that every trader must understand. This section of the book meticulously dissects important terminologies such as ‘strike price,’ ‘expiration date,’ and ‘premium,’ making them comprehensible even to those encountering them for the first time.

Key Terms:

- Strike Price: The fixed price at which the option can be bought or sold when exercised.

- Expiration Date: The last date on which the option can be exercised.

- Premium: The price paid for purchasing the option.

The author elaborates on different types of options available to traders: call options provide the right to buy, while put options grant the right to sell. This foundational knowledge is critical as it enables traders to understand how options function within the broader markets. Furthermore, Sincere emphasizes the importance of risk management strategies, advocating for methods like stop-loss orders to safeguard investments.

In this section, Sincere not only provides theoretical knowledge but also contextualizes it with real-world examples. For instance, he explains how understanding implied volatility a vital pricing model can significantly impact a trader’s decisions, much like the tide influencing a sailor’s journey across the ocean.

Ultimately, the foundation laid in this section empowers readers to approach options trading with confidence, enabling them to navigate the complexities with a clearer vision.

Techniques for Purchase and Sale of Options

“Understanding Options” moves from basic information to useful tactics for purchasing and disposing of options. Because it offers a variety of trading techniques and gives traders tools they can use in actual market situations, this section of the book is especially interesting.

Techniques Examined

- Covered Calls: A trading method that reduces risk and generates money by having a trader sell call options while retaining an equivalent quantity of the underlying stock.

- Buying a call and a put option at the same strike price is known as straddling, and it gives traders the ability to take advantage of market volatility in any direction.

Sincere clearly describes these tactics and provides examples of their successful application. He compares a covered call to renting out a room in your home while keeping ownership, for example, and explains how it might be a prudent way to make money.

Similar to a marathon runner who must pace themselves to cross the finish line, the book also emphasizes the psychological components of trading and counsels readers to maintain discipline and refrain from making emotional decisions. The reader is given both theoretical information and practical methods to incorporate into their trading habits, since the tactics are interwoven with real-world applications.

Advanced Topics in Options Trading

As traders progress in their journeys, they often encounter more complex concepts that require a deeper understanding. In this section, Sincere addresses advanced topics such as option greeks, volatility, and technical analysis, providing seasoned traders with insights to refine their strategies.

Key Concepts Discussed:

- Option Greeks: Delta, Gamma, Theta, and Vega, each providing crucial information about how options react to various market factors.

- Volatility: The degree of variation in trading prices, a critical element that influences options pricing and trading strategies.

- Technical Analysis: A method of evaluating investments through analyzing statistical trends gathered from trading activity, leading to informed decision-making.

Engagingly, Sincere likens the analysis of these advanced topics to playing a game of chess, where anticipating an opponent’s moves is crucial for success. By comprehending market volatility and the greeks associated with options, traders can strategize accordingly and adapt to the constantly shifting market environment.

Additionally, the quizzes that are incorporated into this part highlight Sincere’s captivating teaching style, which strengthens comprehension and memory of difficult content. The author offers a thorough toolset that enables traders to handle even the most volatile market situations by skillfully incorporating these complex subjects into the larger story of options trading.

An Active Pedagogical Method

Michael Sincere’s captivating teaching approach is among “Understanding Options”‘s most admirable features. Sincere uses a personable tone to make difficult concepts easy to understand and entertaining rather than overloading readers with jargon-filled explanations. Readers are encouraged to think of themselves as fellow traders rather than as passive information consumers by his ability to convey information in a conversational style.

Sincere creates an engaging learning environment that promotes greater comprehension by utilizing tests and real-world experiences. By encouraging active engagement, this approach enables readers to assess their understanding and apply ideas in real-world situations.

Sincere dispels the myth that options trading is a scary endeavor by comparing it to learning how to ride a bike. Although difficult at first, it eventually results in a renewed sense of freedom and excitement with practice. Sincere successfully demystifies options trading for readers by connecting its complexities to real-world situations.

Limitations for Experienced Traders

Despite its strengths, “Understanding Options” does have its limitations, particularly for experienced traders. While the book serves as an excellent resource for beginners and intermediates, seasoned investors may find the content lacking in depth concerning more sophisticated strategies. The focus is primarily on foundational concepts and popular approaches, which could leave advanced traders seeking more comprehensive analyses.

Potential Limitations:

- Lack of in-depth exploration of complex strategies.

- Limited focus on niche market conditions and their implications on trading strategies.

- Minimal coverage of advanced risk management techniques.

For traders who have already navigated the basics, this resource may feel somewhat superficial, as it doesn’t delve deeply into the nuances of strategy optimization or niche trading environments. However, the value of clear explanations and engaging examples cannot be understated, making it a vital primer for those entering the field.

In conclusion

To sum up, “Understanding Options” by Michael Sincere is a very useful manual for beginning and intermediate traders. Sincere lays the groundwork for readers to successfully participate in options trading by simplifying difficult ideas into understandable language and providing useful tactics. Although more experienced traders may want more in-depth information, the book does a great job at providing fundamental concepts and keeping the reader interested.

In the end, this thorough book acts as a springboard, allowing traders to develop a solid foundation of knowledge before starting their options trading careers. “Understanding Options” is a suggested read that should improve your trading skills and strengthen your investing methods, regardless of whether you are just starting to learn about this complex market or want to brush up on your knowledge.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Understanding Options with Paul North – CFI Education” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.