Your Easy Phone Money Membership

297,00 $ Original price was: 297,00 $.5,00 $Current price is: 5,00 $.

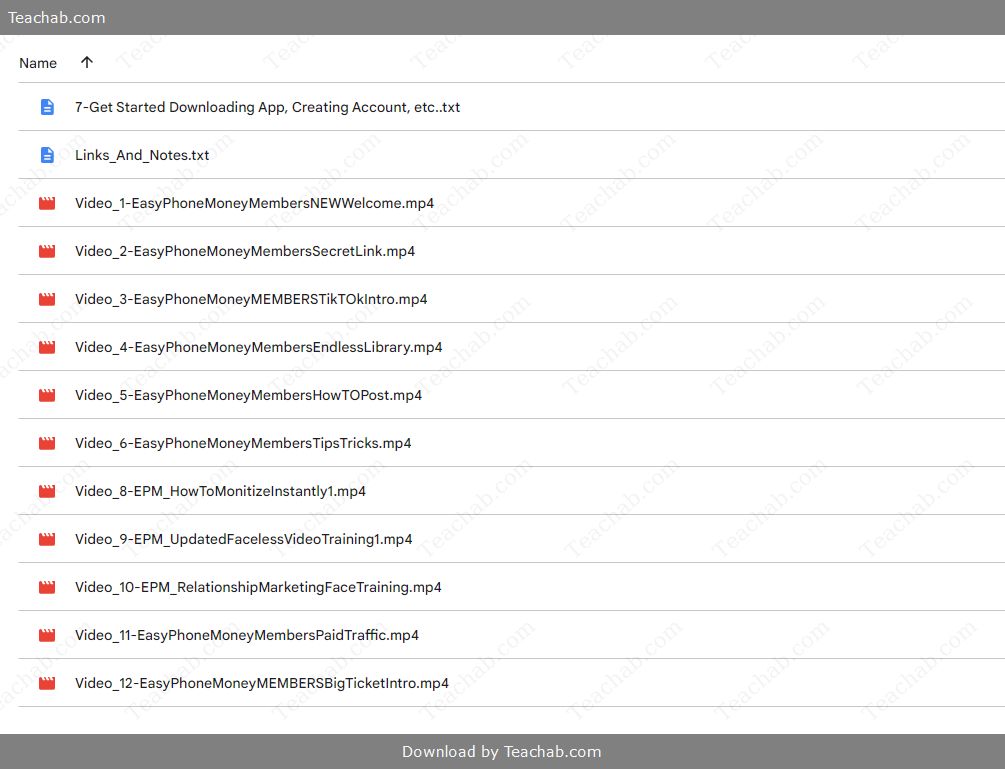

You may check content proof of “Your Easy Phone Money Membership” below:

Easy Phone Money Membership Review

Entering the world of online financial services can feel like wading into a maze, especially for those searching for the most easy ways to handle their money. The Easy Phone Money Membership offers itself as a light of hope for people who want to take control of their financial lives, providing tools and services to help them manage their money more effectively. Designed particularly for consumers who want to use their cellphones for financial purposes, this membership program offers a variety of advantages designed to improve both savings and simplicity of use.

In a world where mobile apps are constantly growing, the demand for financial services that address current concerns is critical. Many people struggle to navigate complex financial systems, hidden fees, and unattractive interfaces that complicate rather than simplify their financial life. Easy Phone Money Membership aims to overcome these gaps by offering an accessible and user-friendly platform. This evaluation delves into the membership program’s core features, advantages, and overall experience, determining if it delivers on its claims and comparing it to other available options.

Key Features of Easy Phone Money Membership:

The Easy Phone Money Membership includes a number of tools aimed at simplifying money management. Here’s a quick summary:

- Step-by-Step Video Instructions: Members get access to extensive video lessons that break down financial topics, making it easier for users to comprehend and achieve their financial objectives. These films are similar to having a personal finance coach that guides them through each stage of the process.

- Exclusive Training Material: Membership includes exclusive training resources that go into numerous financial techniques applicable to the internet economy. This is very important for people who want to enhance their knowledge and utilize their cellphones efficiently to complete financial activities.

- Promotional Pricing: The membership is presently available at a discounted rate, making it an affordable option for potential consumers. This technique is similar to an initial deal at a gym, encouraging consumers to join while the stakes are low and the advantages are great.

- Access to Marketing Tools: In addition to educational films, users may acquire valuable marketing tools to aid in their financial endeavors. This might include budget tracking applications, spending management tools, and more resources to help them improve their financial operations.

- Community Support: Members can also join a group of people who share their interests. This peer network may offer support, share experiences, and promote the exchange of suggestions, reducing feelings of isolation that many users encounter during their financial journeys.

- Educational Materials: In addition to videos, users get access to e-books and manuals that cover a variety of topics in depth, expanding their learning experience.

Overview of Member Benefits

The Easy Phone Money Membership provides a wide range of perks, making it an appealing option for anyone looking to better manage their funds. Here’s a deeper look at what members may gain:

- Members may improve their financial management skills by accessing special training and instructional resources. Consider being provided with a wealth of financial knowledge, allowing them to make sound judgments.

- Cost Savings: Members may expect not just cheap initial prices owing to special pricing, but also possible savings on a wide range of items and services through unique discounts. This combined advantage of immediate and long-term financial relief is akin to discovering a hidden discount code for a regular purchase.

- Community Engagement: Networking enables participants to access a resource pool that promotes encouragement and collaborative issue solving. This participation, much like a support group, may be quite beneficial to people facing similar issues.

- Flexible Learning: The flexibility to study at one’s own speed leads to greater confidence and mastery of financial instruments. This adaptability is similar to the self-paced learning choices provided in online courses, which adjust to the individual’s learning speed.

- Comprehensive assistance: With continual access to marketing tools and community assistance, members can be certain that they are not alone in their path. This sensation of assistance is similar to the experience of having a mentor guide you through unknown territory.

Collectively, these features not only improve the user experience, but also make the Easy Phone Money Membership an appealing alternative for anybody wishing to improve their financial literacy and management abilities.

Exclusive Member Offers

One of the most notable features of the Easy Phone Money Membership is access to unique deals tailored particularly for its subscribers. This section will look at what members may anticipate to receive in terms of discounts and perks:

- Members may be eligible for discounted rates on service plans, electronic devices, and mobile applications crucial to financial management. These reductions range between 10% and 30% off ordinary pricing, adding considerably to a member’s overall savings.

- Health Service Discounts: The membership may also provide preferred prices on health services, which is essential for ensuring that members’ general well-being is taken care of, as good health leads to better financial decision-making.

- Travel Benefits: Members can save significantly on travel-related services such as hotel reservations and rental vehicles, which can be very useful for people who travel regularly for work or recreation.

- Early Access Promotions: Membership typically gives early warning of impending sales and special promotions that the general public may not see right away, allowing members to take advantage of savings before they sell out.

These special offerings significantly increase the value of the membership, similar to a VIP experience in which members are constantly one step ahead in youthfully managing their funds.

Access to exclusive promotions.

Throughout the year, Easy Phone Money Membership offers a range of special incentives to ensure that its customers get the most out of their membership. Here’s what members should expect:

- Seasonal deals: Members are frequently treated to seasonal deals that coincide with holiday shopping periods, offering exceptional savings on electronic devices and services.

- Members may have access to flash sales, which are limited-time offers accessible for a certain amount of time, allowing enthusiastic consumers to take advantage of discounts before they expire.

- Member-Only Events: Attending events developed particularly for members may enhance the experience by mixing networking with educational opportunities, such as webinars with financial experts.

- Promotional Bundles: On occasion, the membership may combine items and services into bundle packages that give a larger discount than individual purchases, making it enticing to consumers trying to save money.

These unique promos demonstrate the membership’s commitment to offering continuing value, ensuring that members always feel they are enjoying the benefits of their investment.

User-Friendly Interface.

The inclusion of an easy-to-use interface within the Easy Phone Money Membership system can have a major impact on user engagement. The design concept emphasizes intuitive navigation, which may make or break a member’s experience on the site. Here’s how it succeeds in this area:

- Intuitive Navigation: The interface is intended to be simple, reducing the learning curve for new users. A user-friendly interface fluidly directs members through various functions, much as good architecture does for visitors to a building.

- Accessibility: Ensuring that the platform is useable on a variety of devices, including smartphones, tablets, and desktop computers, improves accessibility for a larger range of users, similar to a contemporary library that provides rooms for a variety of study purposes.

- Visual Appeal: Information presented with appealing images and clear layouts reduces cognitive burden for members, making complicated financial information simpler to comprehend, similar to a well-structured infographic.

- Responsive Design: Ensuring that the platform runs seamlessly across all screen sizes improves the user experience, much as how a well-fitted garment gracefully tailors itself to the wearer.

- Quick Access to Features: Key features are clearly presented, allowing users to easily access required tools and information without feeling overwhelmed, which is critical in retaining engagement.

A user-friendly interface not only improves the user experience, but it also motivates users to actively use the offered capabilities, resulting in improved money management practices.

Pricing & Subscription Plans

Exploring the pricing structure and subscription tiers linked with the Easy Phone Money Membership reveals an appealing offer for potential members. This is a quick summary:

- Promotional prices: To begin, members can take advantage of limited-time promotional pricing, which is frequently much cheaper than market standard prices, allowing them to opt in with less financial burden.

- Monthly vs. Annual options: It normally provides both monthly and annual subscription options, with annual subscriptions typically offering a large discount to encourage consumers to commit for the long term.

- Members may also discover various payment alternatives, such as the opportunity to divide charges or use different payment methods, which adds ease to the membership experience.

- No Hidden Fees: Pricing transparency guarantees that members understand exactly what they are paying for, with no surprise costs creeping into their invoicing, which is a regular occurrence on many financial platforms today.

With these varied price schemes, the Easy Phone Money Membership promotes itself as an affordable choice for many people looking to improve their financial literacy and management skills.

Comparison of several plans

When reviewing the Easy Phone Money Membership, it is critical to compare it to other financial services to determine its market standing. Here’s a full comparison of various popular membership packages, including their features and costs:

| Feature | Easy Phone Money | Rocket Money | Mint Mobile | Tello |

| **Initial Cost** | Promotional Price | Free basic subscription | $15/month (first 3 months) | $19/month (10GB) |

| **Exclusive Discounts** | Yes | Yes | No | No |

| **Educational Resources** | Comprehensive | Limited | No | No |

| **Community Support** | Active Community | Community Guidelines | No | No |

| **User-Friendly Interface** | Yes | Moderate | Yes | Simple |

This table clearly illustrates the differences. For example, although Rocket Money offers basic subscription management for free, it lacks the instructional elements included with the Easy Phone Money Membership. Tello and Mint Mobile, on the other hand, are excellent choices for telecommunications but do not prioritize financial literacy.

In a world full of options, this comparison provides potential members with the information they need to choose the best platform for their financial management goals.

Hidden Fees to Look Out For

Navigating any membership program requires being aware of any hidden fees that might unexpectedly increase total expenditures. The Easy Phone Money Membership is supposed to be transparent; yet, let’s look at what members should be aware of:

- Regulatory costs: Some services charge costs that may not be obvious at first appearance. It’s similar to the tiny print in contracts, which might affect your final expenditures if neglected.

- Late Fees: Prompt payment is critical. If a member fails to pay on time, late fines may apply, potentially disrupting budgetary plans.

- Upgrade Costs: While the base membership may include a variety of services, further functions may necessitate separate expenditures or upgrades, which users should be prepared for.

- Certain transactions may incur costs, particularly when transferring cash or making payments through third-party services.

- Cancellation costs: If members choose to leave the service sooner than intended, certain platforms charge cancellation costs that may not be revealed during the membership process.

Understanding both the obvious and potential hidden costs connected with membership allows members to budget appropriately and avoid unexpected spending.

Refund and Cancellation Policies

When using a subscription service like Easy Phone Money, it is critical to understand the refund and cancellation rules beforehand. Here’s a quick summary of what to expect:

- Grace Period: Typically, memberships include a grace period in which members can drop out within a certain length after joining up, providing them a risk-free trial.

- Easy Cancellation procedure: Ideally, consumers should find the cancellation procedure simple, allowing them to terminate their subscription as easily as they joined up. The motto ‘click to cancel’ is excellent for customer pleasure.

- Refunds for Early Cancellations: Some memberships may give partial refunds if canceled before the end of a subscription cycle, which provides some confidence.

- Circumstances for Refunds: Organizations frequently define certain circumstances under which refunds may be granted, so always read the fine print to prevent misunderstanding.

- Reactivation costs: If a member decides to revive their account after cancellation, there may be costs associated, as is usual with many financial service providers.

Understanding these regulations gradually allows members to confidently traverse the membership environment, resulting in a smooth financial management journey.

User Experience

The user experience associated with the Easy Phone Money Membership may have a major impact on member satisfaction and engagement levels. Here are essential components that influence the whole experience:

- The platform’s interactive design promotes a hands-on experience, allowing members to interact with tools without feeling overwhelmed or confused.

- Real-Time Support: Having access to real-time support chat functionality allows consumers to quickly answer issues or concerns, which improves retention.

- Feedback Mechanisms: Having opportunities to submit feedback has a direct influence on user satisfaction since it makes members feel valued and considered.

- Diverse Learning Styles: By accommodating different learning styles through video, text, and interactive information, the platform reaches a larger audience, enhancing overall satisfaction.

- User Retention Rates: High retention rates reflect a great user experience, implying that happy users are more likely to continue using the service in the future.

These critical features work together to provide an appealing and successful user experience, increasing the likelihood of attaining excellent financial management using the platform.

Navigation and usability

Navigation and usability are critical components of every digital service, since they have a significant impact on customer happiness. Here’s a summary of what goes into the Easy Phone Money Membership in these aspects:

- Clear Menu structure: The clear menu structure helps users to locate what they need without spending too much time clicking or searching, similar to a well-organized library that promotes user questions.

- Mobile Optimization: Given Easy Phone Money’s mobile-centric design, guaranteeing usability across mobile devices is critical, and it does this without sacrificing functionality.

- User Feedback Integration: Designing the interface based on user feedback encourages responsiveness to real-world user demands, proving that consumer feedback affects future enhancements.

- Quick Access Features: Key features are readily available, allowing clients to handle their accounts and transactions quickly. The more direct the access, the greater the involvement.

- Limit Color and Clutter: A minimalist design concept helps to avoid overwhelming consumers while simplifying their experience, similar to a great, clean workplace atmosphere that boosts productivity.

Easy Phone Money Membership aims to provide all members with a pleasant and engaging user experience by utilizing good navigation and usability concepts.

Customer Support Availability

Effective customer service is an essential component of any successful membership service. Here’s how Easy Phone Money intends to give enough assistance for its users:

- 24/7 Availability: Offering round-the-clock customer support guarantees that users can get help whenever they need it, accommodating various schedules and responsibilities.

- Multiple Contact Channels: A variety of contact options, including live chat, email, and phone support, allow consumers to pick their preferred communication mode, increasing user comfort.

- Proactive Communication: Providing regular updates on membership changes, new services, and policies demonstrates a dedication to keeping members informed and involved.

- Feedback Loop: Encouraging users to share their issues or experiences helps to refine support replies and increase overall satisfaction.

- Expert Support: Having skilled support workers who can answer specific questions guarantees that members get correct information fast.

This combination of support tactics attempts to increase member happiness and loyalty, resulting in a community in which users feel respected and heard.

Member Testimonial and Feedback

Utilizing member testimonials and comments is critical to increasing confidence and trust in the Easy Phone Money Membership. Here’s why obtaining and utilizing this input is critical.

- Social evidence: Testimonials serve as social evidence of the membership’s efficacy and worth, allowing potential members to make educated judgments before joining.

- Real Experiences: Gathering varied testimonies demonstrates how the membership has benefited various people, stressing adaptation and applicability to varying requirements.

- Feedback Channels: Providing easy access to feedback fosters honest testimonials, ensuring a two-way connection between members and the service.

- Continuous Improvement: By reviewing feedback on a regular basis, the organization may make the required changes to improve overall member satisfaction and service quality.

- Community Building: Sharing testimonies builds a feeling of community, allowing individuals to feel connected as they share their financial experiences.

Emphasizing member testimonies and comments promotes continued engagement and communication, hence strengthening confidence in the Easy Phone Money brand.

Performance Analysis

Evaluating the Easy Phone Money Membership goes beyond initial engagement and includes performance measures, which are critical for determining overall happiness and efficacy of the membership. Here’s a deeper look at the performance analysis components.

- User Engagement Metrics: Metrics like as login frequency, interactions with training materials, and tool usage give information on how successfully members use their resources.

- Satisfaction Surveys: Distributing surveys on a regular basis helps to assess member satisfaction, identify areas for development, and ensure that customer demands are satisfied.

- Retention and Churn Rates: Understanding retention rates, as well as cancelation trends, can help identify areas for improvement in member satisfaction.

- Training Outcomes: Tracking members’ progress through training materials enables for evaluation of educational success, which can assist shape future offers.

- Benchmarking against rivals can reveal strengths and shortcomings, allowing for essential course modifications.

These performance analysis methodologies guarantee that the Easy Phone Money Membership is responsive and flexible, hence increasing member satisfaction.

Speed and Efficiency Ratings

Speed and efficiency are critical components of retention and satisfaction in membership programs. Users want procedures to be quick and efficient, ensuring that their experience is seamless. Here’s how Easy Phone Money might be assessed in this regard:

- Response Times: Tracking how long it takes for the app to load and processes to finish helps determine performance efficiency. Slow response times might turn off users, reducing retention.

- Transaction Speeds: When measuring payment processing speeds and fund accessibility, the focus is on how quickly members can complete transactions and access their money.

- User Interface Responsiveness: The responsiveness of interface elements, particularly on mobile devices, is critical. Users should anticipate smooth transitions and little latency when using the app.

- Efficiency Reporting Tools: Having analytical tools in place to analyze user activities can expose bottlenecks in processes, allowing you to identify areas that need to be improved.

- Technical Support Availability: Quick access to support solutions when technical difficulties emerge restores functionality, reducing disturbance for users.

These assessments can determine the overall usefulness of the Easy Phone Money Membership, ensuring that it evolves to fulfill user expectations.

Compatible with a variety of devices.

Compatibility with diverse devices is an important characteristic that improves the usefulness of membership programs. Here’s how Easy Phone Money handles this component:

- Cross-Platform Functionality: Ensuring that its program functions effortlessly across many operating systems (iOS, Android, and so on) increases access to a larger user base.

- Device Testing: Extensive testing of common devices to verify compatibility reduces user aggravation and promotes great experiences.

- Responsive Design: The interface changes to the device being used, ensuring that functionality stays unchanged independent of screen size or resolution.

- Regular Updates: Frequent updates to support new devices and operating systems keep the membership current and working.

- User input on Device Performance: Actively gathering input on user experiences across several devices enables personalized adjustments that ensure seamless interactions.

Focusing on compatibility ensures that users may access the services they require without limits or hassles, hence enhancing overall satisfaction.

Issues and Complaints Reported

Monitoring concerns and complaints about financial service subscriptions enables proactive changes in service delivery. Here’s how Easy Phone Money handles consumer concerns:

- Transparent Reporting Mechanisms: Providing clear pathways for members to report concerns fosters accountability and openness.

- Timely replies to reported issues build trust in the company by demonstrating a commitment to properly resolving concerns.

- Regular Complaint Reviews: Analyzing complaints enables for the identification of common issues that may effect the overall user experience, ensuring that service modifications are made on time.

- Open Dialogue with Members: Encouraging open communication develops a community environment in which users feel comfortable sharing comments and lodging concerns.

- Adaptation and progress: By not just responding to concerns, but also using them as a catalyst for progress, the membership program is always evolving to suit the demands of its users.

Easy Phone Money touts itself as responsive and flexible, prioritizing the user experience.

Security and Privacy

In an era dominated by digital transactions, the Easy Phone Money Membership promotes user security and privacy as fundamental features. Here’s how they protect their members:

- Encryption Standards: Using strong encryption techniques guarantees that user data is secure, preventing illegal access and breaches.

- Regular Security Audits: Conducting periodic security audits helps discover weaknesses and reinforce defenses, similar to a vehicle’s routine inspection to guarantee it functions properly.

- Clear privacy rules define how user data is gathered, kept, and used, increasing openness and helping to establish confidence.

- User Control Over Data: Allowing members to modify their data choices empowers them and creates a sense of security.

- Rapid problem Response Plans: Creating methods to respond quickly in the case of a security problem instills members’ trust in the protection of their data.

By creating rigorous security and privacy procedures, the Easy Phone Money Membership allows members to use the service with pride and confidence.

Data Protection Measures

Protecting members’ personal data is both a responsibility and a necessity under several rules. Here’s how Easy Phone Money uses data protection measures:

- Compliance with Legislation: Following data protection legislation, such as the GDPR and CCPA, guarantees that user data rights are respected and safeguarded.

- Access Controls: Restricting access to sensitive data to authorized persons only reduces the risk of data breaches while strengthening the overall security posture.

- Data Minimization Principle: Collecting just needed data guarantees that sensitive information is not acquired needlessly, lowering exposure in the event of a breach.

- Secure Backup Protocols: Regular data backups guarantee that member information is recoverable in the event of data loss due to cyber catastrophes.

- User Training: Ongoing training for staff members on data protection principles promotes a security culture throughout the firm.

Through these safeguards, Easy Phone Money creates a secure environment for its members, reducing worries about data privacy in financial transactions.

User Privacy Policies

Easy Phone Money’s user privacy policy is straightforward and comprehensive, outlining how it maintains member data and tackles privacy issues. Here’s how these policies work.

- Transparency: User privacy rules describe what data is collected, how it is used, and the reasons for data sharing, ensuring that users understand their rights.

- Users’ Rights: Clearly defined user rights to their information (such as access, deletion, and correction) empower members and boost platform confidence.

- Notification of Changes: Maintaining procedures for notifying users of any changes or updates to privacy practices encourages an open culture.

- Third-Party Data Usage: Specifying when and how third-party partners may access user data promotes openness in partnership and data-sharing processes.

- Method for issues: Giving users a clear way to address privacy issues improves customer service and demonstrates a commitment to preserving member interests.

By stressing clear privacy regulations, Easy Phone Money builds confidence while negotiating the hurdles of user data management.

Fraud Prevention Strategies

Fraud prevention is critical in today’s rapidly changing financial scene. Easy Phone Money has numerous measures to prevent fraudulent activities:

- Education on Fraud Recognition: Teaching users how to recognize fraudulent transactions improves the community’s capacity to protect their assets.

- Transaction Monitoring: Actively monitoring transactions for odd activity helps to detect possibly fraudulent behavior before it escalates.

- Advanced Security Measures: Using powerful technologies to detect fraud trends and notify consumers when questionable activity is found reduces risk.

- Secure Communication Protocols: Communicating securely with members via encrypted channels creates a safe line of communication while protecting critical information.

- Continuous Adaptation: Evaluating fraud prevention methods and adjusting them to evolving threats guarantees that the service stays safe as tactics change.

By using these fraud protection techniques, Easy Phone Money protects its integrity while creating a safe environment for transactions.

Alternatives for Easy Phone Money Membership

In an ever-changing financial world, it is critical to consider alternatives to Easy Phone Money Membership that offer comparable services. Consider the choices below:

- PayPal: Provides a complete platform for financial management by offering significant capabilities for online transactions, budgeting, and invoicing.

- Cash App simplifies peer-to-peer transactions while also allowing users to invest in stocks and cryptocurrencies, making it suitable for people looking for a variety of financial services.

- Venmo: Venmo, which focuses on social connections, delivers a community experience while handling transactions, making it appealing to younger consumers.

- Mint Mobile: While mostly focused on telecoms, its budgeting tools allow for some financial management, which is particularly appealing to mobile consumers.

- Western Union: Best for worldwide transactions, it places a major emphasis on cross-border monetary transfers, empowering individuals with global requirements.

These options meet a variety of financial management requirements, providing users with access to a variety of tools tailored to their financial practices and goals.

Competitive Membership Programs

Exploring comparable membership programs might provide viable alternatives to Easy Phone Money Membership. The following are significant possibilities to consider:

- Rocket Money provides budgeting tools, subscription management services, and spending analysis. It is particularly effective in encouraging users to closely monitor their habits.

- Simplifi by Quicken: Known for its complete financial overview features, Simplifi provides a user-friendly interface for managing all accounts in one dashboard.

- Truebill, a competitor subscription management application, allows customers to successfully simplify their financial duties.

- Digit specializes on automated savings, making it an excellent choice for anybody wishing to improve their saving habits without requiring active manual oversight.

- YNAB (You Need A Budget): In addition to its budgeting tools, YNAB offers an instructional platform for individuals who want to gain considerable control over their budgeting habits and financial objectives.

Comparing these competing membership programs provides consumers with useful alternatives, directing them to the solutions that best match their unique needs.

Feature Comparison with Alternatives

When contemplating Easy Phone Money Membership, it is critical to compare its features to alternatives so that people can make educated judgments. Here’s the breakdown:

| Feature | Easy Phone Money | Rocket Money | Cash App | Mint Mobile |

| **Initial Cost** | Promotional Price | Free Basic | Free for most applications. | $15/month (first 3 months) |

| **Budgeting Tools** | Yes | Yes | Basic Budgeting | No |

| **Community Support** | Yes | Limited | No | No |

| **Investment Options** | None | None | Yes | No |

| **Complete Analysis** | Moderate | High | Moderate | No |

This table demonstrates the varying offers across several services. For example, whereas Easy Phone Money prioritizes educational resources and community assistance, Cash App offers investment alternatives that may appeal to a different user group.

Advantages and disadvantages of other options

Understanding the advantages and disadvantages of various platforms is necessary while evaluating possible memberships. Here’s a comparison of different possibilities to Easy Phone Money.

Rocket Money

Pros:

- Comprehensive budgeting tools enable consumers to manage their resources effectively.

- Provides subscription management services, assisting in the identification and elimination of needless costs.

Cons:

- Some features need a subscription edition, which may discourage people from fully engaging.

- In comparison to Easy Phone Money, there is less community support.

Cash App

Pros:

- Strong peer-to-peer payment capabilities makes money transfers rapid and easy.

- The ability to invest in equities and cryptocurrencies is appealing to a modern audience.

Cons:

- Lacks the teaching components featured in Easy Phone Money, which are important for novices.

- Users must stay careful against fraud, as frauds are widespread with P2P transfers.

Mint Mobile

Pros:

- Competitive cost for mobile communications and simple budgeting features.

- A user-friendly experience similar to Easy Phone Money.

Cons:

- Financial management options are limited when compared to specialist systems.

- The emphasis is mostly on telecommunications, which may exclude important financial education.

These comparisons allow customers to carefully analyze the advantages and downsides of various services before making a commitment.

Conclusion of Easy Phone Money Membership Review.

The Easy Phone Money Membership provides consumers with a dynamic approach to improving their financial literacy and access to savings options. However, as previously said, potential members should be cautious regarding price structures, hidden costs, and overall efficacy when compared to comparable membership schemes. Finally, while membership offers many benefits, the choice to join should be based on thorough study and assessment of both personal financial requirements and aspirations.

Final Thoughts on Value

Finally, examining the total worth of the Easy Phone Money Membership indicates a favorable outlook for customers, which is consistent with the company’s aims of improving financial management using mobile platforms. The educational tools, community support, and unique offers distinguish themselves from other choices on the market, laying the groundwork for sound financial decisions.

Recommendations to Potential Members

For people considering joining the Easy Phone Money Membership, it’s recommended that:

- Thorough Research: Look into customer testimonials, comments, and reviews on independent sites to have a better understanding of user experiences.

- Consider Your Personal requirements: To determine membership alignment, assess if the features correspond with your unique financial objectives and requirements.

- Utilize Trial Periods: If available, using trial chances can give insights regarding the membership’s appropriateness without requiring a cash commitment.

- Engage with the Community: Talk with current members to learn about their viewpoints and gain practical ideas from their experiences.

The route to financial prudence begins with educated decisions, and the Easy Phone Money Membership may be a valuable companion in this trip if it meets the specific requirements of potential members.

Overall Rating and Summary.

Overall, the Easy Phone Money Membership is worth considering, especially given its wide products and emphasis on community support. However, the necessity for careful consideration of price and alternatives persists. For members looking for personal finance education and a supportive group, this membership may be a valuable resource for managing the intricacies of modern financial responsibilities with ease and efficiency.

Frequently Asked Questions:

Business Model Innovation:

Embrace the concept of a legitimate business! Our strategy revolves around organizing group buys where participants collectively share the costs. The pooled funds are used to purchase popular courses, which we then offer to individuals with limited financial resources. While the authors of these courses might have concerns, our clients appreciate the affordability and accessibility we provide.

The Legal Landscape:

The legality of our activities is a gray area. Although we don’t have explicit permission from the course authors to resell the material, there’s a technical nuance involved. The course authors did not outline specific restrictions on resale when the courses were purchased. This legal nuance presents both an opportunity for us and a benefit for those seeking affordable access.

Quality Assurance: Addressing the Core Issue

When it comes to quality, purchasing a course directly from the sale page ensures that all materials and resources are identical to those obtained through traditional channels.

However, we set ourselves apart by offering more than just personal research and resale. It’s important to understand that we are not the official providers of these courses, which means that certain premium services are not included in our offering:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not available.

- Membership in the author’s private forum is not included.

- There is no direct email support from the author or their team.

We operate independently with the aim of making courses more affordable by excluding the additional services offered through official channels. We greatly appreciate your understanding of our unique approach.

Be the first to review “Your Easy Phone Money Membership” Cancel reply

You must be logged in to post a review.

Related products

Marketing

Reviews

There are no reviews yet.